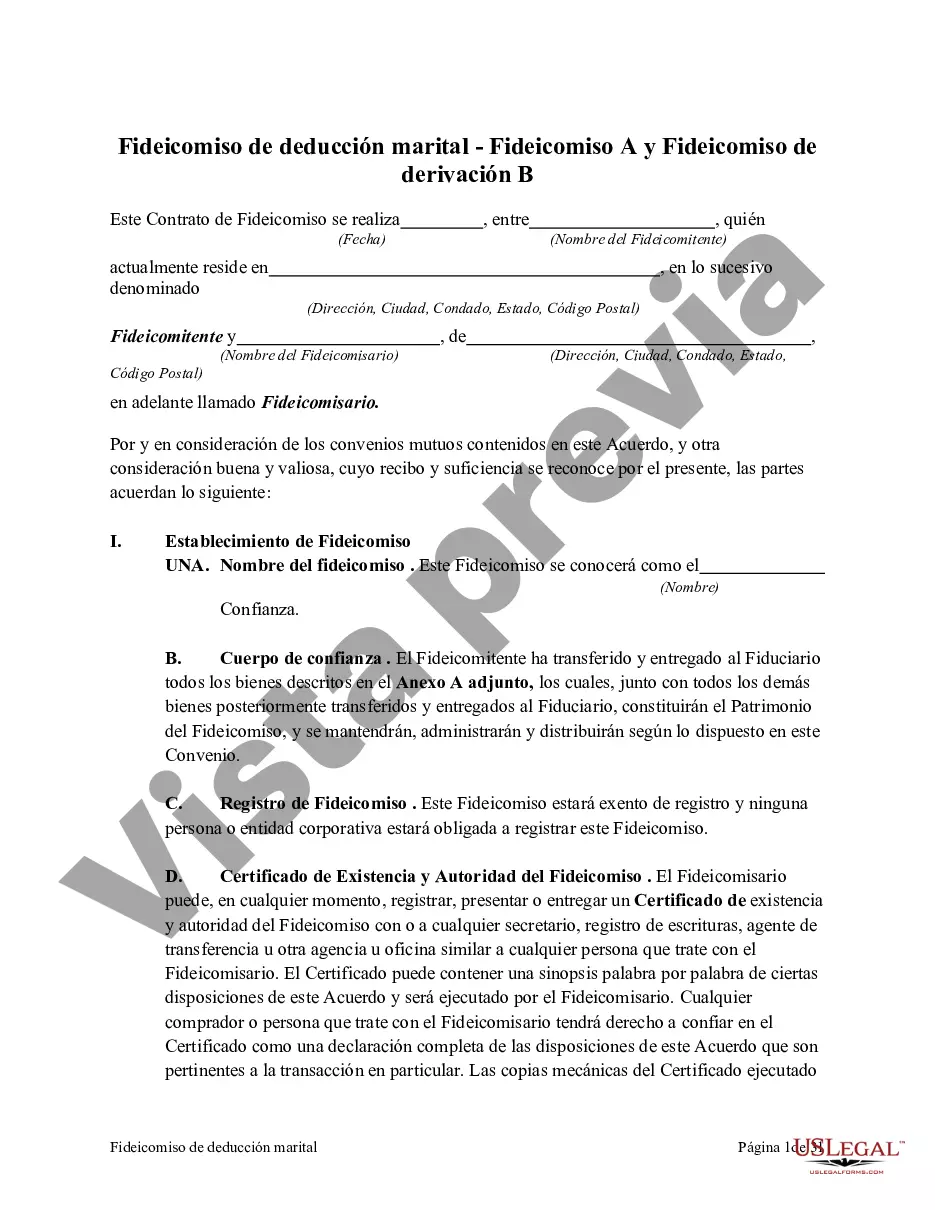

Miami-Dade Florida Fideicomiso de deducción marital - Fideicomiso A y Fideicomiso de derivación B - Florida Marital Deduction Trust - Trust A and Bypass Trust B

Description

How to fill out Florida Fideicomiso De Deducción Marital - Fideicomiso A Y Fideicomiso De Derivación B?

Locating authenticated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online repository of over 85,000 legal documents catering to both personal and professional requirements, as well as various real-life circumstances.

All forms are efficiently sorted by area of application and jurisdiction, making it simple and quick to find the Miami-Dade Florida Marital Deduction Trust - Trust A and Bypass Trust B.

Maintaining organized paperwork that complies with legal standards is crucial. Utilize the US Legal Forms library to ensure you always have vital document templates readily available for all your needs!

