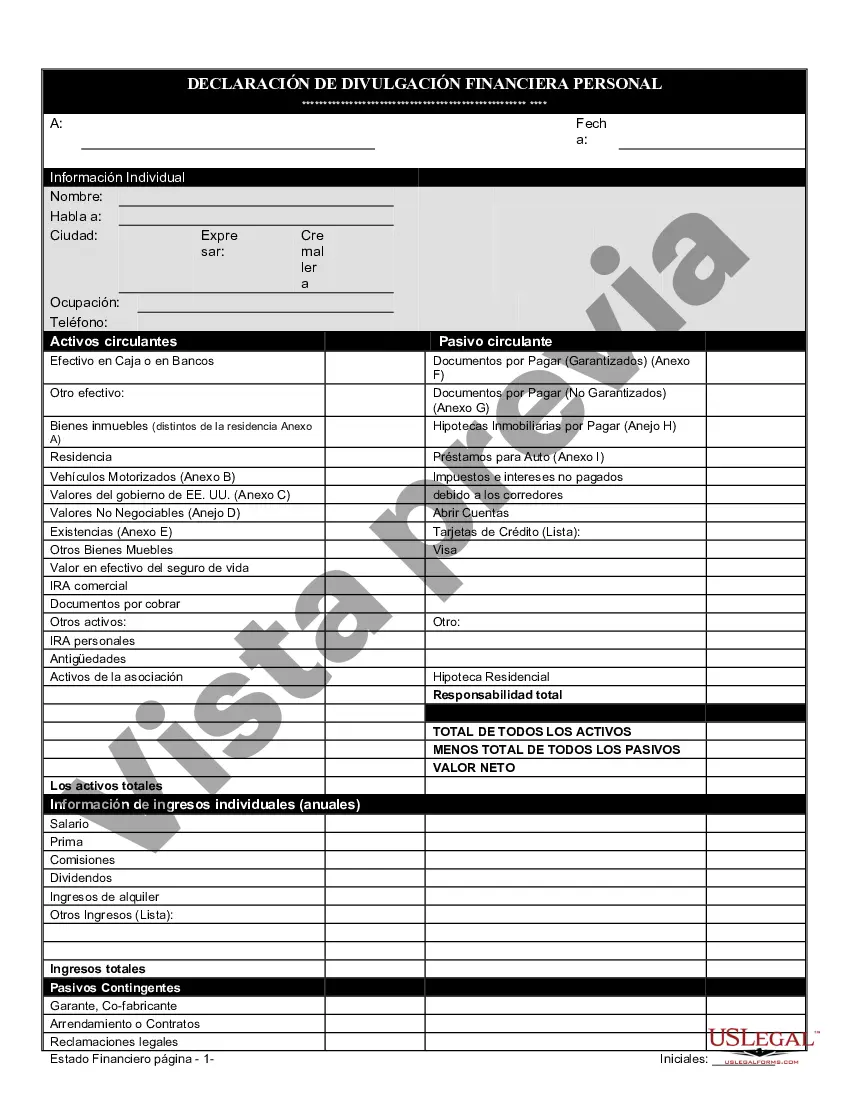

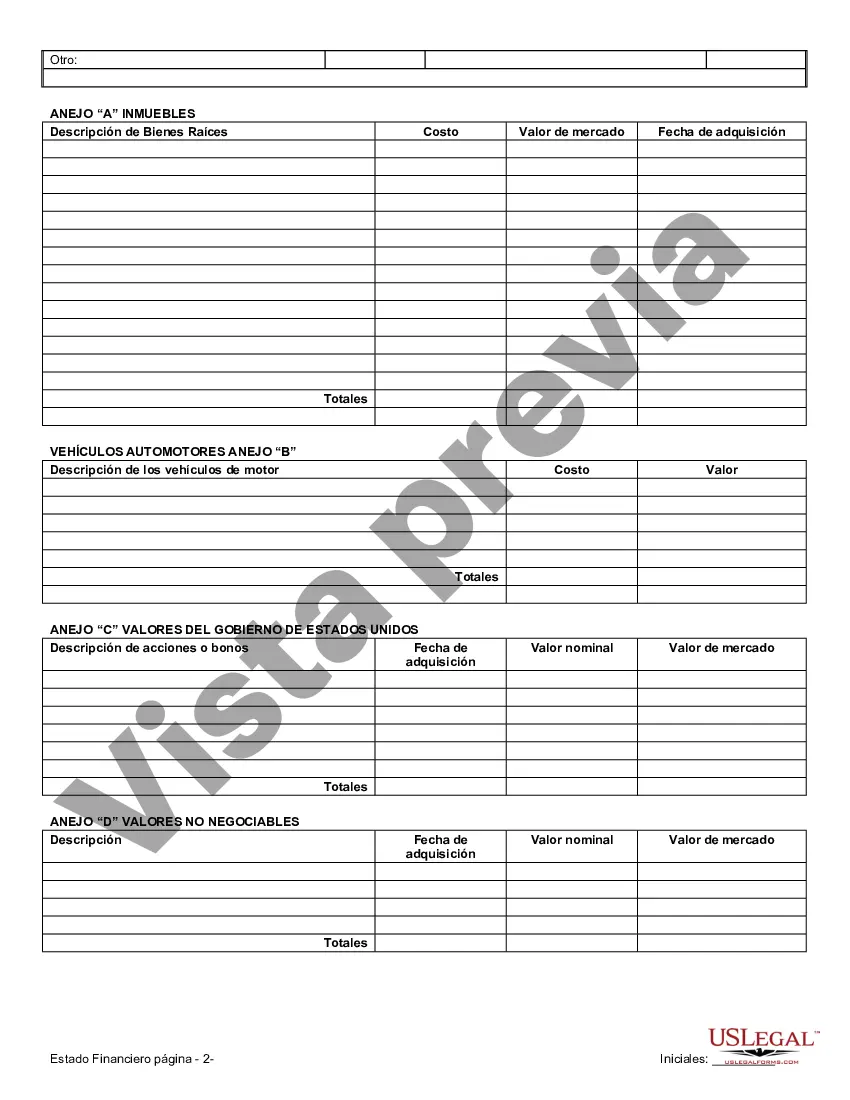

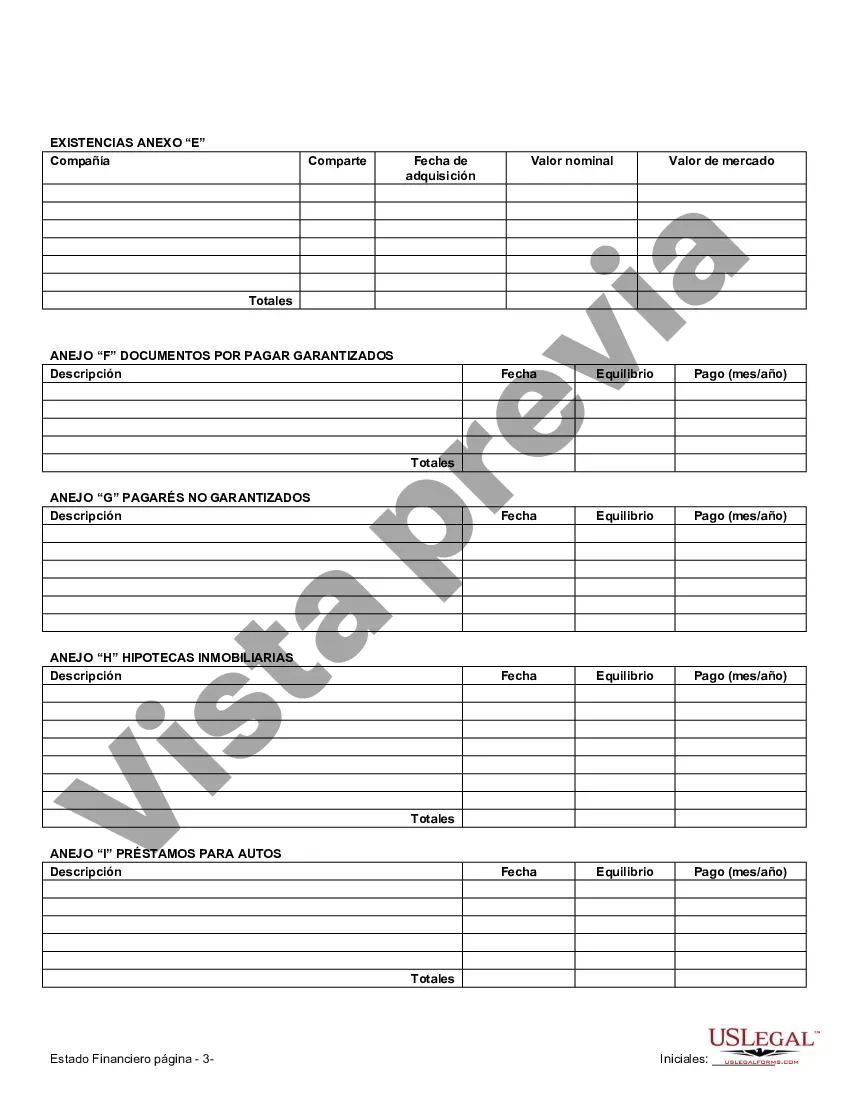

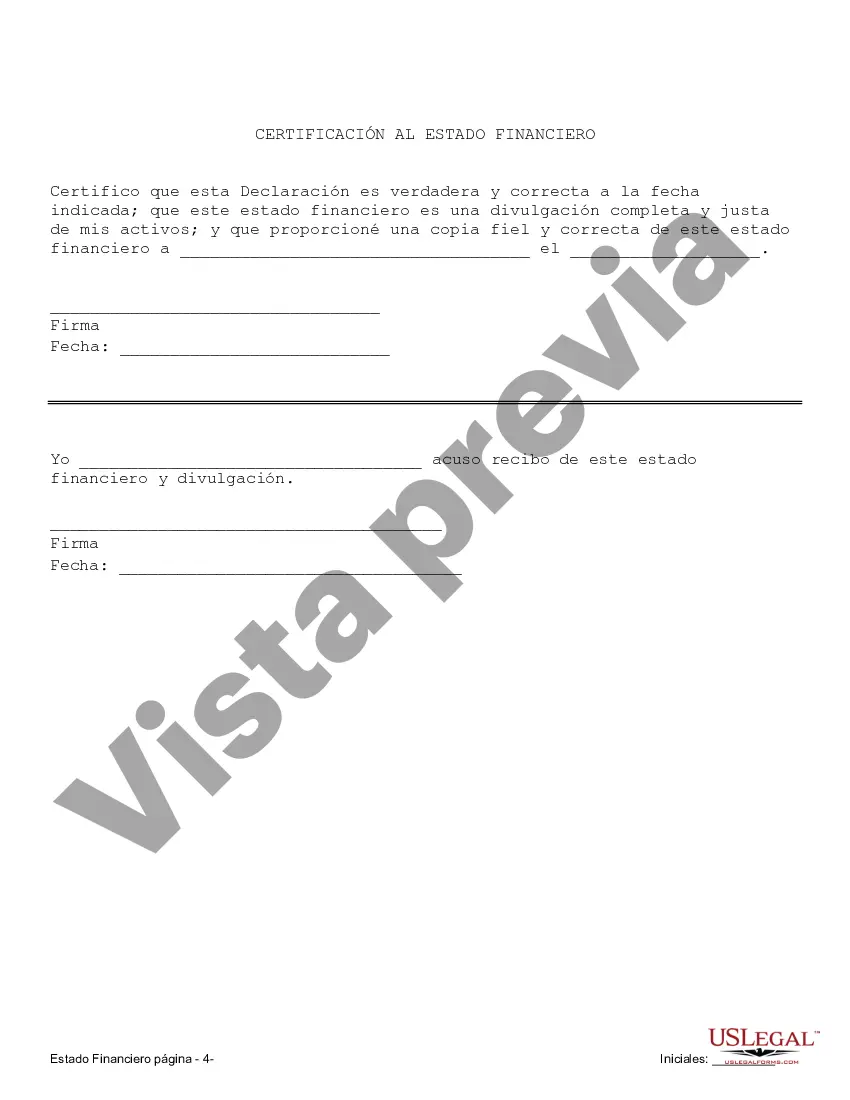

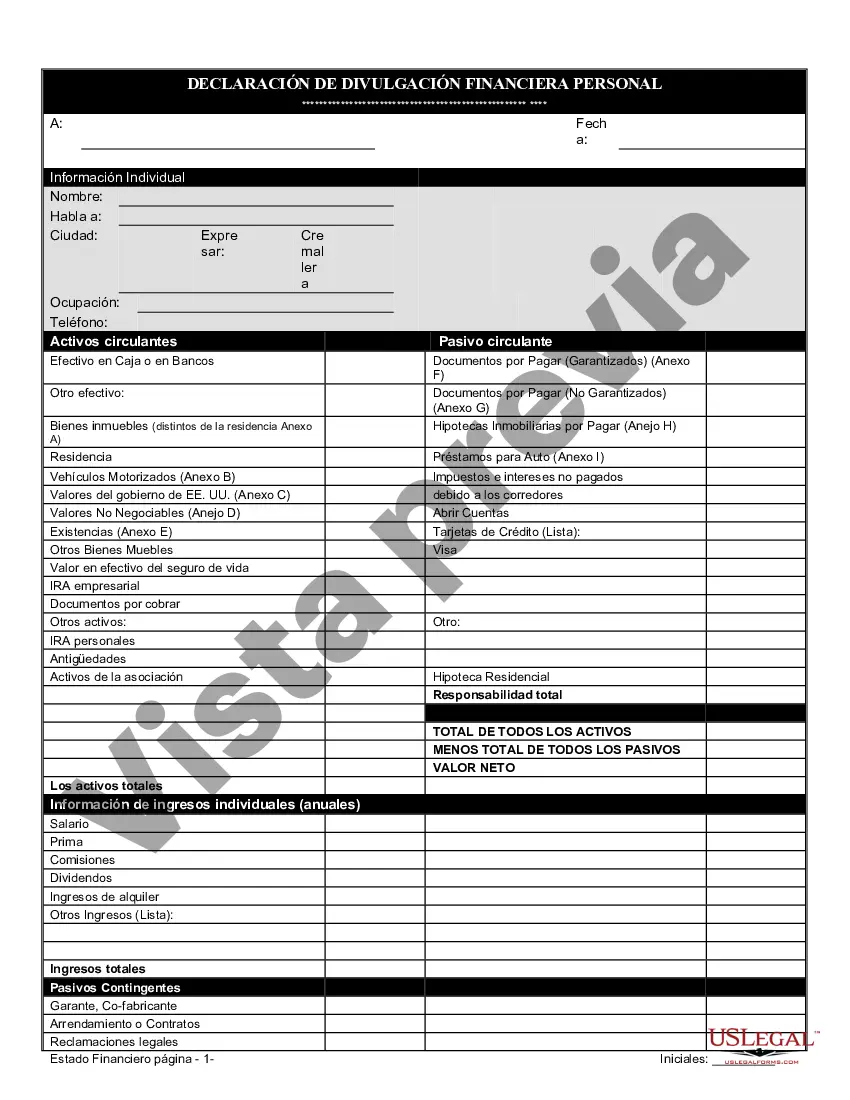

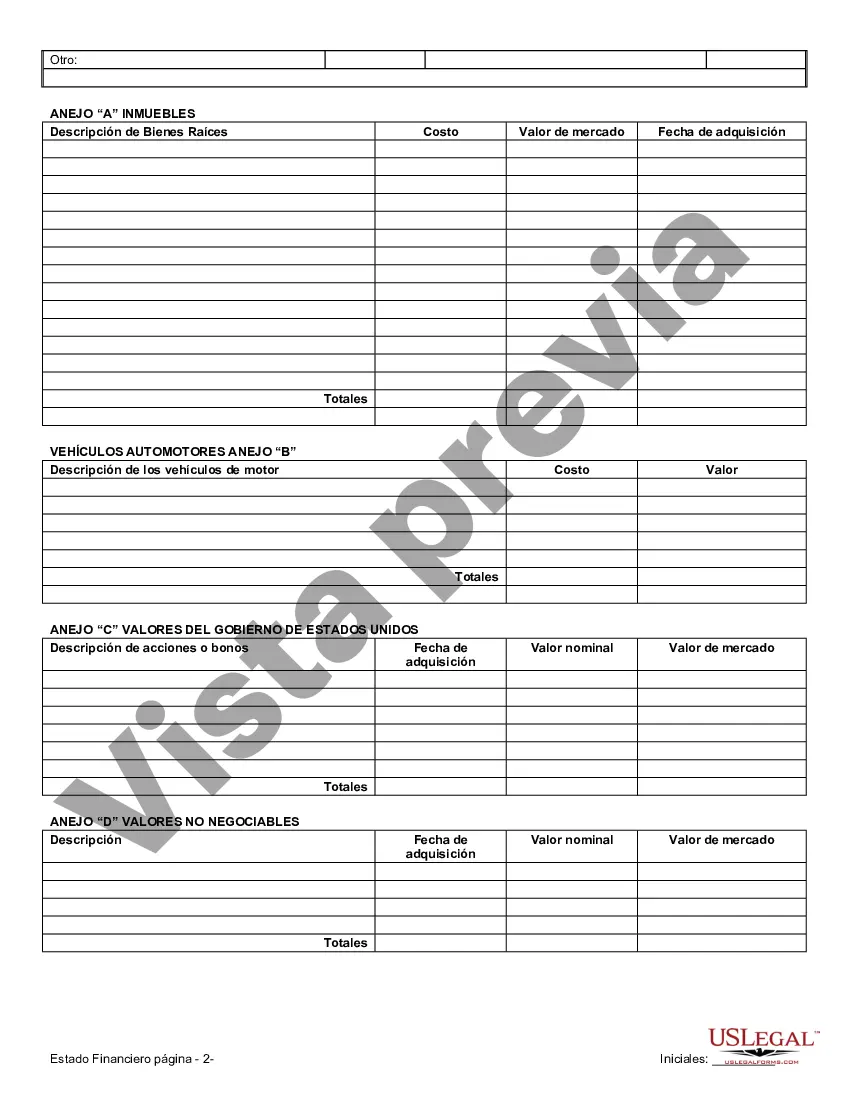

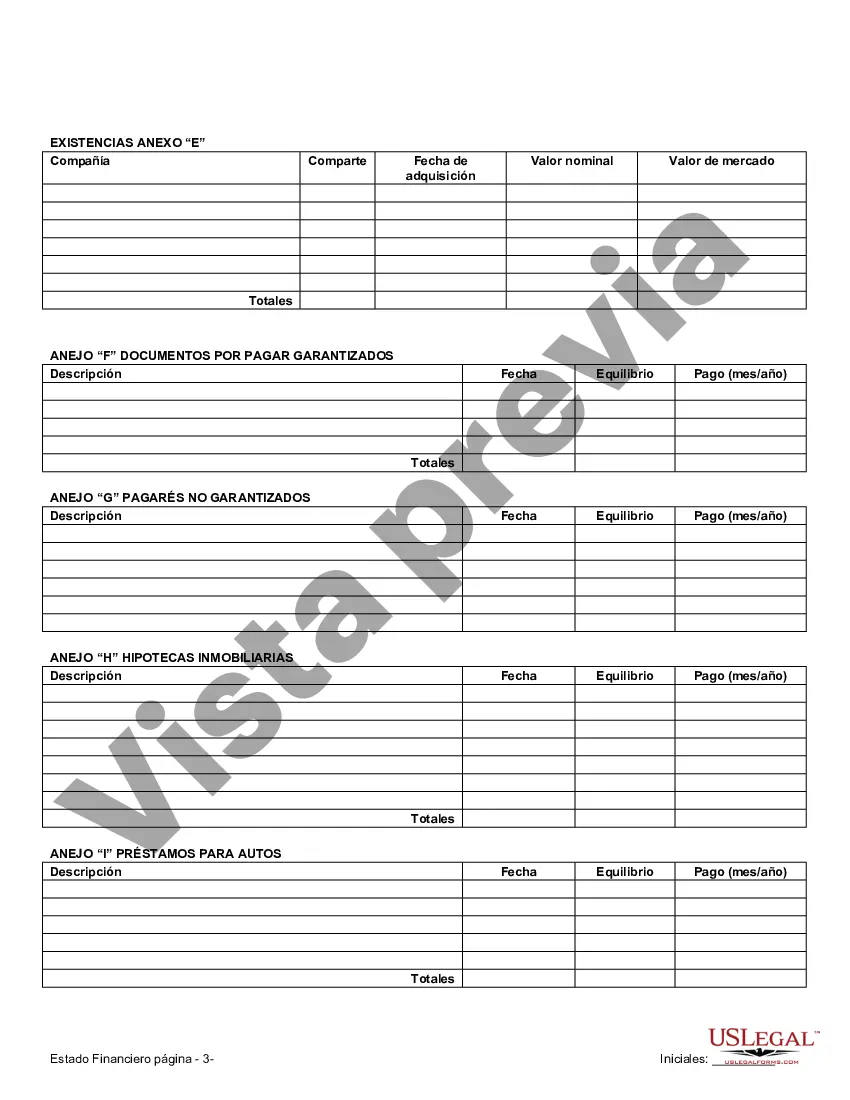

Miami-Dade Florida financial statements in connection with prenuptial premarital agreements are legal documents that provide a comprehensive overview of the financial status of individuals entering into a marriage or domestic partnership in Miami-Dade County, Florida. These statements play a crucial role in establishing transparency, trust, and fairness in the event of divorce or separation. The main purpose of Miami-Dade financial statements in connection with prenuptial premarital agreements is to disclose assets, liabilities, income, and expenses of each party involved. By including these statements in a prenuptial agreement, both parties can clearly understand each other's financial positions