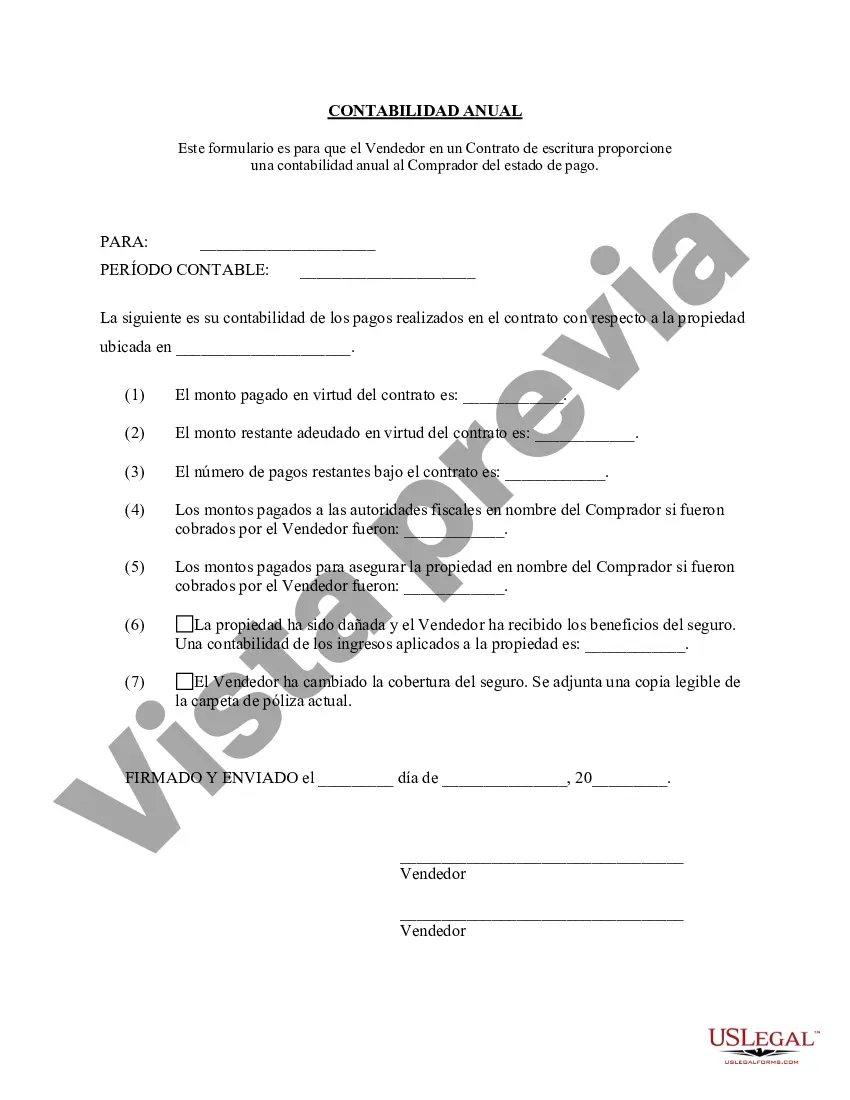

The Miami Gardens Florida Contracts for Deed Seller's Annual Accounting Statement is a crucial document that outlines the detailed financial transactions and activities associated with a specific contract for deed agreement in Miami Gardens, Florida. This statement serves as a comprehensive record of all receipts, disbursements, and related financial information pertaining to the sale and financing of real estate through a contract for deed arrangement. The annual accounting statement provides a transparent overview of the financial dealings between the contract for deed seller (also known as the vendor) and the buyer (also known as the Vendée). This statement reflects any payments made by the Vendée towards the purchase price of the property, including principal and interest payments, as well as any additional charges or fees outlined in the contract for deed agreement. The statement also accounts for any expenses incurred by the seller, such as property taxes, insurance premiums, or maintenance costs, which may have been paid on behalf of the Vendée. This breakdown ensures that both parties involved have a clear understanding of all financial transactions related to the contract for deed. Different types or variations of the Miami Gardens Florida Contracts for Deed Seller's Annual Accounting Statement may include: 1. Basic Annual Accounting Statement: This statement outlines the fundamental financial aspects of the contract for deed, including principal and interest payments, as well as any property taxes and insurance premiums paid by the seller. 