Title: Understanding the Bridgeport, Connecticut Notice of Dishonored Check — Civil Proceedings Introduction: The Bridgeport Connecticut Notice of Dishonored Check — Civil is an essential legal document that addresses instances of a bad check or a bounced check in the city. This notification plays a vital role in protecting the rights of individuals or businesses who have been affected by insufficient funds in a check transaction. Let's delve into the specifics of this notice, including types, implications, and procedures to provide a comprehensive understanding for all parties involved. Types of Bridgeport Connecticut Notice of Dishonored Check — Civil: 1. Notice of DishonoreCheckec— – Personal: This type of notice typically pertains to individuals who issue a personal check that subsequently bounces due to inadequate funds. It is essential to distinguish personal checks from company checks to ensure appropriate legal procedures are followed. 2. Notice of Dishonored Check — Business: In cases where businesses or organizations issue checks that are returned due to insufficient funds, the Notice of Dishonored Check — Civil ensures that suitable action can be taken within the legal framework. This type of notice can involve both small and large businesses. Implications of a Bad Check or Bounced Check: 1. Financial Liability: A bad check or bounced check can result in severe financial consequences for both the check issuer and the recipient. The individual or entity liable for the check may be required to reimburse the recipient for the amount specified on the check, along with any additional fees or penalties that may apply. 2. Legal Ramifications: Upon receipt of a Notice of Dishonored Check — Civil, legal procedures may be initiated against the check issuer. This may result in civil actions, lawsuits, or legal judgments, depending on the severity of the offense and the specific circumstances. Procedures in Response to a Bridgeport Connecticut Notice of Dishonored Check — Civil: 1. Collection Attempts: The recipient of a bad check or bounced check should initially attempt to collect the owed amount directly from the issuer. This may involve contacting the issuer, sending reminder letters or emails, or utilizing debt collection agencies. 2. Legal Action: If collection attempts to prove unsuccessful, the recipient can choose to pursue legal action. This typically involves filing a lawsuit and providing evidence supporting the claim. A qualified attorney specializing in check dishonor cases can guide individuals or businesses throughout the legal process. Conclusion: The Bridgeport Connecticut Notice of Dishonored Check — Civil stands as a crucial tool for addressing instances of bad checks or bounced checks within the city. Being informed about the different types of notices, their implications, and the necessary procedures ensures a fair resolution for all parties involved. It is essential to consult legal professionals to determine the most appropriate course of action in response to such notifications.

