Hillsborough Florida Fideicomiso de deducción marital - Fideicomiso A y Fideicomiso de derivación B - Florida Marital Deduction Trust - Trust A and Bypass Trust B

Description

How to fill out Florida Fideicomiso De Deducción Marital - Fideicomiso A Y Fideicomiso De Derivación B?

If you’ve previously employed our service, Log In to your account and download the Hillsborough Florida Marital Deduction Trust - Trust A and Bypass Trust B to your device by hitting the Download button. Ensure your subscription is active. If it’s not, renew it as per your payment method.

If this is your initial encounter with our service, follow these straightforward steps to obtain your document.

You have lifetime access to all documents you have acquired: you can find it in your profile under the My documents section whenever you need to use it again. Utilize the US Legal Forms service to swiftly locate and save any template for your personal or business requirements!

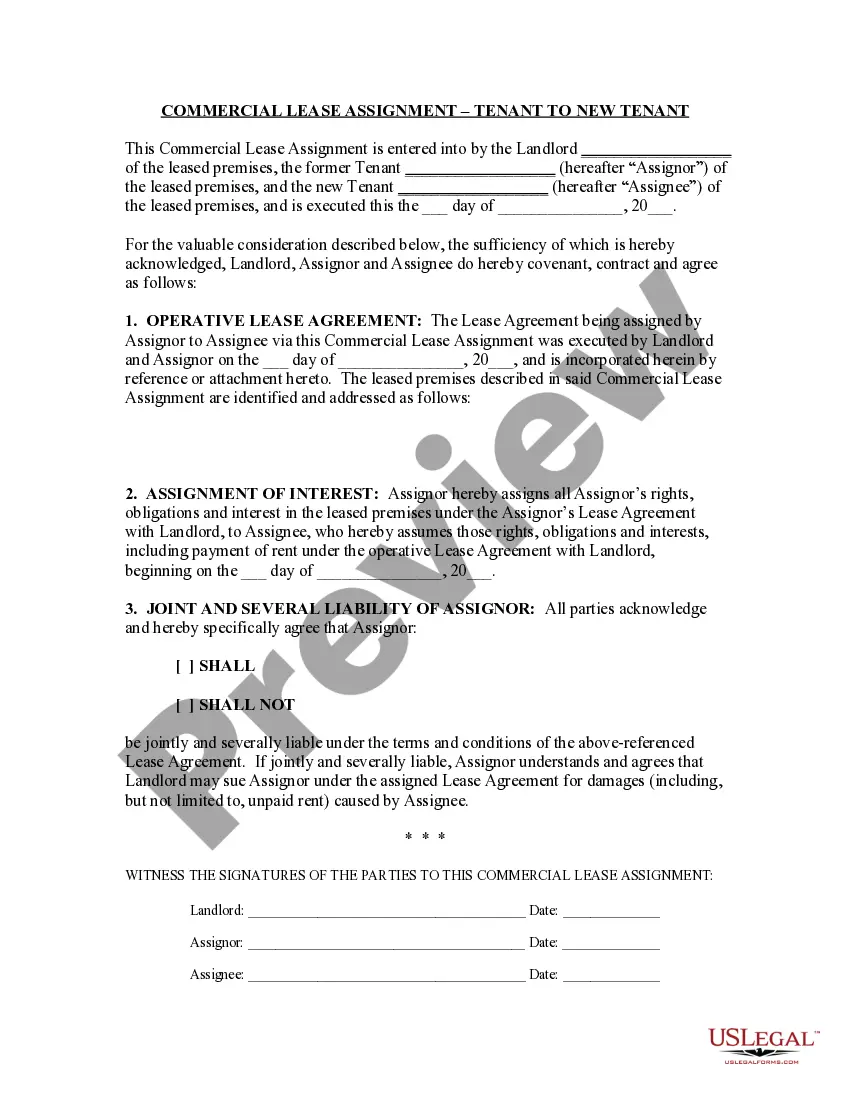

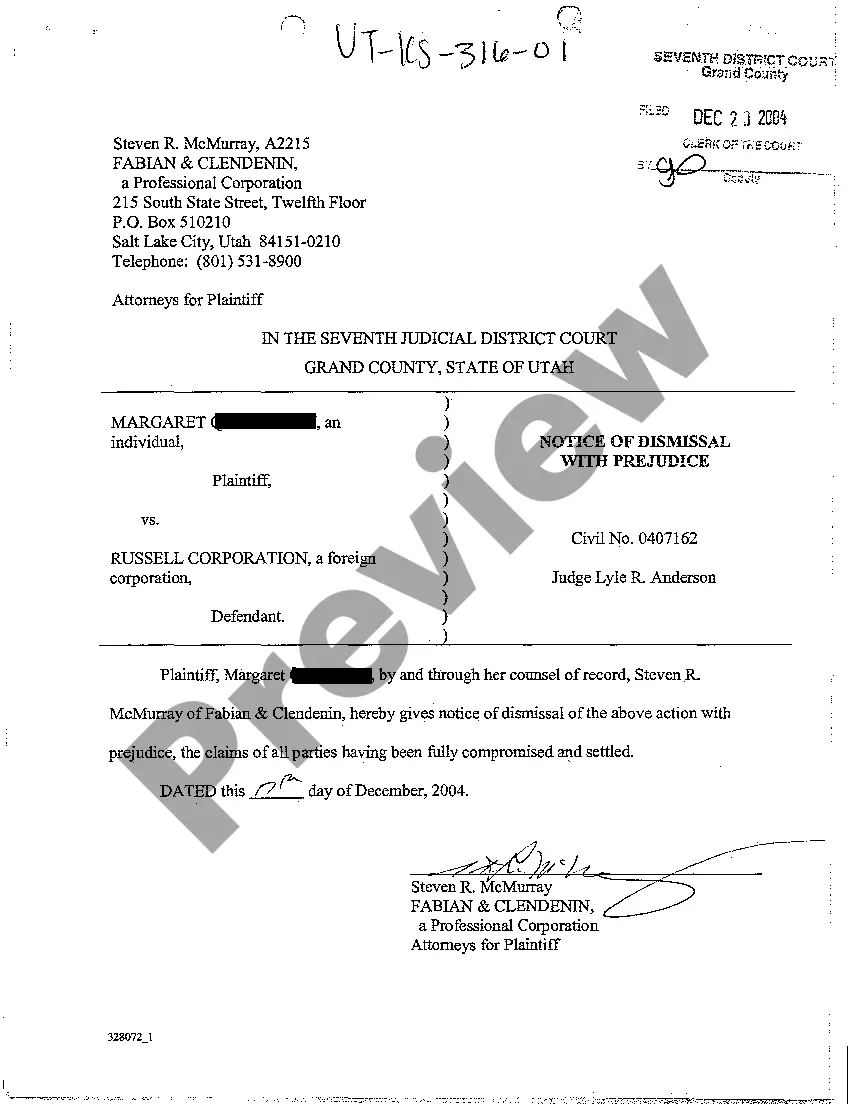

- Ensure you’ve located an appropriate document. Browse through the description and utilize the Preview feature, if available, to verify it suits your requirements. If it doesn’t match, utilize the Search tab above to find the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Create an account and complete the payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Hillsborough Florida Marital Deduction Trust - Trust A and Bypass Trust B. Choose the file format for your document and save it on your device.

- Complete your form. Print it or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

Es un contrato basado principalmente en la confianza, en el cual una persona transfiere bienes o derechos a favor de un patrimonio autonomo, el cual es administrado por Interbank y dirigido a cumplir determinados objetivos.

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

Hay tres partes clave que componen un fideicomiso: un otorgante, que establece un fideicomiso y lo llena con sus activos, un beneficiario, que es la persona elegida para recibir los activos del fideicomiso y un fiduciario, que es el encargado de administrar los activos que se le han confiado.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

El Formulario 1041 es una declaracion de impuestos donde la entidad reporta actualmente y paga sus impuestos.