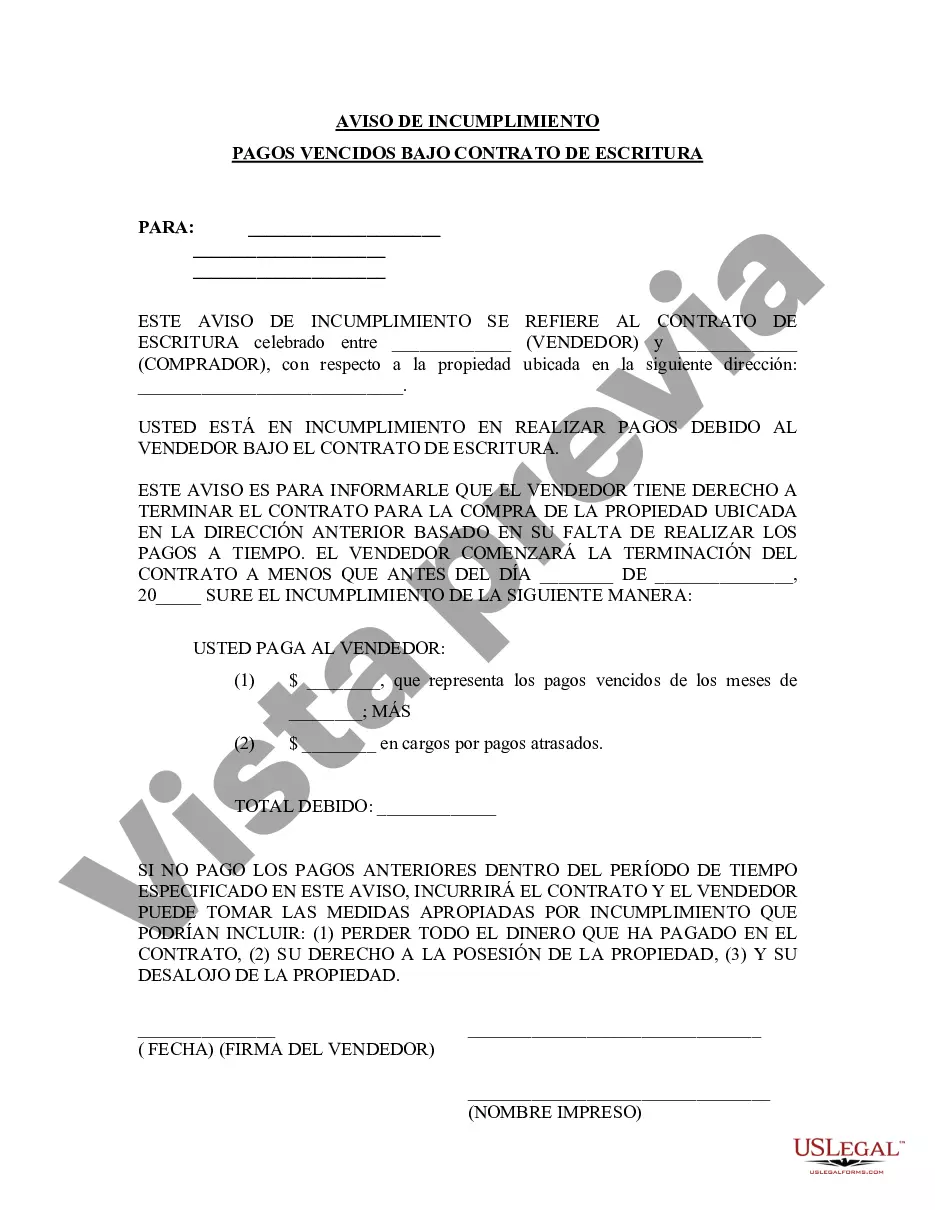

Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed provides an official notification to a borrower that they have failed to make their payments as agreed upon in a Contract for Deed. This legal document outlines the specific terms of the contract that have been violated and serves as a warning to the borrower that legal action may be taken if the past due payments are not resolved promptly. Keywords: Miramar Florida, Notice of Default, Past Due Payments, Contract for Deed, legal document, borrower, terms, violated, warning, legal action, resolved promptly. There are different types of Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed, depending on the severity and stage of the delinquency. Here are a few examples: 1. Preliminary Notice of Default: This is the first formal notice sent to the borrower when they default on their payment obligations in connection with a Contract for Deed. It serves as a warning and provides an opportunity for the borrower to rectify the situation before further actions are taken. 2. Notice of Default: This notice is sent when the borrower has failed to bring their payments up to date despite receiving the preliminary notice. It typically includes a specific deadline by which the outstanding payments must be made, along with the consequences of non-compliance. 3. Notice of Intent to Accelerate: If the borrower fails to cure the default mentioned in the Notice of Default within the specified timeframe, the lender may issue a Notice of Intent to Accelerate. This notice notifies the borrower that the entire loan balance becomes due immediately if the past due payments are not resolved within a certain period. 4. Notice of Sale: If the borrower still fails to cure the default after receiving the Notice of Intent to Accelerate, the lender may proceed with foreclosure proceedings. The Notice of Sale is typically issued to inform the borrower of the date and time of the foreclosure sale, giving them one last chance to pay off the debt or seek alternatives such as short sale or loan modification. It is important to note that the specific content and terms of each notice may vary depending on the contractual agreement and applicable laws in Miramar, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miramar Florida Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Florida Notice of Default for Past Due Payments in connection with Contract for Deed

State:

Florida

City:

Miramar

Control #:

FL-00470-8

Format:

Word

Instant download

Description

Aviso al Comprador de que los pagos están vencidos. Aviso inicial.

Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed provides an official notification to a borrower that they have failed to make their payments as agreed upon in a Contract for Deed. This legal document outlines the specific terms of the contract that have been violated and serves as a warning to the borrower that legal action may be taken if the past due payments are not resolved promptly. Keywords: Miramar Florida, Notice of Default, Past Due Payments, Contract for Deed, legal document, borrower, terms, violated, warning, legal action, resolved promptly. There are different types of Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed, depending on the severity and stage of the delinquency. Here are a few examples: 1. Preliminary Notice of Default: This is the first formal notice sent to the borrower when they default on their payment obligations in connection with a Contract for Deed. It serves as a warning and provides an opportunity for the borrower to rectify the situation before further actions are taken. 2. Notice of Default: This notice is sent when the borrower has failed to bring their payments up to date despite receiving the preliminary notice. It typically includes a specific deadline by which the outstanding payments must be made, along with the consequences of non-compliance. 3. Notice of Intent to Accelerate: If the borrower fails to cure the default mentioned in the Notice of Default within the specified timeframe, the lender may issue a Notice of Intent to Accelerate. This notice notifies the borrower that the entire loan balance becomes due immediately if the past due payments are not resolved within a certain period. 4. Notice of Sale: If the borrower still fails to cure the default after receiving the Notice of Intent to Accelerate, the lender may proceed with foreclosure proceedings. The Notice of Sale is typically issued to inform the borrower of the date and time of the foreclosure sale, giving them one last chance to pay off the debt or seek alternatives such as short sale or loan modification. It is important to note that the specific content and terms of each notice may vary depending on the contractual agreement and applicable laws in Miramar, Florida.

Free preview

How to fill out Miramar Florida Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

If you’ve already used our service before, log in to your account and download the Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to get your file:

- Ensure you’ve located a suitable document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to find the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Miramar Florida Notice of Default for Past Due Payments in connection with Contract for Deed. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your individual or professional needs!