before entering into a legally binding commitment. This helps in determining the division of assets and debts in the case of divorce or dissolution of the marriage. There are different types of Miami-Dade Florida financial statements that can be included in a prenuptial premarital agreement. These include: 1. Personal Financial Statements: Individuals disclose their personal financial information such as bank accounts, savings, investments, real estate properties, vehicles, and retirement accounts. This statement provides a comprehensive view of their assets and identifies any potential disputes over ownership. 2. Business Financial Statements: If either party owns a business or has a stake in one, additional financial statements must be provided. These statements involve disclosing business income, expenses, assets, liabilities, and valuation. They are essential when determining the division of business assets in divorce cases. 3. Tax Returns: Including copies of recent tax returns provides important information about each party's income, deductions, and potential tax liabilities. Tax returns are particularly useful in evaluating the earning capacity, financial stability, and overall financial health of a party. 4. Investment Statements: Individuals may include investment statements, such as brokerage or investment account statements, to disclose holdings, realized and unrealized gains or losses, and other related financial information. These statements provide insights into the individuals' investment portfolios and help assess their financial obligations and resources. 5. Debt Statements: Disclosing debts, including mortgages, loans, credit cards, and other financial obligations, is crucial. Outstanding debts can significantly impact the division of assets and financial responsibilities in the event of a divorce or separation. Debt statements ensure transparency and prevent any hidden obligations from surfacing later. In conclusion, Miami-Dade Florida