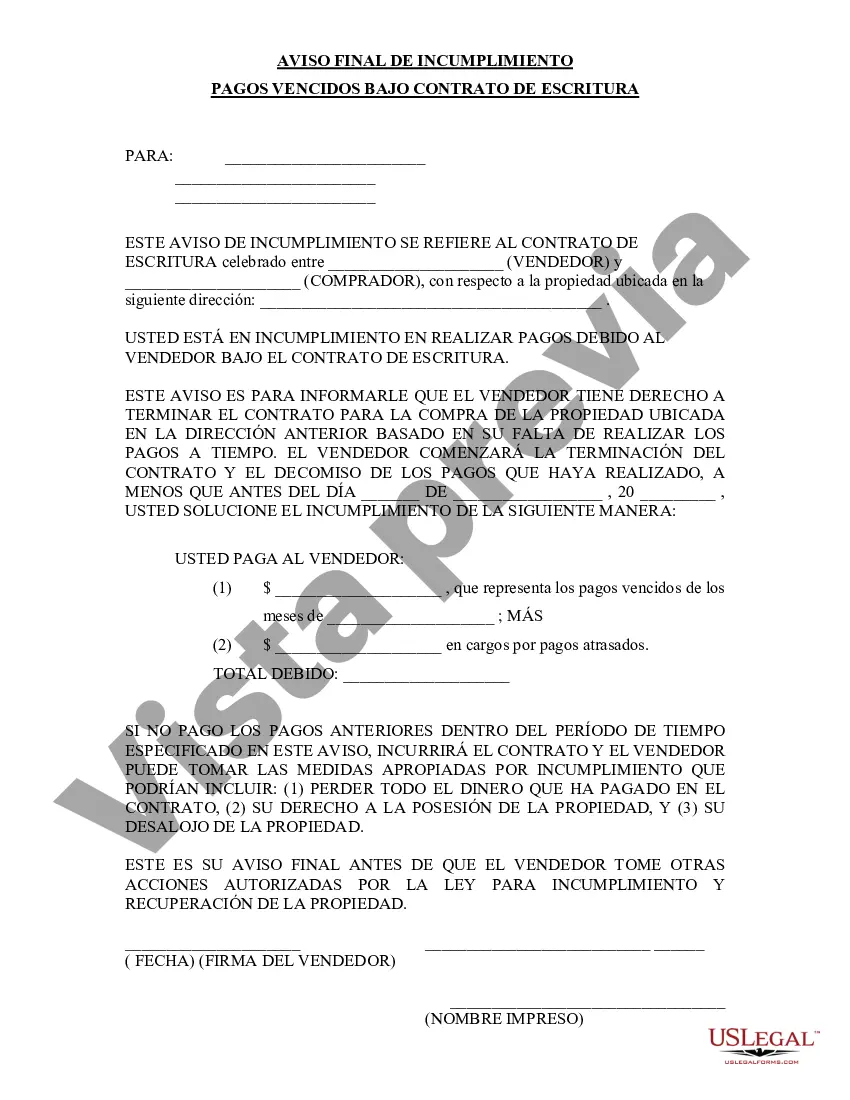

Orlando Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed In Orlando, Florida, a Final Notice of Default for Past Due Payments in connection with a Contract for Deed is a legal document sent to a borrower who has failed to make timely payments on their property purchased through a Contract for Deed agreement. This notice serves as a formal notification to the borrower that they are in default and must take immediate action to rectify the situation. Keywords: Orlando Florida, Final Notice of Default, Past Due Payments, Contract for Deed Different types of Orlando Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: 1. First Notice of Default: This is the initial notification sent to the borrower when they miss their first payment on their property purchased through a Contract for Deed. It outlines the exact amount past due, the payment deadline, and the consequences of failing to make payment. 2. Second Notice of Default: If the borrower fails to settle their payment obligations after receiving the first notice, a second notice of default is sent. This notice serves as a more serious warning, emphasizing that immediate payment is necessary to avoid further legal actions, such as foreclosure. 3. Final Notice of Default: The Final Notice of Default is the most severe type of notice sent to the borrower. It is sent when all previous attempts to collect the outstanding payment have failed, and the lender or seller intends to pursue legal action, such as foreclosure, to recover the property or the outstanding debt. The Final Notice of Default typically includes the following information: — The borrower's name, address, and contact information. — The lender or seller's name, address, and contact information. — Specific details of the property in question, including its address, legal description, and any relevant identification numbers. — The outstanding payment amount and the due date. — A clear statement that the borrower is in default, emphasizing the consequences of failing to pay, which may include foreclosure. — Instructions on how to settle the debt, including acceptable payment methods, deadlines, and contact information to discuss alternative repayment options if applicable. — Contact information for legal resources or counseling services that may help the borrower in finding a resolution. It is crucial for the borrower to carefully review the Final Notice of Default and address the past due payment promptly. Failure to respond or take appropriate action may result in the lender or seller initiating legal proceedings to recover the property or enforce payment in Orlando, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Orlando Florida Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Orlando Florida Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

We always want to minimize or avoid legal issues when dealing with nuanced legal or financial affairs. To do so, we sign up for attorney services that, as a rule, are extremely expensive. Nevertheless, not all legal matters are equally complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your affairs into your own hands without the need of turning to an attorney. We offer access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Orlando Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can register your account in a matter of minutes.

- Make sure to check if the Orlando Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Orlando Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed is suitable for you, you can pick the subscription plan and proceed to payment.

- Then you can download the document in any suitable file format.

For over 24 years of our existence, we’ve served millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!