A Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that serves as a formal notice to a borrower who has failed to make the required payments under a Contract for Deed agreement. This notice signals the beginning of the foreclosure process and notifies the borrower of their default status. Keywords: Palm Beach Florida, Notice of Default, Past Due Payments, Contract for Deed, foreclosure process, borrower There are various types of Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed based on the specific circumstances of the default and the requirements of the lender. Some common types include: 1. Initial Notice of Default: This type of notice is typically sent to the borrower when they miss their first payment or fail to make a payment within the grace period specified in the Contract for Deed. It serves as a wake-up call to the borrower, reminding them of their obligations. 2. Cure or Quit Notice: If the borrower does not address the default within a specified period after receiving the initial notice, a cure or quit notice is sent. This notice demands that the borrower either pay the past due amounts or face termination of the Contract for Deed. 3. Intent to Accelerate Notice: If the borrower continues to default on payments even after receiving the cure or quit notice, the lender may send an intent to accelerate notice. This notice declares the lender's intention to accelerate the remaining balance of the contract and demand the full payment within a specified timeframe. 4. Final Notice of Default: If the borrower fails to cure the default or pay the full amount within the specified timeframe, the lender will issue a final notice of default. This notice formally initiates the foreclosure process and provides the borrower with a final opportunity to resolve the default before legal action is taken. 5. Foreclosure Sale Notice: Following the final notice of default, if the borrower fails to rectify the default, the lender may proceed with a foreclosure sale. In Palm Beach County, Florida, a foreclosure sale notice is typically published in a local newspaper and posted on the property. This notice informs the borrower and potential buyers of the upcoming sale of the property. It is essential for borrowers to understand their rights and obligations under a Contract for Deed to avoid default and the potential foreclosure process. Seeking legal advice or negotiating with the lender may provide options to resolve the default and reinstate the contract, thereby preventing the loss of the property.

