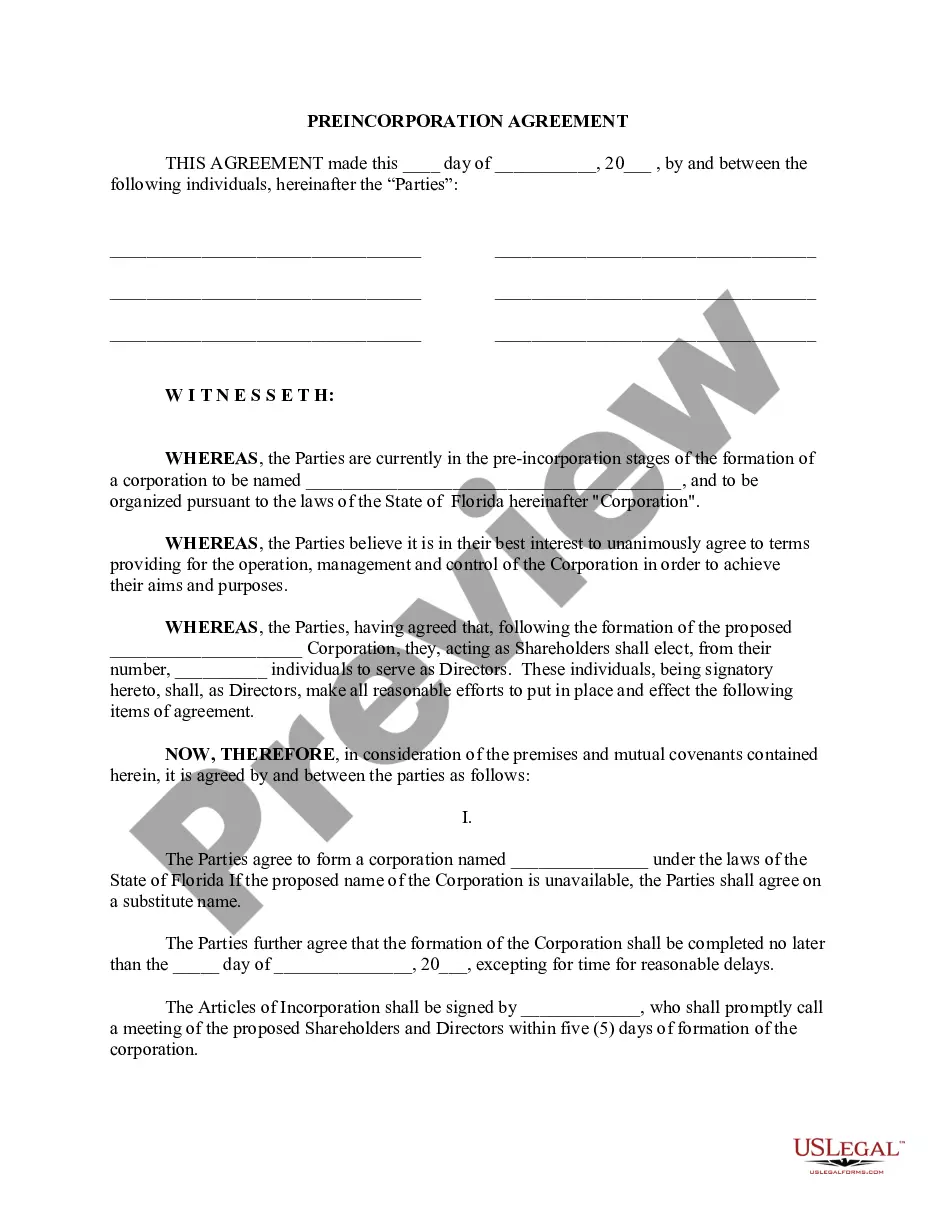

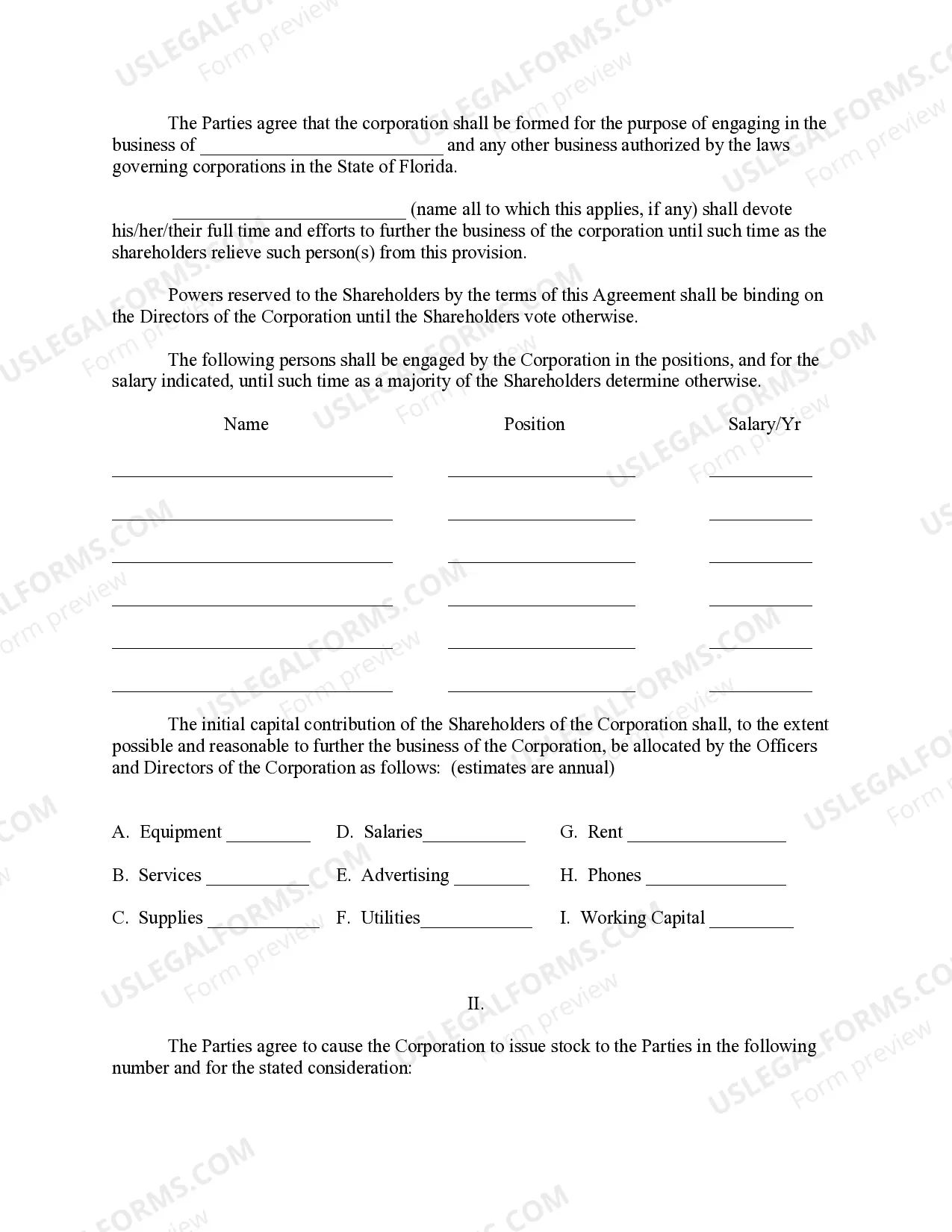

This package of forms contains a pre-incorporation agreement for the formers of a corporation to sign agreeing on how the corporate will be operated, who will be elected as officers and directors, salaries and many other corporate matters.

