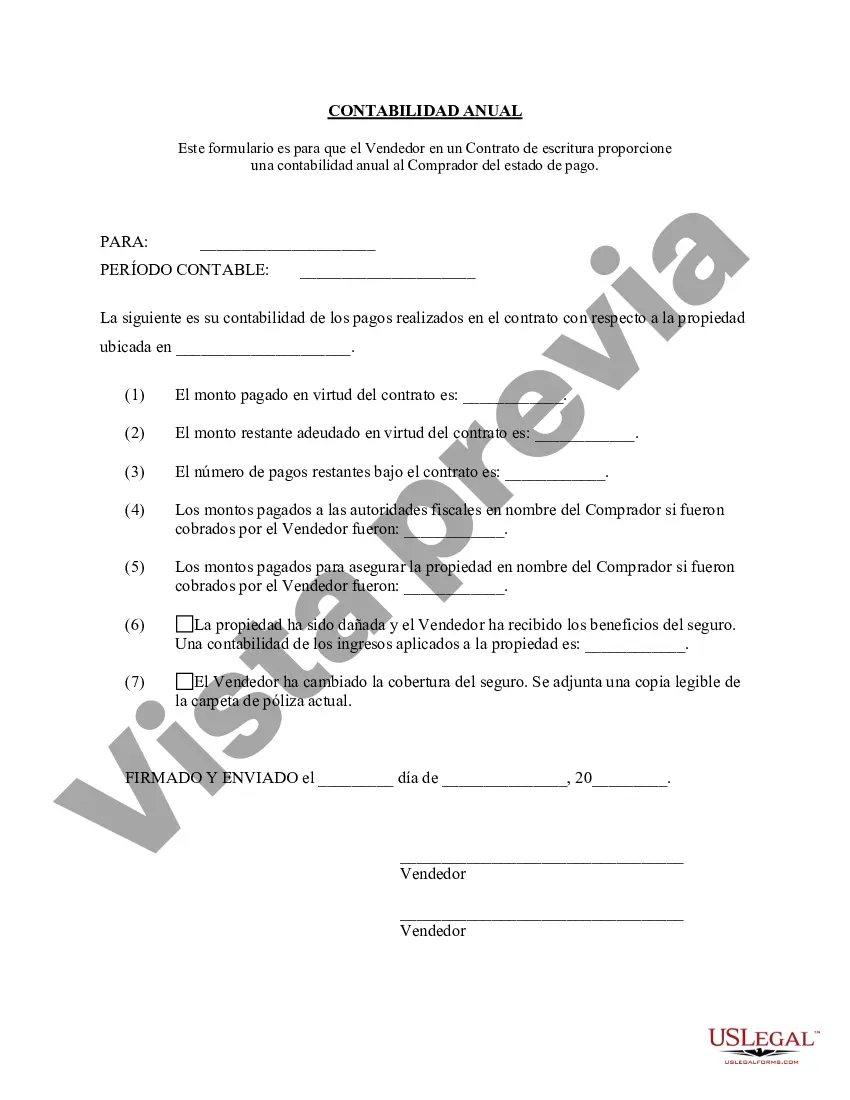

The Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement is an important document that provides a comprehensive breakdown of financial transactions and obligations for sellers involved in contract for deed agreements in Tallahassee, Florida. This statement serves as an accounting tool to track income, expenses, and overall financial status for sellers throughout a given year. It helps to maintain transparency and allows both parties involved in the contract for deed agreement to stay informed about financial matters. The Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement typically includes several key elements. Firstly, it outlines the total amount of payments received from the buyer during the accounting period. This section might detail the periodic payments, such as monthly or yearly, as well as any additional payments made towards the contract for deed. The statement also highlights any late or missed payments, providing a clear view of the buyer's payment history. Additionally, the annual accounting statement includes details about the distribution of funds received. It specifies how much of the payments were allocated towards the principal balance of the contract for deed, the interest accrued, and any applicable fees or charges. This section helps the seller understand the progress made in paying off the property and the amount remaining to be paid. Moreover, the statement might include information regarding taxes and insurance. It outlines the seller's responsibilities for property taxes and insurance premiums, including any payments made by the seller on behalf of the buyer. This section ensures that both parties are aware of their respective obligations and any adjustments needed for the upcoming year. Furthermore, the Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement may discuss any outstanding or unresolved issues related to the agreement. This includes any disputes, maintenance or repair expenses, or changes in the property's condition. It serves as a platform for communication between the buyer and seller to address any concerns and find suitable resolutions. Types of Tallahassee Florida Contract for Deed Seller's Annual Accounting Statements may vary depending on the specifics of the contract and the preferences of the parties involved. Some variations could be the "Amortization Schedule Accounting Statement," which focuses primarily on tracking the distribution of payments between principal and interest. Another possible type is the "Escrow Account Accounting Statement," which includes details about funds held in an escrow account for taxes and insurance purposes. In conclusion, the Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement is a vital document for contract for deed sellers in the Tallahassee area. It provides a comprehensive overview of financial transactions, obligations, and overall financial status. This statement promotes transparency, helps track progress, and supports effective communication between sellers and buyers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Tallahassee Florida Contrato de Escrituración Estado Contable Anual del Vendedor - Florida Contract for Deed Seller's Annual Accounting Statement

Description

How to fill out Tallahassee Florida Contrato De Escrituración Estado Contable Anual Del Vendedor?

If you are searching for a valid form, it’s impossible to find a more convenient service than the US Legal Forms website – one of the most extensive libraries on the web. With this library, you can find a large number of form samples for company and individual purposes by types and regions, or key phrases. With our high-quality search feature, getting the newest Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement is as elementary as 1-2-3. Moreover, the relevance of every file is proved by a team of professional attorneys that regularly check the templates on our platform and revise them in accordance with the most recent state and county demands.

If you already know about our platform and have a registered account, all you need to receive the Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement is to log in to your profile and click the Download option.

If you make use of US Legal Forms for the first time, just follow the instructions listed below:

- Make sure you have discovered the form you require. Read its explanation and make use of the Preview option (if available) to check its content. If it doesn’t meet your needs, utilize the Search field near the top of the screen to discover the proper document.

- Affirm your decision. Click the Buy now option. Following that, select the preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Make use of your credit card or PayPal account to complete the registration procedure.

- Get the form. Choose the file format and save it to your system.

- Make modifications. Fill out, revise, print, and sign the received Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement.

Every single form you save in your profile does not have an expiry date and is yours forever. You can easily gain access to them using the My Forms menu, so if you want to get an additional version for enhancing or printing, feel free to come back and download it once again at any time.

Make use of the US Legal Forms professional collection to gain access to the Tallahassee Florida Contract for Deed Seller's Annual Accounting Statement you were seeking and a large number of other professional and state-specific samples in one place!