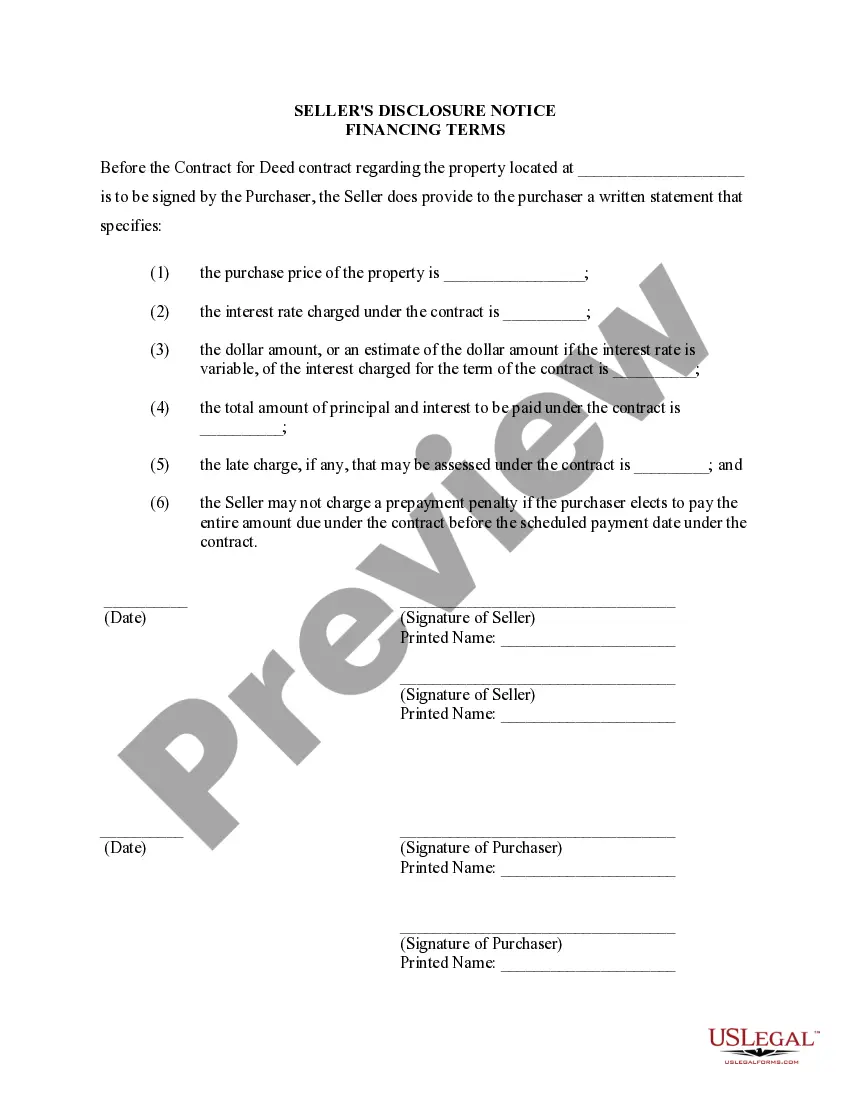

This Seller's Disclosure Notice of Financing Terms Contract for Deed serves as notice to Purchaser of the purchase price of property and how payments, interest, and late charges are set. This document should be completed by Seller of property and provided to the Purchaser at or before the signing of the contract for deed.

