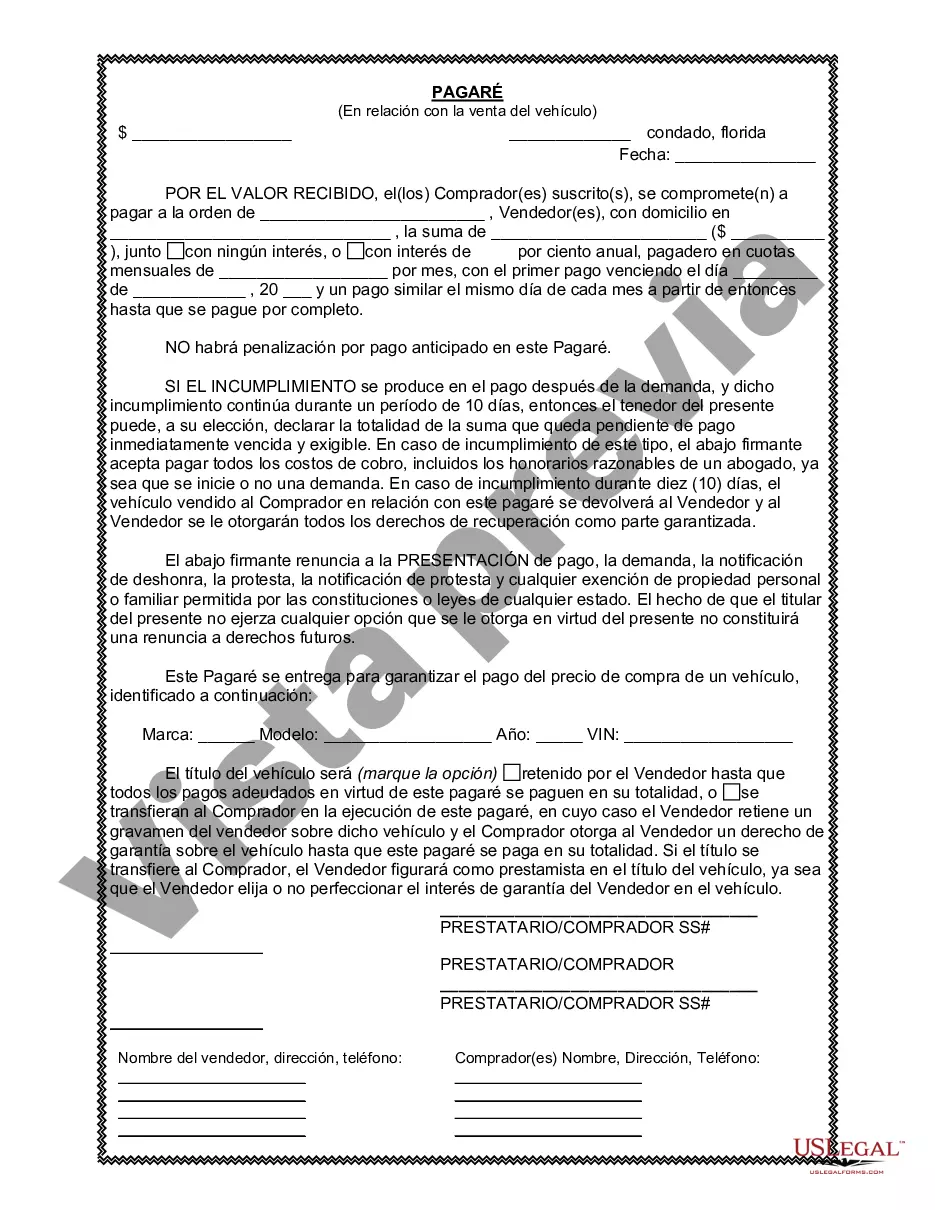

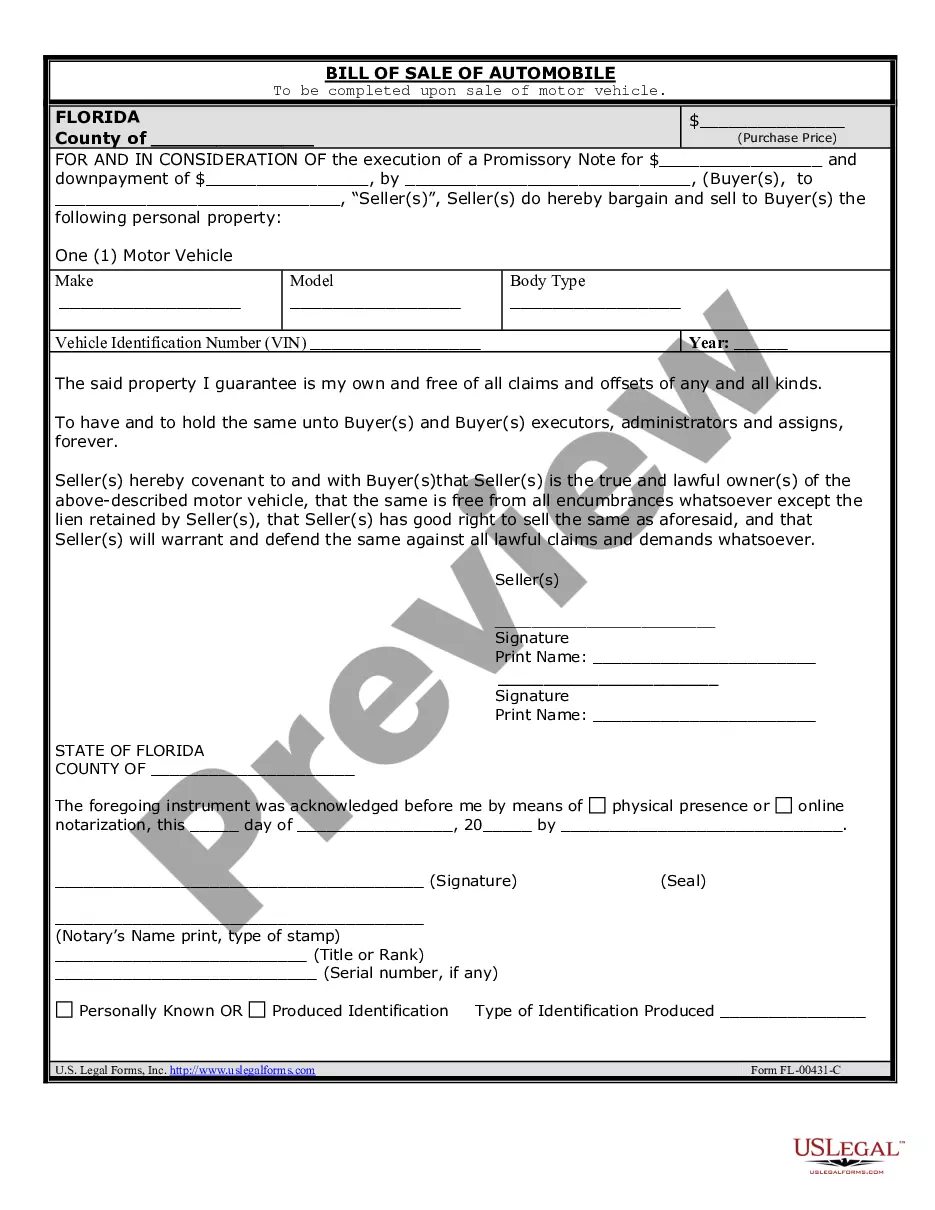

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Miami-Dade Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financing arrangement between a buyer and a seller for the purchase of a vehicle in Miami-Dade County, Florida. This document serves as a written agreement between both parties, providing a detailed description of the financial aspects involved in the sale. Keywords: Miami-Dade Florida, promissory note, sale of vehicle, automobile, financing arrangement, buyer, seller, purchase, terms and conditions, written agreement, financial aspects, sale. There are different types of Miami-Dade Florida Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Simple Promissory Note: This type of promissory note is straightforward and includes basic clauses such as the principal amount, interest rate, repayment schedule, and consequences of default. It is commonly used for smaller transactions or when the parties have a pre-existing relationship. 2. Installment Promissory Note: This type of promissory note is used when the buyer agrees to pay the purchase price in installments rather than a lump sum. It includes specific terms related to the timing and amount of each installment, interest calculation, and penalties for late payments. 3. Balloon Promissory Note: This type of promissory note involves regular payments for a specific period, with a larger "balloon" payment due at the end. This is often used when the buyer needs time to arrange for financing or intends to refinance the vehicle before the balloon payment becomes due. 4. Secured Promissory Note: This type of promissory note includes a security interest or lien on the vehicle being sold. In the event of default, the seller can reclaim the vehicle as collateral. This provides additional protection for the seller in case the buyer fails to make the agreed-upon payments. 5. Unsecured Promissory Note: This type of promissory note does not have any collateral or security interest attached to it. It relies solely on the buyer's promise to repay the loan according to the agreed-upon terms. Unsecured promissory notes may carry higher interest rates or stricter penalties for late payments due to the increased risk for the seller. In conclusion, a Miami-Dade Florida Promissory Note in Connection with Sale of Vehicle or Automobile is an essential legal document that establishes the terms and conditions of a financing arrangement for the purchase of a vehicle. Different types of promissory notes exist to cater to various financing scenarios and provide appropriate protection for