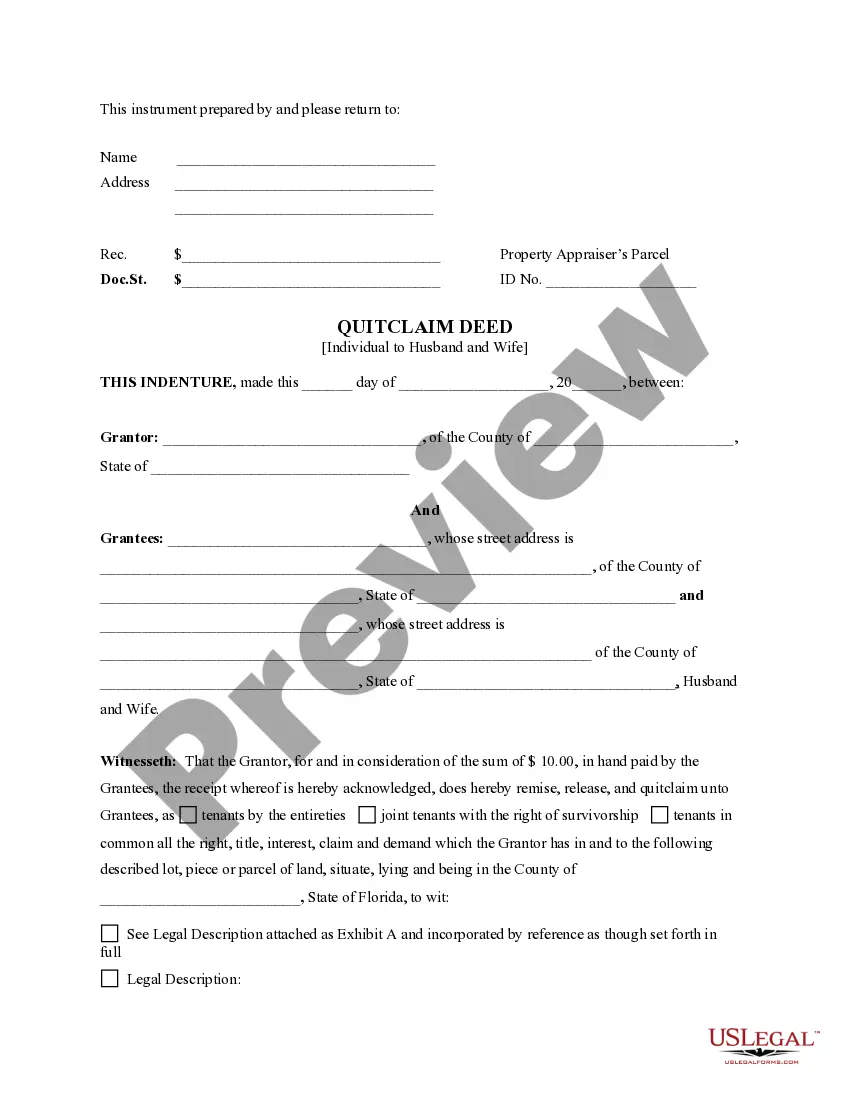

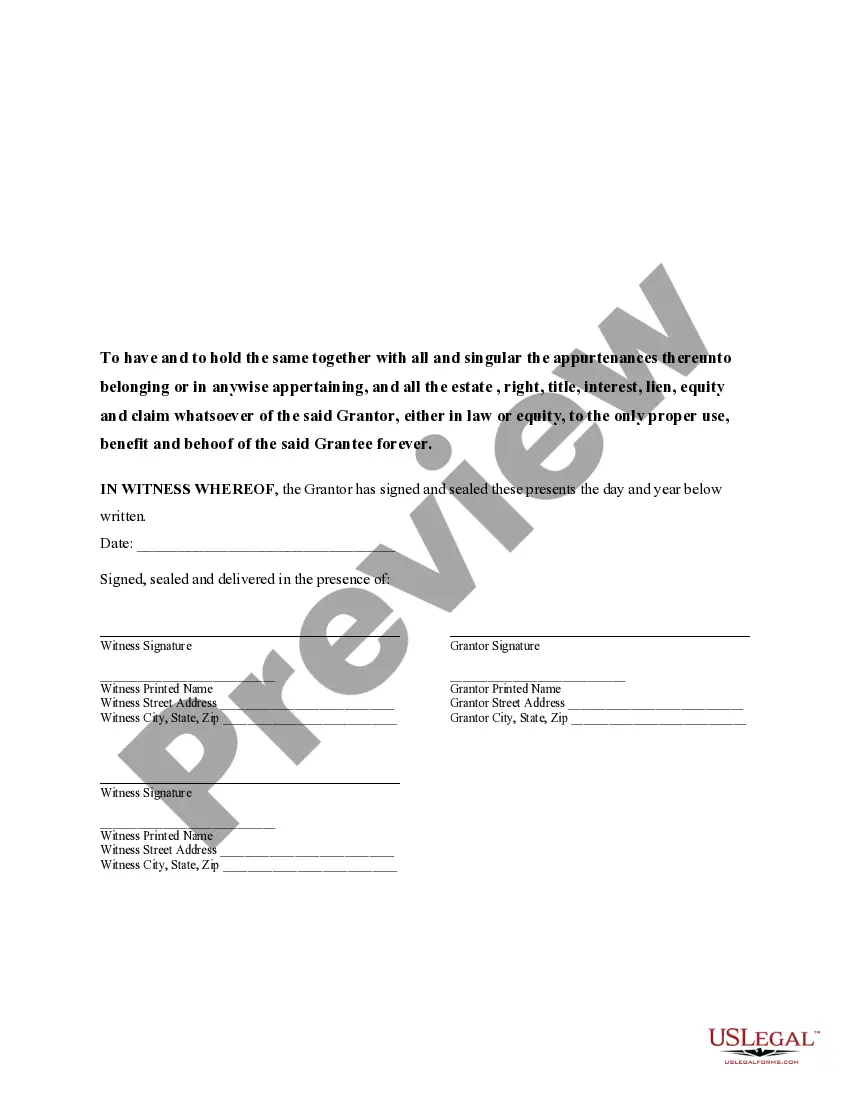

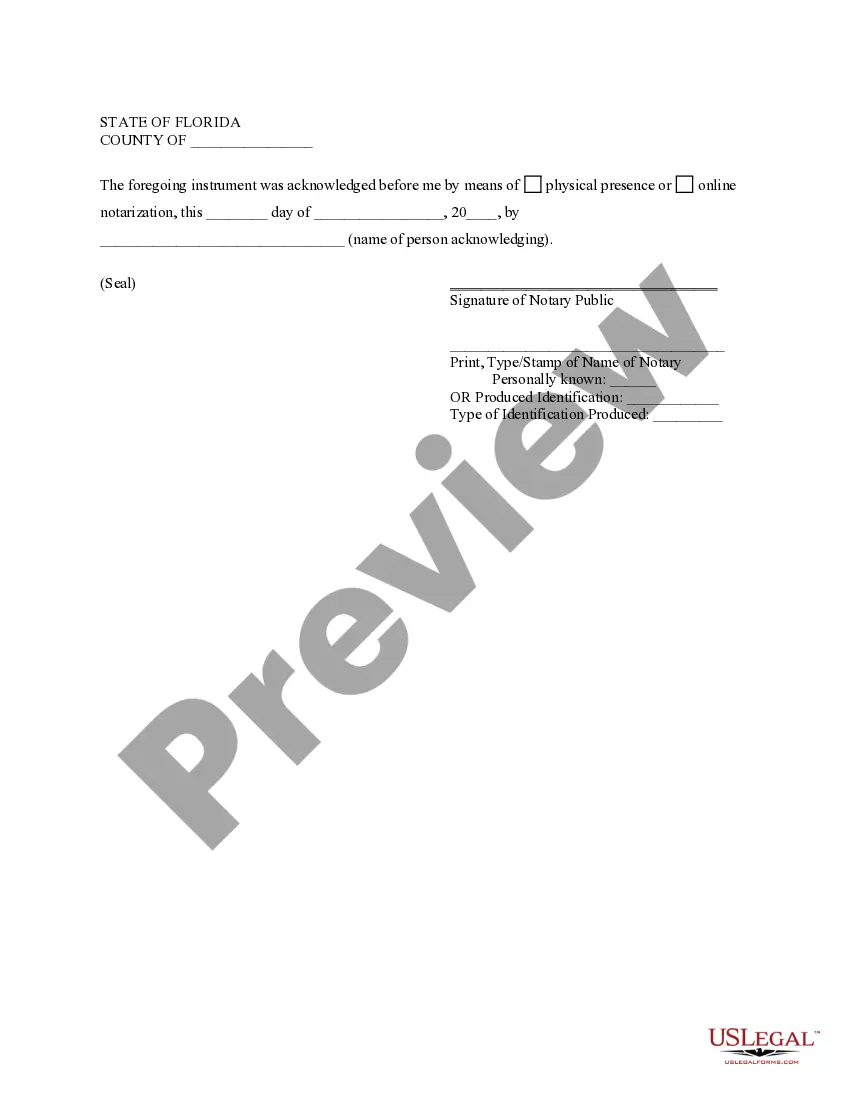

This Quitclaim Deed from Individual to Husband and Wife form is a Quitclaim Deed where the Grantor is an individual and the Grantees are husband and wife. Grantor conveys and quitclaims the described property to Grantees, less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all applicable state statutory laws.

