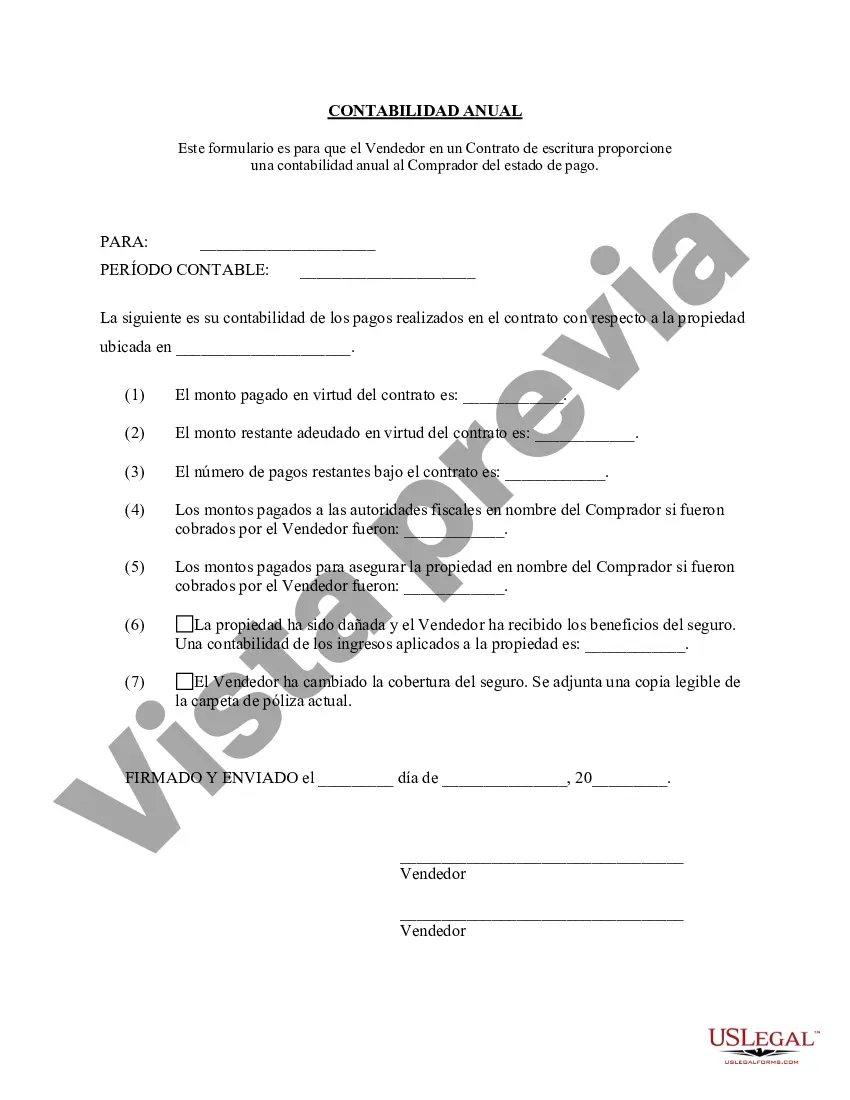

The Jacksonville Florida Contract for Deed Seller's Annual Accounting Statement is a comprehensive financial document prepared by a seller participating in a Contract for Deed transaction in Jacksonville, Florida. As the seller, this statement is crucial for fulfilling legal obligations, maintaining transparency, and providing a detailed overview of the financial aspects of the Contract for Deed agreement. The statement serves as an annual summary of all financial transactions, showcasing the income, expenses, and overall financial status of the seller. It is typically prepared at the end of each fiscal year and includes a wide range of important information. The primary purpose of this statement is to ensure that the seller is fulfilling their financial responsibilities and accurately monitoring the progress of the Contract for Deed agreement. Key sections and components of the Jacksonville Florida Contract for Deed Seller's Annual Accounting Statement may include: 1. Income: This section outlines all sources of income received by the seller, such as monthly payments, interest accrued, additional fees, or any other income related to the Contract for Deed agreement. 2. Expenses: This section details all expenses incurred by the seller, which may include property maintenance costs, property taxes, insurance payments, legal fees, administrative expenses, and any other costs related to the Contract for Deed transaction. 3. Debt and Interest: This section includes information about any outstanding debts or loans related to the property being sold through the Contract for Deed agreement. It also includes details about the interest rates applied to these debts. 4. Principal Balance: This section provides a snapshot of the remaining balance on the property being sold through the Contract for Deed agreement, calculated annually. 5. Payments Received: This section outlines all the payments received from the buyer throughout the year, as well as any outstanding or late payments. It provides a breakdown of the payment sources and ensures the seller is receiving the agreed-upon payments. 6. Detailed Account of Transactions: This section offers a comprehensive account of all financial transactions that occurred during the year, including dates, amounts, and purpose. It helps to maintain a clear record of the financial history of the Contract for Deed agreement. It is important to note that the specific structure and components of the Jacksonville Florida Contract for Deed Seller's Annual Accounting Statement may vary depending on the terms outlined in the Contract for Deed agreement and any additional regulations or requirements imposed by Jacksonville, Florida. Different types or variations of the Jacksonville Florida Contract for Deed Seller's Annual Accounting Statement may not exist, as it is primarily a standardized document prepared by the seller to fulfill legal obligations and ensure transparency. However, the content and format may vary slightly based on individual preferences or specific contractual agreements between the buyer and seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Jacksonville Florida Contrato de Escrituración Estado Contable Anual del Vendedor - Florida Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Jacksonville Florida Contrato De Escrituración Estado Contable Anual Del Vendedor?

Utilize the US Legal Forms and gain instant access to any document sample you desire.

Our helpful platform with a vast array of documents makes it easy to discover and acquire nearly any document sample you require.

You can export, complete, and authenticate the Jacksonville Florida Contract for Deed Seller's Annual Accounting Statement in just a few minutes, instead of spending hours online searching for the correct template.

Using our catalog is an excellent approach to enhance the security of your document filing.

In case you have not created an account yet, follow the steps outlined below.

