Title: Understanding Pembroke Pines Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Pembroke Pines Florida, Final Notice of Default, Past Due Payments, Contract for Deed, types Introduction: Pembroke Pines, located in Florida, implements a Final Notice of Default for Past Due Payments in connection with a Contract for Deed. This notice serves as a warning to individuals who have missed payments under their contractual agreement. Let's delve deeper into the specifics of this notice and discuss any potential variations that may exist. 1. Pembroke Pines Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: When a borrower fails to make timely payments on a property acquired through a Contract for Deed in Pembroke Pines, Florida, the lender or property owner issues a Final Notice of Default. This notice serves as a formal acknowledgment of the delinquency and triggers a series of subsequent actions. 2. Types of Pembroke Pines Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed: a) Standard Final Notice of Default: Typically, this notice outlines the specifics of the missed payments and the total amount due. It informs the borrower about the potential consequences of further non-payment, such as foreclosure or legal action. b) Cure or Quit Notice: In some cases, the lender may issue a Cure or Quit Notice to give the borrower a chance to rectify the past due payments. This notice specifies a deadline by which the borrower must either clear the arrears or face severe consequences, such as eviction or foreclosure. c) Notice of Intent to Accelerate: If the borrower continues to ignore the past due payments, the lender may proceed to issue a Notice of Intent to Accelerate. This notice declares the borrower's obligation to immediately pay the full outstanding balance to avoid foreclosure and legal proceedings. d) Foreclosure Warning Letter: As a last resort, a foreclosure warning letter might be sent to the borrower by the lender or property owner. This letter clearly states the intent to initiate foreclosure proceedings if the borrower fails to resolve the outstanding payments within a specified period. Conclusion: Understanding the Pembroke Pines Florida Final Notice of Default for Past Due Payments in connection with a Contract for Deed is crucial for both lenders and borrowers. It serves as a formal warning regarding missed payments and outlines potential consequences if the delinquency is not addressed promptly. By being aware of the various types of notices that may be issued, borrowers can make informed decisions to protect their property rights and financial stability.

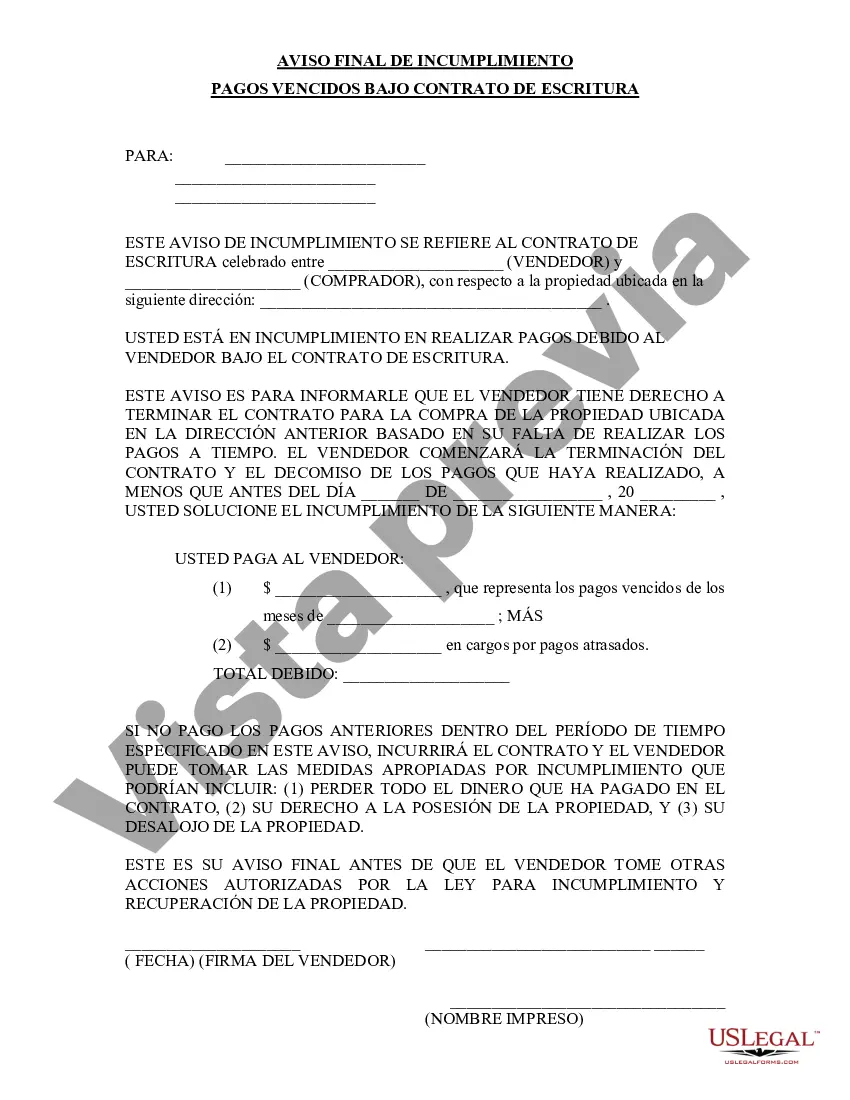

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pembroke Pines Florida Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Pembroke Pines Florida Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

We always want to reduce or avoid legal damage when dealing with nuanced law-related or financial matters. To accomplish this, we sign up for legal services that, as a rule, are extremely expensive. Nevertheless, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your matters into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to find and download the Pembroke Pines Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed or any other form quickly and securely. Simply log in to your account and click the Get button next to it. If you happened to lose the document, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can register your account within minutes.

- Make sure to check if the Pembroke Pines Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the Pembroke Pines Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed would work for your case, you can choose the subscription option and make a payment.

- Then you can download the document in any available file format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save time and resources!