Are you a resident of Stamford, Connecticut, considering setting up a living trust to protect your assets and ensure your family's financial future? Look no further! In this article, we will provide you with a detailed description of what a Stamford Connecticut Living Trust for Husband and Wife with Minor and/or Adult Children entails. We will also outline the different types of living trusts available to meet your specific needs. A living trust, often referred to as a revocable trust, is a legal document that allows individuals to transfer their assets into a trust during their lifetime. This type of trust is specifically designed to provide control and flexibility while avoiding probate. For married couples residing in Stamford, Connecticut, a living trust can offer numerous benefits when it comes to estate planning. When it comes to living trusts for Husband and Wife with Minor and/or Adult Children, there are a few variations available. Let's explore the most common types: 1. Joint Living Trust: This is the most popular choice for married couples. In this type of trust, both spouses are named as contractors and co-trustees, allowing them to maintain control over their assets during their lifetime. It ensures that their children, whether minor or adults, are beneficiaries of the trust. This trust becomes irrevocable upon the death of the first spouse, and the surviving spouse gains complete control over the assets. 2. AB Living Trust (also known as A/B Trust or Survivor's Trust): This type of trust is specifically designed to minimize estate taxes. It splits the trust into two parts, an A trust (marital trust) and a B trust (family trust). Upon the death of the first spouse, the A trust becomes irrevocable, providing income and other benefits to the surviving spouse. The B trust, also known as a bypass trust, ensures that the couple's children (regardless of their age) are the ultimate beneficiaries of the trust. 3. Testamentary Living Trust: This type of trust is different from the aforementioned ones. It doesn't come into effect until after the death of both spouses. The primary purpose of a testamentary living trust is to provide instructions on the distribution of assets and management of affairs after the second spouse passes away. It can be particularly beneficial for families with minor children, as it allows for the appointment of a designated guardian to care for them and manage their inheritance. Regardless of the type of trust you choose, setting up a Stamford Connecticut Living Trust for Husband and Wife with Minor and/or Adult Children can bring peace of mind and substantial advantages in estate planning. It can help preserve your wealth, avoid probate, provide for your loved ones, and ensure a smooth transfer of assets after your passing. If you're considering establishing a living trust, it is advisable to consult with an experienced estate planning attorney who can guide you through the process and tailor the trust to meet your specific needs and goals. Take control of your family's financial future and enjoy the benefits a living trust can offer in Stamford, Connecticut.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Stamford Connecticut Fideicomiso en vida para esposo y esposa con hijos menores o adultos - Connecticut Living Trust for Husband and Wife with Minor and or Adult Children

Description

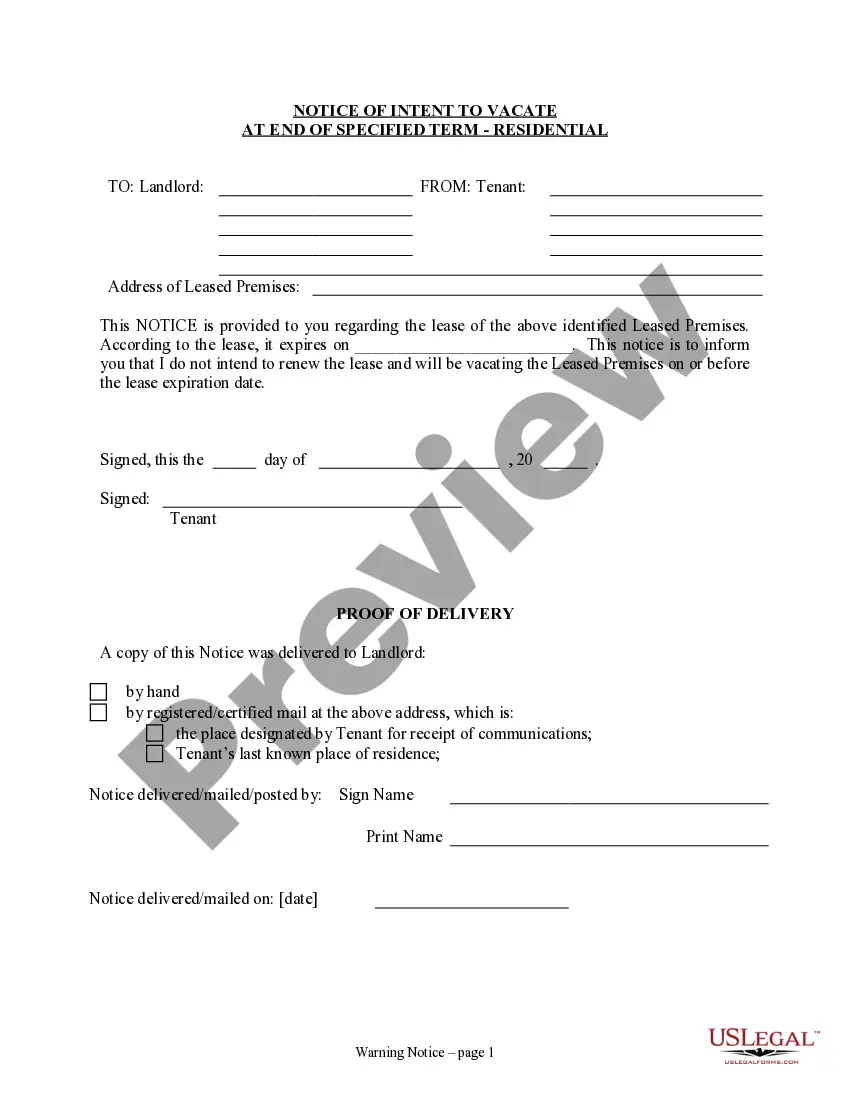

How to fill out Stamford Connecticut Fideicomiso En Vida Para Esposo Y Esposa Con Hijos Menores O Adultos?

Take advantage of the US Legal Forms and obtain instant access to any form template you want. Our helpful platform with thousands of templates makes it easy to find and obtain virtually any document sample you want. It is possible to save, complete, and certify the Stamford Connecticut Living Trust for Husband and Wife with Minor and or Adult Children in just a matter of minutes instead of surfing the Net for many hours searching for a proper template.

Utilizing our collection is a wonderful way to improve the safety of your form filing. Our professional attorneys on a regular basis check all the documents to make sure that the templates are relevant for a particular state and compliant with new acts and regulations.

How do you obtain the Stamford Connecticut Living Trust for Husband and Wife with Minor and or Adult Children? If you have a profile, just log in to the account. The Download option will be enabled on all the documents you look at. Furthermore, you can get all the earlier saved documents in the My Forms menu.

If you don’t have a profile yet, follow the instructions below:

- Find the form you require. Make sure that it is the form you were looking for: check its title and description, and make use of the Preview option when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and select the pricing plan you like. Then, create an account and process your order utilizing a credit card or PayPal.

- Export the document. Select the format to get the Stamford Connecticut Living Trust for Husband and Wife with Minor and or Adult Children and edit and complete, or sign it according to your requirements.

US Legal Forms is one of the most significant and trustworthy document libraries on the internet. Our company is always happy to assist you in any legal process, even if it is just downloading the Stamford Connecticut Living Trust for Husband and Wife with Minor and or Adult Children.

Feel free to make the most of our form catalog and make your document experience as convenient as possible!