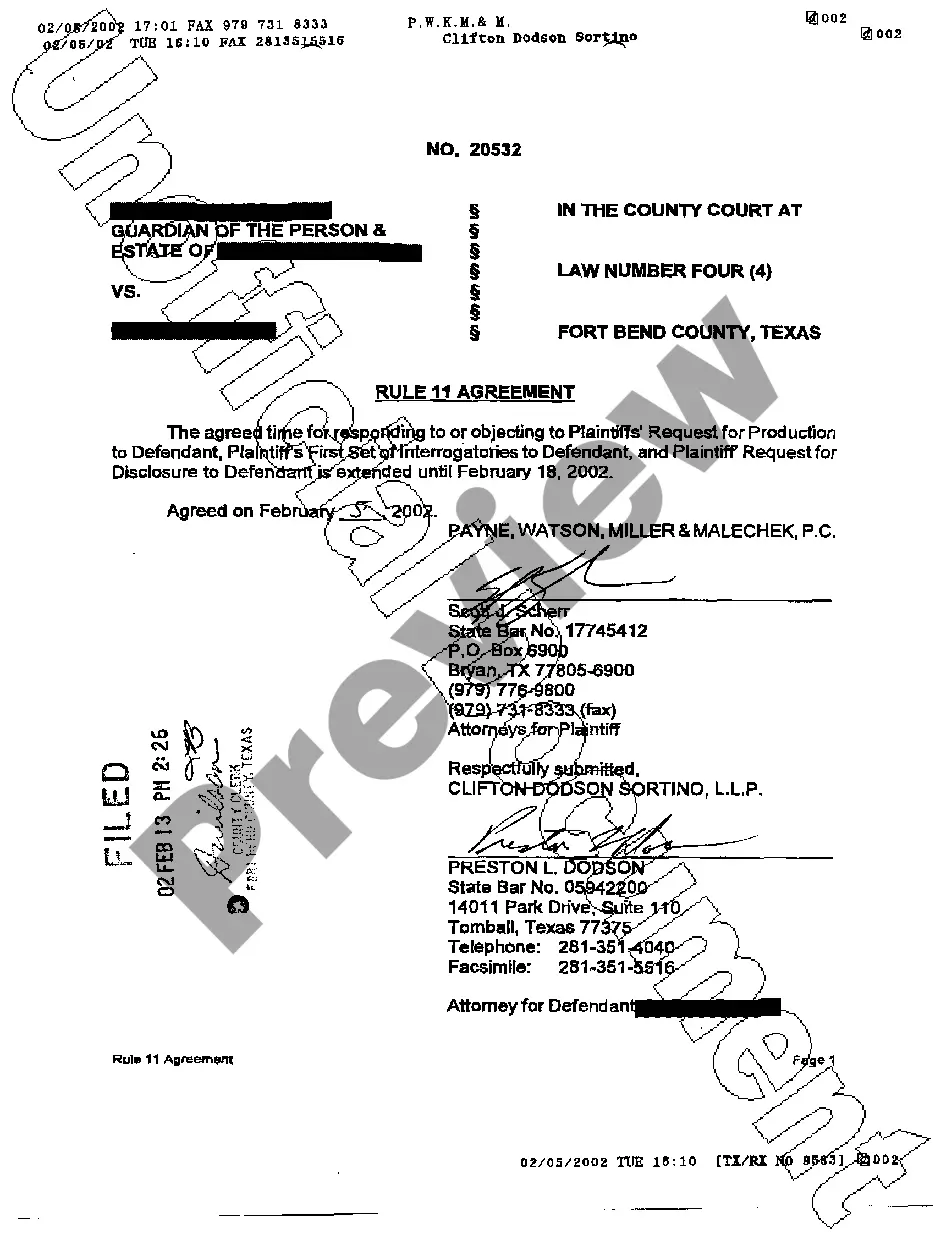

Access the page containing the form you require. Confirm that it is the template you were trying to find: check its title and description, and use the Preview option if it is accessible. Otherwise, use the Search bar to locate the necessary one.

- Our qualified legal experts routinely examine all documents to ensure that the templates are suitable for a specific region and adhere to current laws and regulations.

- How do you get the Jacksonville Florida Contract for Deed Seller's Annual Accounting Statement.

- If you already possess an account, simply Log In to your account. The Download function will be available on all the samples you examine.

- Additionally, you can locate all the previously saved documents in the My documents section.

Form popularity

FAQ

?No contract, agreement, or other instrument purporting to contain an agreement to purchase or sell real estate shall be recorded in the public records of any county in the state, unless such contract, agreement or other instrument is acknowledged by the vendor in the manner provided by law for the acknowledgment of

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

Pros and Cons of a Contract for Deed Pro 1: Flexibility. Typically, when homebuyers set out to purchase a new home, there are several rules that must be followed.Pro 2: Less Time Waiting.Con 1: In Case of Default.Con 2: Higher Interest Rates.

Disadvantages of Common Law Contracts Contracts cost time and money to write. Whether they're drafted by a lawyer or reviewed by one, or even if they are written by an HR professional, contracts require a good deal of energy and are not an inexpensive undertaking.

If you fall behind on payments, the contract can be terminated and you will lose whatever equity was previously built. Furthermore, if the seller has a mortgage and defaults on their payments, you may lose the property even though your own payments to the seller are current.

In Florida a contract for deed, or land contract, is a real property sale where the owner provides the financing for the purchase. The seller keeps the title for the property until the buyer makes the final payment on the agreed amount.

In Florida the seller of a contract for deed can sell the rights to a property to a third party while the buyer is making payments. However, Florida land contract law requires the seller to provide the buyer with a signed and notarized notice stating the contract for deed has been assigned to another party.

A disadvantage to the seller is that a contract for deed is frequently characterized by a low down payment and the purchase price is paid in installments instead of one lump sum. If a seller needs funds from the sale to buy another property, this would not be a beneficial method of selling real estate.

Essentially, an Agreement for Deed is a purchase money mortgage from the seller to the buyer, allowing the buyer to take possession before the full purchase price is paid to the seller. The Florida Courts and Legislature view an Agreement for Deed as a mortgage, securing an obligation to pay.

The contract for deed is a much faster and less costly transaction to execute than a traditional, purchase-money mortgage. In a typical contract for deed, there are no origination fees, formal applications, or high closing and settlement costs.