Pompano Beach Florida Buyer's Request for Accounting from Seller under Contract for Deed — Understanding the Process of Financial Disclosure When entering into a Contract for Deed in Pompano Beach, Florida, buyers may have specific requirements and concerns regarding the financial aspects of the transaction. As part of the due diligence process, potential buyers often request accounting information from the seller to ensure transparency and protect their interests. This detailed description will help you understand the buyer's request for accounting from the seller under Contract for Deed in Pompano Beach. What is a Contract for Deed? Before diving into the buyer's request for accounting, it's essential to define what a Contract for Deed is. In Pompano Beach, Florida, a Contract for Deed, also known as a land contract or installment contract, is a real estate agreement where the seller finances the purchase of the property, acting as the lender. Instead of obtaining traditional financing from a bank, the buyer makes regular payments to the seller until the agreed-upon purchase price is paid in full. Once paid, the seller transfers the property's title to the buyer. Why Request Accounting from the Seller? When purchasing a property through a Contract for Deed, buyers commonly request accounting information from sellers to gain a comprehensive understanding of the financial aspects involved in the transaction. This request allows buyers to assess the payment history, the remaining balance, any outstanding liens or encumbrances, and the calculation and allocation of interest, if applicable. The accounting information helps ensure transparency and protects the buyer from unexpected financial surprises during the contract term. Types of Pompano Beach Florida Buyer's Request for Accounting from Seller under Contract for Deed: 1. Payment History: Buyers typically request a detailed breakdown of the payment history, including dates, amounts paid, and any late fees assessed. This information allows buyers to confirm that the seller has accurately recorded all payments made to date. 2. Remaining Balance: Knowing the outstanding balance is crucial for buyers to plan their future payments and understand how much more they need to pay before obtaining the property's title. 3. Verification of Title: Buyers often inquire about the status of the property's title to ensure that no liens or encumbrances exist, which could hinder their ability to receive clear title upon the final payment. 4. Interest Calculation and Allocation (if applicable): In some cases, the seller may charge interest on the unpaid balance. Buyers may request a breakdown of the interest calculation and how the interest is allocated to each payment to ensure accuracy and compliance with the agreed terms. 5. Escrow Account Verification: If the seller is responsible for paying property taxes, insurance, or other expenses on behalf of the buyer, the buyer might request an accounting of these charges. This ensures that the seller has fulfilled their obligations and prevents any potential issues with unpaid expenses. In conclusion, a Pompano Beach Florida Buyer's Request for Accounting from Seller under Contract for Deed is a vital step in the due diligence process. Buyers should carefully review past payment records, understand the remaining balance and any potential interest charges, verify the property's title status, and confirm the transfer of funds in escrow accounts. By thoroughly examining these accounting details, buyers can safeguard their investment and ensure a smooth transition of property ownership.

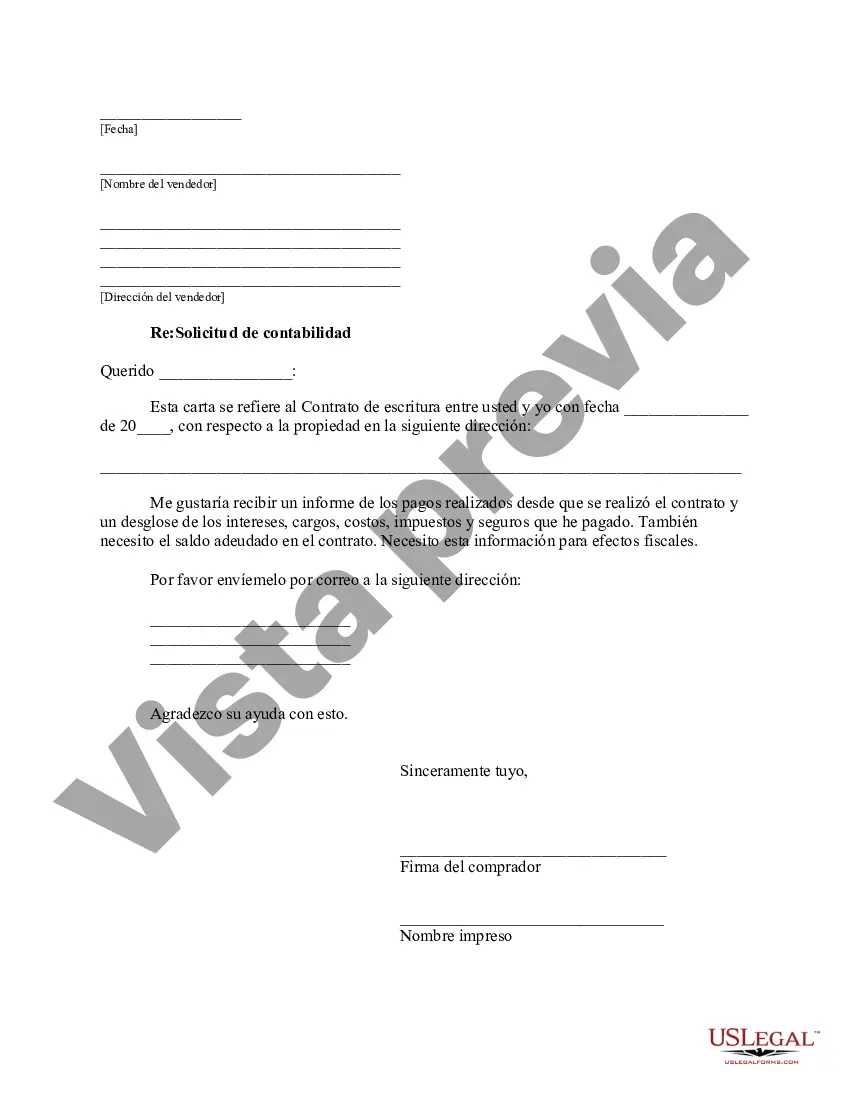

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pompano Beach Florida Solicitud del Comprador para la Contabilidad del Vendedor bajo el Contrato de Escritura - Florida Buyer's Request for Accounting from Seller under Contract for Deed

Description

How to fill out Pompano Beach Florida Solicitud Del Comprador Para La Contabilidad Del Vendedor Bajo El Contrato De Escritura?

Regardless of social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s practically impossible for a person with no legal background to draft this sort of paperwork cfrom the ground up, mainly because of the convoluted jargon and legal nuances they entail. This is where US Legal Forms comes to the rescue. Our platform provides a massive catalog with over 85,000 ready-to-use state-specific forms that work for pretty much any legal scenario. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you require the Pompano Beach Florida Buyer's Request for Accounting from Seller under Contract for Deed or any other paperwork that will be valid in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Pompano Beach Florida Buyer's Request for Accounting from Seller under Contract for Deed in minutes using our reliable platform. In case you are already a subscriber, you can go ahead and log in to your account to download the appropriate form.

Nevertheless, in case you are unfamiliar with our platform, make sure to follow these steps before downloading the Pompano Beach Florida Buyer's Request for Accounting from Seller under Contract for Deed:

- Be sure the template you have found is suitable for your area since the rules of one state or area do not work for another state or area.

- Preview the form and go through a brief description (if provided) of scenarios the document can be used for.

- If the form you picked doesn’t meet your needs, you can start over and look for the necessary document.

- Click Buy now and pick the subscription option you prefer the best.

- utilizing your credentials or register for one from scratch.

- Pick the payment gateway and proceed to download the Pompano Beach Florida Buyer's Request for Accounting from Seller under Contract for Deed once the payment is completed.

You’re good to go! Now you can go ahead and print the form or fill it out online. If you have any issues locating your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out now and see for yourself.