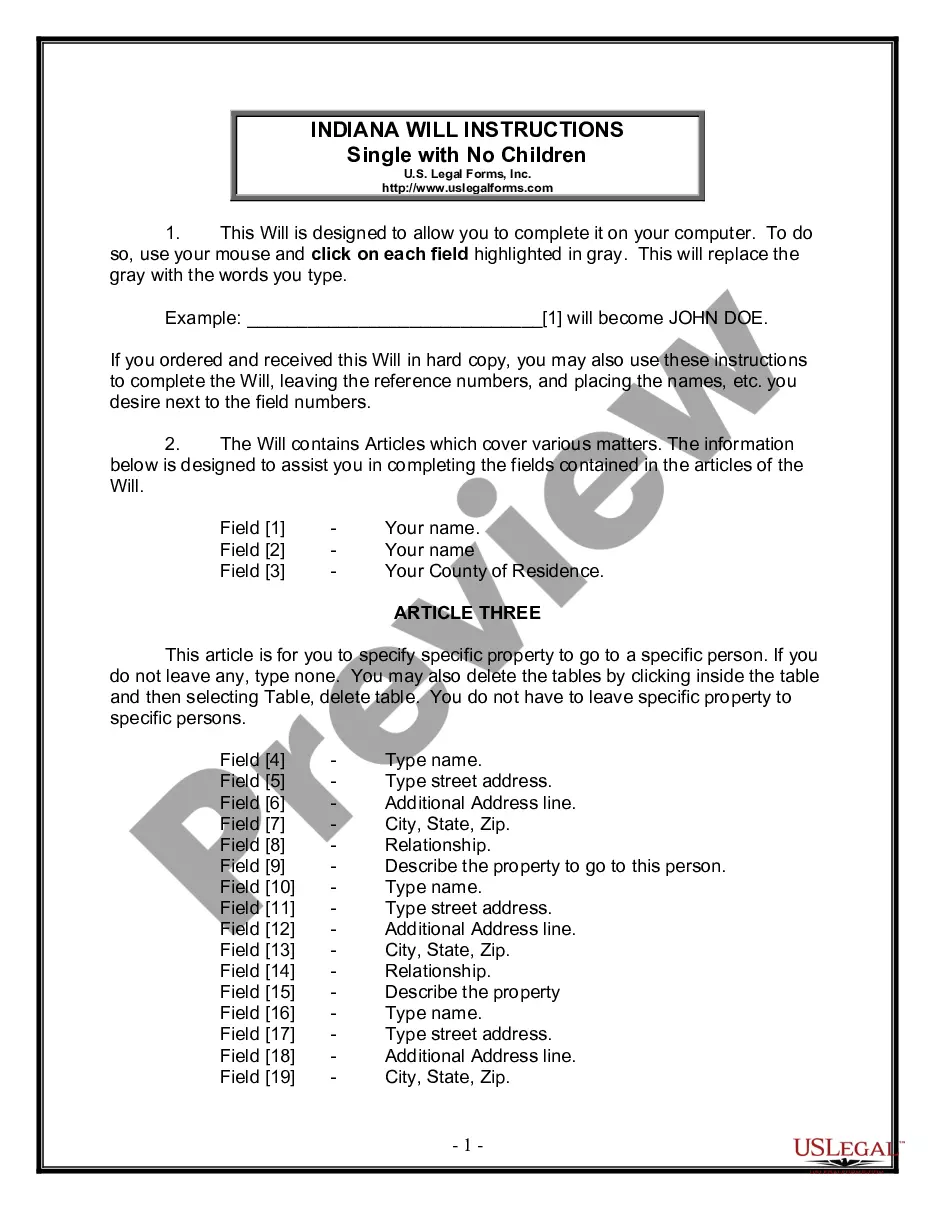

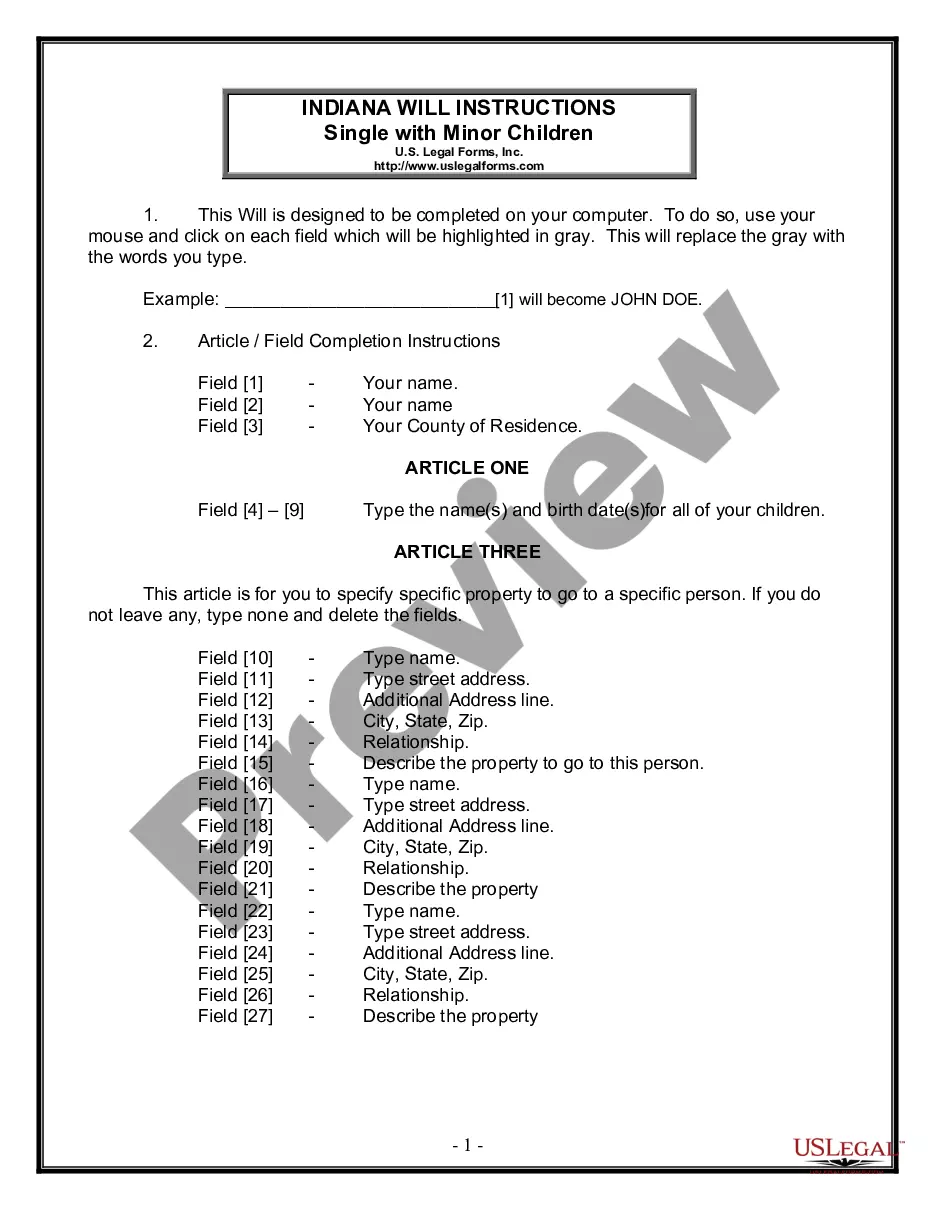

- Verify the Preview mode and form details.

- Ensure you’ve picked the appropriate one that fulfills your needs and aligns with your local jurisdiction standards.

- Look for an alternative template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the correct one.

- If it meets your requirements, proceed to the next phase.

Form popularity

FAQ

Existen varias razones por las que los fideicomisos son una buena alternativa para asegurar la correcta administracion de tus bienes en el futuro: Proteges tus activos de las malas intenciones.Cuidas a tus seres queridos.Resguardas tus activos.Puedes definir un plan para que tus activos generen rentas.

Un fideicomiso revocable es un documento (el acuerdo de fideicomiso) creado por usted para administrar sus activos durante su vida y para distribuir los activos que queden despues de su muerte. La persona que constituye un fideicomiso se denomina otorgante o fideicomitente.

El costo de un fideicomiso preparado por un abogado puede ser aproximadamente entre $1,000 a $1,500 dolares si se trata de una sola persona, y de $1,200 a $2,500 dolares si se trata de una pareja. Estos precios pueden variar dependiendo del abogado y de las circunstancias.

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Se reconoce como un fideicomiso al contrato mediante el cual una persona a la que se le conoce como fideicomitente o fiduciante delega determinados bienes de su propiedad, a otra persona llamada fiduciario, para que esta administre de la mejor manera los bienes en beneficio de un tercero, llamado fideicomisario o

Es un producto financiero que ademas de ser parecido a un plan de ahorro, garantiza que el beneficiario, es decir tu hija o hijo, reciba el dinero acordado para continuar sus estudios en nivel superior aun cuando faltes.

El Formulario 1041 es una declaracion de impuestos donde la entidad reporta actualmente y paga sus impuestos.