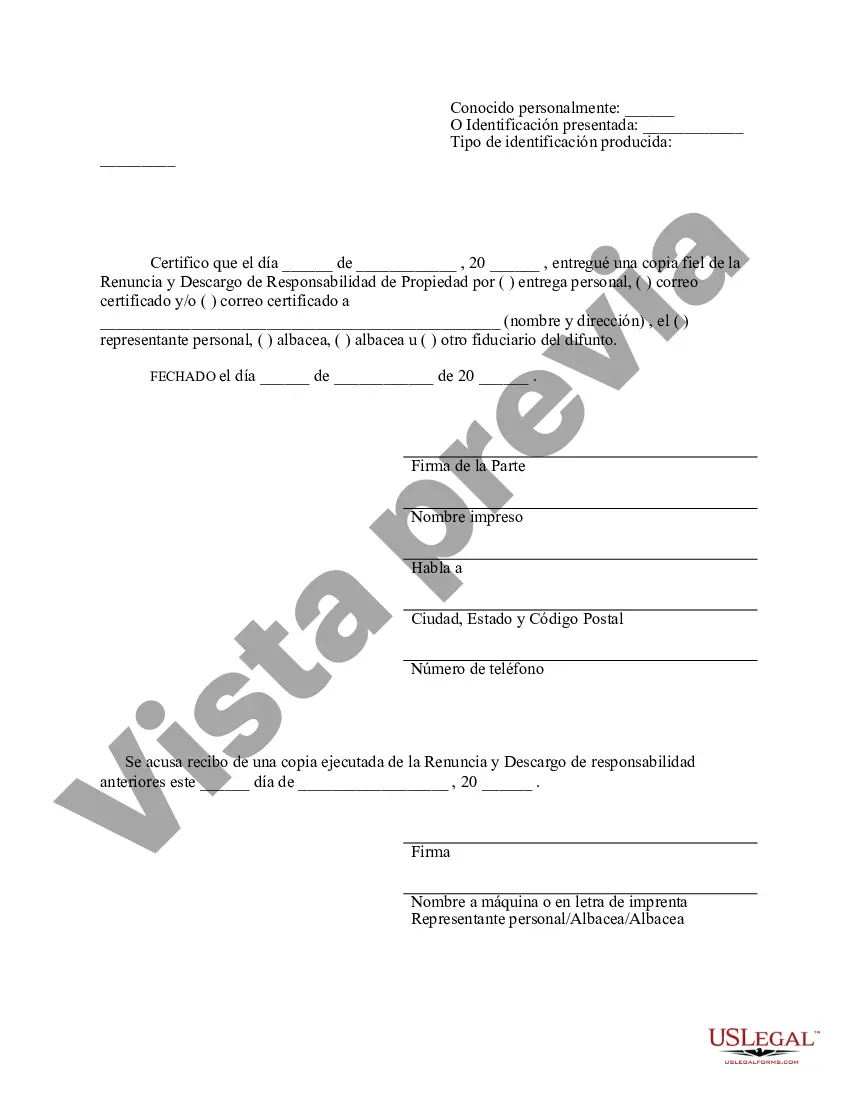

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. However, pursuant to the Florida Statutes Title 42, Chap. 732, the beneficiary is entitled to renounce a portion of or the entire interest in the property. For the disclaimer to be valid, the beneficiary must file the disclaimer within nine months of the death of the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Miramar Florida Renunciation And Disclaimer of Property from Will by Testate allows individuals to legally give up their right to inherit property as stated in a will. It is important to note that this renunciation and disclaimer can only be made by a person who is mentioned as a beneficiary in the will. This legal process is generally used when the beneficiary does not want to accept the inheritance, whether due to personal circumstances, financial considerations, or any other reason. By renouncing the property, the beneficiary essentially opts out of their entitlement, allowing the assets to be distributed to other named beneficiaries or in accordance with the laws of intestacy. In Miramar, Florida, there might be several types of renunciations and disclaimers of property from will by testate, including: 1. Specific Renunciation and Disclaimer: This type of renunciation applies to a particular property or assets mentioned in the will. The beneficiary explicitly states their decision not to accept the mentioned property. 2. Entire Estate Renunciation and Disclaimer: In this case, the beneficiary renounces their entitlement to the entire estate mentioned in the will. This means they reject all assets, property, and any other benefits outlined in the will. 3. Partial Renunciation and Disclaimer: A partial renunciation occurs when a beneficiary only rejects specific portions of the inheritance. They might choose to refuse particular assets or a percentage of the overall estate, while still accepting other parts outlined in the will. 4. Conditional Renunciation and Disclaimer: This type of renunciation is made with certain conditions attached. For example, a beneficiary may renounce their entitlement if a specified condition is met, such as an outstanding debt being settled or the property being sold. It is crucial to consult with an experienced attorney in Miramar, Florida, who specializes in estate law to properly navigate the renunciation and disclaimer process. The attorney will guide beneficiaries throughout the legal procedure, ensuring all necessary paperwork is correctly filed and that the renunciation is legally binding. By renouncing and disclaiming property from a will, beneficiaries can ensure assets are distributed according to their wishes or the preferences of the testator, thus allowing for a smoother and more efficient administration of the estate.Miramar Florida Renunciation And Disclaimer of Property from Will by Testate allows individuals to legally give up their right to inherit property as stated in a will. It is important to note that this renunciation and disclaimer can only be made by a person who is mentioned as a beneficiary in the will. This legal process is generally used when the beneficiary does not want to accept the inheritance, whether due to personal circumstances, financial considerations, or any other reason. By renouncing the property, the beneficiary essentially opts out of their entitlement, allowing the assets to be distributed to other named beneficiaries or in accordance with the laws of intestacy. In Miramar, Florida, there might be several types of renunciations and disclaimers of property from will by testate, including: 1. Specific Renunciation and Disclaimer: This type of renunciation applies to a particular property or assets mentioned in the will. The beneficiary explicitly states their decision not to accept the mentioned property. 2. Entire Estate Renunciation and Disclaimer: In this case, the beneficiary renounces their entitlement to the entire estate mentioned in the will. This means they reject all assets, property, and any other benefits outlined in the will. 3. Partial Renunciation and Disclaimer: A partial renunciation occurs when a beneficiary only rejects specific portions of the inheritance. They might choose to refuse particular assets or a percentage of the overall estate, while still accepting other parts outlined in the will. 4. Conditional Renunciation and Disclaimer: This type of renunciation is made with certain conditions attached. For example, a beneficiary may renounce their entitlement if a specified condition is met, such as an outstanding debt being settled or the property being sold. It is crucial to consult with an experienced attorney in Miramar, Florida, who specializes in estate law to properly navigate the renunciation and disclaimer process. The attorney will guide beneficiaries throughout the legal procedure, ensuring all necessary paperwork is correctly filed and that the renunciation is legally binding. By renouncing and disclaiming property from a will, beneficiaries can ensure assets are distributed according to their wishes or the preferences of the testator, thus allowing for a smoother and more efficient administration of the estate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.