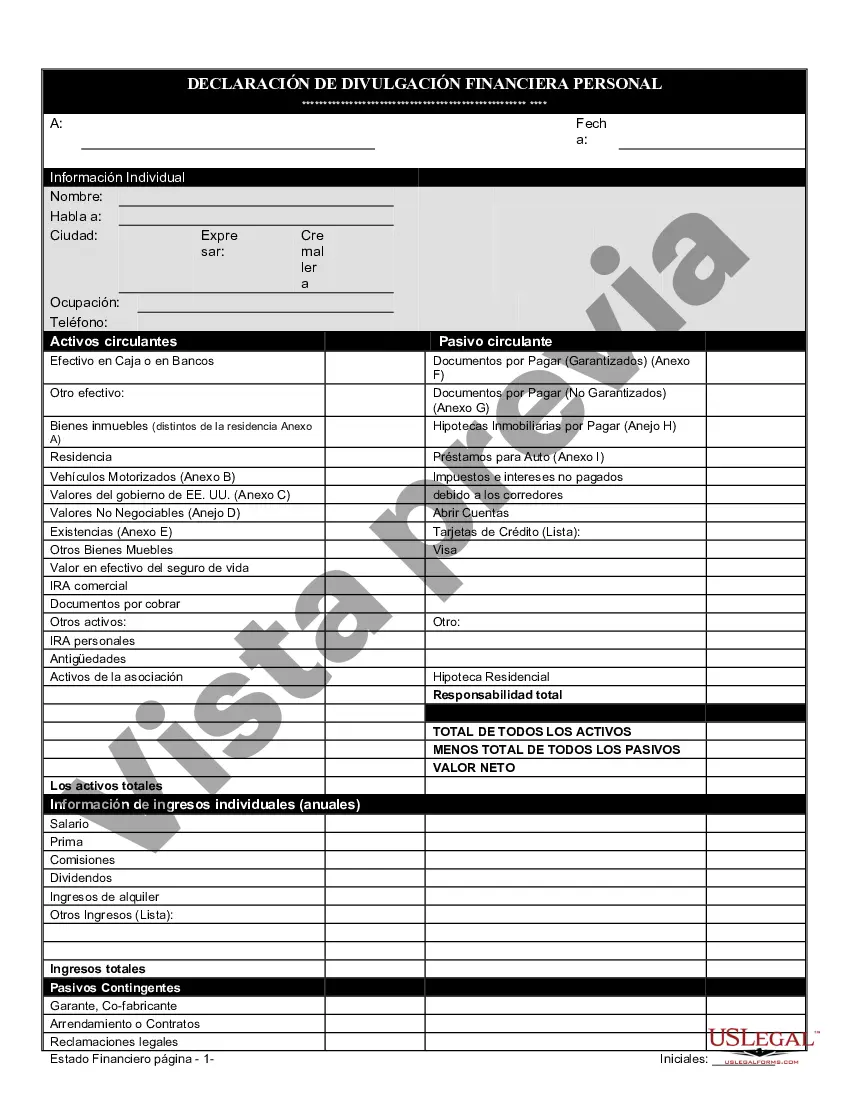

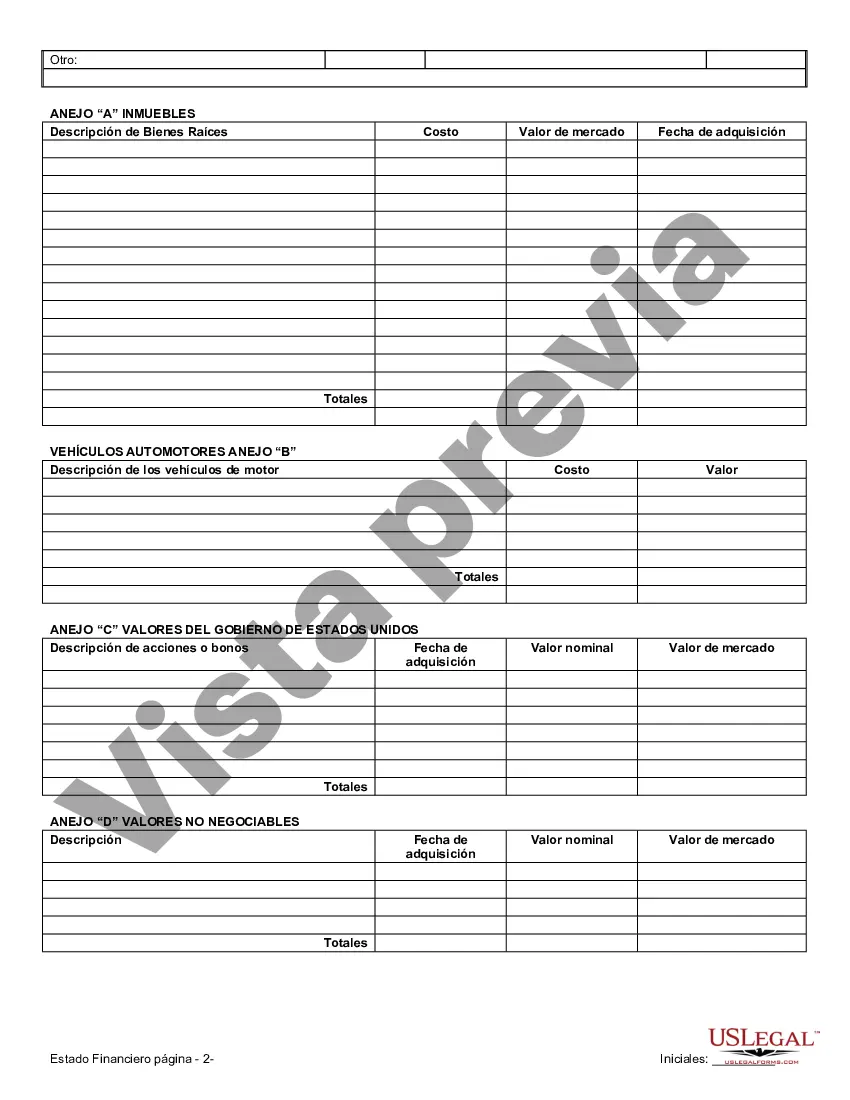

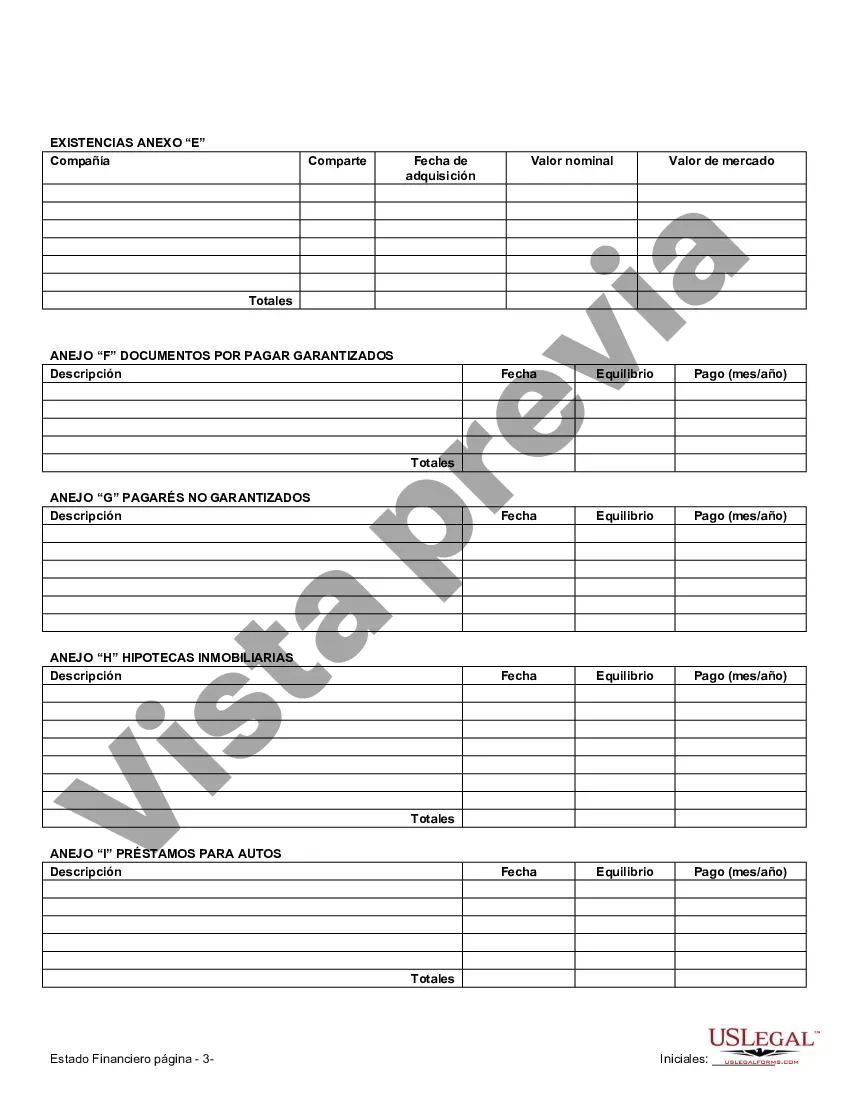

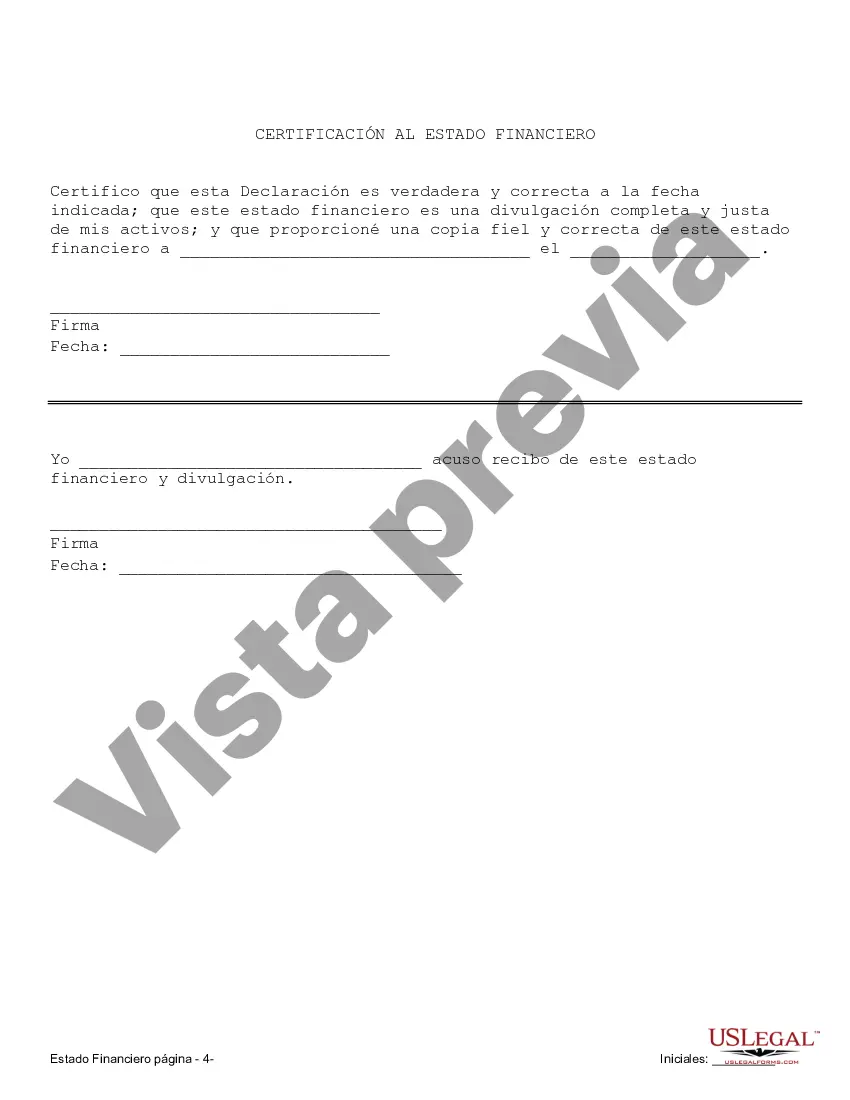

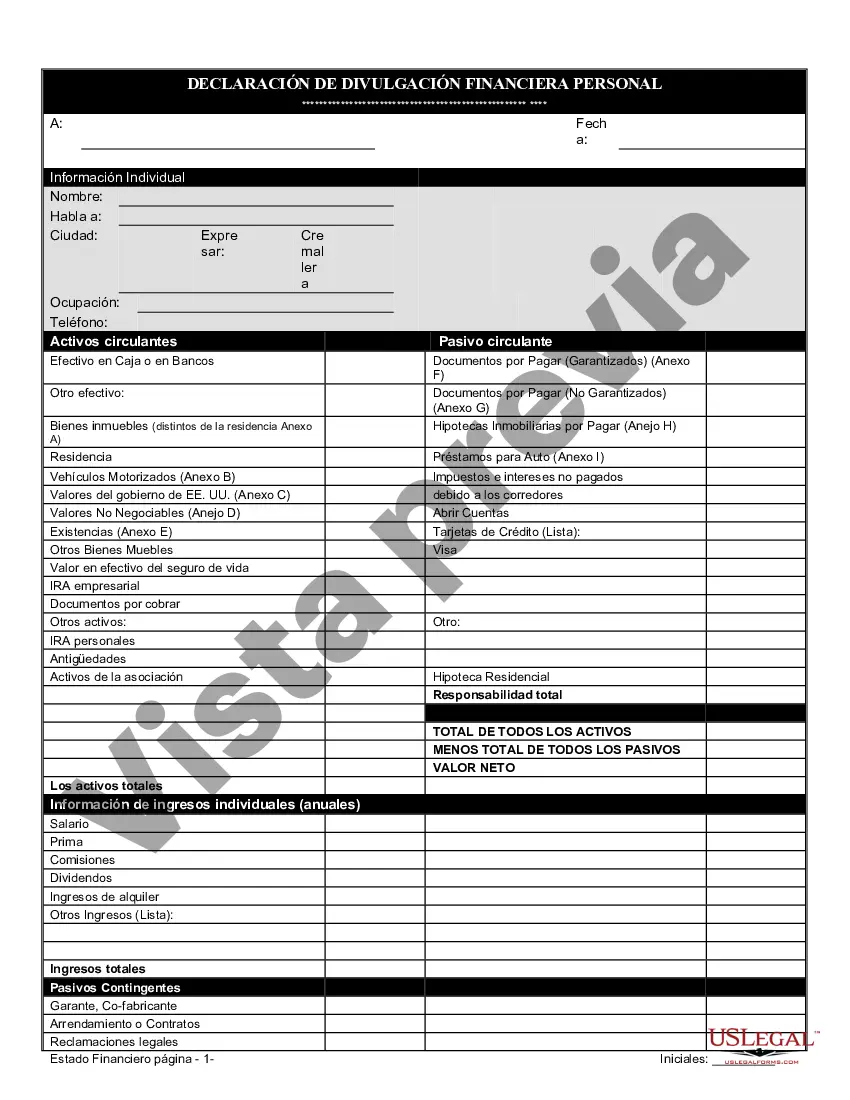

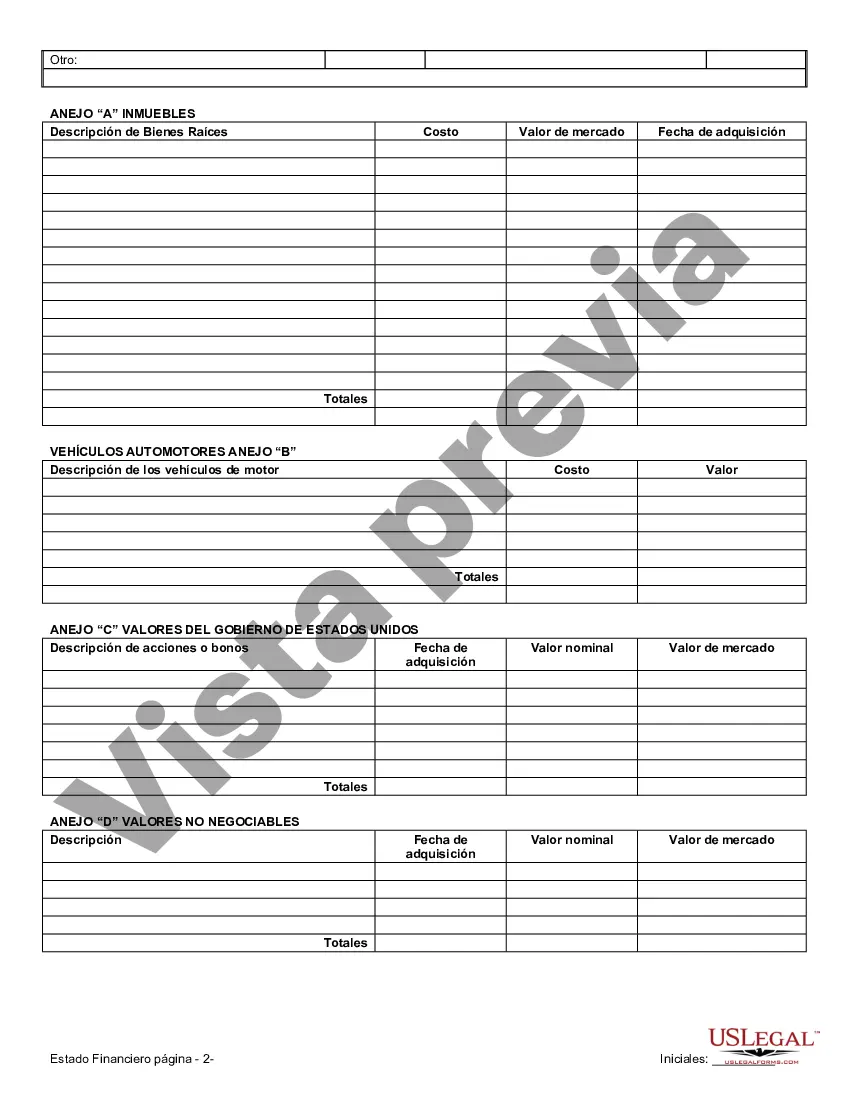

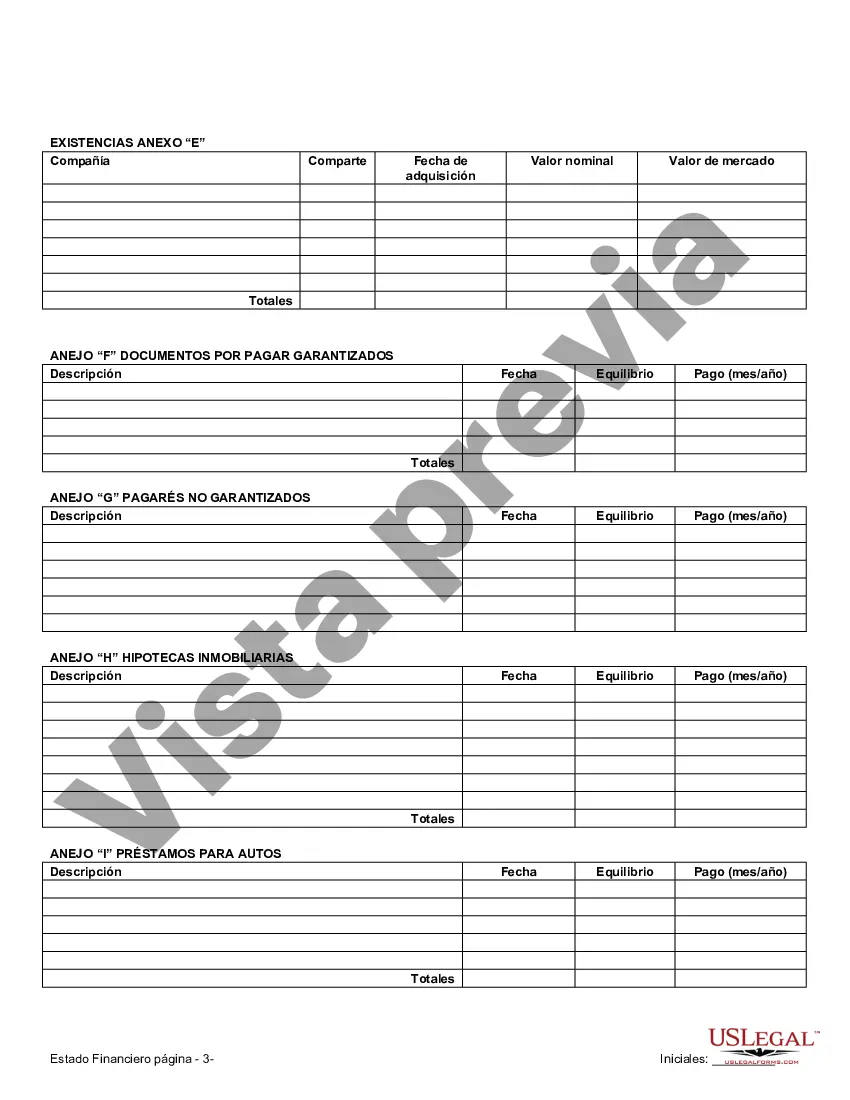

Cape Coral, Florida Financial Statements: A Crucial Component of Prenuptial Premarital Agreements In the beautiful coastal city of Cape Coral, Florida, financial statements play a vital role in prenuptial/premarital agreements. These documents provide a comprehensive overview of an individual's financial