2. Detailed Annual Accounting Statement: This type of statement provides a more comprehensive breakdown of all financial activities associated with the contract for deed, offering detailed information on payments, charges, and expenses for both the buyer and seller. It may include additional details such as late fees, penalties, or even escrow account information if applicable. 3. Tax-Related Accounting Statement: This specific type of annual accounting statement focuses on the tax implications and considerations associated with the contract for deed. It provides an overview of any tax deductions or credits available to the buyer or seller and ensures compliance with tax regulations. 4. Property Maintenance Accounting Statement: In cases where the seller is responsible for property maintenance or repairs, this type of statement specifically highlights all expenses incurred for maintaining the property during the accounting period. It includes costs such as repairs, landscaping, or any other necessary maintenance work. Overall, the Miami Gardens Florida Contracts for Deed Seller's Annual Accounting Statement is an essential record-keeping tool that ensures transparency and accountability between the buyer and seller within a contract for deed arrangement. It offers a detailed overview of all financial transactions within a specific period and ensures that both parties are aware of their financial obligations and rights as outlined in the contract for deed agreement.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami Gardens Florida Contrato de Escrituración Estado Contable Anual del Vendedor - Florida Contract for Deed Seller's Annual Accounting Statement

State:

Florida

City:

Miami Gardens

Control #:

FL-00470-4

Format:

Word

Instant download

Description

Declaración por escrito notificando al Comprador el número y monto de los pagos realizados hacia el contrato por el capital e intereses de la escritura.

