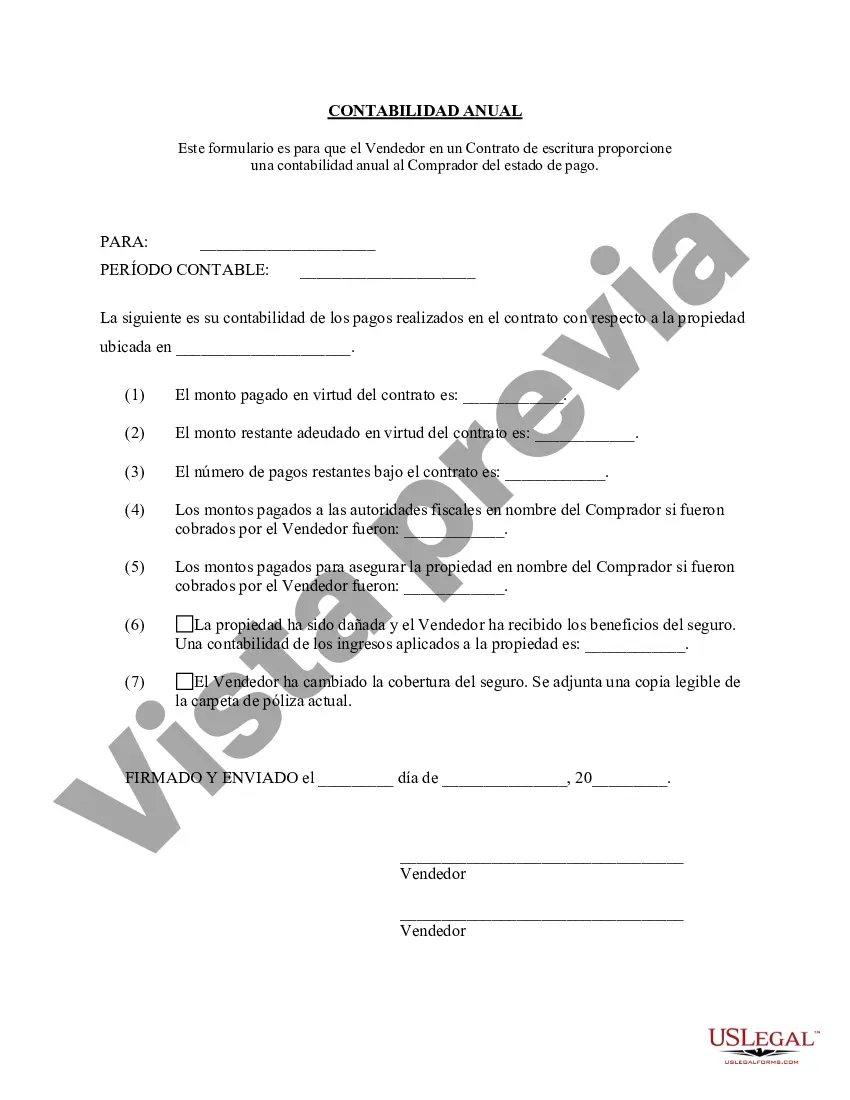

The Broward Florida Contract for Deed Seller's Annual Accounting Statement is a critical document that summarizes the financial transactions and performance of sellers involved in selling properties through a contract for deed in Broward County, Florida. This statement is mandatory for sellers to fulfill their legal obligations and provide transparency to the involved parties. The Broward Florida Contract for Deed Seller's Annual Accounting Statement includes several essential components to ensure accurate reporting and accountability. These components consist of income and expenses related to the contract for deed property, including payments received from the buyer, property taxes, insurance premiums, repair costs, and other relevant expenditures. It also encompasses the calculation of interest accrued on the seller's financing, principal balance, and the remaining term of the contract. This statement presents a comprehensive overview of the property's cash flow, allowing sellers to assess the profitability and financial health of their investment. By providing this annual accounting statement to the buyer and any relevant parties involved, sellers can maintain transparency and comply with Broward County regulations. There are various types of Broward Florida Contract for Deed Seller's Annual Accounting Statements that may be used depending on the specific requirements and terms agreed upon in the contract. These can include: 1. Basic Annual Accounting Statement: This statement typically includes essential financial information, such as the total amount of payments received, property expenses, and the remaining balance on the contract. It provides a simple overview of the property's financial performance. 2. Detailed Annual Accounting Statement: This statement provides a more in-depth analysis of the property's financials, including a breakdown of income and expenses. It may include specific categories for various expenditures, such as maintenance costs, property management fees, or utilities. This level of detail allows sellers to have a clearer understanding of the property's financial position. 3. Amended Annual Accounting Statement: This statement is used when there are changes or modifications to the original contract terms or when additional information needs to be included. It ensures that all parties are aware of any updates or amendments that may impact the financial reporting. The Broward Florida Contract for Deed Seller's Annual Accounting Statement serves as a crucial tool for sellers engaged in contract for deed transactions in Broward County. It facilitates financial transparency, helps track income and expenses, and provides an accurate representation of the property's financial wellbeing. By utilizing these statements, sellers can ensure compliance with local regulations and maintain clear communication with buyers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Contrato de Escrituración Estado Contable Anual del Vendedor - Florida Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Broward Florida Contrato De Escrituración Estado Contable Anual Del Vendedor?

Make use of the US Legal Forms and have immediate access to any form you want. Our useful platform with a huge number of document templates simplifies the way to find and obtain virtually any document sample you require. You can save, fill, and certify the Broward Florida Contract for Deed Seller's Annual Accounting Statement in a few minutes instead of surfing the Net for many hours searching for an appropriate template.

Using our catalog is a great strategy to improve the safety of your form filing. Our professional lawyers on a regular basis check all the records to ensure that the forms are appropriate for a particular state and compliant with new acts and regulations.

How do you obtain the Broward Florida Contract for Deed Seller's Annual Accounting Statement? If you already have a subscription, just log in to the account. The Download option will appear on all the samples you view. Furthermore, you can find all the earlier saved records in the My Forms menu.

If you don’t have a profile yet, stick to the instructions below:

- Find the form you need. Ensure that it is the template you were hoping to find: examine its title and description, and take take advantage of the Preview feature when it is available. Otherwise, make use of the Search field to look for the appropriate one.

- Start the saving procedure. Click Buy Now and choose the pricing plan you like. Then, create an account and process your order with a credit card or PayPal.

- Export the file. Select the format to obtain the Broward Florida Contract for Deed Seller's Annual Accounting Statement and edit and fill, or sign it according to your requirements.

US Legal Forms is one of the most considerable and reliable document libraries on the internet. Our company is always happy to help you in virtually any legal case, even if it is just downloading the Broward Florida Contract for Deed Seller's Annual Accounting Statement.

Feel free to take advantage of our service and make your document experience as straightforward as possible!

Form popularity

Interesting Questions

More info

Buyer would have to prove that Seller has breached the agreement under an affidavit. Can the seller sell the property without disclosing an issue of interest in the home? Can the seller be held liable for the lender's error? Can the lender be held liable for the error? Can the lender and seller renegotiate the contract? Can the lender and seller enforce their agreement? Can the lender and seller sign the agreement? No. If the seller is the only person who owns the property, the seller cannot sell the property without disclosing any issues of interest in the property to the other people who may live in the home. Can the seller sell the property without disclosing an issue of interest in the home? Are there other terms and conditions in the contract that the seller can either not or choose not to disclose to the other party? You cannot unilaterally get out of a contract if you are both the only owners of the land on which it is located.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.