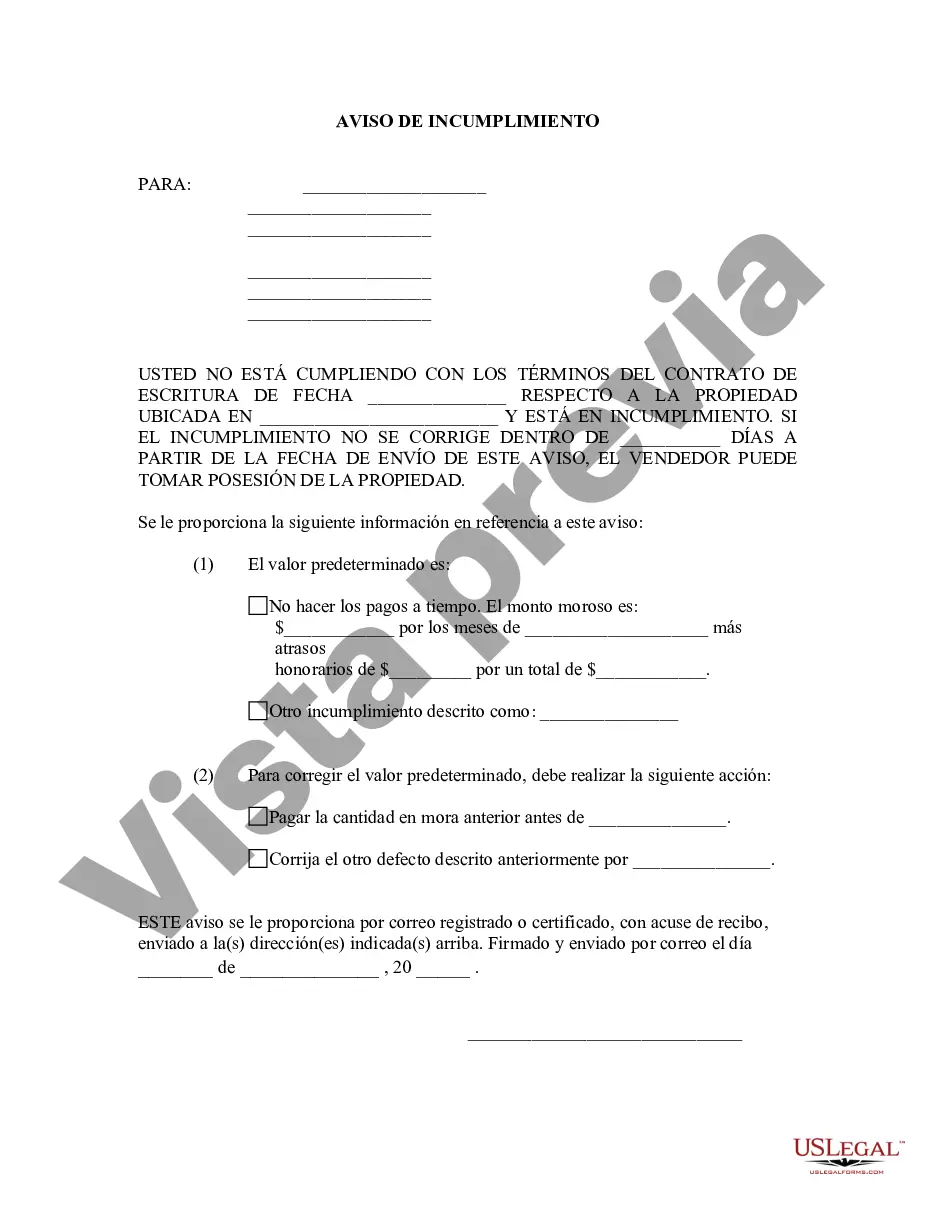

Title: Miramar, Florida — General Notice of Default for Contract for Deed Explained Introduction: In Miramar, Florida, a General Notice of Default for a Contract for Deed serves as a crucial legal document that outlines the actions to be taken when a party defaults on a contract for deed agreement. This informative article provides a detailed description of what a Notice of Default entails, explaining its significance in protecting the rights and interests of both the seller and the buyer involved in a Contract for Deed transaction. Additionally, we will touch upon the different types of Notices of Default that may exist in a Miramar, Florida context. I. Understanding the Notice of Default for Contract for Deed: The Notice of Default for a Contract for Deed is a legal document required in the state of Florida to notify the buyer of the default and to prompt them to take appropriate steps to rectify the situation. This notice is typically issued by the seller, also known as the vendor, to the buyer, referred to as the Vendée. II. Content and Purpose of the Notice of Default: 1. Clear Identification: The Notice of Default should clearly identify the parties involved, including their names, addresses, and contact information. This ensures that the notice reaches the intended recipient promptly. 2. Reason for Default: The notice must provide a detailed explanation of the reason for default, outlining any specific breach of contract terms, such as missed payments or failure to meet other obligations under the agreement. 3. Cure Period: A crucial component of the Notice of Default is specifying a reasonable time frame, known as the cure period, within which the buyer must rectify the default. This period allows the buyer the opportunity to catch up on payments or fulfill their contractual obligations. 4. Consequences of Failure to Cure: The consequences of failing to cure the default within the stipulated cure period should be mentioned in the notice. This may include the initiation of foreclosure proceedings or termination of the contract, potentially leading to the return of the property to the seller. III. Types of Miramar, Florida General Notice of Default for Contract for Deed: 1. Notice of Default for Missed Payments: This type of notice is issued when the buyer fails to make timely payments as specified in the agreed-upon contract for deed. 2. Notice of Default for Breach of Contract: This notice is used when the buyer violates the terms and conditions of the contract in ways other than payments, such as failure to maintain the property, unauthorized alterations, or any other contractual breach. 