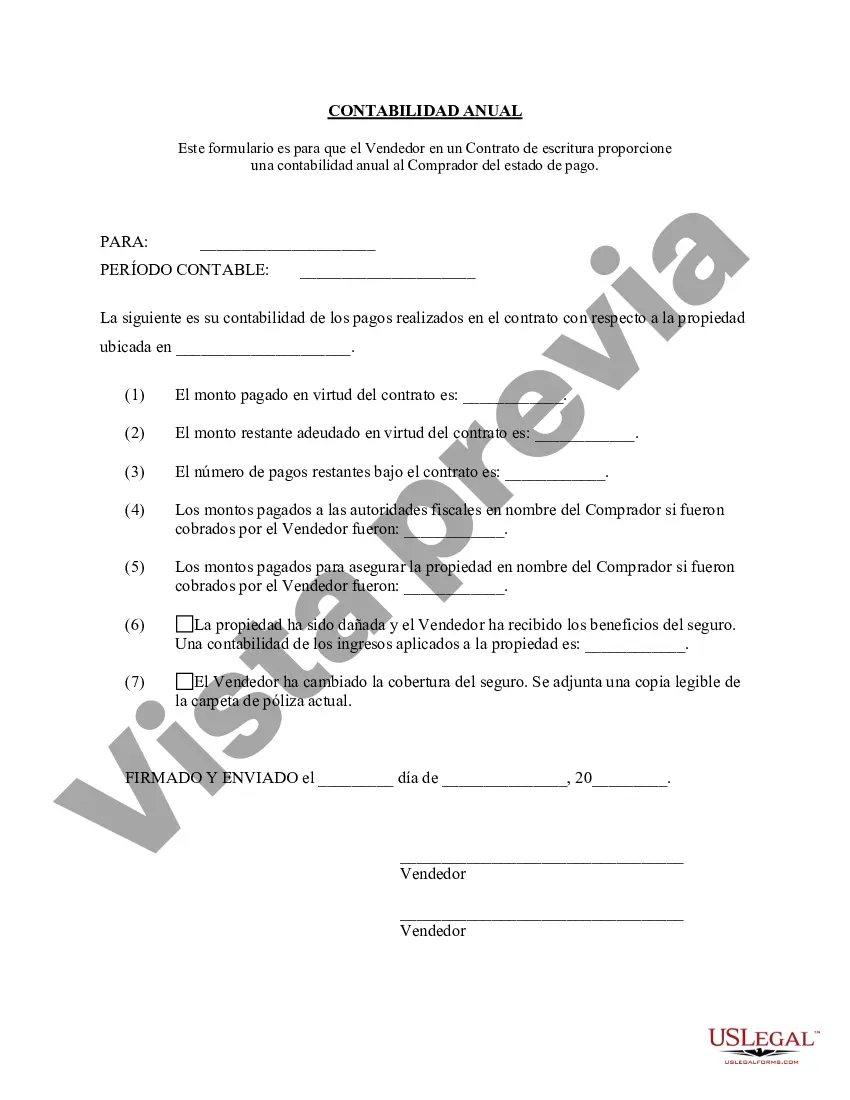

Miramar Florida Contract for Deed Seller's Annual Accounting Statement is a financial document that provides a detailed summary of financial transactions between a seller and buyer involved in a contract for deed agreement in Miramar, Florida. This statement serves as an important tool in ensuring transparency, accountability, and accurate record-keeping throughout the contract for deed transaction. The Miramar Florida Contract for Deed Seller's Annual Accounting Statement includes various components to provide a comprehensive overview of the financial aspects, which may vary based on the specific terms of the agreement. Some key elements covered in this statement are: 1. Purchase Price: The statement includes the original purchase price agreed upon by the seller and the buyer, which is the total monetary consideration for the property involved in the contract. 2. Payment Schedule: It outlines the payment schedule for the buyer, including the frequency (monthly, quarterly, etc.) and the due dates for each installment. This helps keep track of when payments are expected throughout the year. 3. Principal and Interest Payments: The seller's annual accounting statement breaks down the principal and interest portion of each payment made by the buyer. This information helps calculate the outstanding balance and the reduction of the principal amount over time. 4. Escrow Account Details: If an escrow account was established as part of the contract for deed agreement, the statement will include a detailed breakdown of any funds held in escrow for insurance, taxes, or other purposes. 5. Additional Charges: Any additional charges, such as late fees or penalties, are mentioned in the statement. This ensures both parties are aware of any outstanding obligations or fees that need to be settled. 6. Taxes and Insurance: The seller's annual accounting statement highlights the payment of property taxes and homeowner's insurance if the seller agrees to handle these responsibilities on behalf of the buyer. This section helps understand the allocation and management of these expenses. 7. Repairs and Maintenance: In some cases, the seller may be responsible for repairs and maintenance expenses. The statement will outline these costs and any reimbursements made by the buyer. Miramar Florida Contract for Deed Seller's Annual Accounting Statement may have variations based on specific contractual agreements. For example, there could be statements that focus solely on the principal and interest payments, while others may include additional information such as late fees, repairs, or escrow account details. In conclusion, the Miramar Florida Contract for Deed Seller's Annual Accounting Statement is a crucial financial document that ensures transparency and accurate reporting of financial transactions between a seller and buyer under a contract for deed agreement. It provides essential information regarding payment schedules, principal and interest payments, escrow account details, additional charges, taxes and insurance payments, and repairs and maintenance expenses, among others.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miramar Florida Contrato de Escrituración Estado Contable Anual del Vendedor - Florida Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Miramar Florida Contrato De Escrituración Estado Contable Anual Del Vendedor?

Regardless of social or professional status, filling out legal documents is an unfortunate necessity in today’s world. Very often, it’s practically impossible for a person with no law education to create this sort of paperwork cfrom the ground up, mostly due to the convoluted terminology and legal subtleties they involve. This is where US Legal Forms can save the day. Our service provides a massive library with more than 85,000 ready-to-use state-specific documents that work for pretty much any legal scenario. US Legal Forms also is an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you require the Miramar Florida Contract for Deed Seller's Annual Accounting Statement or any other document that will be good in your state or area, with US Legal Forms, everything is on hand. Here’s how you can get the Miramar Florida Contract for Deed Seller's Annual Accounting Statement in minutes using our trusted service. If you are presently an existing customer, you can proceed to log in to your account to download the appropriate form.

However, if you are a novice to our library, ensure that you follow these steps before obtaining the Miramar Florida Contract for Deed Seller's Annual Accounting Statement:

- Ensure the template you have found is good for your area since the rules of one state or area do not work for another state or area.

- Preview the document and go through a quick outline (if available) of cases the paper can be used for.

- In case the form you picked doesn’t meet your requirements, you can start over and search for the suitable document.

- Click Buy now and pick the subscription option that suits you the best.

- with your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Miramar Florida Contract for Deed Seller's Annual Accounting Statement once the payment is through.

You’re good to go! Now you can proceed to print the document or complete it online. If you have any issues getting your purchased documents, you can easily access them in the My Forms tab.

Whatever situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.