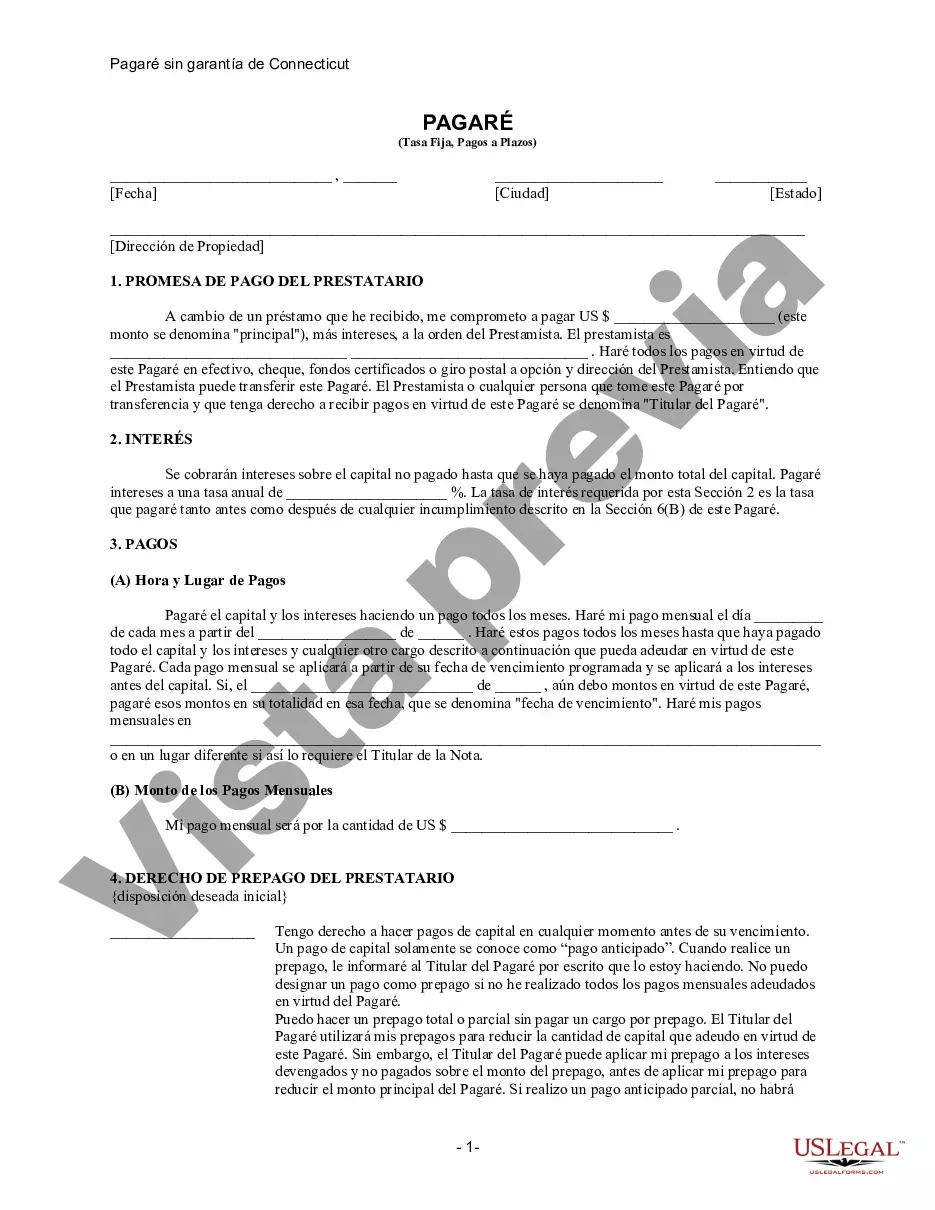

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note is used when the borrower wants to obtain a personal loan in Stamford, Connecticut, without offering any collateral. The Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate sets forth the repayment schedule, interest rate, and other essential details of the loan. This type of promissory note is particularly beneficial for borrowers who do not have any assets to offer as security for the loan. The key features of the Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate include a fixed interest rate, which means that the interest rate remains constant throughout the repayment period. This allows the borrower to plan their finances efficiently without worrying about fluctuations in the interest rate. Additionally, this promissory note specifies the installment payment plan, outlining the number of payments, frequency, and the due dates for each installment. By having a clearly defined payment schedule, both the lender and borrower can anticipate and plan for repayment accordingly. Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate provides legal protection to both parties involved in the loan transaction. It clearly states the consequences of default, late payments, and other breach of terms, ensuring that both parties are aware of their responsibilities and obligations. While the Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate generally refers to a standard unsecured personal loan agreement, there can be variations or additional types based on specific requirements: 1. Stamford Connecticut Unsecured Mortgage Installment Payment Promissory Note for Fixed Rate: This type of promissory note applies when a borrower obtains a loan specifically for a mortgage purpose without collateral. It includes additional clauses related to mortgage-specific terms and regulations. 2. Stamford Connecticut Unsecured Student Loan Installment Payment Promissory Note for Fixed Rate: This variation is specifically designed for student loans, helping students finance their education without having to offer collateral. It may include deferment and forbearance options and provisions related to academic progress. Overall, the Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate serves as a legal contract between a lender and borrower, ensuring transparency, protection, and clear repayment terms for loans without collateral.Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note is used when the borrower wants to obtain a personal loan in Stamford, Connecticut, without offering any collateral. The Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate sets forth the repayment schedule, interest rate, and other essential details of the loan. This type of promissory note is particularly beneficial for borrowers who do not have any assets to offer as security for the loan. The key features of the Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate include a fixed interest rate, which means that the interest rate remains constant throughout the repayment period. This allows the borrower to plan their finances efficiently without worrying about fluctuations in the interest rate. Additionally, this promissory note specifies the installment payment plan, outlining the number of payments, frequency, and the due dates for each installment. By having a clearly defined payment schedule, both the lender and borrower can anticipate and plan for repayment accordingly. Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate provides legal protection to both parties involved in the loan transaction. It clearly states the consequences of default, late payments, and other breach of terms, ensuring that both parties are aware of their responsibilities and obligations. While the Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate generally refers to a standard unsecured personal loan agreement, there can be variations or additional types based on specific requirements: 1. Stamford Connecticut Unsecured Mortgage Installment Payment Promissory Note for Fixed Rate: This type of promissory note applies when a borrower obtains a loan specifically for a mortgage purpose without collateral. It includes additional clauses related to mortgage-specific terms and regulations. 2. Stamford Connecticut Unsecured Student Loan Installment Payment Promissory Note for Fixed Rate: This variation is specifically designed for student loans, helping students finance their education without having to offer collateral. It may include deferment and forbearance options and provisions related to academic progress. Overall, the Stamford Connecticut Unsecured Installment Payment Promissory Note for Fixed Rate serves as a legal contract between a lender and borrower, ensuring transparency, protection, and clear repayment terms for loans without collateral.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.