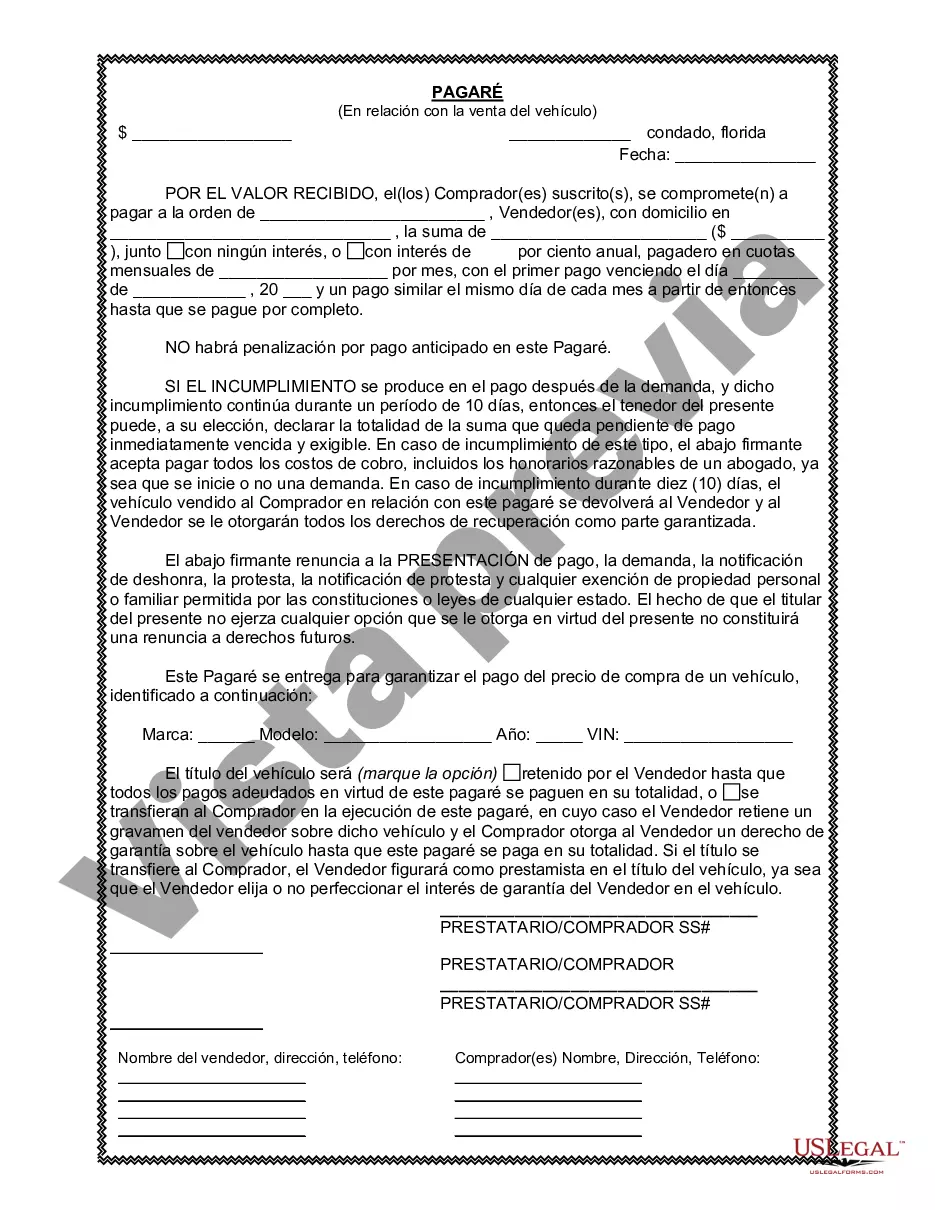

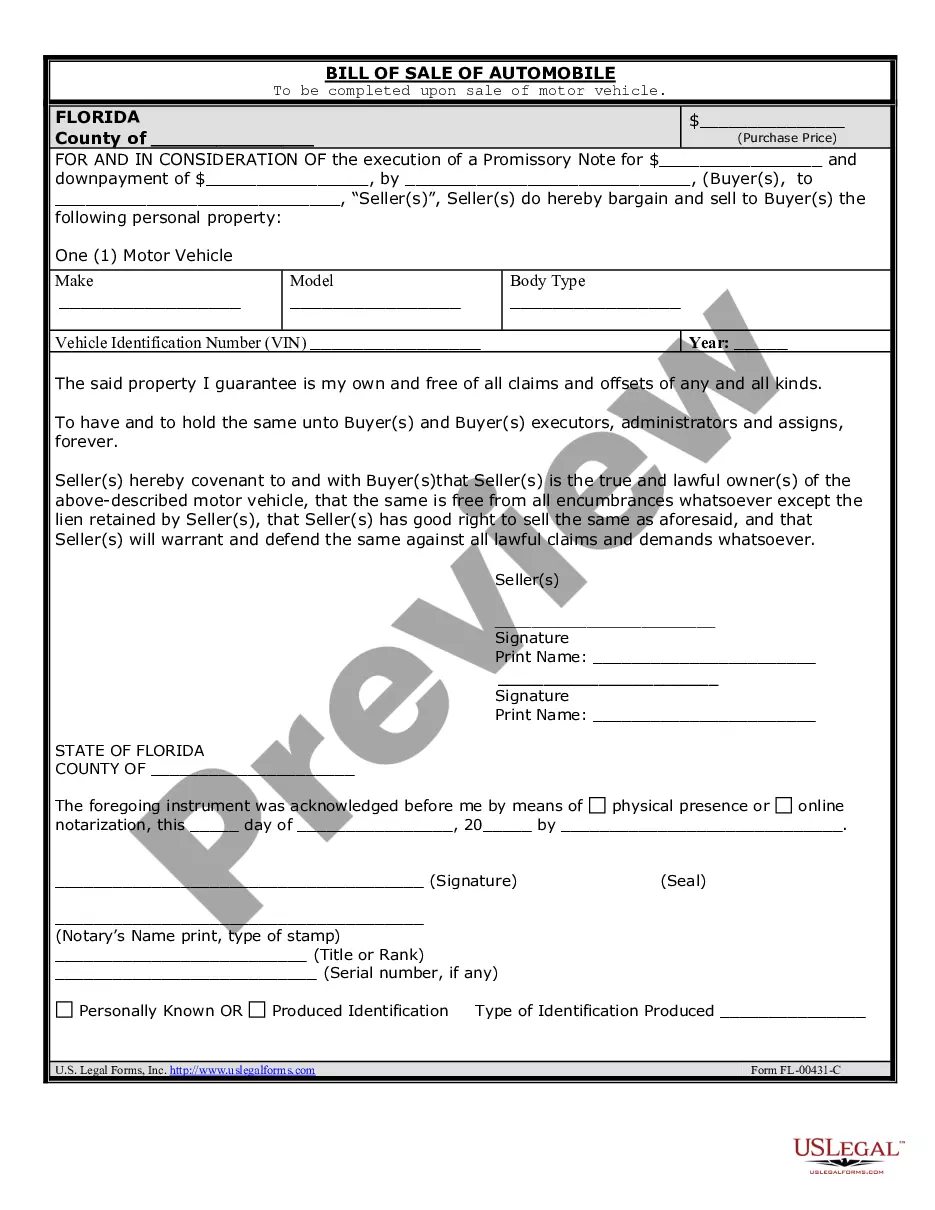

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Port St. Lucie Florida promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financial agreement between the buyer and the seller. It serves as evidence of a loan made by the seller to the buyer for the purchase of a vehicle, with the buyer promising to repay the loan amount in installments, including any applicable interest. The promissory note includes key details such as the identities of the parties involved (buyer and seller), the date of the agreement, the description of the vehicle being sold, the total loan amount, the repayment schedule, the interest rate (if any), and any additional terms and conditions agreed upon by both parties. It is crucial to clearly state the consequences of non-payment or default, including potential legal actions or repossession of the vehicle. There are different types of promissory notes that can be utilized in Port St. Lucie, Florida, for the sale of a vehicle or automobile: 1. Secured Promissory Note: This type of note includes a provision that grants the seller a security interest in the vehicle being sold. In the event of a default, the seller can reclaim the vehicle to satisfy the outstanding debt. 2. Unsecured Promissory Note: This note does not have any collateral attached to it. If the buyer defaults on payments, the seller may have to pursue legal actions to recover the loan amount. 3. Installment Promissory Note: This note establishes a structured repayment plan, specifying the amount and frequency of payments, including any applicable interest, until the loan is fully repaid. 4. Demand Promissory Note: Unlike an installment note, this type allows the lender to demand full repayment of the loan at their discretion. The buyer must repay the debt immediately upon request. 5. Interest-Bearing Promissory Note: This note includes an agreed-upon interest rate that accrues over the term of the loan, resulting in higher total repayment compared to a simple interest-free loan. When creating a Port St. Lucie Florida promissory note, it is crucial for both parties to carefully review and understand the terms before signing. It is also advisable for each party to seek legal counsel to ensure compliance with state and federal laws regarding vehicle sales and loans.A