Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed is an essential legal document that outlines the rights and obligations of both the seller and the buyer in a real estate transaction involving a contract for deed arrangement. This disclosure is designed to protect both parties and ensure transparency throughout the process. In Miramar, Florida, there are different types of Seller's Disclosure of Forfeiture Rights for the Contract for Deed, depending on the specific circumstances and agreements made between the seller and the buyer. Here are some possible types: 1. Standard Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed: This is the most common type, used when there are no special conditions or unique arrangements between the parties. 2. Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed with Special Conditions: This type of disclosure is used when there are specific terms and conditions agreed upon between the seller and the buyer. These conditions may include additional rights, restrictions, or obligations. 3. Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed with Escrow Agreement: In some cases, the parties may choose to include an escrow agreement as part of the contract for deed. This type of disclosure would include details about the escrow arrangement, including the responsibilities of each party involved. Regardless of the specific type, a Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed typically covers several important aspects: 1. Property details: It provides a comprehensive description of the property, including its legal address, lot size, construction details, and any potential defects or issues known to the seller. 2. Financial terms: The disclosure outlines the financial terms of the contract for deed, including the purchase price, down payment, monthly payment amount, interest rate, and any late payment or default penalties. 3. Seller obligations: It explains the responsibilities of the seller during the contract for deed period, such as maintaining property insurance, paying property taxes, and addressing any necessary repairs or maintenance. 4. Buyer obligations: The disclosure outlines the obligations of the buyer, including making timely payments, maintaining property insurance, and complying with any homeowner association rules or restrictions. 5. Forfeiture rights: This is a crucial aspect of the disclosure and highlights the potential consequences for both parties in case of default or breach of contract. It explains the conditions under which the seller can forfeit the buyer's rights to the property and what steps need to be taken to initiate this process. 6. Disclosure of potential risks or issues: The document also discloses any known defects, hazards, or environmental issues related to the property that the seller is aware of. This helps the buyer make an informed decision and understand what they are acquiring. In summary, the Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed is a critical legal document that outlines the rights, obligations, and potential risks involved in a contract for deed arrangement. It ensures transparency and protects the interests of both the seller and the buyer throughout the real estate transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miramar Florida Divulgación del vendedor de los derechos de confiscación del contrato de escritura - Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed

Description

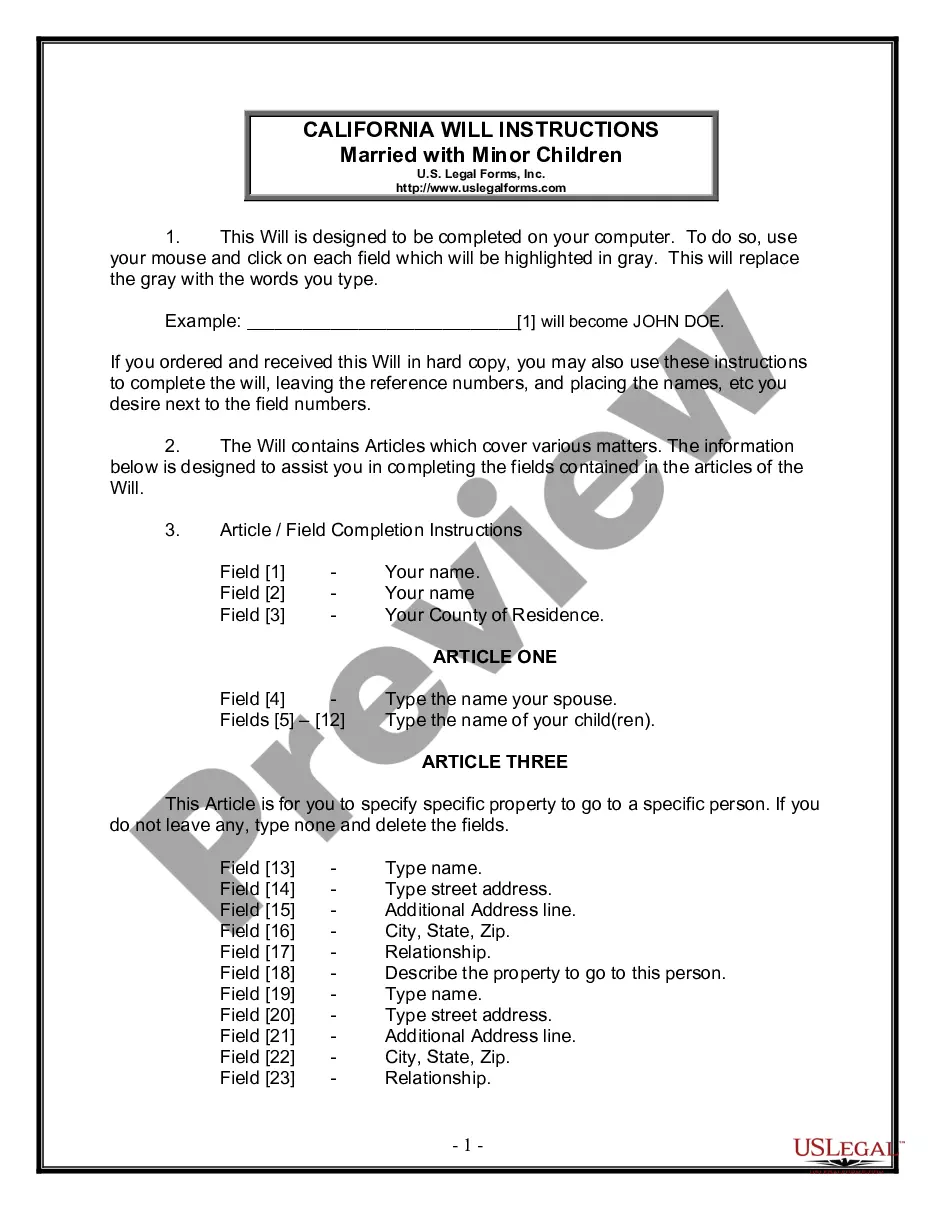

How to fill out Miramar Florida Divulgación Del Vendedor De Los Derechos De Confiscación Del Contrato De Escritura?

Benefit from the US Legal Forms and obtain immediate access to any form sample you need. Our useful website with a large number of templates makes it easy to find and obtain almost any document sample you need. It is possible to save, complete, and sign the Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed in just a couple of minutes instead of browsing the web for many hours attempting to find an appropriate template.

Utilizing our catalog is a wonderful way to improve the safety of your record filing. Our experienced attorneys regularly review all the documents to make sure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How can you get the Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed? If you already have a profile, just log in to the account. The Download option will appear on all the samples you look at. Additionally, you can find all the previously saved documents in the My Forms menu.

If you don’t have a profile yet, stick to the instruction listed below:

- Open the page with the template you require. Make certain that it is the form you were looking for: verify its headline and description, and use the Preview option if it is available. Otherwise, use the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order using a credit card or PayPal.

- Download the document. Indicate the format to get the Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed and revise and complete, or sign it according to your requirements.

US Legal Forms is among the most significant and reliable template libraries on the web. Our company is always happy to help you in virtually any legal process, even if it is just downloading the Miramar Florida Seller's Disclosure of Forfeiture Rights for Contract for Deed.

Feel free to take full advantage of our form catalog and make your document experience as efficient as possible!