situation, assets, liabilities, and income, ensuring transparency and safeguarding the interests of both parties before entering into marriage. The financial statements involved in a Cape Coral prenuptial/premarital agreement vary depending on the specific circumstances of each couple. However, some common types of financial statements that might be included are: 1. Personal Financial Statement: The personal financial statement is a comprehensive document that outlines an individual's assets, liabilities, income, and expenses. It includes details such as bank account balances, investments, real estate, debts, and any other financial interests or obligations. This statement provides a comprehensive snapshot of an individual's financial health, forming a foundation for the prenuptial agreement. 2. Business Financial Statement: If one or both parties own a business, a business financial statement may be required. This document presents detailed information about the company's assets, financial performance, and liabilities. It helps assess the business's value and potential impact on the marriage, influencing the terms of the prenuptial agreement related to business ownership or division. 3. Property and Real Estate Statement: In Cape Coral, Florida, a city known for its sprawling waterfront properties, a property and real estate statement is often necessary. This statement outlines the details of any real estate owned by either party involved in the prenuptial agreement. It includes information such as property values, mortgages, liens, and any other relevant property-related financial considerations for equitable division in case of a marital dissolution. 4. Retirement Account Statements: If one or both individuals have retirement accounts, such as 401(k)s or IRAs, their statements become crucial. These documents offer insights into the value, contributions, and beneficiary designations of retirement savings. They ensure transparency and facilitate discussions on how these assets should be divided or protected in the event of divorce or separation. 5. Debt Statement: Debt statements disclose any liabilities an individual may have, such as student loans, credit card debts, personal loans, or outstanding obligations. These statements help determine how debts should be allocated in the prenuptial agreement and provide a comprehensive understanding of each party's total financial picture. In conclusion, Cape Coral, Florida financial statements are a vital component in prenuptial/premarital agreements. These statements, which can include personal financial statements, business financial statements, property and real estate statements, retirement account statements, and debt statements, help safeguard the interests of both parties involved and ensure transparency regarding financial matters. By providing a detailed overview of each individual's financial situation, these statements help pave the way for an equitable and informed prenuptial agreement.

