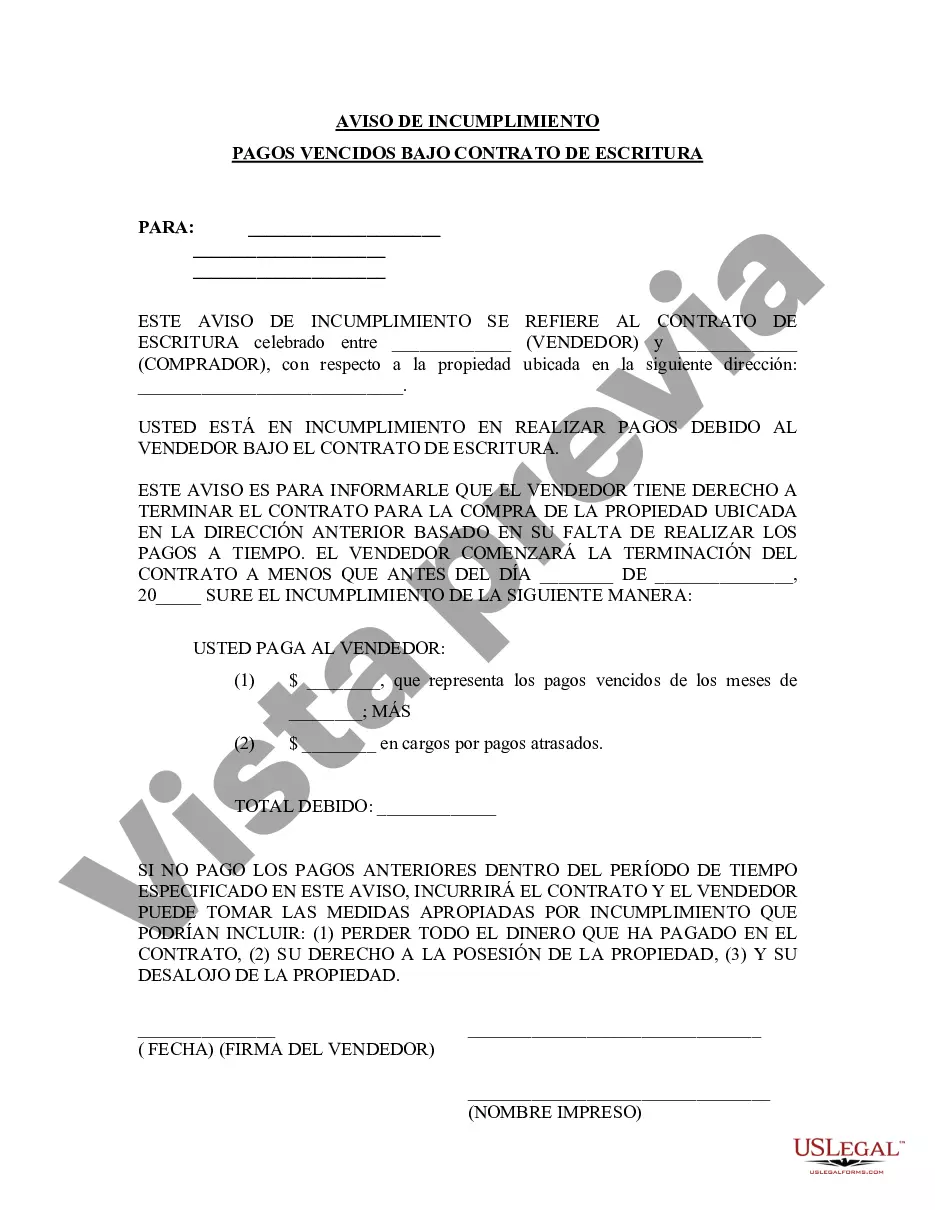

The Broward Florida Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document that outlines the consequences of missed payments and the actions that may be taken by the seller or lender. This notice is specifically relevant to individuals who have entered into a Contract for Deed in Broward County, Florida, and have fallen behind on their payment obligations. A Contract for Deed, also known as a land contract or installment sales contract, is an agreement between a buyer and seller where the buyer agrees to make periodic payments over time to eventually purchase the property. The Broward Florida Notice of Default for Past Due Payments serves as a warning and notifies the buyer that they are in default due to non-payment. Key phrases and keywords relevant to this topic may include: 1. Broward County: Refers to the specific location where the contract and the notice of default are applicable — Broward County, Florida. 2. Notice of Default: The legal document that informs the buyer of their default on the Contract for Deed due to late or non-payment. 3. Past Due Payments: Indicates that the buyer has failed to make timely payments as per the terms of the Contract for Deed. 4. Contract for Deed: The agreement between the buyer and seller detailing the terms of the property purchase, including payment schedule and obligations. 5. Consequences of Default: Explains the potential actions that the seller or lender may take as a result of the buyer's default, such as terminating the contract or initiating foreclosure proceedings. Types of Broward Florida Notices of Default for Past Due Payments in connection with a Contract for Deed may vary based on specific circumstances and language used in the contract. For example: 1. Initial Notice of Default: The first formal notice sent to the buyer indicating their default and warning them of the potential consequences if they fail to rectify the situation. 2. Cure or Quit Notice: If the buyer does not address the default after the initial notice, a cure or quit notice may be issued, providing a specified period for the buyer to bring their payments up to date or risk termination of the contract. 3. Intent to Foreclose Notice: If the default persists and the buyer fails to remedy the situation, the seller or lender may issue an intent to foreclose notice, indicating their intention to initiate foreclosure proceedings if the outstanding payments are not made. 4. Termination of Contract Notice: The final and most severe notice, informing the buyer that the contract has been terminated due to non-payment, and legal actions, such as eviction or foreclosure, may be pursued. It is important to note that the specific wording and legal requirements for Broward Florida Notices of Default for Past Due Payments in connection with a Contract for Deed may vary based on local laws, the terms of the contract, and the individual circumstances of the case. Therefore, it is advisable to consult with a legal professional for accurate guidance and assistance with drafting or interpreting such notices.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Broward Florida Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Florida Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Broward Florida Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

