This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Waterbury, Connecticut offers its residents a Special Durable Power of Attorney for Bank Account Matters, which plays a crucial role in managing financial affairs. This legal document grants an individual, known as the agent or attorney-in-fact, the authority to make informed decisions and take necessary actions pertaining to specific bank account matters on behalf of the principal, who is the person granting the power of attorney. The Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters is designed to endure even if the principal becomes incapacitated or unable to manage their own affairs. This ensures that their financial interests are protected and managed according to their wishes. It is essential for individuals with bank accounts in Waterbury to consider this power of attorney as part of their estate planning. While there may be variations or customized forms, two common types of Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters include: 1. General Bank Account Power of Attorney: This type of power of attorney grants the agent the authority to manage all aspects of the principal's bank accounts. It empowers the agent to conduct various transactions, such as making deposits, withdrawals, transferring funds, paying bills, and managing investments. 2. Limited Bank Account Power of Attorney: In contrast to the general power of attorney, this type focuses on specific bank account matters designated by the principal. It limits the agent's authority to perform only the specified tasks, providing more control and customization to the principal's preferences. When creating a Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters, it is crucial to consult with an experienced attorney familiar with state laws and regulations to ensure compliance and validity. The document should encompass clear instructions, identify the agent and alternate agents if desired, and specify any limitations imposed by the principal. The power of attorney may also include provisions for revocation or expiration based on certain events or timelines. By creating a Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters, individuals can have peace of mind knowing that their bank accounts will be managed responsibly and in accordance with their best interests. They can readily designate a trusted agent to handle financial matters efficiently, providing a practical solution for those unable to manage their own accounts due to physical or mental incapacity.Waterbury, Connecticut offers its residents a Special Durable Power of Attorney for Bank Account Matters, which plays a crucial role in managing financial affairs. This legal document grants an individual, known as the agent or attorney-in-fact, the authority to make informed decisions and take necessary actions pertaining to specific bank account matters on behalf of the principal, who is the person granting the power of attorney. The Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters is designed to endure even if the principal becomes incapacitated or unable to manage their own affairs. This ensures that their financial interests are protected and managed according to their wishes. It is essential for individuals with bank accounts in Waterbury to consider this power of attorney as part of their estate planning. While there may be variations or customized forms, two common types of Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters include: 1. General Bank Account Power of Attorney: This type of power of attorney grants the agent the authority to manage all aspects of the principal's bank accounts. It empowers the agent to conduct various transactions, such as making deposits, withdrawals, transferring funds, paying bills, and managing investments. 2. Limited Bank Account Power of Attorney: In contrast to the general power of attorney, this type focuses on specific bank account matters designated by the principal. It limits the agent's authority to perform only the specified tasks, providing more control and customization to the principal's preferences. When creating a Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters, it is crucial to consult with an experienced attorney familiar with state laws and regulations to ensure compliance and validity. The document should encompass clear instructions, identify the agent and alternate agents if desired, and specify any limitations imposed by the principal. The power of attorney may also include provisions for revocation or expiration based on certain events or timelines. By creating a Waterbury Connecticut Special Durable Power of Attorney for Bank Account Matters, individuals can have peace of mind knowing that their bank accounts will be managed responsibly and in accordance with their best interests. They can readily designate a trusted agent to handle financial matters efficiently, providing a practical solution for those unable to manage their own accounts due to physical or mental incapacity.

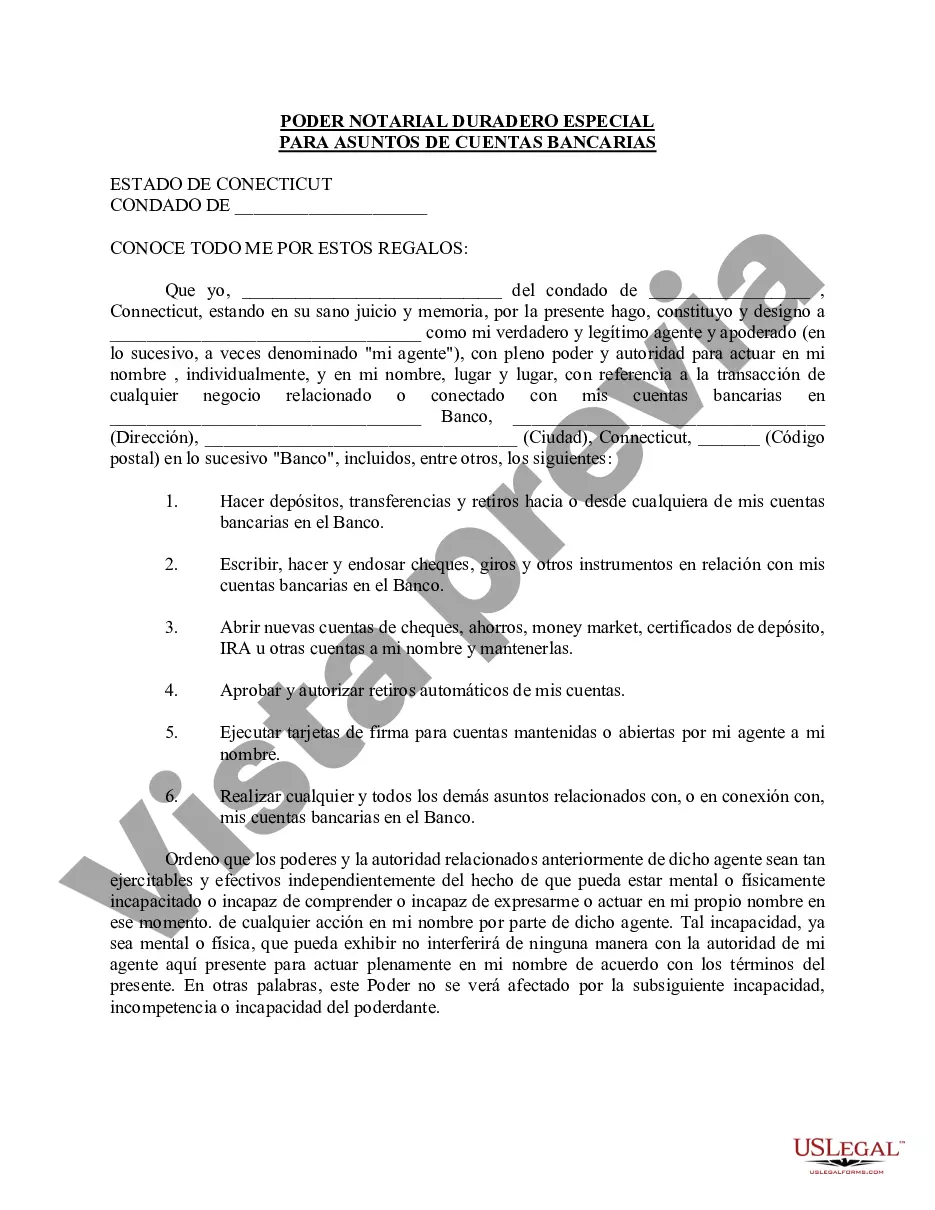

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.