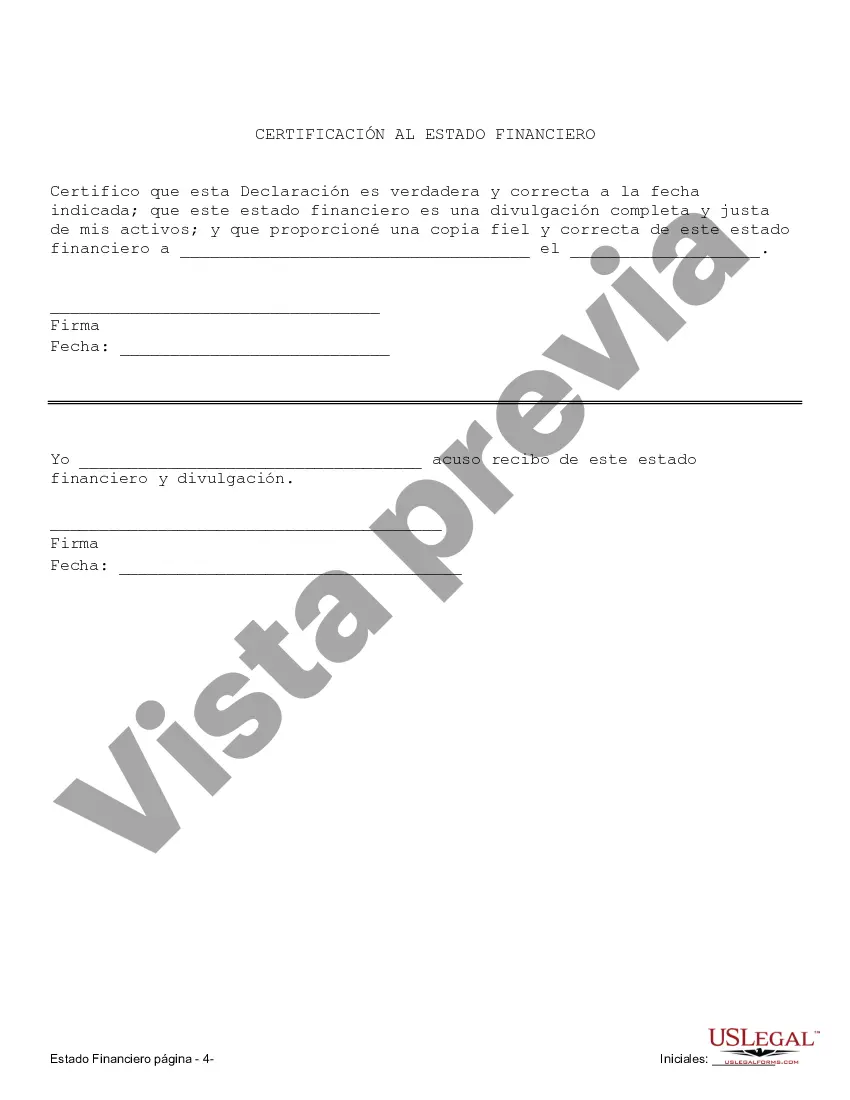

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cape Coral Florida Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Florida Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Cape Coral Florida Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Do you need a reliable and inexpensive legal forms provider to buy the Cape Coral Florida Financial Statements only in Connection with Prenuptial Premarital Agreement? US Legal Forms is your go-to choice.

Whether you require a basic agreement to set rules for cohabitating with your partner or a package of documents to move your divorce through the court, we got you covered. Our website offers more than 85,000 up-to-date legal document templates for personal and business use. All templates that we give access to aren’t generic and framed based on the requirements of particular state and county.

To download the document, you need to log in account, find the needed template, and click the Download button next to it. Please keep in mind that you can download your previously purchased document templates anytime in the My Forms tab.

Are you new to our website? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Cape Coral Florida Financial Statements only in Connection with Prenuptial Premarital Agreement conforms to the laws of your state and local area.

- Go through the form’s details (if available) to learn who and what the document is good for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can register your account. Then select the subscription option and proceed to payment. Once the payment is done, download the Cape Coral Florida Financial Statements only in Connection with Prenuptial Premarital Agreement in any available file format. You can return to the website at any time and redownload the document free of charge.

Finding up-to-date legal documents has never been easier. Give US Legal Forms a try today, and forget about wasting your valuable time learning about legal paperwork online for good.