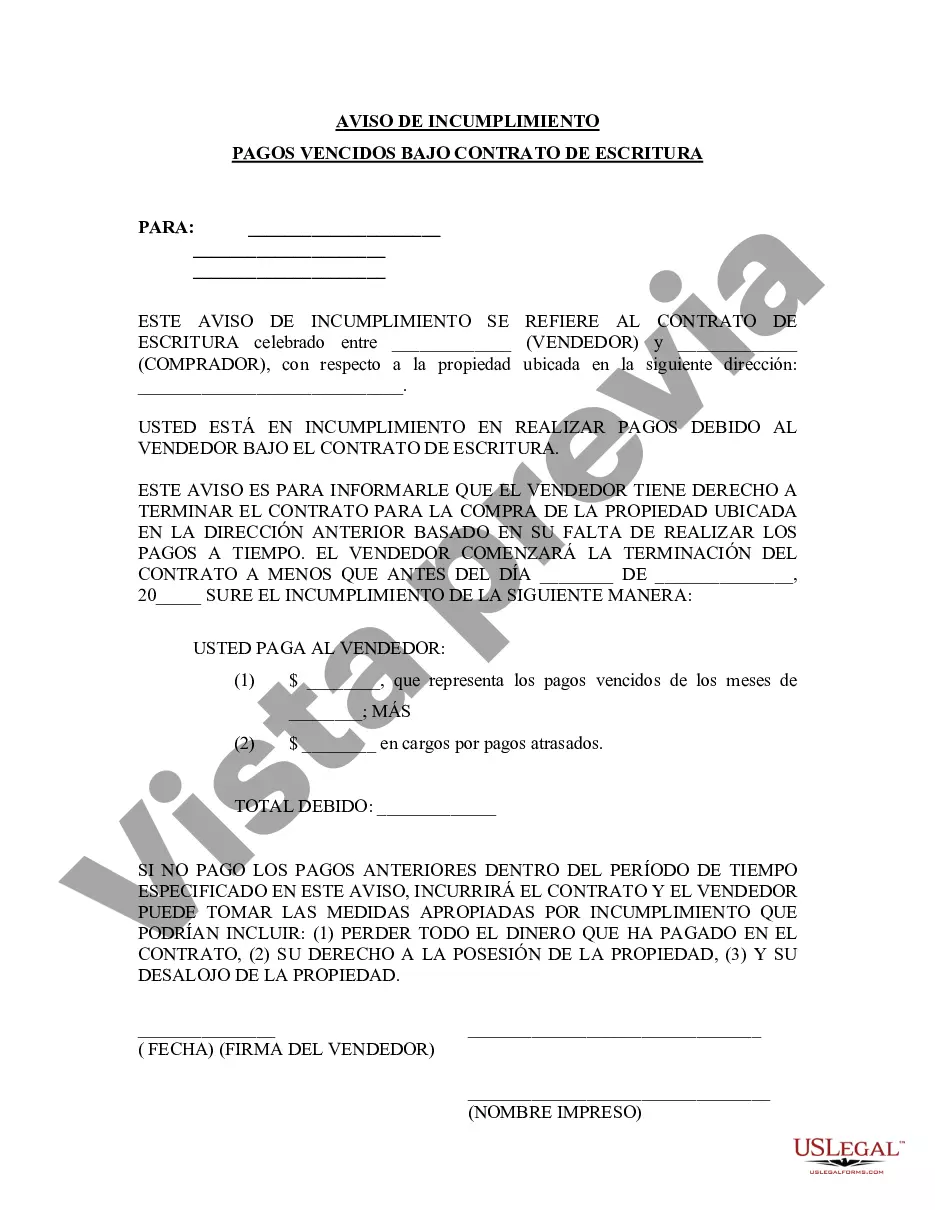

A West Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed is an official document that notifies the party involved in a Contract for Deed agreement that they have failed to make timely payments as stipulated in the contract. This notice is often issued by the seller or the lender and serves as a formal warning that immediate action needs to be taken to rectify the payment default. Keywords: West Palm Beach, Florida, Notice of Default, Past Due Payments, Contract for Deed. There can be different types of West Palm Beach Florida Notices of Default for Past Due Payments in connection with Contract for Deed, based on the specific circumstances of the default. Here are a few common types: 1. Initial Notice of Default: This is the first notice sent to the party who has defaulted on the Contract for Deed. It highlights the missed payments and provides a grace period during which the defaulting party is given a chance to catch up on their payments. 2. Second Notice of Default: If the defaulting party fails to rectify the payment default within the grace period provided in the initial notice, a second notice may be issued. This notice emphasizes the seriousness of the situation and may include additional penalties or legal consequences if the default continues. 3. Notice of Intent to Accelerate: If the default remains unresolved, the seller or lender may send a notice of intent to accelerate the outstanding balance of the Contract for Deed. This notice notifies the defaulting party that the entire balance is due immediately, rather than spreading out the payments over the agreed-upon period. 4. Notice of Foreclosure: In extreme cases of non-payment or prolonged default, a notice of foreclosure may be issued. This notice informs the defaulting party that legal action will be taken to reclaim the property, potentially resulting in eviction and loss of ownership rights. It is crucial for both parties involved in a Contract for Deed to understand the implications of a West Palm Beach Florida Notice of Default for Past Due Payments. It is recommended to seek legal advice and explore alternatives to resolve the default, such as payment plans, loan modifications, or negotiating a new agreement. Failure to address the notice promptly and adequately can lead to significant financial and legal consequences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.West Palm Beach Florida Notificación de Incumplimiento de Pagos Atrasados en relación con el Contrato de Escritura - Florida Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out West Palm Beach Florida Notificación De Incumplimiento De Pagos Atrasados En Relación Con El Contrato De Escritura?

No matter the social or professional status, completing law-related documents is an unfortunate necessity in today’s world. Too often, it’s virtually impossible for someone with no law background to create such papers cfrom the ground up, mainly due to the convoluted terminology and legal nuances they involve. This is where US Legal Forms comes to the rescue. Our platform offers a huge library with more than 85,000 ready-to-use state-specific documents that work for practically any legal case. US Legal Forms also is an excellent resource for associates or legal counsels who want to to be more efficient time-wise using our DYI forms.

No matter if you want the West Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed or any other paperwork that will be good in your state or county, with US Legal Forms, everything is on hand. Here’s how you can get the West Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed quickly using our trustworthy platform. If you are already an existing customer, you can go on and log in to your account to download the appropriate form.

Nevertheless, if you are a novice to our library, make sure to follow these steps prior to downloading the West Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed:

- Be sure the template you have found is good for your area since the regulations of one state or county do not work for another state or county.

- Preview the document and read a quick outline (if available) of cases the paper can be used for.

- If the form you chosen doesn’t suit your needs, you can start again and search for the suitable document.

- Click Buy now and choose the subscription plan you prefer the best.

- utilizing your credentials or create one from scratch.

- Select the payment gateway and proceed to download the West Palm Beach Florida Notice of Default for Past Due Payments in connection with Contract for Deed once the payment is done.

You’re good to go! Now you can go on and print out the document or fill it out online. If you have any issues getting your purchased documents, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.