3. Notice of Default for Failure to Fulfill Obligations: This type of notice is sent when the buyer fails to meet other obligations stipulated in the contract, such as the payment of property taxes, homeowner association fees, insurance premiums, or failure to maintain adequate insurance coverage. Conclusion: In Miramar, Florida, the General Notice of Default for a Contract for Deed plays a vital role in communicating the buyer's default to the seller and outlining necessary steps for resolution. By providing detailed information on the nature of default, specified cure periods, and potential consequences, this notice helps maintain clarity, transparency, and fairness within Contract for Deed transactions. Proper attention to contractual obligations and communication is essential for both buyers and sellers to ensure a smooth and successful real estate transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miramar Florida Aviso general de incumplimiento de contrato de escritura - Florida General Notice of Default for Contract for Deed

Description

How to fill out Miramar Florida Aviso General De Incumplimiento De Contrato De Escritura?

If you are looking for a valid form, it’s impossible to choose a more convenient place than the US Legal Forms website – probably the most comprehensive online libraries. With this library, you can find thousands of document samples for business and individual purposes by categories and regions, or keywords. With our high-quality search feature, getting the newest Miramar Florida General Notice of Default for Contract for Deed is as easy as 1-2-3. Furthermore, the relevance of every document is confirmed by a team of expert lawyers that regularly review the templates on our platform and revise them based on the newest state and county requirements.

If you already know about our system and have a registered account, all you should do to get the Miramar Florida General Notice of Default for Contract for Deed is to log in to your user profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines below:

- Make sure you have found the form you want. Read its explanation and make use of the Preview feature to explore its content. If it doesn’t suit your needs, utilize the Search option near the top of the screen to get the proper file.

- Affirm your selection. Click the Buy now button. Following that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to complete the registration procedure.

- Get the template. Pick the file format and save it on your device.

- Make adjustments. Fill out, edit, print, and sign the received Miramar Florida General Notice of Default for Contract for Deed.

Each template you save in your user profile has no expiry date and is yours forever. It is possible to gain access to them via the My Forms menu, so if you need to have an extra version for editing or printing, feel free to return and export it once again at any time.

Make use of the US Legal Forms extensive catalogue to get access to the Miramar Florida General Notice of Default for Contract for Deed you were looking for and thousands of other professional and state-specific templates on a single platform!