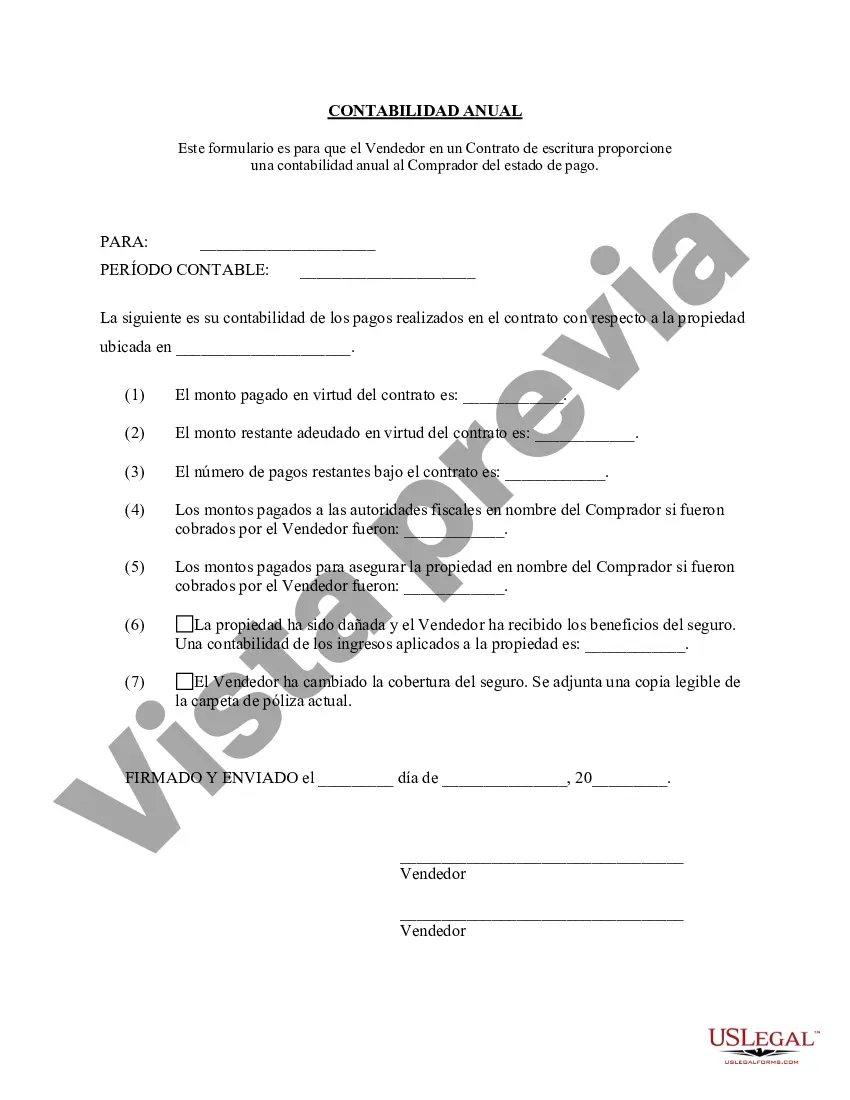

The Hillsborough Florida Contract for Deed Seller's Annual Accounting Statement is a crucial document that provides a comprehensive overview of the financial transactions and obligations between the seller and buyer involved in a contract for deed agreement in Hillsborough County, Florida. This statement serves as an essential tool to maintain transparency and track the financial progress of the contract. In its essence, the Hillsborough Florida Contract for Deed Seller's Annual Accounting Statement offers a detailed breakdown of the annual financial activities related to the property's sale through a contract for deed. Sellers are required to prepare this statement annually and provide it to the buyer. It involves several key elements, including: 1. Parties Involved: The statement identifies both the seller and buyer involved in the contract for deed agreement. Their contact information, legal names, and any other pertinent details are mentioned here. 2. Property Information: This section provides a thorough description of the property being sold, including the address, legal description, and any unique identifiers like parcel or tax numbers. 3. Transaction Summary: The seller's annual accounting statement contains an exhaustive record of all financial transactions between the seller and the buyer during the specific annual period. It includes details about the principal payments made by the buyer, interest charges (if applicable), any additional fees, and late payment penalties. 4. Escrow Account: If an escrow account is established as part of the contract for deed agreement, the statement will outline the current balance, any deposits made, and all disbursements from the account. 5. Expenses and Taxes: This section lists any expenses related to the property that the buyer is responsible for, including property taxes, insurance, repairs, or maintenance costs. Additionally, it highlights if the seller has covered any of these expenses on the buyer's behalf during the accounting period. 6. Credits and Adjustments: In case of any credits or adjustments made, such as credits for on-time payments or penalties for late payments, this section explicitly outlines the details and corresponding amounts. 7. Outstanding Balances: The statement concludes by summarizing any outstanding balances or arrears owed by the buyer. It takes into account any late or missed payments, penalties, or interest charges, if applicable. It is important to note that there might not be different types of Hillsborough Florida Contract for Deed Seller's Annual Accounting Statements per se, as the content and structure typically remain consistent. However, the format and specific sections within the statement may differ based on individual contract for deed agreements or any additional stipulations mutually agreed upon by the parties involved. In conclusion, the Hillsborough Florida Contract for Deed Seller's Annual Accounting Statement is a vital document that enables both sellers and buyers to stay informed about the financial obligations and progress associated with a contract for deed agreement. By providing a comprehensive breakdown of transactions, expenses, and outstanding balances, this statement fosters transparency and effective communication between the involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Contrato de Escrituración Estado Contable Anual del Vendedor - Florida Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Hillsborough Florida Contrato De Escrituración Estado Contable Anual Del Vendedor?

Are you looking for a reliable and affordable legal forms provider to get the Hillsborough Florida Contract for Deed Seller's Annual Accounting Statement? US Legal Forms is your go-to choice.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a package of forms to advance your separation or divorce through the court, we got you covered. Our platform provides over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t generic and frameworked in accordance with the requirements of separate state and county.

To download the form, you need to log in account, find the required template, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates at any time from the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Hillsborough Florida Contract for Deed Seller's Annual Accounting Statement conforms to the laws of your state and local area.

- Read the form’s description (if available) to learn who and what the form is good for.

- Start the search over in case the template isn’t suitable for your legal scenario.

Now you can register your account. Then pick the subscription plan and proceed to payment. As soon as the payment is done, download the Hillsborough Florida Contract for Deed Seller's Annual Accounting Statement in any available format. You can get back to the website when you need and redownload the form free of charge.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online for good.