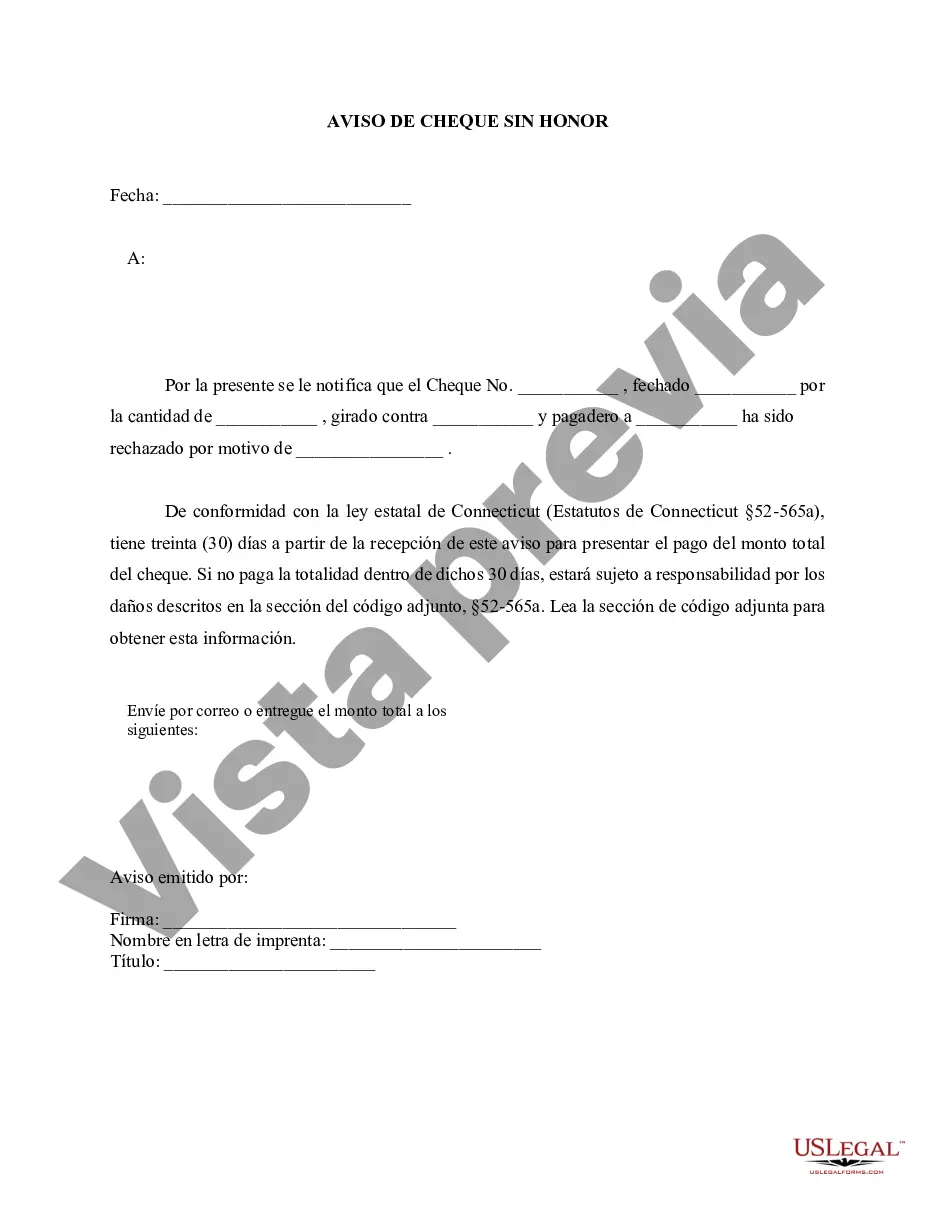

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bridgeport Connecticut Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

State:

Connecticut

City:

Bridgeport

Control #:

CT-401N

Format:

Word

Instant download

Description

Formulario de aviso de cheque sin fondos.

Title: Understanding the Bridgeport, Connecticut Notice of Dishonored Check — Civil Proceedings Introduction: The Bridgeport Connecticut Notice of Dishonored Check — Civil is an essential legal document that addresses instances of a bad check or a bounced check in the city. This notification plays a vital role in protecting the rights of individuals or businesses who have been affected by insufficient funds in a check transaction. Let's delve into the specifics of this notice, including types, implications, and procedures to provide a comprehensive understanding for all parties involved. Types of Bridgeport Connecticut Notice of Dishonored Check — Civil: 1. Notice of DishonoreCheckec— – Personal: This type of notice typically pertains to individuals who issue a personal check that subsequently bounces due to inadequate funds. It is essential to distinguish personal checks from company checks to ensure appropriate legal procedures are followed. 2. Notice of Dishonored Check — Business: In cases where businesses or organizations issue checks that are returned due to insufficient funds, the Notice of Dishonored Check — Civil ensures that suitable action can be taken within the legal framework. This type of notice can involve both small and large businesses. Implications of a Bad Check or Bounced Check: 1. Financial Liability: A bad check or bounced check can result in severe financial consequences for both the check issuer and the recipient. The individual or entity liable for the check may be required to reimburse the recipient for the amount specified on the check, along with any additional fees or penalties that may apply. 2. Legal Ramifications: Upon receipt of a Notice of Dishonored Check — Civil, legal procedures may be initiated against the check issuer. This may result in civil actions, lawsuits, or legal judgments, depending on the severity of the offense and the specific circumstances. Procedures in Response to a Bridgeport Connecticut Notice of Dishonored Check — Civil: 1. Collection Attempts: The recipient of a bad check or bounced check should initially attempt to collect the owed amount directly from the issuer. This may involve contacting the issuer, sending reminder letters or emails, or utilizing debt collection agencies. 2. Legal Action: If collection attempts to prove unsuccessful, the recipient can choose to pursue legal action. This typically involves filing a lawsuit and providing evidence supporting the claim. A qualified attorney specializing in check dishonor cases can guide individuals or businesses throughout the legal process. Conclusion: The Bridgeport Connecticut Notice of Dishonored Check — Civil stands as a crucial tool for addressing instances of bad checks or bounced checks within the city. Being informed about the different types of notices, their implications, and the necessary procedures ensures a fair resolution for all parties involved. It is essential to consult legal professionals to determine the most appropriate course of action in response to such notifications.

