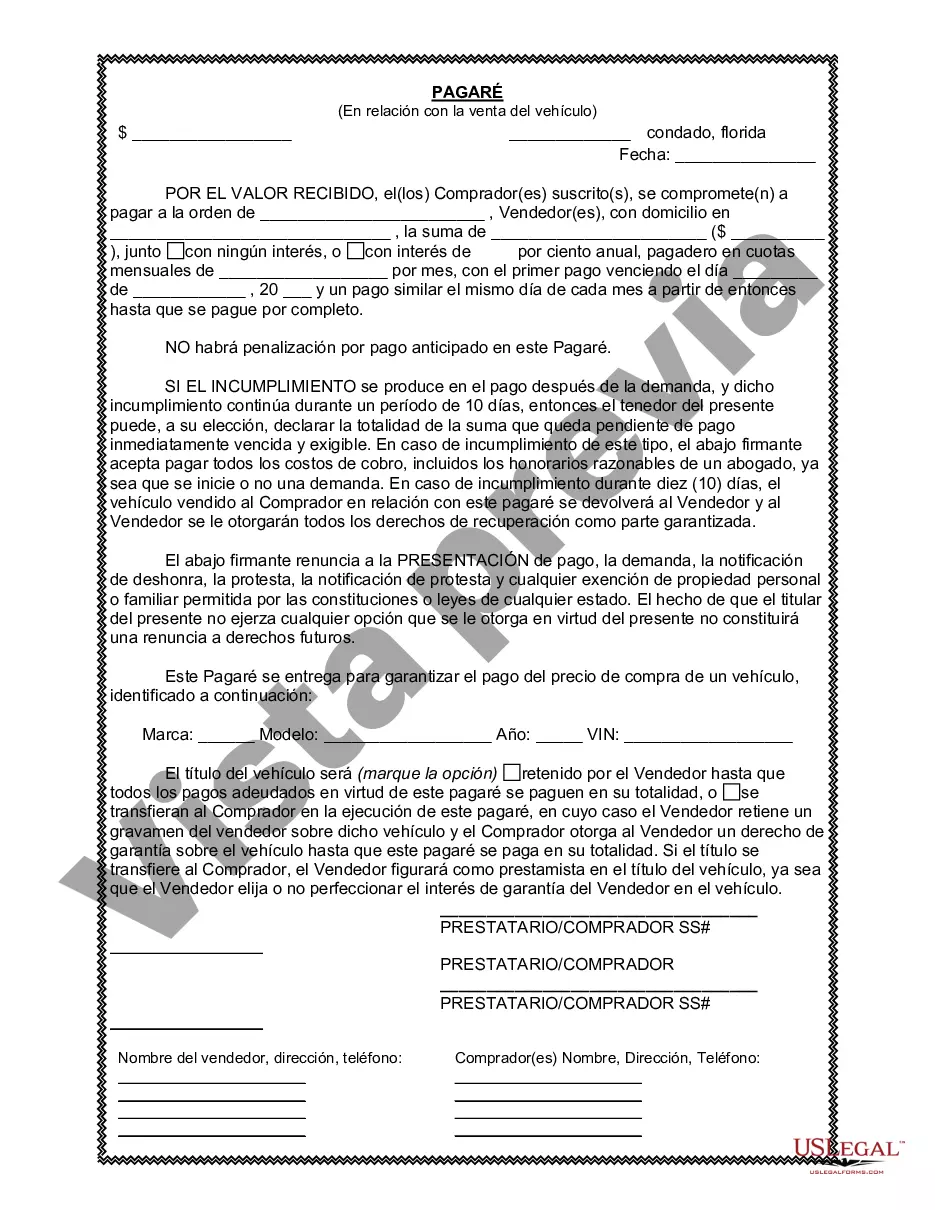

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Hialeah Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a financing agreement between a seller and a buyer for the purchase of a vehicle or automobile. This note serves as evidence of the buyer's promise to repay the seller for the vehicle over a specified period. In Hialeah, Florida, there are several types of promissory notes commonly used for vehicle sales, each tailored to specific circumstances: 1. Installment Promissory Note: This type of promissory note is used when the buyer agrees to make regular payments, typically on a monthly basis, until the entire purchase price, including any interest, is paid off. 2. Balloon Promissory Note: A balloon promissory note allows the buyer to make smaller monthly payments for a set period, and then a larger "balloon" payment is due at the end of the term. This option is ideal for buyers who expect to have a lump sum of money available at the end of the term. 3. Default Promissory Note: In the event of a buyer's default, a default promissory note outlines the terms and consequences of late payments or non-payment. This note establishes the actions the seller can take, such as repossessing the vehicle, charging late fees, or pursuing legal action to recover the outstanding debt. 4. Secured Promissory Note: This note is used when the buyer pledges collateral, such as the vehicle being purchased, to secure the loan. If the buyer fails to make payments as agreed, the seller has the right to take possession of the pledged collateral. It is important for all parties involved in a vehicle sale to understand and carefully draft a promissory note to protect their interests. The note should include essential details such as the names and addresses of the buyer and seller, the vehicle's description and identification number, the purchase price, the interest rate (if applicable), the repayment schedule, and any applicable provisions or contingencies. By utilizing a Hialeah Florida Promissory Note in connection with the sale of a vehicle, both the buyer and the seller can establish clear expectations and obligations, ensuring a smooth transaction and minimizing the potential for disputes or misunderstandings in the future.A Hialeah Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding document that outlines the terms and conditions of a financing agreement between a seller and a buyer for the purchase of a vehicle or automobile. This note serves as evidence of the buyer's promise to repay the seller for the vehicle over a specified period. In Hialeah, Florida, there are several types of promissory notes commonly used for vehicle sales, each tailored to specific circumstances: 1. Installment Promissory Note: This type of promissory note is used when the buyer agrees to make regular payments, typically on a monthly basis, until the entire purchase price, including any interest, is paid off. 2. Balloon Promissory Note: A balloon promissory note allows the buyer to make smaller monthly payments for a set period, and then a larger "balloon" payment is due at the end of the term. This option is ideal for buyers who expect to have a lump sum of money available at the end of the term. 3. Default Promissory Note: In the event of a buyer's default, a default promissory note outlines the terms and consequences of late payments or non-payment. This note establishes the actions the seller can take, such as repossessing the vehicle, charging late fees, or pursuing legal action to recover the outstanding debt. 4. Secured Promissory Note: This note is used when the buyer pledges collateral, such as the vehicle being purchased, to secure the loan. If the buyer fails to make payments as agreed, the seller has the right to take possession of the pledged collateral. It is important for all parties involved in a vehicle sale to understand and carefully draft a promissory note to protect their interests. The note should include essential details such as the names and addresses of the buyer and seller, the vehicle's description and identification number, the purchase price, the interest rate (if applicable), the repayment schedule, and any applicable provisions or contingencies. By utilizing a Hialeah Florida Promissory Note in connection with the sale of a vehicle, both the buyer and the seller can establish clear expectations and obligations, ensuring a smooth transaction and minimizing the potential for disputes or misunderstandings in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.