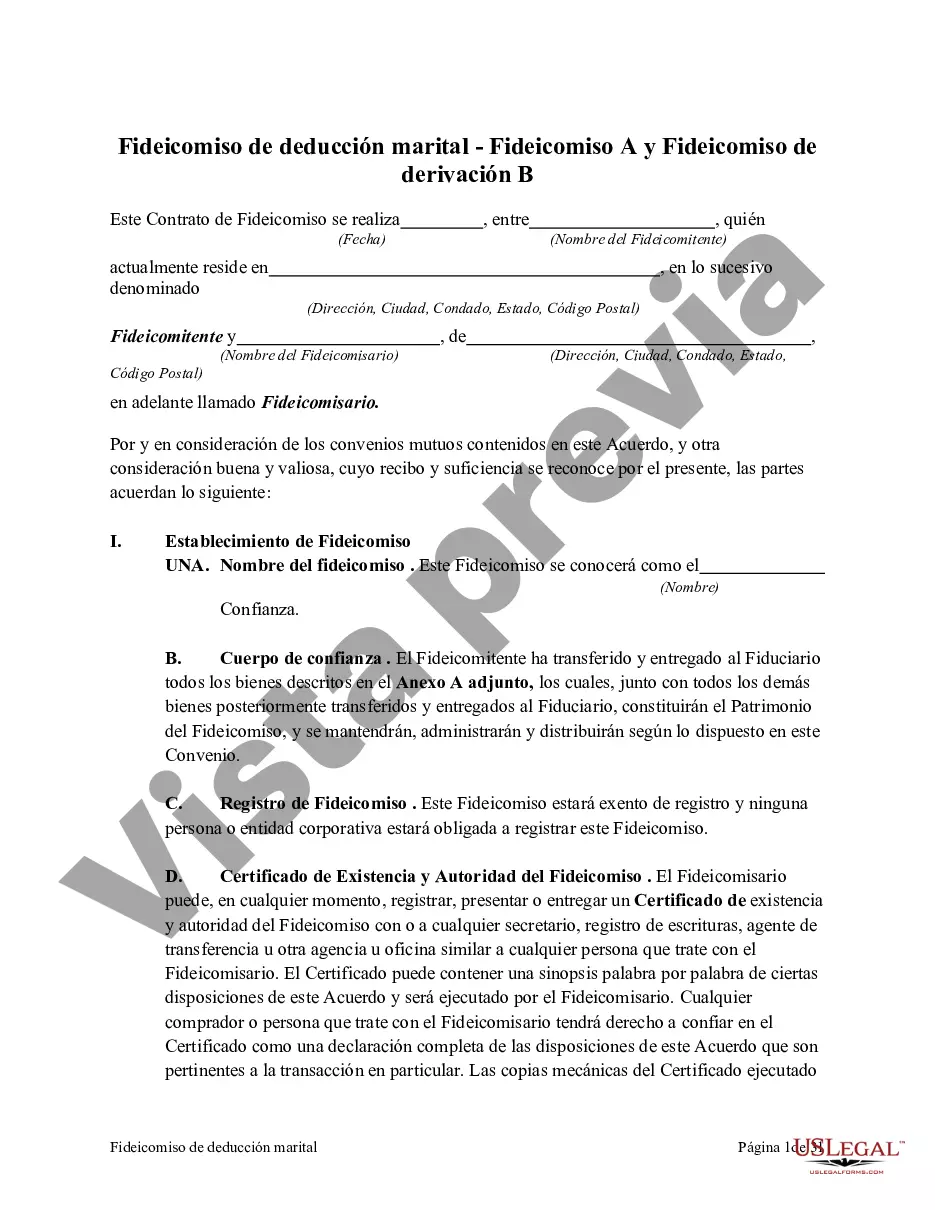

A Palm Beach Florida Marital Deduction Trust, also commonly known as a Marital Trust, is an estate planning tool that allows married couples to take advantage of the marital deduction rule to reduce their estate tax liability. This trust is specifically designed to ensure that the surviving spouse has sufficient income and support during their lifetime while also preserving the couple's estate for the benefit of their heirs or beneficiaries. Trust A, also referred to as the Marital Trust or "A" Trust, is created upon the death of the first spouse. The assets transferred to Trust A are exempt from federal estate taxes due to the unlimited marital deduction. The surviving spouse becomes the primary beneficiary of Trust A and can receive income generated from the trust assets. The surviving spouse is also given the authority to make distributions from Trust A if needed for their health, education, maintenance, or support. Bypass Trust B, also known as the Credit Shelter Trust, Family Trust, or "B" Trust, is created at the same time as Trust A. The purpose of Trust B is to maximize the couples' federal estate tax exemption by utilizing the deceased spouse's unused exemption, commonly referred to as portability or the Deceased Spousal Unused Exclusion Amount (DUE). Assets up to the estate tax exemption amount go into Trust B, bypassing the surviving spouse's estate and reducing potential estate taxes upon the death of the surviving spouse. By creating a Palm Beach Florida Marital Deduction Trust with Trust A and Bypass Trust B, married couples can ensure the preservation of their assets while minimizing estate tax obligations. This planning strategy is especially valuable for high net worth individuals who want to pass on their wealth to their family and loved ones. It should be noted that the types or names of Marital Deduction Trusts may vary depending on the specific estate planning goals, the state's laws, and individual circumstances. It is essential to consult an experienced estate planning attorney in Palm Beach, Florida, to understand the options available and tailor a plan that best suits your needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Palm Beach Florida Fideicomiso de deducción marital - Fideicomiso A y Fideicomiso de derivación B - Florida Marital Deduction Trust - Trust A and Bypass Trust B

Description

How to fill out Palm Beach Florida Fideicomiso De Deducción Marital - Fideicomiso A Y Fideicomiso De Derivación B?

Are you looking for a trustworthy and inexpensive legal forms provider to buy the Palm Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B? US Legal Forms is your go-to option.

No matter if you require a basic arrangement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers over 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and framed in accordance with the requirements of particular state and area.

To download the form, you need to log in account, locate the required template, and hit the Download button next to it. Please take into account that you can download your previously purchased form templates at any time in the My Forms tab.

Is the first time you visit our platform? No worries. You can create an account with swift ease, but before that, make sure to do the following:

- Find out if the Palm Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B conforms to the laws of your state and local area.