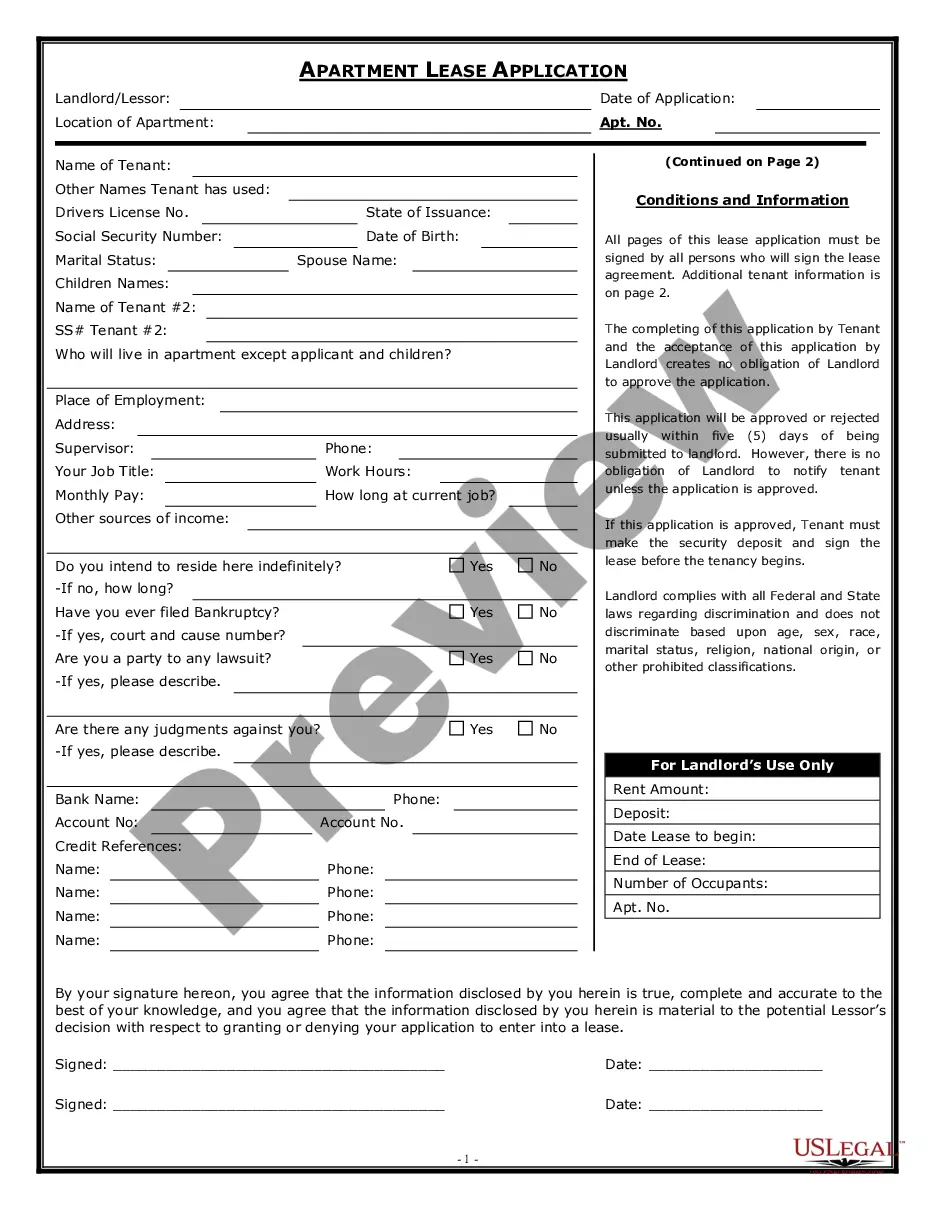

How to fill out Florida Contrato De Escrituración Estado Contable Anual Del Vendedor?

Regardless of one's social or occupational standing, completing legal documents is a regrettable requirement in today's society.

Frequently, it’s nearly unfeasible for an individual without any legal expertise to draft this type of paperwork from the ground up, primarily due to the intricate language and legal subtleties they involve.

This is where US Legal Forms can come to the rescue.

Ensure that the template you have selected is appropriate for your locality, as the regulations of one state or county may not apply to another.

Review the document and examine a brief outline (if available) of instances where the document can be utilized.

- Our service offers an extensive collection with over 85,000 ready-to-use state-specific forms that cater to nearly any legal circumstance.

- US Legal Forms is also a fantastic resource for associates or legal advisors aiming to enhance their time efficiency by using our DIY forms.

- Whether you require the Miami Gardens Florida Contract for Deed Seller's Annual Accounting Statement or any other document valid in your jurisdiction, with US Legal Forms, everything is easily accessible.

- Here’s how to swiftly acquire the Miami Gardens Florida Contract for Deed Seller's Annual Accounting Statement by utilizing our reliable service.

- If you are already a current customer, please proceed to Log In to your account to obtain the necessary form.

- However, if you are not familiar with our library, make sure to follow these steps before acquiring the Miami Gardens Florida Contract for Deed Seller's Annual Accounting Statement.

