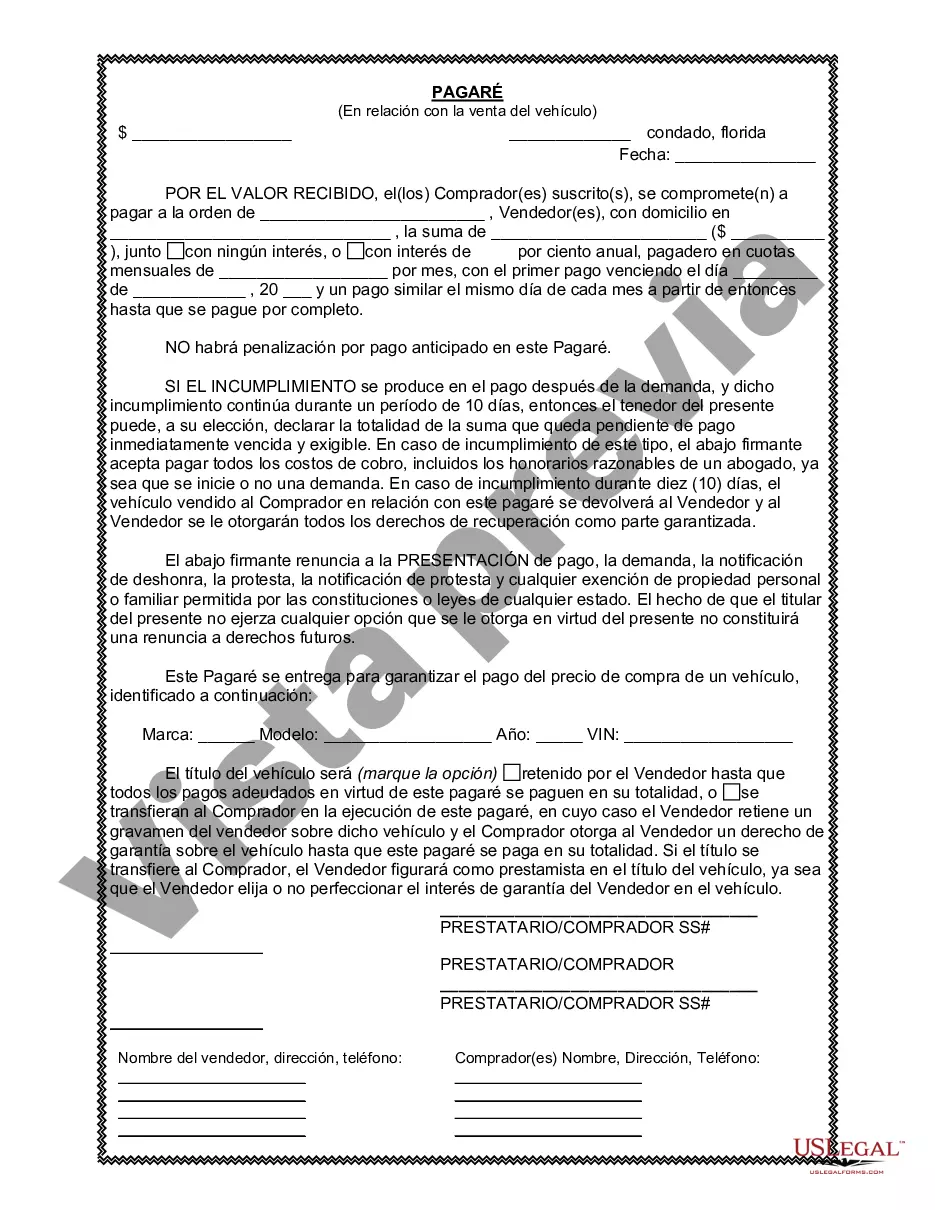

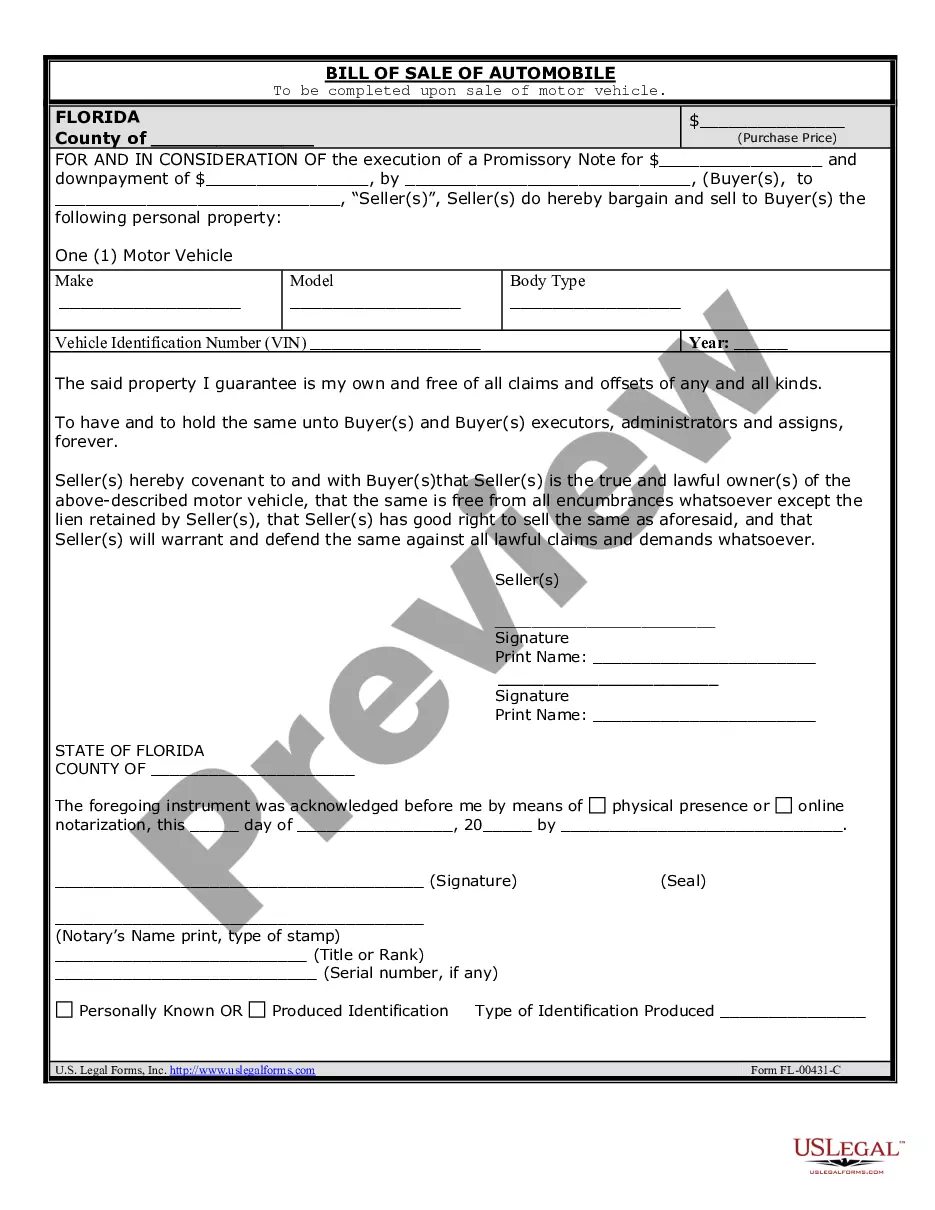

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Pembroke Pines Florida promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financial agreement between a buyer and a seller. This type of promissory note is commonly used when the buyer does not have the full amount for purchasing the vehicle upfront and agrees to pay in installments over a specific period of time. The promissory note serves as a written record of the agreement and includes vital information such as the identities of both the buyer and the seller, detailed vehicle specifications, and the agreed-upon purchase price. It outlines the terms of payment, including the number of installments, the due dates, and the method of payment. The promissory note also includes important clauses such as late payment fees, default consequences, and provisions for resolving disputes. It typically includes a clear statement that the seller retains ownership of the vehicle until all payments have been made in full, serving as a form of security for the seller. There are different types of Pembroke Pines Florida promissory notes in connection with the sale of a vehicle or automobile, including: 1. Simple Promissory Note: This is the most common type of promissory note used in vehicle sales. It outlines the basic terms of the agreement such as payment amount, installment schedule, and consequences for default. 2. Secured Promissory Note: In some cases, the seller may request additional security to minimize the risk of default. A secured promissory note includes provisions for collateral, such as the vehicle itself. If the buyer fails to make payments, the seller has the right to repossess the vehicle. 3. Balloon Payment Promissory Note: This type of promissory note structure allows the buyer to make smaller monthly payments over a specified period with a large final payment, known as a balloon payment, due at the end of the term. This can be beneficial for buyers who expect an influx of money in the future, such as a tax refund or a bonus. 4. Installment Sale Promissory Note: This type of promissory note allows the seller to retain ownership of the vehicle until the buyer has made all the agreed-upon payments. Once all payments are completed, the seller transfers ownership to the buyer. Before entering into any financial agreement, it is crucial for both the buyer and the seller to consult with legal professionals and ensure that the promissory note complies with Pembroke Pines, Florida, and federal laws. This will help protect the rights and interests of both parties