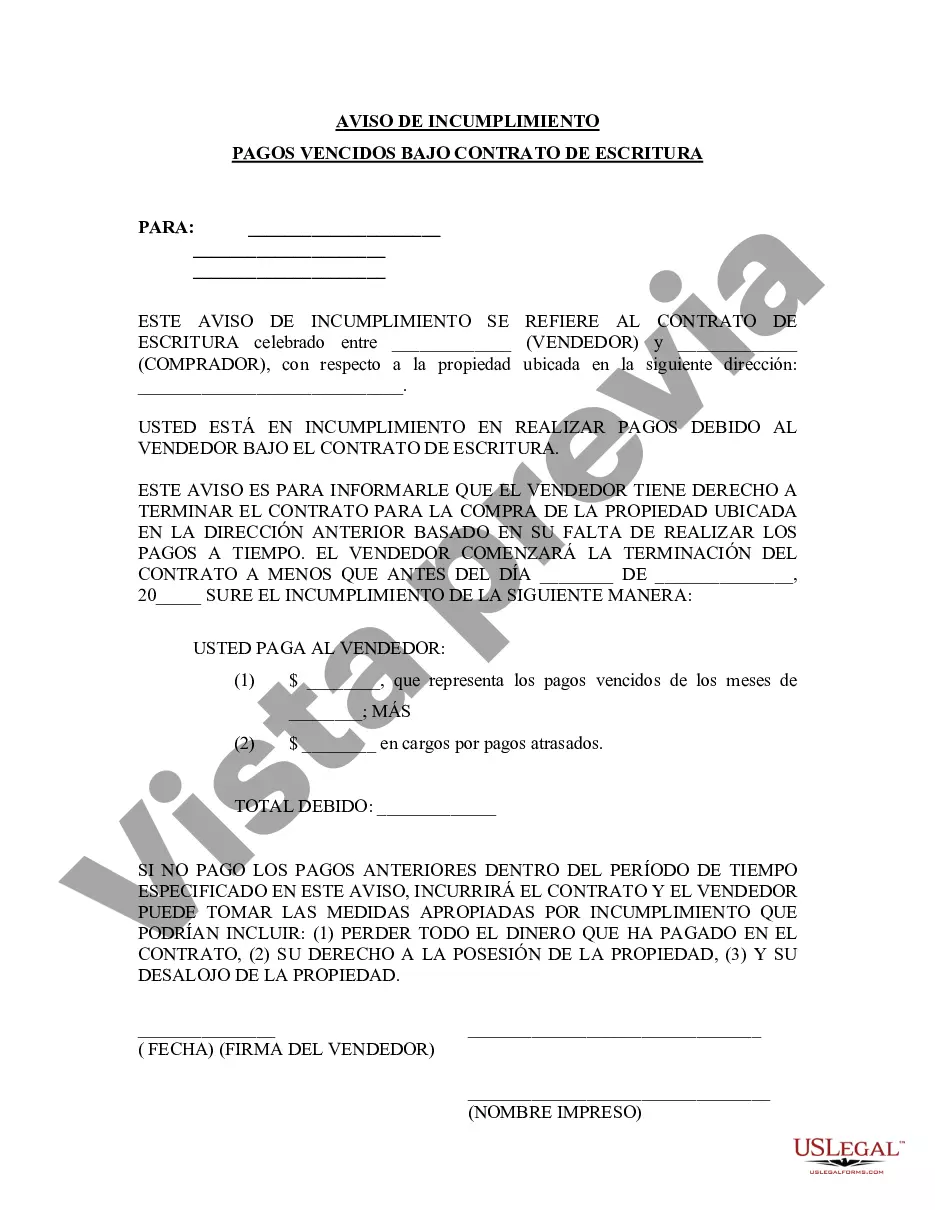

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Florida Notice of Default for Past Due Payments in connection with Contract for Deed

State:

Florida

County:

Palm Beach

Control #:

FL-00470-8

Format:

Word

Instant download

Description

Aviso al Comprador de que los pagos están vencidos. Aviso inicial.

A Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed is a legal document that serves as a formal notice to a borrower who has failed to make the required payments under a Contract for Deed agreement. This notice signals the beginning of the foreclosure process and notifies the borrower of their default status. Keywords: Palm Beach Florida, Notice of Default, Past Due Payments, Contract for Deed, foreclosure process, borrower There are various types of Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed based on the specific circumstances of the default and the requirements of the lender. Some common types include: 1. Initial Notice of Default: This type of notice is typically sent to the borrower when they miss their first payment or fail to make a payment within the grace period specified in the Contract for Deed. It serves as a wake-up call to the borrower, reminding them of their obligations. 2. Cure or Quit Notice: If the borrower does not address the default within a specified period after receiving the initial notice, a cure or quit notice is sent. This notice demands that the borrower either pay the past due amounts or face termination of the Contract for Deed. 3. Intent to Accelerate Notice: If the borrower continues to default on payments even after receiving the cure or quit notice, the lender may send an intent to accelerate notice. This notice declares the lender's intention to accelerate the remaining balance of the contract and demand the full payment within a specified timeframe. 4. Final Notice of Default: If the borrower fails to cure the default or pay the full amount within the specified timeframe, the lender will issue a final notice of default. This notice formally initiates the foreclosure process and provides the borrower with a final opportunity to resolve the default before legal action is taken. 5. Foreclosure Sale Notice: Following the final notice of default, if the borrower fails to rectify the default, the lender may proceed with a foreclosure sale. In Palm Beach County, Florida, a foreclosure sale notice is typically published in a local newspaper and posted on the property. This notice informs the borrower and potential buyers of the upcoming sale of the property. It is essential for borrowers to understand their rights and obligations under a Contract for Deed to avoid default and the potential foreclosure process. Seeking legal advice or negotiating with the lender may provide options to resolve the default and reinstate the contract, thereby preventing the loss of the property.

Free preview

How to fill out Palm Beach Florida Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

If you’ve already utilized our service before, log in to your account and save the Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your file:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, utilize the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Obtain your Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your individual or professional needs!