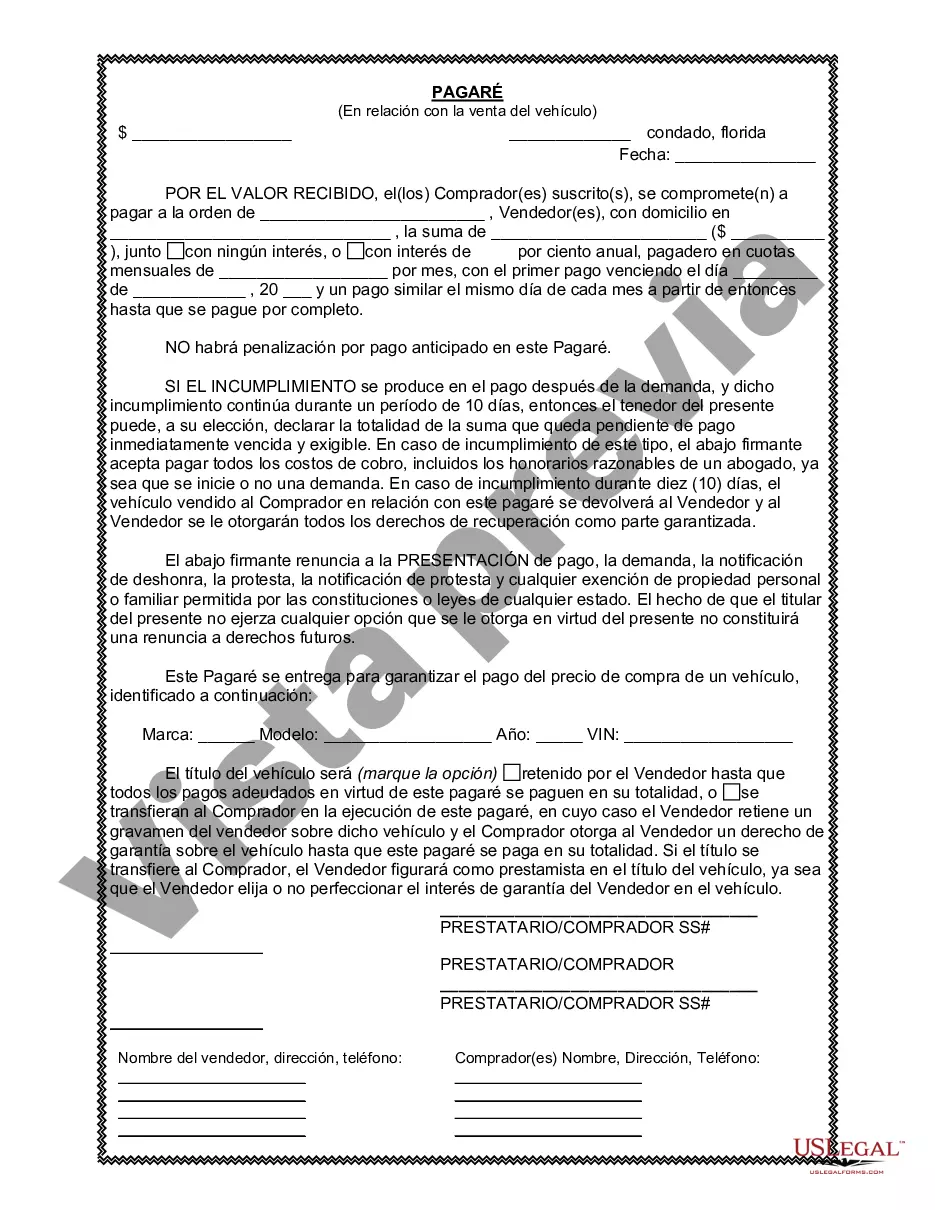

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Jacksonville Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding contract that outlines the terms and conditions of a loan agreement between a buyer and seller for the purchase of a vehicle. This promissory note serves as evidence of the loan amount, payment schedule, and other important details related to the transaction. Keywords: Jacksonville Florida, Promissory Note, Sale of Vehicle, Automobile, legally binding contract, loan agreement, buyer, seller, purchase, evidence, loan amount, payment schedule, transaction. Different types of Jacksonville Florida Promissory Note in Connection with Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: This is a basic promissory note that outlines the loan amount, interest rate (if applicable), payment schedule, and the consequences of defaulting on the loan. 2. Secured Promissory Note: A secured promissory note is a document that includes additional provisions to secure the loan, such as a lien on the vehicle being purchased. In the event of non-payment, the seller can take possession of the vehicle to recover the debt. 3. Installment Promissory Note: An installment promissory note allows the buyer to make periodic payments towards the loan, with each payment covering both principal and interest until the debt is fully repaid. 4. Balloon Promissory Note: A balloon promissory note sets a lower periodic payment amount but includes a larger final payment, often referred to as the "balloon payment," which is due at the end of the term. This type of note is beneficial for buyers who anticipate having a large sum of money at the end of the loan term but is also riskier if the final payment cannot be made. 5. Joint Promissory Note: A joint promissory note involves multiple borrowers sharing the responsibility for the loan. Joint notes are commonly used when multiple individuals are purchasing a vehicle together or when a co-signer is required to secure the loan. It's important to note that while these types of promissory notes may vary in terms of structure and additional provisions, they all serve the purpose of documenting the agreement and protecting the rights of both parties involved in the sale of a vehicle or automobile.A Jacksonville Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legally binding contract that outlines the terms and conditions of a loan agreement between a buyer and seller for the purchase of a vehicle. This promissory note serves as evidence of the loan amount, payment schedule, and other important details related to the transaction. Keywords: Jacksonville Florida, Promissory Note, Sale of Vehicle, Automobile, legally binding contract, loan agreement, buyer, seller, purchase, evidence, loan amount, payment schedule, transaction. Different types of Jacksonville Florida Promissory Note in Connection with Sale of Vehicle or Automobile may include: 1. Simple Promissory Note: This is a basic promissory note that outlines the loan amount, interest rate (if applicable), payment schedule, and the consequences of defaulting on the loan. 2. Secured Promissory Note: A secured promissory note is a document that includes additional provisions to secure the loan, such as a lien on the vehicle being purchased. In the event of non-payment, the seller can take possession of the vehicle to recover the debt. 3. Installment Promissory Note: An installment promissory note allows the buyer to make periodic payments towards the loan, with each payment covering both principal and interest until the debt is fully repaid. 4. Balloon Promissory Note: A balloon promissory note sets a lower periodic payment amount but includes a larger final payment, often referred to as the "balloon payment," which is due at the end of the term. This type of note is beneficial for buyers who anticipate having a large sum of money at the end of the loan term but is also riskier if the final payment cannot be made. 5. Joint Promissory Note: A joint promissory note involves multiple borrowers sharing the responsibility for the loan. Joint notes are commonly used when multiple individuals are purchasing a vehicle together or when a co-signer is required to secure the loan. It's important to note that while these types of promissory notes may vary in terms of structure and additional provisions, they all serve the purpose of documenting the agreement and protecting the rights of both parties involved in the sale of a vehicle or automobile.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.