- Read the form’s details (if available) to find out who and what the form is good for.

- Restart the search in case the template isn’t suitable for your specific situation.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is completed, download the Palm Beach Florida Marital Deduction Trust - Trust A and Bypass Trust B in any available format. You can get back to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a go today, and forget about spending your valuable time researching legal papers online once and for all.

Form popularity

FAQ

Ejemplo de que es un fideicomiso Por ejemplo, si un abuelo quiere dejar una herencia a su nieto sin necesidad de pasar por los padres, lo que hace el abuelo es contratar una empresa fiduciaria para que le administre los bienes a su nieto.

Un fideicomiso es un contrato mediante el cual una persona (el fideicomitente) destina ciertos bienes a un fin determinado, encomendando la realizacion de ese fin a una institucion financiera (el fiduciario). Considerandose un fideicomiso publico el que ejecuta fondos publicos.

En el caso del fideicomiso civil como no hay transferencia de la propiedad, sino que tan solo se constituye un gravamen sobre esa propiedad, el activo o bien convertido en propiedad fiduciaria es declarado por el fiduciante como de costumbre.

El fideicomiso es un contrato de naturaleza mercantil, que conforme a la legislacion vigente es una herramienta legal que facilita la implementacion de estrategias fiscales, cuyo objetivo es el facilitar que converjan las voluntades de diversas personas fisicas y morales, cuyo fin esencial es participar en la

Es una operacion mercantil mediante la cual una persona llamada fideicomitente, destina ciertos bienes a la realizacion de un fin licito determinado, encomendando esta a una institucion de credito.

¿Cuando se presenta? Tienes hasta el 15 de febrero de cada ano para presentar tu declaracion.

Requisitos: Presentaran la solicitud de Preinscripcion proporcionando los datos que se contienen en el formato electronico que se encuentra en la pagina de Internet del SAT. Concluida la captura, se enviara la solicitud de Preinscripcion a traves de la pagina de Internet del SAT.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Requisitos para inscripcion persona individual que debes considerar antes de iniciar: Correo electronico personal que se asociara a la Agencia Virtual. Documento Personal de Identificacion (DPI) o Pasaporte vigente, en caso de ser extranjero.

Inscripcion Fideicomiso - Portal SAT.

Interesting Questions

More info

As indicated in Item 7 the non-spousal beneficiaries must file a claim to the state. As with other exemptions, the beneficiary should file a W-2 with his or her employer. What Can I Do if I Don't Get My Exemption? If you don't get your exemption, you can request a waiver or reduction of your exemption. However, the waiver will be denied in some cases for: Criminal records. Debts to which you owe more than 50,000. Debts to which you owe more than 250,000. Debts secured against real estate by the United States. Failing to file a report on your business income. Refusal to provide personal information to the IRS. Refusal to pay the Social Security Administration. Not meeting the gross income or estate thresholds. Unfailing a payment for a gift. Fraud. The IRS has said it will grant a waiver if you submit evidence that you used up all your exemptions within a reasonable time.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.