A Cape Coral Florida Quitclaim Deed from an Individual to Husband and Wife is a legal document used to transfer the ownership of a property located in Cape Coral, Florida, from an individual seller to a married couple who are both listed as the buyers. This transfer is often executed without any warranties or guarantees regarding the property's title, condition, or encumbrances. There are different types of Cape Coral Florida Quitclaim Deed from an Individual to Husband and Wife, each catering to specific scenarios or situations. Some of them include: 1. Traditional Quitclaim Deed: This type of deed is the most common and straightforward form used for transferring property ownership between an individual seller and a married couple who are buyers. It offers minimal legal protection to the buyers, as the seller only transfers whatever rights they possess without providing any guarantees. 2. Enhanced Life Estate Deed (Lady Bird Deed): This deed grants ownership to the husband and wife while allowing the original individual seller, or granter, to retain certain rights, such as the ability to live on the property for the rest of their life. It ensures a smoother transition of ownership upon the granter's death, bypassing probate and potential disputes. 3. Tenancy by the Entirety Deed: This deed is a specialized form of joint tenancy in which the husband and wife are treated as a single legal entity. It offers unique protections against individual creditors and ensures that if one spouse dies, the surviving spouse automatically inherits sole ownership of the property. When executing a Cape Coral Florida Quitclaim Deed from an Individual to Husband and Wife, it is crucial to seek legal advice and professional assistance to ensure compliance with local laws and to minimize potential risks. It is also recommended to thoroughly investigate the property's title, conduct inspections, and review any encumbrances or liens before finalizing the deed transfer.A Cape Coral Florida Quitclaim Deed from an Individual to Husband and Wife is a legal document used to transfer the ownership of a property located in Cape Coral, Florida, from an individual seller to a married couple who are both listed as the buyers. This transfer is often executed without any warranties or guarantees regarding the property's title, condition, or encumbrances. There are different types of Cape Coral Florida Quitclaim Deed from an Individual to Husband and Wife, each catering to specific scenarios or situations. Some of them include: 1. Traditional Quitclaim Deed: This type of deed is the most common and straightforward form used for transferring property ownership between an individual seller and a married couple who are buyers. It offers minimal legal protection to the buyers, as the seller only transfers whatever rights they possess without providing any guarantees. 2. Enhanced Life Estate Deed (Lady Bird Deed): This deed grants ownership to the husband and wife while allowing the original individual seller, or granter, to retain certain rights, such as the ability to live on the property for the rest of their life. It ensures a smoother transition of ownership upon the granter's death, bypassing probate and potential disputes. 3. Tenancy by the Entirety Deed: This deed is a specialized form of joint tenancy in which the husband and wife are treated as a single legal entity. It offers unique protections against individual creditors and ensures that if one spouse dies, the surviving spouse automatically inherits sole ownership of the property. When executing a Cape Coral Florida Quitclaim Deed from an Individual to Husband and Wife, it is crucial to seek legal advice and professional assistance to ensure compliance with local laws and to minimize potential risks. It is also recommended to thoroughly investigate the property's title, conduct inspections, and review any encumbrances or liens before finalizing the deed transfer.