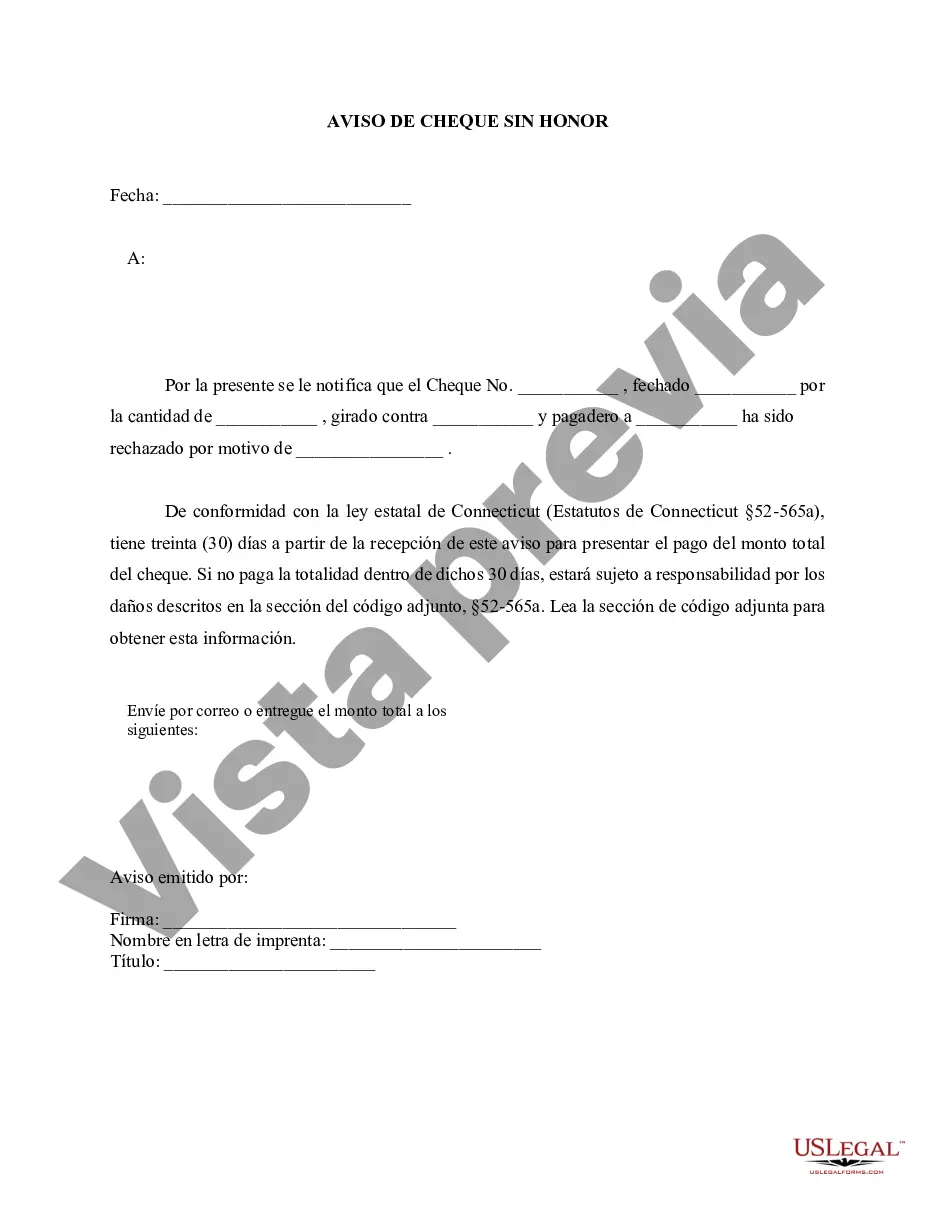

Waterbury Connecticut Notice of Dishonored Check Civilvi— - Keywords: bad check, bounced check A Waterbury Connecticut Notice of Dishonored Check serves as official documentation notifying an individual or business of a dishonored or bad check. When a check is presented for payment but is returned unpaid by the bank due to insufficient funds, it is considered a bounced check. The notice serves to inform the recipient about the dishonored check and outlines the legal actions that may be taken if the matter is not rectified promptly. There are different types of Waterbury Connecticut Notices of Dishonored Check — Civil, based on the specific circumstances and subsequent actions. These may include: 1. Initial Notice: This is the first communication sent to the issuer of the bounced check, informing them that their check has been dishonored due to insufficient funds. The notice emphasizes the need for immediate payment or resolution to avoid further legal consequences. 2. Demand for Payment: If the initial notice goes unanswered or the check remains unpaid, a second notice or demand for payment may be issued. This notice reiterates the dishonor of the check, quotes any applicable state laws, and provides a deadline for the check issuer to settle their debt and cover additional fees or penalties. 3. Legal Consequences Notice: If the check issuer fails to address the situation after receiving the demand for payment, a third notice detailing the potential legal consequences may be sent. This notice focuses on the potential civil liabilities involved, such as being sued for the amount of the bad check, plus legal fees and damages. 4. Court Summons: In extreme cases where all previous attempts fail, the sender of the notice may proceed with filing a lawsuit against the check issuer. A court summons is then issued, requiring the check issuer to appear in court and defend themselves against the accusations of issuing a bad check. 5. Judgement Notice: If the court case rules in favor of the recipient of the bounced check, a judgement notice is sent, notifying the check issuer of their legal obligation to pay the outstanding amount, plus any court-awarded damages or additional charges. 6. Collections Notice: In the event that the check issuer still fails to comply with the court's judgement, a collections notice may be sent. This notice warns them of potential further legal actions, including garnishment of wages, seizure of assets, or negative impact on their credit rating. It is important to note that each notice varies in content and severity depending on the specific circumstances, but all emphasize the need for prompt resolution to avoid legal implications. Engaging in good financial practices and ensuring sufficient funds are available before issuing a check can prevent the inconvenience, costs, and legal ramifications associated with a dishonored or bad check.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Waterbury Connecticut Aviso de cheque sin fondos - Civil - Palabras clave: cheque sin fondos, cheque sin fondos - Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description

How to fill out Waterbury Connecticut Aviso De Cheque Sin Fondos - Civil - Palabras Clave: Cheque Sin Fondos, Cheque Sin Fondos?

We always strive to minimize or prevent legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we apply for legal solutions that, usually, are very costly. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is an online collection of up-to-date DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to a lawyer. We offer access to legal form templates that aren’t always openly available. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Waterbury Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check or any other form easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it in the My Forms tab.

The process is equally effortless if you’re unfamiliar with the website! You can create your account in a matter of minutes.

- Make sure to check if the Waterbury Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve ensured that the Waterbury Connecticut Notice of Dishonored Check - Civil - Keywords: bad check, bounced check would work for you, you can select the subscription option and make a payment.

- Then you can download the document in any suitable format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!