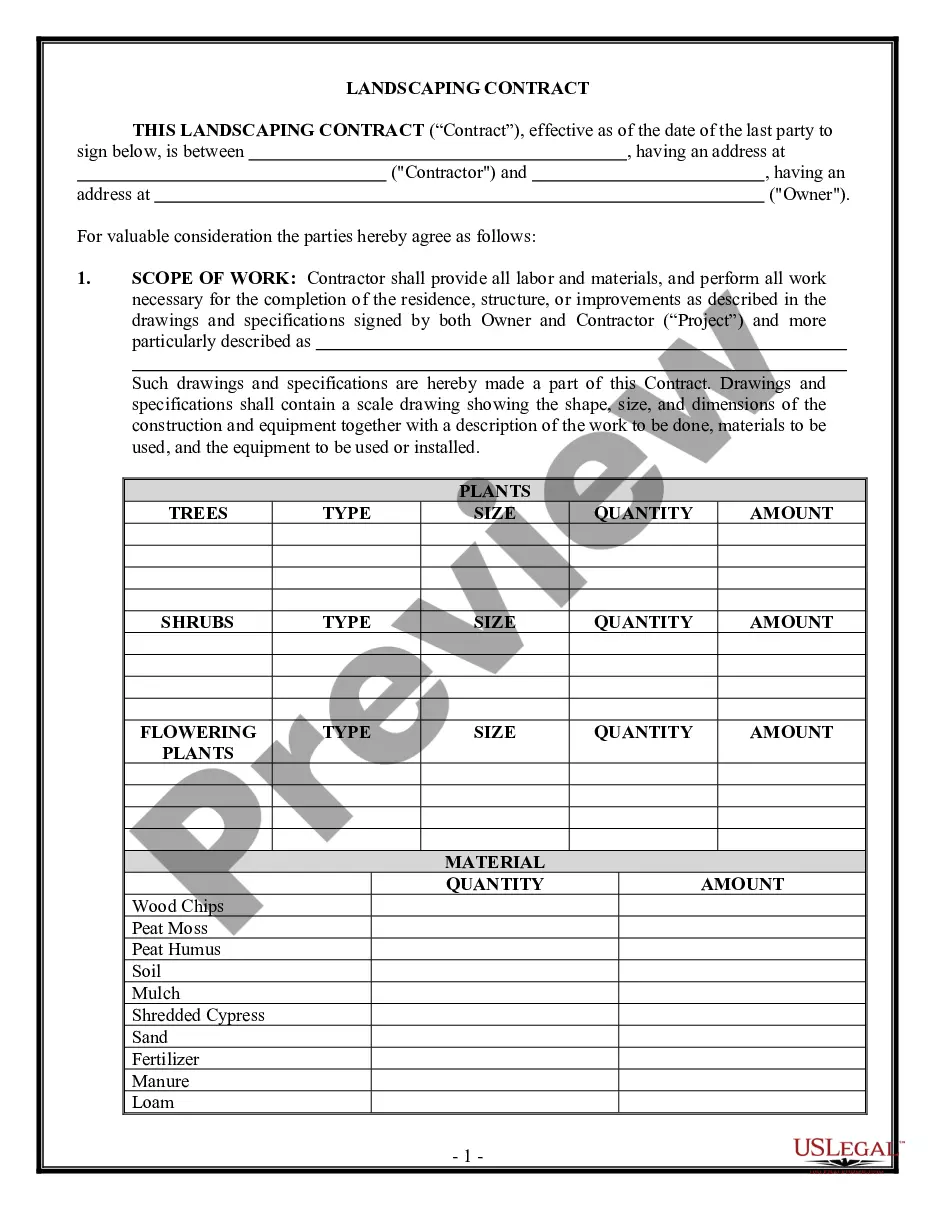

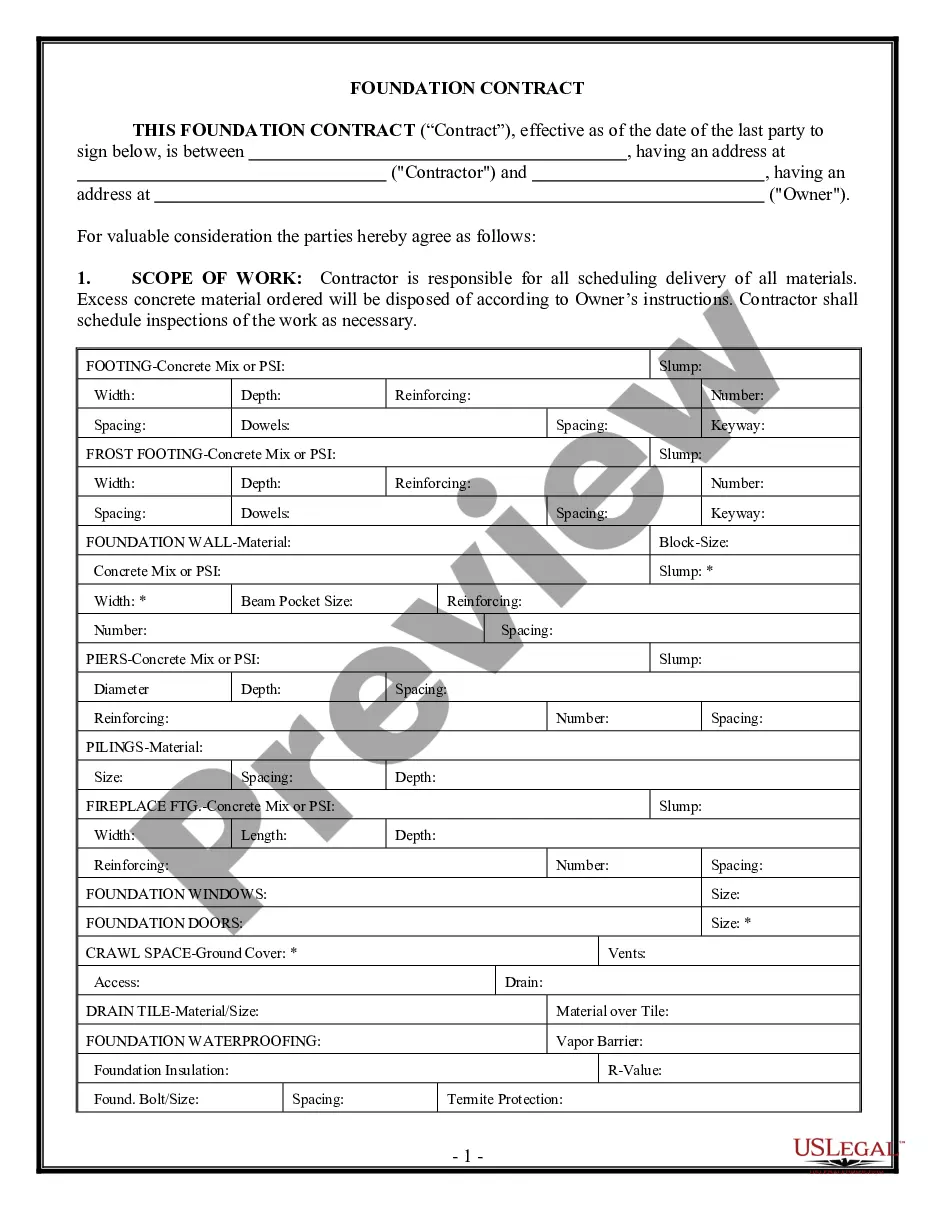

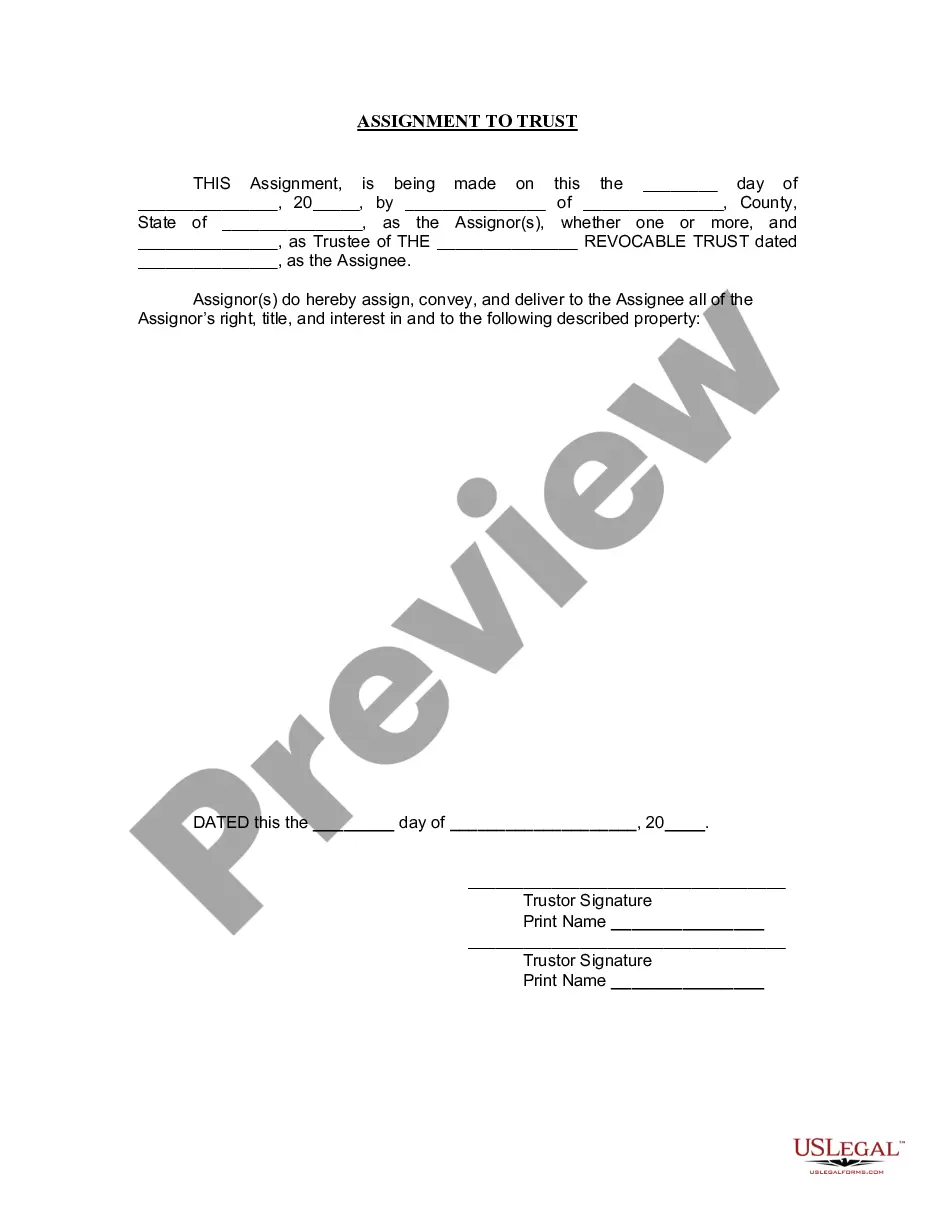

Title: Understanding Miami-Dade Florida LLC Formation for Rental Property: Types and Benefits Introduction: Miami-Dade County in Florida offers several options for individuals interested in establishing a limited liability company (LLC) for rental property purposes. LLC formation allows property owners to protect their personal assets, minimize liability, and optimize tax benefits. This article delves into the details of Miami-Dade Florida LLC formation for rental property, highlighting different types and their respective advantages. Types of Miami-Dade Florida LLC Formation for Rental Property: 1. Single-Member LLC: A single-member LLC is the most common type of LLC formation for rental property in Miami-Dade County. It involves a sole owner, typically an individual, holding ownership and management control over the property. Forming a single-member LLC offers personal liability protection, ensuring business-related debts and obligations are separated from the owner's personal assets. Additionally, this formation type simplifies tax filing as the income is reported on the owner's personal tax return. 2. Multi-Member LLC: A multi-member LLC is suitable for rental properties co-owned by two or more individuals. Each member has ownership rights and shares profits and losses according to the agreed-upon terms. Similar to a single-member LLC, personal liability protection and pass-through taxation benefits are extended. 