Form popularity

Interesting Questions

More info

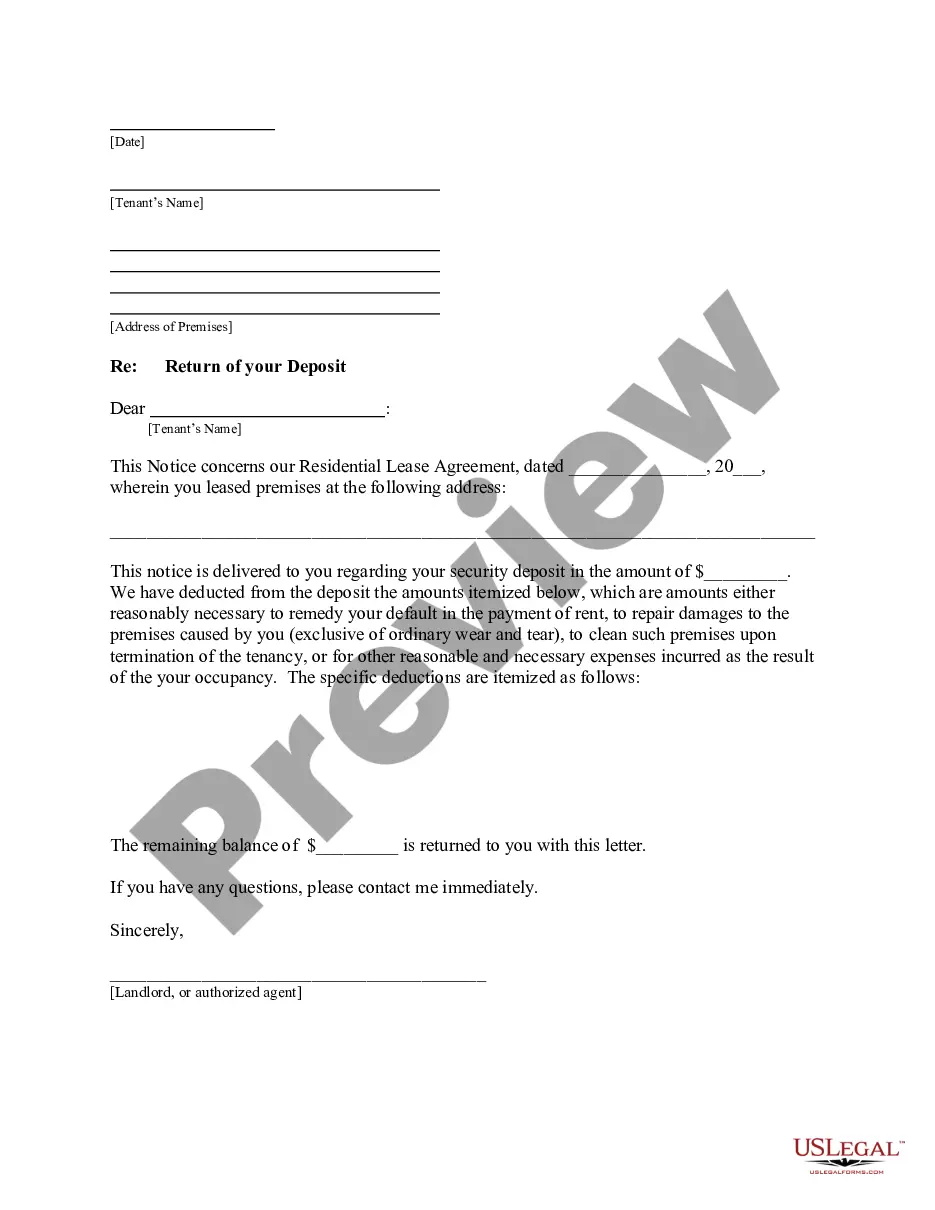

The buyer is able to occupy the home after the closing of the sale, but the seller still retains legal title to the property. MIAMI-DADE COUNTY, FLORIDA • 2018 COMPREHENSIVE ANNUAL FINANCIAL REPORT • INTRODUCTORY SECTION xi nine cities in the Waste Collection Service Area and nine.The Contract for Deed is a way to buy a house that doesn't involve a bank. (for residential contracts). A financial statement for McDowell Properties is enclosed. "Business day" means any calendar day except Saturday, Sunday, or a State or federal holiday. Here's how it works: Fill out and submit the registration form below. We just got the tax bill in the mail for the full year. Appraisal of Larkin 7000 Building (South Miami, FL) - HealthSouth Corp. Town of Davie, Florida.