financial statements in connection with prenuptial premarital agreements are vital for establishing financial transparency and division of assets. Including various types of financial statements helps ensure all parties entering into a marriage or domestic partnership have a clear understanding of each other's financial situations. By providing this information, individuals can protect their rights and ensure a fair resolution in case of a future separation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Florida Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Miami-Dade Florida Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

If you are searching for a valid form template, it’s impossible to find a more convenient platform than the US Legal Forms website – probably the most extensive libraries on the web. With this library, you can find thousands of templates for organization and individual purposes by categories and regions, or keywords. Using our high-quality search option, getting the newest Miami-Dade Florida Financial Statements only in Connection with Prenuptial Premarital Agreement is as elementary as 1-2-3. Furthermore, the relevance of each document is proved by a group of expert lawyers that regularly check the templates on our website and update them based on the most recent state and county laws.

If you already know about our platform and have an account, all you should do to get the Miami-Dade Florida Financial Statements only in Connection with Prenuptial Premarital Agreement is to log in to your account and click the Download option.

If you utilize US Legal Forms for the first time, just refer to the instructions listed below:

- Make sure you have chosen the form you need. Look at its description and make use of the Preview feature (if available) to explore its content. If it doesn’t meet your requirements, use the Search field near the top of the screen to find the appropriate file.

- Affirm your selection. Select the Buy now option. After that, select the preferred pricing plan and provide credentials to register an account.

- Process the financial transaction. Utilize your credit card or PayPal account to finish the registration procedure.

- Obtain the template. Choose the file format and save it on your device.

- Make modifications. Fill out, modify, print, and sign the acquired Miami-Dade Florida Financial Statements only in Connection with Prenuptial Premarital Agreement.

Each and every template you add to your account has no expiry date and is yours forever. You always have the ability to gain access to them via the My Forms menu, so if you need to have an additional duplicate for editing or printing, you may return and export it once more at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Miami-Dade Florida Financial Statements only in Connection with Prenuptial Premarital Agreement you were looking for and thousands of other professional and state-specific samples on a single platform!