3. Family LLC: The family LLC formation is ideal for multi-generational property ownership within a family. It allows families to pool their resources and jointly manage rental properties while reaping the benefits of individual limited liability. Family LCS offer flexibility in estate planning, enabling smooth transfers of ownership from one generation to the next. 4. Holding Company LLC: A holding company LLC acts as a subsidiary entity that holds ownership of multiple rental properties. This formation is particularly beneficial for investors with diversified real estate portfolios. Holding company LCS centralize property management, streamline accounting, and protect individual properties under a single legal entity. Benefits of Miami-Dade Florida LLC Formation for Rental Property: 1. Limited Personal Liability: By forming an LLC, property owners are shielded from personal liability in case of lawsuits, property damage claims, or other liabilities resulting from the rental property. This separation of personal and business assets ensures protection for the owners' personal finances. 2. Pass-through Taxation: LCS are not considered separate taxable entities. Instead, the income and expenses pass through to the LLC owners, who report them on their individual tax returns. This arrangement exempts LCS from double taxation and allows owners to take advantage of various tax deductions and credits available to rental property owners. 3. Flexibility in Management Structure: LLC formations provide flexibility in determining the management structure. Owners can choose to manage the rental property themselves or delegate management responsibilities to a professional property management company. This versatility allows property owners to focus on other ventures while ensuring efficient property operations and tenant management. Conclusion: Miami-Dade Florida LLC formation for rental property presents a range of options suited to the unique needs of property owners. Whether opting for a single-member LLC, multi-member LLC, family LLC, or holding company LLC, establishing an LLC in Miami-Dade County offers enhanced asset protection, tax benefits, and flexibility in property management. Consulting with legal and tax professionals can provide further guidance in selecting the most suitable LLC formation type for one's specific rental property objectives.

Miami-Dade Florida LLC Formation for Rental Property

Description

How to fill out Miami-Dade Florida LLC Formation For Rental Property?

We always strive to reduce or prevent legal damage when dealing with nuanced legal or financial affairs. To do so, we apply for attorney solutions that, as a rule, are extremely expensive. However, not all legal matters are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to an attorney. We offer access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Miami-Dade Florida LLC Formation for Rental Property or any other form quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re new to the website! You can create your account in a matter of minutes.

- Make sure to check if the Miami-Dade Florida LLC Formation for Rental Property complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you check out the form’s outline (if provided), and if you spot any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve made sure that the Miami-Dade Florida LLC Formation for Rental Property is proper for you, you can choose the subscription plan and make a payment.

- Then you can download the form in any available file format.

For over 24 years of our existence, we’ve served millions of people by offering ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save time and resources!