involved in the vehicle sale transaction.A Pembroke Pines Florida promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financial agreement between a buyer and a seller. This type of promissory note is commonly used when the buyer does not have the full amount for purchasing the vehicle upfront and agrees to pay in installments over a specific period of time. The promissory note serves as a written record of the agreement and includes vital information such as the identities of both the buyer and the seller, detailed vehicle specifications, and the agreed-upon purchase price. It outlines the terms of payment, including the number of installments, the due dates, and the method of payment. The promissory note also includes important clauses such as late payment fees, default consequences, and provisions for resolving disputes. It typically includes a clear statement that the seller retains ownership of the vehicle until all payments have been made in full, serving as a form of security for the seller. There are different types of Pembroke Pines Florida promissory notes in connection with the sale of a vehicle or automobile, including: 1. Simple Promissory Note: This is the most common type of promissory note used in vehicle sales. It outlines the basic terms of the agreement such as payment amount, installment schedule, and consequences for default. 2. Secured Promissory Note: In some cases, the seller may request additional security to minimize the risk of default. A secured promissory note includes provisions for collateral, such as the vehicle itself. If the buyer fails to make payments, the seller has the right to repossess the vehicle. 3. Balloon Payment Promissory Note: This type of promissory note structure allows the buyer to make smaller monthly payments over a specified period with a large final payment, known as a balloon payment, due at the end of the term. This can be beneficial for buyers who expect an influx of money in the future, such as a tax refund or a bonus. 4. Installment Sale Promissory Note: This type of promissory note allows the seller to retain ownership of the vehicle until the buyer has made all the agreed-upon payments. Once all payments are completed, the seller transfers ownership to the buyer. Before entering into any financial agreement, it is crucial for both the buyer and the seller to consult with legal professionals and ensure that the promissory note complies with Pembroke Pines, Florida, and federal laws. This will help protect the rights and interests of both parties involved in the vehicle sale transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.