No matter what social or professional status, completing legal documents is an unfortunate necessity in today’s world. Too often, it’s practically impossible for someone with no law education to create such papers cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they entail. This is where US Legal Forms comes in handy. Our platform offers a huge catalog with over 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI forms.

Whether you need the Broward Florida Notice of Default for Past Due Payments in connection with Contract for Deed or any other paperwork that will be good in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Broward Florida Notice of Default for Past Due Payments in connection with Contract for Deed in minutes using our trusted platform. In case you are already an existing customer, you can go ahead and log in to your account to download the appropriate form.

However, in case you are unfamiliar with our library, ensure that you follow these steps before downloading the Broward Florida Notice of Default for Past Due Payments in connection with Contract for Deed:

- Ensure the template you have chosen is specific to your area since the regulations of one state or county do not work for another state or county.

- Review the form and read a short outline (if available) of scenarios the paper can be used for.

- If the one you selected doesn’t meet your needs, you can start over and search for the necessary document.

- Click Buy now and choose the subscription option that suits you the best.

- Access an account {using your login information or create one from scratch.

- Choose the payment gateway and proceed to download the Broward Florida Notice of Default for Past Due Payments in connection with Contract for Deed as soon as the payment is done.

You’re good to go! Now you can go ahead and print the form or fill it out online. Should you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Whatever case you’re trying to solve, US Legal Forms has got you covered. Try it out today and see for yourself.

Form popularity

FAQ

El incumplimiento contractual es un incumplimiento en sentido material que se da cuando se desobedece el contrato por no realizar o hacerla de forma incorrecta algunas de las clausulas que se ven en el contrato: El dolo: es un incumplimiento intencionado.

Hable con la persona o empresa a la que esta pensando demandar....Si decide ir a la corte, tome estos pasos: Averigue como nombrar al demandado. Pida el pago. Encuentre la corte correcta para presentar su reclamo. Llene sus formularios de la corte. Presente su reclamo. Haga la entrega legal de su reclamo. Vaya a la corte.

En caso de renuncia en un contrato a termino indefinido, la liquidacion se calcula con base en la seguridad social y las prestaciones. Si el trabajador tiene contrato a termino fijo y es despedido sin justa causa antes de terminar el periodo pactado, se le deben pagar los meses restantes a la finalizacion del contrato.

¿Cuales son las consecuencias del incumplimiento de los contratos? En caso de que una de las partes contratantes incumpla con sus obligaciones contractuales faculta a la otra para exigir la ejecucion forzosa o la rescision del contrato, mas el pago de una indemnizacion y el pago de los danos y perjuicios causados.

El incumplimiento por parte del trabajador de las obligaciones derivadas de su contrato de trabajo podra dar lugar al establecimiento de una amonestacion verbal o escrita (sobre todo en el caso de las faltas leves) o de otras sanciones por parte del empleador, como ocurre en el caso de la suspension de empleo y sueldo.

Que es el incumplimiento de contrato El200b incumplimientodecontrato200b se presenta cuando alguna de las personas involucradas no cumplen con lo estipulado en el documento legal aceptado.

Si la persona con la que celebro el contrato esta incumpliendo lo pactado, usted puede citarla a un centro de conciliacion para intentar llegar a un acuerdo. Tambien puede demandarla ante un juez civil.

La falta de contrato escrito hace presumir legalmente que son estipulaciones del contrato las que declare el trabajador. Ademas, la no escrituracion del contrato se sanciona con multa de una a cinco UTM.

La inexistencia de un contrato laboral causa que los empleados desconozcan las condiciones bajo las cuales prestan sus servicios. Lo que puede generar abusos por parte del patron. La legislacion laboral establece que la falta de este documento no priva al empleado de los derechos que deriven de las normas de trabajo.

Se entiende por dano la perdida o menoscabo sufrido en el patrimonio por la falta de cumplimiento de una obligacion. ARTICULO 2109. Se reputa perjuicio la privacion de cualquiera ganancia licita, que debiera haberse obtenido con el cumplimiento de la obligacion.

Interesting Questions

More info

In accordance with Florida law (Fla. Stat. Ann. )), candidates must be licensed by the state within 90 days of being hired. Applicants must also show the ability and qualifications to meet and perform their duties with a minimum of 50 hours per week. For more information concerning the position, please e-mail your resume to:. If selected to participate in this job opportunity, you will receive a 100×hour wage. 2 – 11 of 94 — The Broward County Board is soliciting applications for an Administrative Director Position which is available to an experienced Senior Advisor or Manager of Public Services. The position is expected to continue into 2017. This appointment is funded by tax-exempt municipal bonds.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.