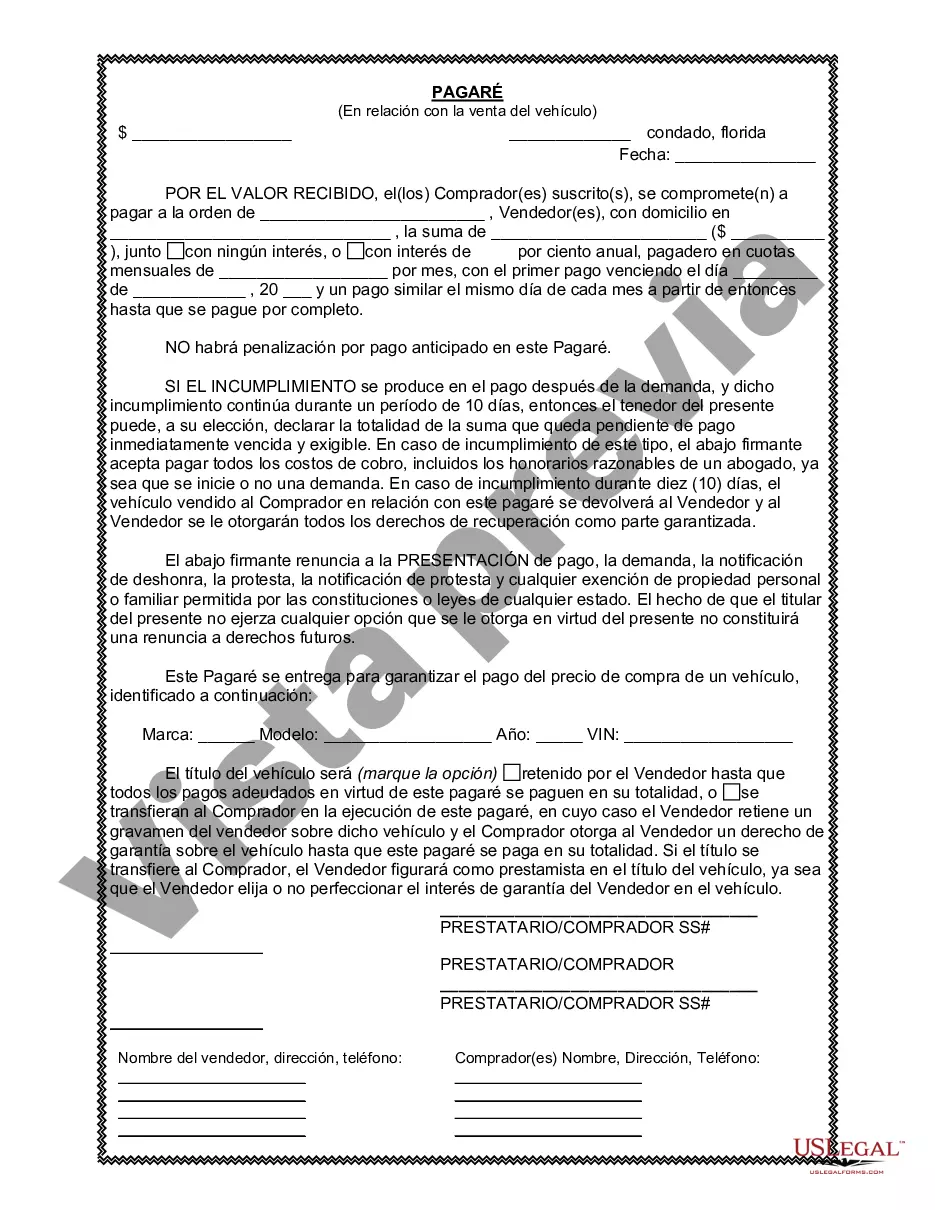

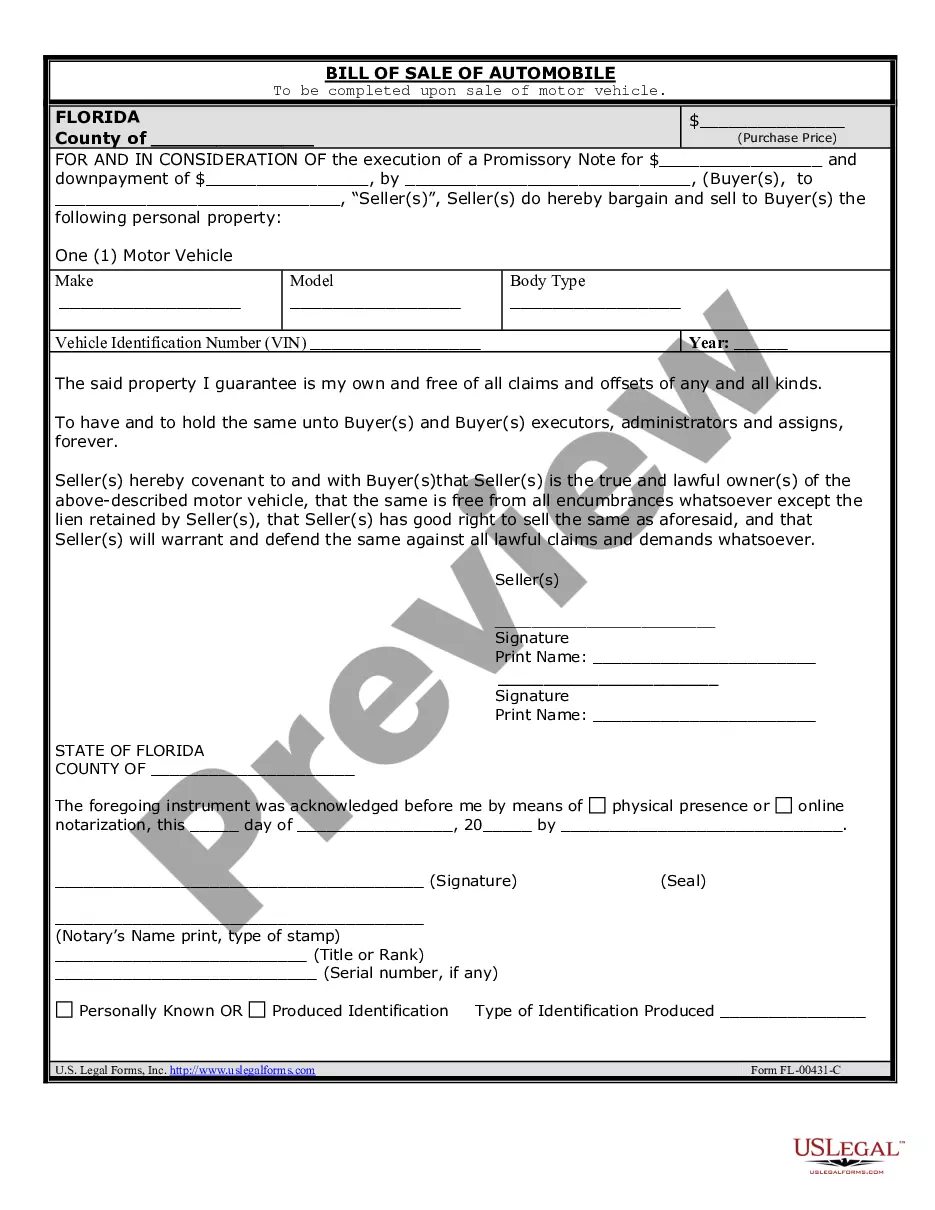

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Tallahassee Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller for the purchase of a vehicle. This promissory note serves as evidence of the loan and establishes the obligation of the buyer to repay the borrowed amount to the seller within the specified time frame and conditions. Keywords: Tallahassee Florida, Promissory Note, Sale of Vehicle, Automobile, loan agreement, buyer, seller, borrowed amount, repayment, terms and conditions. There might be different types of Tallahassee Florida Promissory Notes in Connection with Sale of Vehicle or Automobile, such as: 1. Secured Promissory Note: This type of promissory note includes a collateral clause where the vehicle being purchased acts as security for the loan. In case of default, the seller has the right to repossess the vehicle. 2. Unsecured Promissory Note: Unlike a secured note, this type of promissory note does not involve any collateral. The buyer agrees to repay the borrowed amount without any specific asset securing the loan. 3. Installment Promissory Note: This note includes detailed repayment terms, such as the loan amount, interest rate, and a schedule of regular payments. The buyer is required to repay the loan in fixed installments over a specific period. 4. Balloon Promissory Note: This type of note allows the buyer to make smaller regular payments for a certain period, followed by one larger final payment known as the balloon payment. This provides the buyer with flexibility in smaller payments while ensuring a lump sum payment at the end of the agreement. 5. Adjustable-Rate Promissory Note: This note includes an adjustable interest rate, which means that the interest rate can vary over the term of the loan. The buyer should be aware that the monthly payments may change accordingly. It is important to consult with a legal professional or seek proper legal advice when drafting or signing a Tallahassee Florida Promissory Note in Connection with Sale of Vehicle or Automobile to ensure that all necessary legal