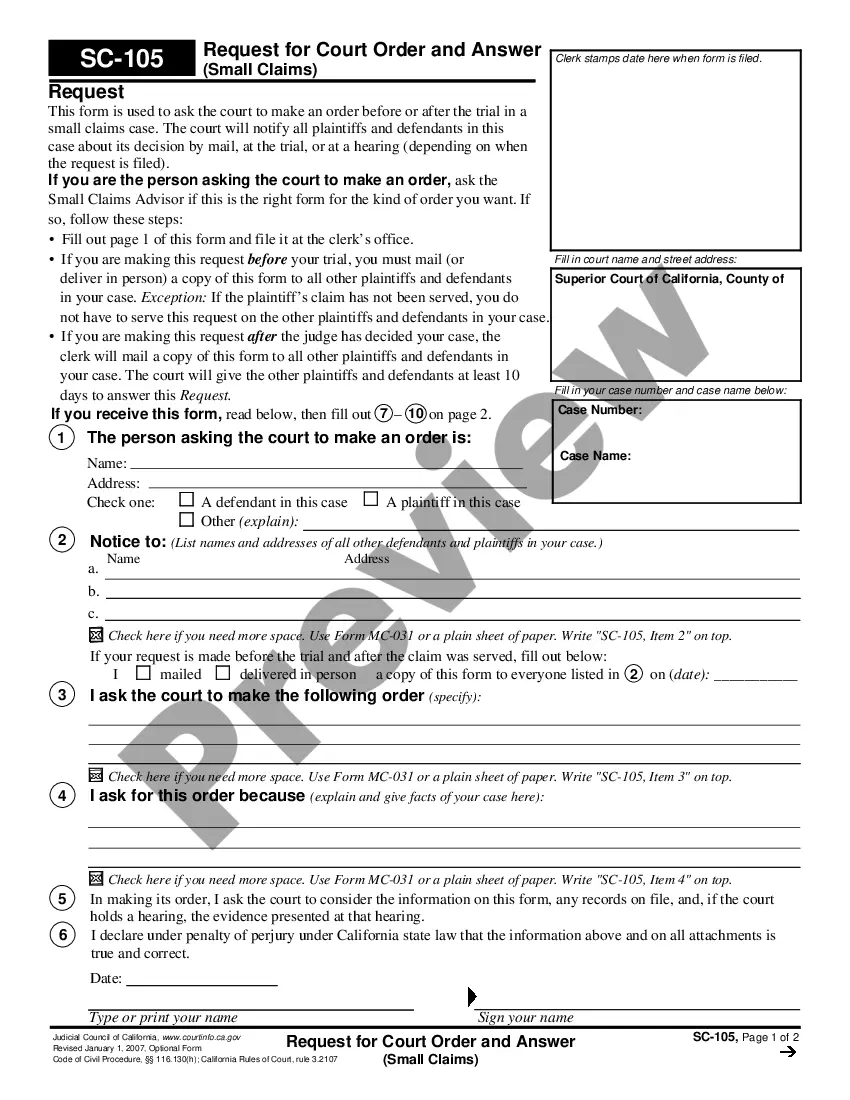

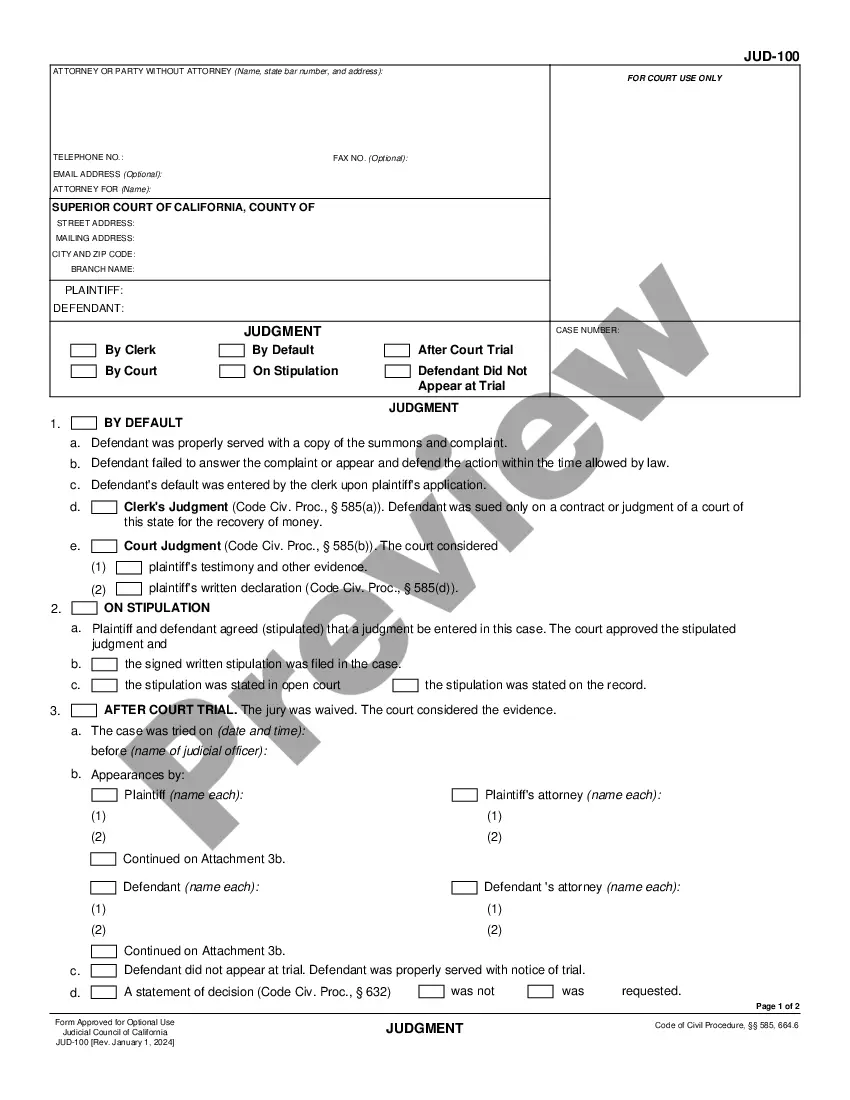

Free preview

How to fill out Bridgeport Connecticut Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

If you’ve already utilized our service before, log in to your account and download the Bridgeport Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check on your device by clicking the Download button. Make certain your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Bridgeport Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!