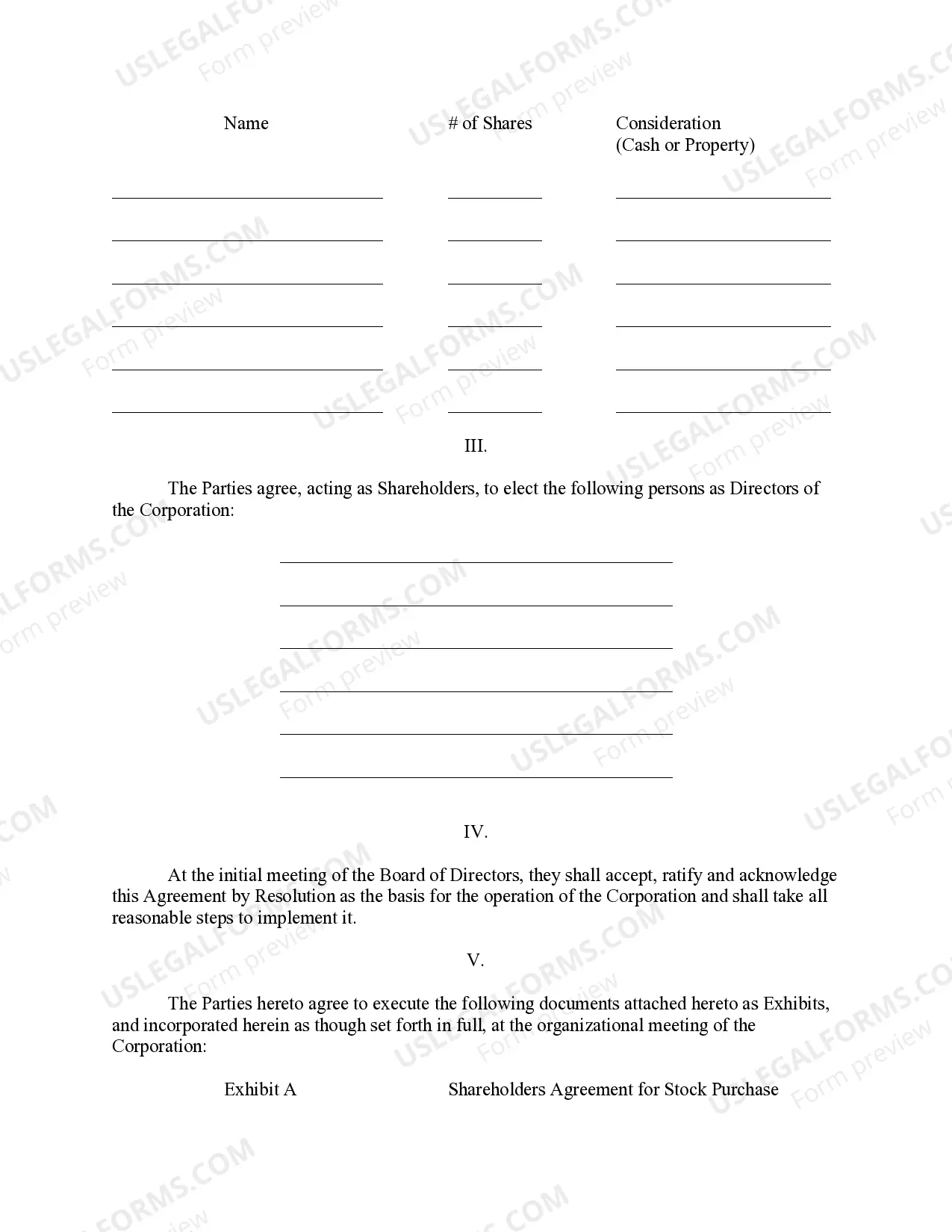

The Shareholders Agreement is signed by the shareholders to agree on how the shares of a deceased shareholder may be purchased and how shares of a person who desires to sell their stock may be obtained by the other shareholders or the corporation. Restrictions on the Sale of stock are included to accomplish the goals of the shareholders to keep the corporation under the control of the existing shareholders.

