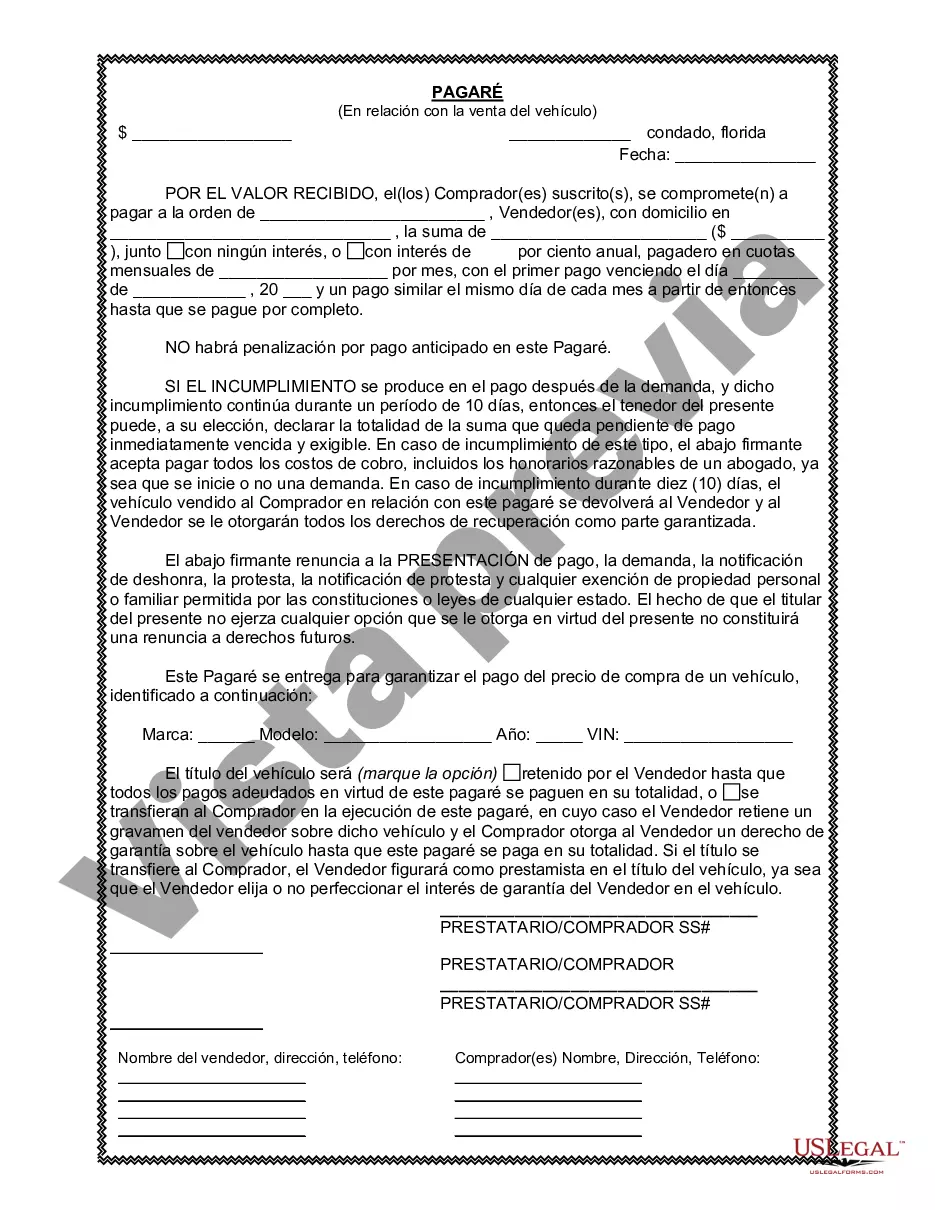

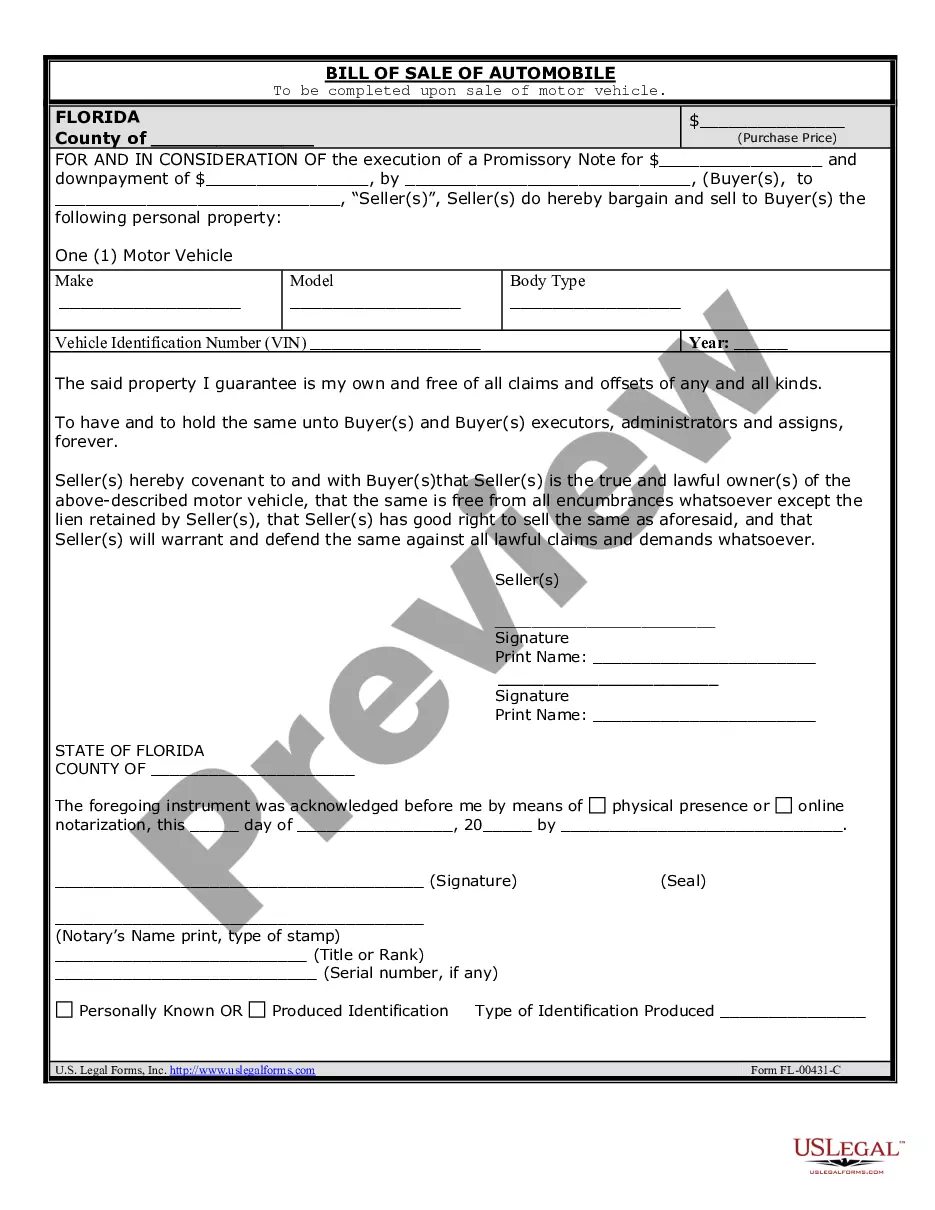

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Lakeland Florida promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and the seller of a vehicle. It serves as a written promise to repay the borrowed amount, often with interest, over a specified period of time. The main purpose of a promissory note is to ensure that both parties involved in the vehicle sale fully understand their obligations and responsibilities. By having a promissory note, the buyer agrees to make regular payments to the seller until the loan is fully paid off. This note also helps protect the seller's interest in the vehicle until the loan is repaid in full. There are a few different types of Lakeland Florida promissory notes in connection with the sale of a vehicle or automobile, namely: 1. Simple promissory note: This is the most common type of promissory note used in vehicle sales. It includes standard terms such as the loan amount, interest rate, payment schedule, and any late payment or default penalties. 2. Secured promissory note: In cases where the buyer fails to make payments as agreed, a secured promissory note allows the seller to repossess the vehicle as collateral to recover their losses. 3. Installment promissory note: This type of note divides the total loan amount into equal installments, making it easier for the buyer to manage repayment over an extended period. Each installment includes both principal and interest. 4. Balloon promissory note: In this type of note, the buyer agrees to make smaller regular payments over a specific period, with a large "balloon" payment due at the end of the term. This option is suitable for buyers who anticipate a large sum of money in the future to cover the final payment. 5. Demand promissory note: This note allows the seller to demand repayment of the loan at any time, usually with a specific notice period. While less common in vehicle sales, it offers flexibility to both parties. It is important for both the buyer and seller to carefully review and understand the terms and conditions outlined in the promissory note before signing. Seeking legal advice or assistance in drafting the note can ensure that all legal requirements are met and protect