The Gainesville Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an essential document that outlines the financing terms and conditions involved in the sale of residential property. This disclosure helps protect the interests of both sellers and buyers by providing transparency and clarity regarding the financial aspects of the transaction. Here are some relevant keywords and information related to this topic: 1. Seller's Disclosure of Financing Terms: This section of the document provides a comprehensive overview of the financing options available to the buyer, including the terms, interest rates, and repayment plans associated with the contract or agreement for deed. It is crucial for sellers to disclose accurate and detailed financing terms to ensure transparency and avoid any misunderstandings during the transaction. 2. Residential Property: The Seller's Disclosure of Financing Terms applies specifically to residential properties, which include single-family homes, townhouses, condominiums, or any other type of property primarily used for residential purposes. It does not typically cover commercial or industrial properties. 3. Contract or Agreement for Deed: Also known as a land contract, this is a legal agreement between the seller and the buyer, where the buyer agrees to make regular payments to the seller in installments over a specified period. Unlike a traditional mortgage, the buyer does not receive immediate ownership of the property but gains equitable interest during the repayment period. 4. Financing Options: The disclosure should outline various financing options available to the buyer, such as fixed-rate mortgages, adjustable-rate mortgages, or even seller financing. It should clearly state the specific terms for each option, including interest rates, repayment period, and any other relevant details. 5. Interest Rates: It is essential to disclose the interest rates associated with the financing terms, whether it is a fixed rate or adjustable rate. The disclosure should clearly state the initial interest rate, any potential future adjustments, and the calculation method used to determine the interest rate. 6. Repayment Plans: The disclosure should outline the repayment plans available to the buyer, including the frequency and amount of payments. This can include monthly payments, bi-weekly payments, or any other agreed-upon schedule. It should also specify whether there are any penalties or fees associated with early or late payments. 7. Down Payment Requirements: It is crucial to specify the down payment requirements, if any, in the disclosure. This includes stating whether a down payment is necessary, the minimum amount required, and any flexibility regarding payment options. 8. Default and Remedies: The disclosure should clearly state the consequences of defaulting on the financing terms, including any penalties, foreclosure procedures, or other remedies available to the seller. It is important for buyers to understand the potential risks and consequences associated with non-payment or breach of the agreement. These are some key aspects involved in the Gainesville Florida Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. It is crucial for both sellers and buyers to thoroughly review and understand this disclosure to ensure a smooth and transparent transaction.The Gainesville Florida Seller's Disclosure of Financing Terms for Residential Property in connection with Contract or Agreement for Deed a/k/a Land Contract is an essential document that outlines the financing terms and conditions involved in the sale of residential property. This disclosure helps protect the interests of both sellers and buyers by providing transparency and clarity regarding the financial aspects of the transaction. Here are some relevant keywords and information related to this topic: 1. Seller's Disclosure of Financing Terms: This section of the document provides a comprehensive overview of the financing options available to the buyer, including the terms, interest rates, and repayment plans associated with the contract or agreement for deed. It is crucial for sellers to disclose accurate and detailed financing terms to ensure transparency and avoid any misunderstandings during the transaction. 2. Residential Property: The Seller's Disclosure of Financing Terms applies specifically to residential properties, which include single-family homes, townhouses, condominiums, or any other type of property primarily used for residential purposes. It does not typically cover commercial or industrial properties. 3. Contract or Agreement for Deed: Also known as a land contract, this is a legal agreement between the seller and the buyer, where the buyer agrees to make regular payments to the seller in installments over a specified period. Unlike a traditional mortgage, the buyer does not receive immediate ownership of the property but gains equitable interest during the repayment period. 4. Financing Options: The disclosure should outline various financing options available to the buyer, such as fixed-rate mortgages, adjustable-rate mortgages, or even seller financing. It should clearly state the specific terms for each option, including interest rates, repayment period, and any other relevant details. 5. Interest Rates: It is essential to disclose the interest rates associated with the financing terms, whether it is a fixed rate or adjustable rate. The disclosure should clearly state the initial interest rate, any potential future adjustments, and the calculation method used to determine the interest rate. 6. Repayment Plans: The disclosure should outline the repayment plans available to the buyer, including the frequency and amount of payments. This can include monthly payments, bi-weekly payments, or any other agreed-upon schedule. It should also specify whether there are any penalties or fees associated with early or late payments. 7. Down Payment Requirements: It is crucial to specify the down payment requirements, if any, in the disclosure. This includes stating whether a down payment is necessary, the minimum amount required, and any flexibility regarding payment options. 8. Default and Remedies: The disclosure should clearly state the consequences of defaulting on the financing terms, including any penalties, foreclosure procedures, or other remedies available to the seller. It is important for buyers to understand the potential risks and consequences associated with non-payment or breach of the agreement. These are some key aspects involved in the Gainesville Florida Seller's Disclosure of Financing Terms for Residential Property in connection with a Contract or Agreement for Deed. It is crucial for both sellers and buyers to thoroughly review and understand this disclosure to ensure a smooth and transparent transaction.