Title: Comprehensive Guide to Bridgeport Connecticut Financial Account Transfer to Living Trust Introduction: When it comes to securing your financial future and ensuring seamless estate planning, Bridgeport Connecticut residents often opt for transferring their financial accounts to a living trust. This process provides numerous benefits, such as avoiding probate, minimizing tax liabilities, and facilitating the smooth transfer of assets upon incapacitation or death. In this article, we will delve into the intricacies of the Bridgeport Connecticut Financial Account Transfer to Living Trust, highlighting its importance and different types for a comprehensive understanding. 1. Understanding the Living Trust: A living trust, often referred to as a revocable trust, is a legal arrangement that allows individuals to transfer their assets, including financial accounts, into a trust during their lifetime. By doing so, the person retains control and can modify or revoke the trust at any time. Upon their incapacitation or death, the trust assets are then managed and transferred according to the individual's wishes as outlined in the trust document. 2. Benefits of Financial Account Transfer to Living Trust: — Avoiding probate: Unlike a will, a living trust bypasses the probate process, saving time and potentially avoiding considerable expenses. — Privacy and confidentiality: Probate proceedings are public, but a living trust ensures that the distribution of assets remains private. — Planning for incapacitation: A living trust helps in managing and distributing assets if you become incapacitated, keeping your affairs in order without court intervention. — Flexibility and control: As thgranteror of a living trust, you retain complete control over your assets during your lifetime and can make changes as you see fit. — Protection against challenges: A well-drafted living trust can provide protection against potential challenges to your estate plan. 3. Types of Bridgeport Connecticut Financial Account Transfer to Living Trust: a. Individual Living Trust: This type of transfer involves a single individual transferring their financial accounts to their own trust for management and distribution according to their wishes. b. Joint Living Trust: Married couples or domestic partners may opt for a joint living trust, where both individuals transfer their financial accounts into the trust. This arrangement allows for smooth asset management and distribution in case of either person's incapacitation or death. c. Testamentary Living Trust: A testamentary living trust is established through a will. The financial accounts are transferred to the trust upon the granter's death, avoiding probate while still providing benefits similar to a traditional living trust. Conclusion: By transferring financial accounts to a living trust in Bridgeport, Connecticut, individuals can ensure their assets are managed and distributed seamlessly according to their wishes. Whether through an individual living trust, joint living trust, or testamentary living trust, this powerful estate planning tool promotes efficient wealth preservation, minimizes taxes and probate costs, and offers much-needed peace of mind. Seek professional guidance from legal and financial experts to create a living trust tailored to your specific needs and objectives.

