Title: Understanding Gainesville Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Introduction: In Gainesville, Florida, when a buyer enters into a Contract for Deed for property purchase, it is crucial to fulfill the payment obligations according to the terms agreed upon. Failure to make timely payments can result in receiving a Final Notice of Default for Past Due Payments. This article aims to delve into the specifics of this notice, providing a detailed description, its implications, and potential consequences. Keywords: Gainesville Florida, Final Notice of Default, Past Due Payments, Contract for Deed, Connection, Types I. Definition and Purpose of Gainesville Florida Final Notice of Default A Final Notice of Default is a legal document sent to the buyer of a property in Gainesville, Florida, who has failed to meet the scheduled payment obligations stipulated within the Contract for Deed. Its purpose is to formally notify the buyer of their default and initiate the next steps that may result in potential consequences. II. Implications of Receiving a Final Notice of Default a. Acceleration of Payment: The notice typically includes a demand for immediate payment of the full balance owed under the Contract for Deed. b. Risk of Foreclosure: Non-compliance with the terms may result in the seller initiating foreclosure proceedings, potentially leading to the loss of the buyer's interest in the property. c. Negative Credit Impact: A default notification gets reported to credit bureaus, leading to a negative impact on the buyer's credit score. d. Legal Proceedings: The seller may pursue legal action to recover the outstanding payments, which can lead to additional costs and potential legal consequences for the buyer. III. Different Types of Gainesville Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed 1. Formal Notice of Default: This initial notification serves as an official communication informing the buyer about the past-due payments. 2. Final Notice of Default: If the buyer fails to rectify their default within a specific timeframe mentioned in the formal notice, a final notice is served, demanding immediate payment and indicating potential legal actions. IV. Steps to Resolve the Notice of Default 1. Contact the Seller: Buyers should promptly communicate with the seller or the seller's representative to discuss the situation and explore possible remedies. 2. Negotiate a Repayment Plan: Buyers can try to negotiate a repayment plan that allows them to catch up on the overdue payments while adhering to the Contract for Deed. 3. Seek Legal Guidance: If necessary, consult a legal professional experienced in real estate matters to ensure a comprehensive understanding of rights and options. 4. Consider Refinancing or Sale: Under certain circumstances, refinancing the contract or considering the sale of the property may be viable options to resolve the default notice. Conclusion: Receiving a Gainesville Florida Final Notice of Default for Past Due Payments in connection with a Contract for Deed can have serious consequences. It is crucial for buyers to act promptly, communicate effectively, and explore every possible option to resolve the default notice's issues. Seek the guidance of legal professionals and engage in fair negotiations to protect your rights and property interests.

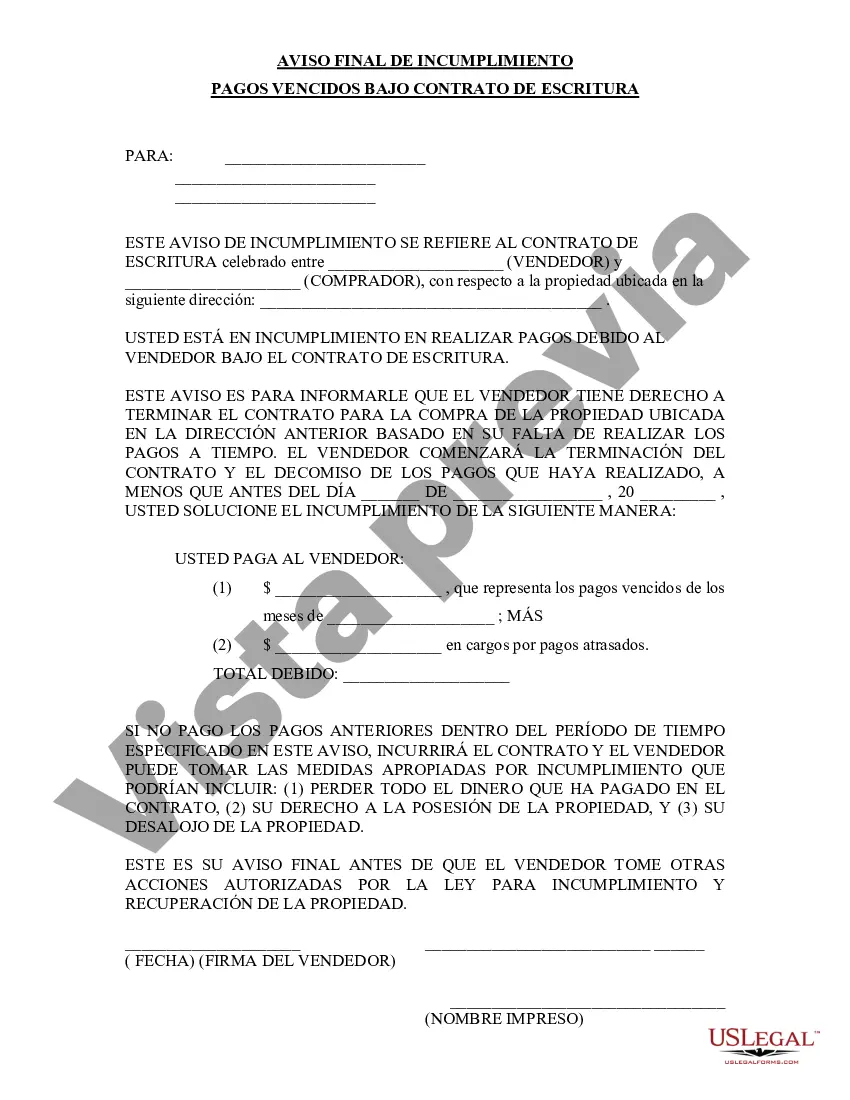

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Gainesville Florida Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Gainesville Florida Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

No matter the social or professional status, completing legal forms is an unfortunate necessity in today’s world. Very often, it’s practically impossible for someone with no law education to create this sort of paperwork cfrom the ground up, mostly because of the convoluted jargon and legal subtleties they involve. This is where US Legal Forms comes in handy. Our platform provides a massive library with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal case. US Legal Forms also is a great resource for associates or legal counsels who want to to be more efficient time-wise utilizing our DYI tpapers.

No matter if you want the Gainesville Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other paperwork that will be good in your state or area, with US Legal Forms, everything is at your fingertips. Here’s how to get the Gainesville Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed in minutes using our trustworthy platform. In case you are already an existing customer, you can proceed to log in to your account to download the needed form.

Nevertheless, if you are unfamiliar with our platform, ensure that you follow these steps before downloading the Gainesville Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed:

- Ensure the template you have found is good for your location because the regulations of one state or area do not work for another state or area.

- Preview the document and read a quick description (if available) of scenarios the paper can be used for.

- In case the form you chosen doesn’t meet your needs, you can start over and look for the necessary form.

- Click Buy now and pick the subscription option you prefer the best.

- with your login information or register for one from scratch.

- Choose the payment method and proceed to download the Gainesville Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed once the payment is done.

You’re all set! Now you can proceed to print the document or complete it online. Should you have any problems getting your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Try it out now and see for yourself.