both parties' interests.A Lakeland Florida promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a loan agreement between the buyer and the seller of a vehicle. It serves as a written promise to repay the borrowed amount, often with interest, over a specified period of time. The main purpose of a promissory note is to ensure that both parties involved in the vehicle sale fully understand their obligations and responsibilities. By having a promissory note, the buyer agrees to make regular payments to the seller until the loan is fully paid off. This note also helps protect the seller's interest in the vehicle until the loan is repaid in full. There are a few different types of Lakeland Florida promissory notes in connection with the sale of a vehicle or automobile, namely: 1. Simple promissory note: This is the most common type of promissory note used in vehicle sales. It includes standard terms such as the loan amount, interest rate, payment schedule, and any late payment or default penalties. 2. Secured promissory note: In cases where the buyer fails to make payments as agreed, a secured promissory note allows the seller to repossess the vehicle as collateral to recover their losses. 3. Installment promissory note: This type of note divides the total loan amount into equal installments, making it easier for the buyer to manage repayment over an extended period. Each installment includes both principal and interest. 4. Balloon promissory note: In this type of note, the buyer agrees to make smaller regular payments over a specific period, with a large "balloon" payment due at the end of the term. This option is suitable for buyers who anticipate a large sum of money in the future to cover the final payment. 5. Demand promissory note: This note allows the seller to demand repayment of the loan at any time, usually with a specific notice period. While less common in vehicle sales, it offers flexibility to both parties. It is important for both the buyer and seller to carefully review and understand the terms and conditions outlined in the promissory note before signing. Seeking legal advice or assistance in drafting the note can ensure that all legal requirements are met and protect both parties' interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.