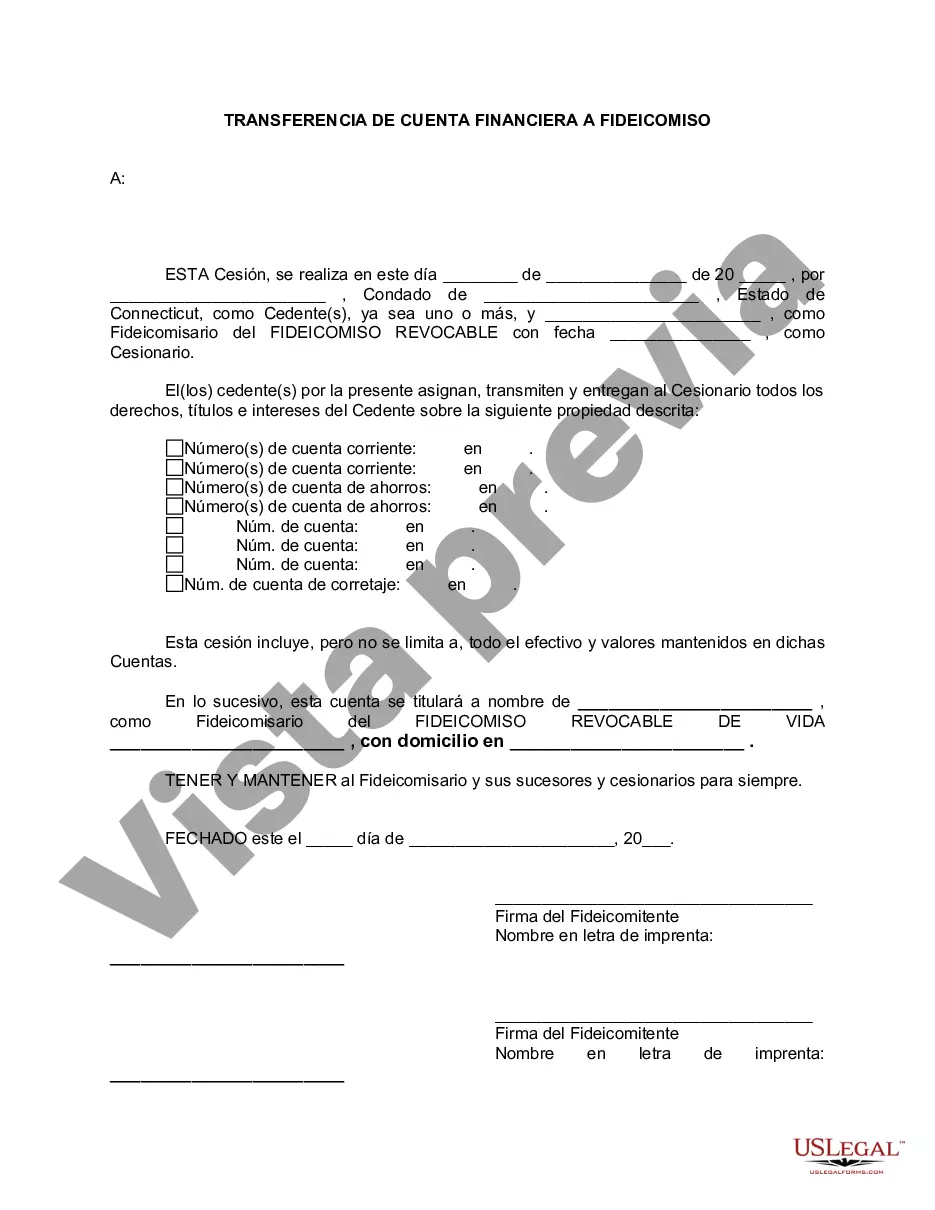

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bridgeport Connecticut Transferencia de cuenta financiera a fideicomiso en vida - Connecticut Financial Account Transfer to Living Trust

State:

Connecticut

City:

Bridgeport

Control #:

CT-E0178C

Format:

Word

Instant download

Description

Formulario para transferir cuentas financieras a un fideicomiso en vida.

Title: Comprehensive Guide to Bridgeport Connecticut Financial Account Transfer to Living Trust Introduction: When it comes to securing your financial future and ensuring seamless estate planning, Bridgeport Connecticut residents often opt for transferring their financial accounts to a living trust. This process provides numerous benefits, such as avoiding probate, minimizing tax liabilities, and facilitating the smooth transfer of assets upon incapacitation or death. In this article, we will delve into the intricacies of the Bridgeport Connecticut Financial Account Transfer to Living Trust, highlighting its importance and different types for a comprehensive understanding. 1. Understanding the Living Trust: A living trust, often referred to as a revocable trust, is a legal arrangement that allows individuals to transfer their assets, including financial accounts, into a trust during their lifetime. By doing so, the person retains control and can modify or revoke the trust at any time. Upon their incapacitation or death, the trust assets are then managed and transferred according to the individual's wishes as outlined in the trust document. 2. Benefits of Financial Account Transfer to Living Trust: — Avoiding probate: Unlike a will, a living trust bypasses the probate process, saving time and potentially avoiding considerable expenses. — Privacy and confidentiality: Probate proceedings are public, but a living trust ensures that the distribution of assets remains private. — Planning for incapacitation: A living trust helps in managing and distributing assets if you become incapacitated, keeping your affairs in order without court intervention. — Flexibility and control: As thgranteror of a living trust, you retain complete control over your assets during your lifetime and can make changes as you see fit. — Protection against challenges: A well-drafted living trust can provide protection against potential challenges to your estate plan. 3. Types of Bridgeport Connecticut Financial Account Transfer to Living Trust: a. Individual Living Trust: This type of transfer involves a single individual transferring their financial accounts to their own trust for management and distribution according to their wishes. b. Joint Living Trust: Married couples or domestic partners may opt for a joint living trust, where both individuals transfer their financial accounts into the trust. This arrangement allows for smooth asset management and distribution in case of either person's incapacitation or death. c. Testamentary Living Trust: A testamentary living trust is established through a will. The financial accounts are transferred to the trust upon the granter's death, avoiding probate while still providing benefits similar to a traditional living trust. Conclusion: By transferring financial accounts to a living trust in Bridgeport, Connecticut, individuals can ensure their assets are managed and distributed seamlessly according to their wishes. Whether through an individual living trust, joint living trust, or testamentary living trust, this powerful estate planning tool promotes efficient wealth preservation, minimizes taxes and probate costs, and offers much-needed peace of mind. Seek professional guidance from legal and financial experts to create a living trust tailored to your specific needs and objectives.

Free preview

How to fill out Bridgeport Connecticut Transferencia De Cuenta Financiera A Fideicomiso En Vida?

If you’ve already used our service before, log in to your account and download the Bridgeport Connecticut Financial Account Transfer to Living Trust on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve found the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Obtain your Bridgeport Connecticut Financial Account Transfer to Living Trust. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!