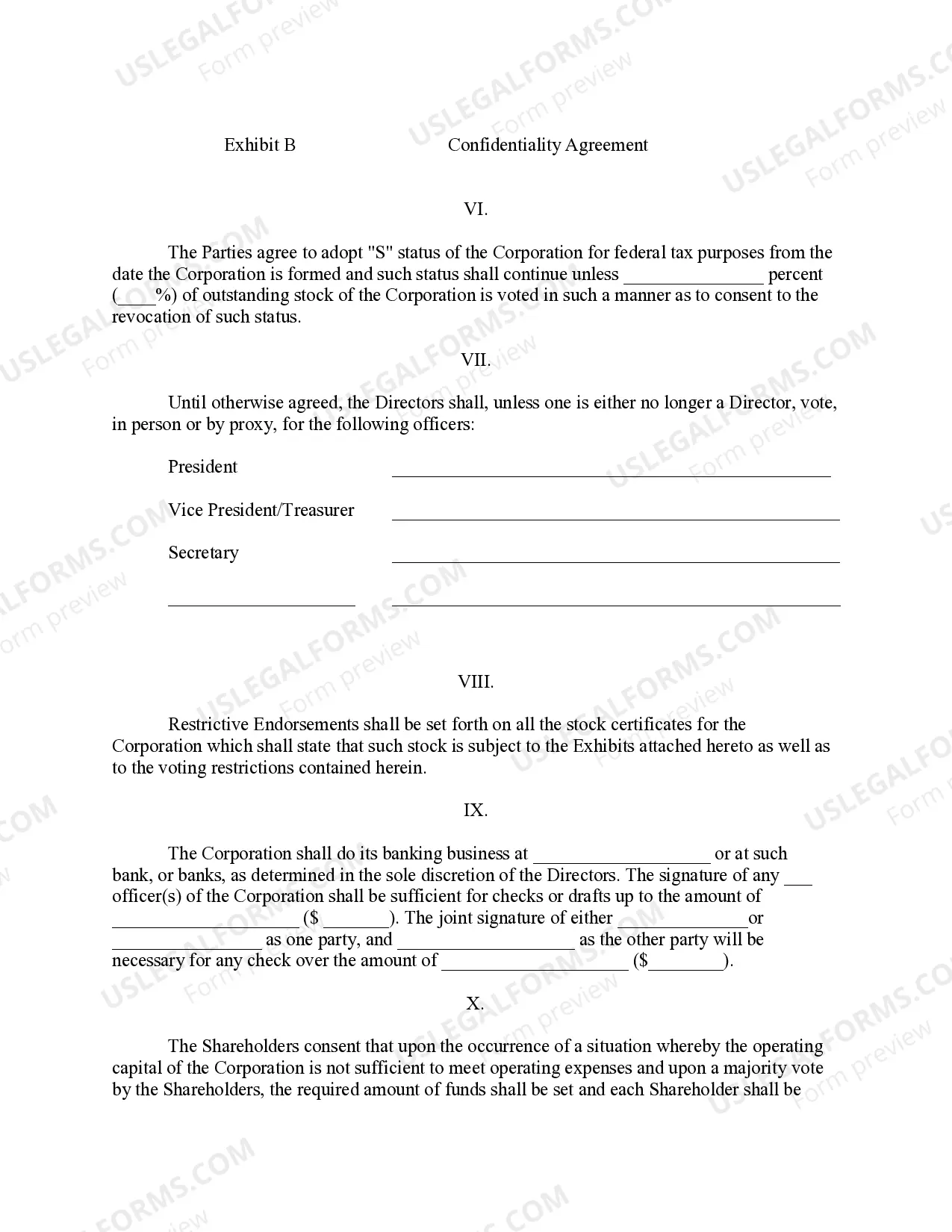

The Confidentiality Agreement is made between the shareholders wherein they agree to keep confidential certain corporate matters.

Fort Lauderdale Florida Pre-Incorporation Agreement: A Fort Lauderdale Florida Pre-Incorporation Agreement is a legal document drafted before the official incorporation of a company in Fort Lauderdale, Florida. This agreement outlines the preliminary steps, terms, and conditions that need to be fulfilled before the actual incorporation process can take place. By defining the rights, responsibilities, and duties of the parties involved, a Pre-Incorporation Agreement ensures a smooth and transparent transition into incorporation. Different types of Fort Lauderdale Florida Pre-Incorporation Agreements include: 1. Standard Pre-Incorporation Agreement: This is the most common type of agreement used in Fort Lauderdale, Florida. It covers basic elements like the company's name, purpose, capital structure, initial directors, and officers. 2. Detailed Pre-Incorporation Agreement: This type of agreement includes more comprehensive clauses, covering additional topics such as financing arrangements, dispute resolution mechanisms, and non-compete clauses. Fort Lauderdale Florida Shareholders Agreement: A Fort Lauderdale Florida Shareholders Agreement is a legally binding contract between shareholders of a company based in Fort Lauderdale, Florida. This agreement outlines the rights, obligations, and protections of shareholders, ensuring a fair and transparent relationship among them. It covers various aspects such as voting rights, management roles, profit distribution, share transfer restrictions, and dispute resolution mechanisms. Different types of Fort Lauderdale Florida Shareholders Agreements include: 1. Founders Shareholders Agreement: This type of agreement is specifically tailored for the founding members of a company. It typically includes provisions related to intellectual property rights, founder vesting schedules, and management control. 2. Investor Shareholders Agreement: When external investors participate in a Fort Lauderdale-based company, an investor shareholders agreement is crucial. This agreement establishes the rights and obligations of both the company and the investor, including matters related to share acquisitions, board representation, and information disclosure. Fort Lauderdale Florida Confidentiality Agreement: A Fort Lauderdale Florida Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that safeguards sensitive and confidential information shared between parties involved in a business relationship. This agreement ensures that the information remains confidential and cannot be disclosed to third parties without proper authorization. Different types of Fort Lauderdale Florida Confidentiality Agreements include: 1. Mutual Confidentiality Agreement: This is an agreement between two or more parties where all parties are obligated to protect each other's confidential information. It is commonly used when there is a mutual exchange of sensitive information. 2. Unilateral Confidentiality Agreement: This type of agreement is when one party discloses confidential information to another party, and only the receiving party is obligated to keep it confidential. It is typically used in situations where one party shares proprietary information with potential business partners or investors. In conclusion, Fort Lauderdale Florida Pre-Incorporation Agreements, Shareholders Agreements, and Confidentiality Agreements play vital roles in the establishment, governance, and protection of businesses in Fort Lauderdale, Florida. Understanding and carefully drafting these agreements are crucial steps in