both the buyer and the seller.Miami-Dade Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a financing arrangement between a buyer and a seller for the purchase of a vehicle in Miami-Dade County, Florida. This document serves as a written agreement between both parties, providing a detailed description of the financial aspects involved in the sale. Keywords: Miami-Dade Florida, promissory note, sale of vehicle, automobile, financing arrangement, buyer, seller, purchase, terms and conditions, written agreement, financial aspects, sale. There are different types of Miami-Dade Florida Promissory Notes in Connection with Sale of Vehicle or Automobile, including: 1. Simple Promissory Note: This type of promissory note is straightforward and includes basic clauses such as the principal amount, interest rate, repayment schedule, and consequences of default. It is commonly used for smaller transactions or when the parties have a pre-existing relationship. 2. Installment Promissory Note: This type of promissory note is used when the buyer agrees to pay the purchase price in installments rather than a lump sum. It includes specific terms related to the timing and amount of each installment, interest calculation, and penalties for late payments. 3. Balloon Promissory Note: This type of promissory note involves regular payments for a specific period, with a larger "balloon" payment due at the end. This is often used when the buyer needs time to arrange for financing or intends to refinance the vehicle before the balloon payment becomes due. 4. Secured Promissory Note: This type of promissory note includes a security interest or lien on the vehicle being sold. In the event of default, the seller can reclaim the vehicle as collateral. This provides additional protection for the seller in case the buyer fails to make the agreed-upon payments. 5. Unsecured Promissory Note: This type of promissory note does not have any collateral or security interest attached to it. It relies solely on the buyer's promise to repay the loan according to the agreed-upon terms. Unsecured promissory notes may carry higher interest rates or stricter penalties for late payments due to the increased risk for the seller. In conclusion, a Miami-Dade Florida Promissory Note in Connection with Sale of Vehicle or Automobile is an essential legal document that establishes the terms and conditions of a financing arrangement for the purchase of a vehicle. Different types of promissory notes exist to cater to various financing scenarios and provide appropriate protection for both the buyer and the seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.