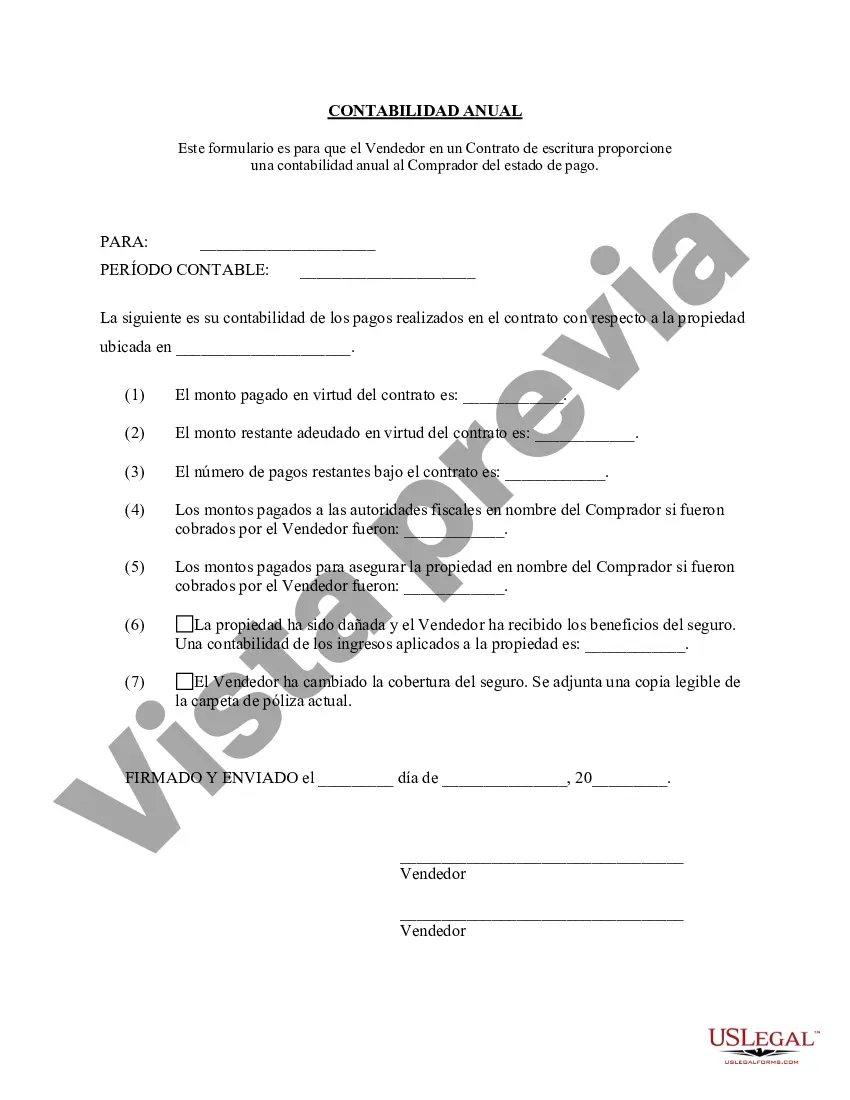

Gainesville Florida Contrato de Escrituración Estado Contable Anual del Vendedor - Florida Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Florida Contrato De Escrituración Estado Contable Anual Del Vendedor?

Locating verified templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements and various real-life situations.

All the materials are meticulously arranged by usage category and jurisdiction, making the search for the Gainesville Florida Contract for Deed Seller's Annual Accounting Statement as quick and effortless as ABC.

Enter your credit card information or utilize your PayPal account to settle the payment for the service. Download the Gainesville Florida Contract for Deed Seller's Annual Accounting Statement to save the template on your device for further completion, and access it anytime in the My documents menu of your profile. Maintaining organized paperwork that conforms to legal stipulations is crucial. Utilize the US Legal Forms library to always have essential document templates readily available for any requirements!

- Examine the Preview mode and document description.

- Ensure you’ve selected the correct one that addresses your needs and fully aligns with your local jurisdiction stipulations.

- Look for another template, if necessary.

- If you encounter any discrepancies, utilize the Search tab above to find the appropriate one. If it meets your requirements, proceed to the next step.

- Purchase the document.