requirements and regulations are met.A Tallahassee Florida Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller for the purchase of a vehicle. This promissory note serves as evidence of the loan and establishes the obligation of the buyer to repay the borrowed amount to the seller within the specified time frame and conditions. Keywords: Tallahassee Florida, Promissory Note, Sale of Vehicle, Automobile, loan agreement, buyer, seller, borrowed amount, repayment, terms and conditions. There might be different types of Tallahassee Florida Promissory Notes in Connection with Sale of Vehicle or Automobile, such as: 1. Secured Promissory Note: This type of promissory note includes a collateral clause where the vehicle being purchased acts as security for the loan. In case of default, the seller has the right to repossess the vehicle. 2. Unsecured Promissory Note: Unlike a secured note, this type of promissory note does not involve any collateral. The buyer agrees to repay the borrowed amount without any specific asset securing the loan. 3. Installment Promissory Note: This note includes detailed repayment terms, such as the loan amount, interest rate, and a schedule of regular payments. The buyer is required to repay the loan in fixed installments over a specific period. 4. Balloon Promissory Note: This type of note allows the buyer to make smaller regular payments for a certain period, followed by one larger final payment known as the balloon payment. This provides the buyer with flexibility in smaller payments while ensuring a lump sum payment at the end of the agreement. 5. Adjustable-Rate Promissory Note: This note includes an adjustable interest rate, which means that the interest rate can vary over the term of the loan. The buyer should be aware that the monthly payments may change accordingly. It is important to consult with a legal professional or seek proper legal advice when drafting or signing a Tallahassee Florida Promissory Note in Connection with Sale of Vehicle or Automobile to ensure that all necessary legal requirements and regulations are met.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.