Port St. Lucie Florida promissory note in connection with the sale of a vehicle or automobile is a legally binding document that outlines the terms and conditions of a financial agreement between the buyer and the seller. It serves as evidence of a loan made by the seller to the buyer for the purchase of a vehicle, with the buyer promising to repay the loan amount in installments, including any applicable interest. The promissory note includes key details such as the identities of the parties involved (buyer and seller), the date of the agreement, the description of the vehicle being sold, the total loan amount, the repayment schedule, the interest rate (if any), and any additional terms and conditions agreed upon by both parties. It is crucial to clearly state the consequences of non-payment or default, including potential legal actions or repossession of the vehicle. There are different types of promissory notes that can be utilized in Port St. Lucie, Florida, for the sale of a vehicle or automobile: 1. Secured Promissory Note: This type of note includes a provision that grants the seller a security interest in the vehicle being sold. In the event of a default, the seller can reclaim the vehicle to satisfy the outstanding debt. 2. Unsecured Promissory Note: This note does not have any collateral attached to it. If the buyer defaults on payments, the seller may have to pursue legal actions to recover the loan amount. 3. Installment Promissory Note: This note establishes a structured repayment plan, specifying the amount and frequency of payments, including any applicable interest, until the loan is fully repaid. 4. Demand Promissory Note: Unlike an installment note, this type allows the lender to demand full repayment of the loan at their discretion. The buyer must repay the debt immediately upon request. 5. Interest-Bearing Promissory Note: This note includes an agreed-upon interest rate that accrues over the term of the loan, resulting in higher total repayment compared to a simple interest-free loan. When creating a Port St. Lucie Florida promissory note, it is crucial for both parties to carefully review and understand the terms before signing. It is also advisable for each party to seek legal counsel to ensure compliance with state and federal laws regarding vehicle sales and loans.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.