Title: Understanding Port St. Lucie, Florida Final Notice of Default for Past Due Payments in Connection with Contract for Deed Keywords: Port St. Lucie, Florida, final notice of default, past due payments, Contract for Deed, types Introduction: Port St. Lucie, Florida, is a vibrant city known for its picturesque landscapes and desirable neighborhoods. However, in the realm of real estate, homeowners may face financial difficulties, which can lead to a Final Notice of Default for Past Due Payments in connection with a Contract for Deed. This article aims to provide a thorough description of what this notice entails, highlighting its implications and potential consequences. Port St. Lucie, Florida Final Notice of Default for Past Due Payments in Connection with a Contract for Deed: 1. Definition: A Port St. Lucie Final Notice of Default for Past Due Payments typically arises when a homeowner fails to make timely payments for a property under a Contract for Deed. This notice serves as a warning signifying that the homeowner is significantly behind on their payments and may face serious repercussions if immediate action is not taken. 2. Implications: Receiving a Final Notice of Default can have severe implications for homeowners. This notice notifies the homeowner that their property may be subject to foreclosure or other legal actions if they fail to rectify their outstanding payments within a specified timeframe. It is critical for homeowners to address the situation promptly to avoid further complications. 3. Consequences: Upon receiving a Final Notice of Default, homeowners must make diligent efforts to resolve the payment issues. Failure to do so may result in the initiation of foreclosure proceedings, potentially leading to the loss of the property. Alongside this, credit scores may be negatively impacted, making future loan applications or real estate transactions challenging. Types of Port St. Lucie, Florida Final Notices of Default for Past Due Payments in Connection with a Contract for Deed: 1. Preliminary Notice of Default: Prior to issuing a Final Notice of Default, lenders may send a preliminary notice that informs homeowners of missed or late payments. This preliminary notice serves as a warning signal, urging homeowners to address the delinquency promptly to avoid further consequences. 2. Formal Notice of Default: If homeowners fail to rectify their payments within the specified timeframe mentioned in the preliminary notice, lenders may proceed to issue a Formal Notice of Default. This document highlights the past due payments, the current amount owed, and the timeline within which the homeowners must settle the outstanding balance. Conclusion: Receiving a Port St. Lucie, Florida Final Notice of Default for Past Due Payments in connection with a Contract for Deed can be an unnerving experience for homeowners. Understanding the implications and consequences associated with this notice is crucial to taking appropriate actions and avoiding potential foreclosure. Promptly addressing the issue by working closely with lenders can prevent further complications and the loss of property.

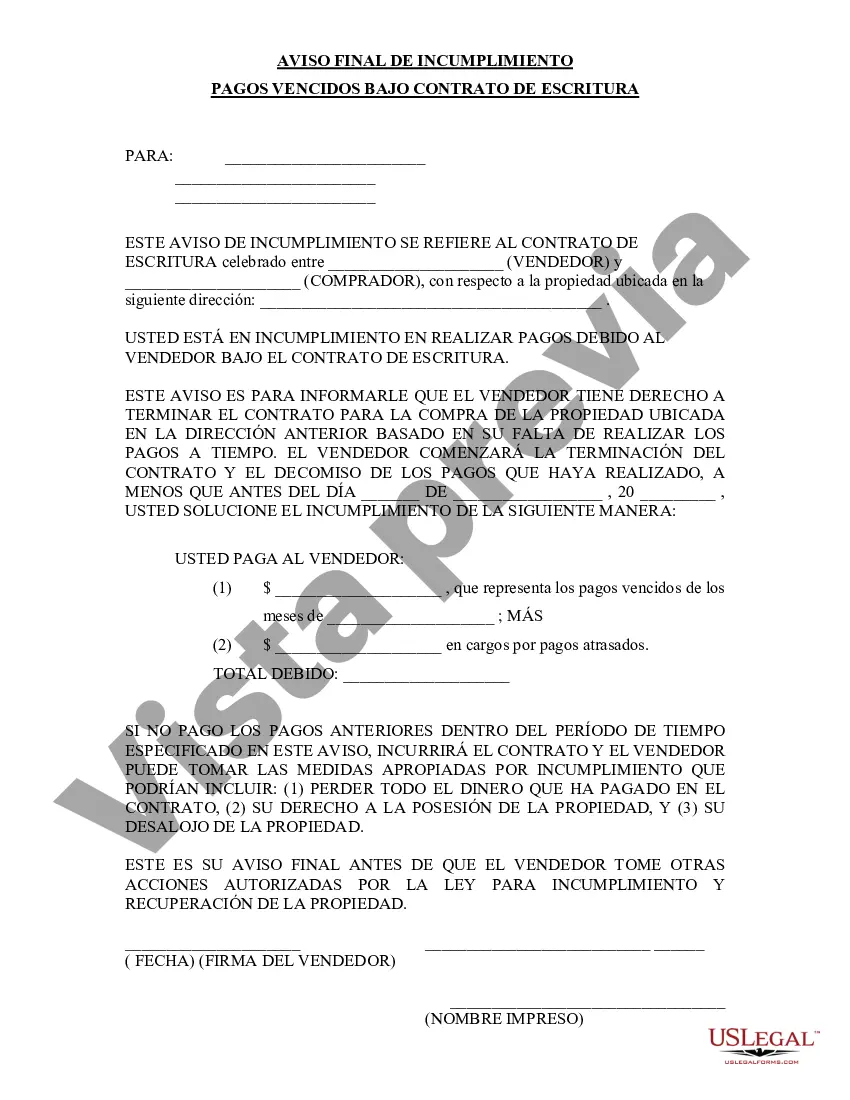

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Port St. Lucie Florida Aviso final de incumplimiento de pagos vencidos en relación con el contrato de escritura - Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed

Description

How to fill out Port St. Lucie Florida Aviso Final De Incumplimiento De Pagos Vencidos En Relación Con El Contrato De Escritura?

Finding verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Port St. Lucie Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the Port St. Lucie Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed takes just a few clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a couple of additional steps to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and fully corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Port St. Lucie Florida Final Notice of Default for Past Due Payments in connection with Contract for Deed. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile whenever you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!