building successful and legally compliant ventures in the region.Fort Lauderdale Florida Pre-Incorporation Agreement: A Fort Lauderdale Florida Pre-Incorporation Agreement is a legal document drafted before the official incorporation of a company in Fort Lauderdale, Florida. This agreement outlines the preliminary steps, terms, and conditions that need to be fulfilled before the actual incorporation process can take place. By defining the rights, responsibilities, and duties of the parties involved, a Pre-Incorporation Agreement ensures a smooth and transparent transition into incorporation. Different types of Fort Lauderdale Florida Pre-Incorporation Agreements include: 1. Standard Pre-Incorporation Agreement: This is the most common type of agreement used in Fort Lauderdale, Florida. It covers basic elements like the company's name, purpose, capital structure, initial directors, and officers. 2. Detailed Pre-Incorporation Agreement: This type of agreement includes more comprehensive clauses, covering additional topics such as financing arrangements, dispute resolution mechanisms, and non-compete clauses. Fort Lauderdale Florida Shareholders Agreement: A Fort Lauderdale Florida Shareholders Agreement is a legally binding contract between shareholders of a company based in Fort Lauderdale, Florida. This agreement outlines the rights, obligations, and protections of shareholders, ensuring a fair and transparent relationship among them. It covers various aspects such as voting rights, management roles, profit distribution, share transfer restrictions, and dispute resolution mechanisms. Different types of Fort Lauderdale Florida Shareholders Agreements include: 1. Founders Shareholders Agreement: This type of agreement is specifically tailored for the founding members of a company. It typically includes provisions related to intellectual property rights, founder vesting schedules, and management control. 2. Investor Shareholders Agreement: When external investors participate in a Fort Lauderdale-based company, an investor shareholders agreement is crucial. This agreement establishes the rights and obligations of both the company and the investor, including matters related to share acquisitions, board representation, and information disclosure. Fort Lauderdale Florida Confidentiality Agreement: A Fort Lauderdale Florida Confidentiality Agreement, also known as a Non-Disclosure Agreement (NDA), is a legal contract that safeguards sensitive and confidential information shared between parties involved in a business relationship. This agreement ensures that the information remains confidential and cannot be disclosed to third parties without proper authorization. Different types of Fort Lauderdale Florida Confidentiality Agreements include: 1. Mutual Confidentiality Agreement: This is an agreement between two or more parties where all parties are obligated to protect each other's confidential information. It is commonly used when there is a mutual exchange of sensitive information. 2. Unilateral Confidentiality Agreement: This type of agreement is when one party discloses confidential information to another party, and only the receiving party is obligated to keep it confidential. It is typically used in situations where one party shares proprietary information with potential business partners or investors. In conclusion, Fort Lauderdale Florida Pre-Incorporation Agreements, Shareholders Agreements, and Confidentiality Agreements play vital roles in the establishment, governance, and protection of businesses in Fort Lauderdale, Florida. Understanding and carefully drafting these agreements are crucial steps in building successful and legally compliant ventures in the region.