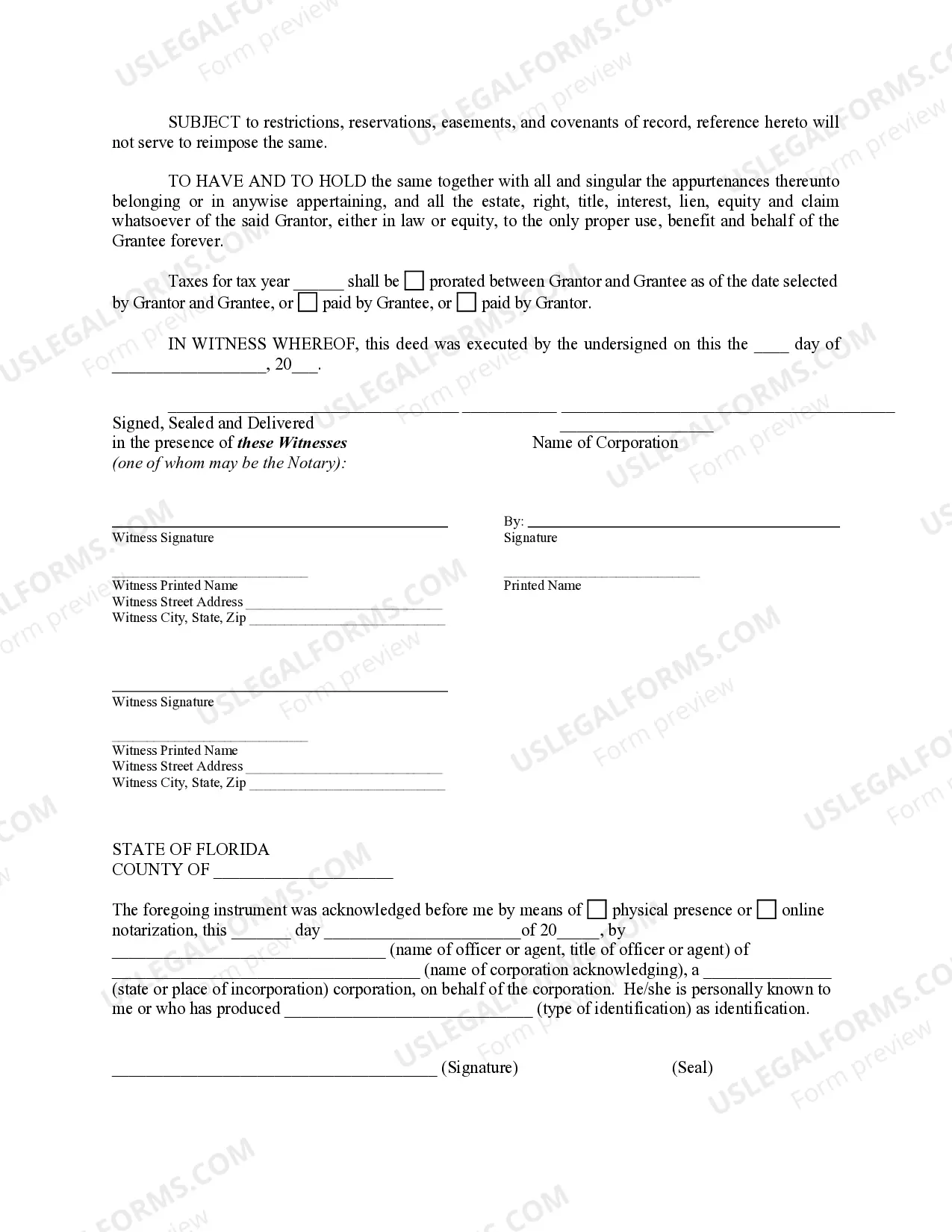

This Quitclaim Deed from Corporation to Individual form is a Quitclaim Deed where the Grantor is a corporation and the Grantee is an individual. Grantor conveys and quitclaims the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor. This deed complies with all state statutory laws.

A Broward Florida quitclaim deed from corporation to individual is a legal document that facilitates the transfer of property ownership from a corporation to an individual in Broward County, Florida. The purpose of this deed is to legally release any interest or claim that the corporation may have on the property to the individual. Such a deed is commonly used in various situations, such as when a corporation wishes to transfer property to one of its shareholders, an executive, or a third party. The Broward Florida quitclaim deed serves as proof of the transfer of ownership and outlines the specifics of the property being conveyed. It includes details like the legal description of the property, identification of the corporation, identification of the individual receiving the property, and any considerations exchanged as part of the transfer. Additionally, this deed ensures that the corporation makes no warranties regarding the property's title, and any potential liens, claims, or encumbrances are not guaranteed. There are several types of Broward Florida Quitclaim Deeds from Corporation to Individual, each catering to specific scenarios: 1. Broward Florida Corporation to Shareholder Quitclaim Deed: This type of quitclaim deed is used when a corporation transfers property to one of its shareholders, either as part of share distribution, compensation, or any other purpose agreed upon by the corporation. 2. Broward Florida Corporation to Executive Quitclaim Deed: This type of quitclaim deed is utilized when a corporation wishes to transfer property ownership to an executive within the organization. This could include scenarios such as granting a property as part of a compensation package or other business-related reasons. 3. Broward Florida Corporation to Third Party Quitclaim Deed: This quitclaim deed is employed when a corporation transfers property ownership to an individual who is not a shareholder or executive. It could involve situations like selling surplus corporate assets or transferring property to a contractor, business partner, or any other third party. In conclusion, a Broward Florida quitclaim deed from corporation to individual is a crucial legal document facilitating the transfer of property ownership and releasing the corporation's interest in the property. The different types of quitclaim deeds cater to various scenarios involving shareholders, executives, or third parties. It is always advisable to consult with a qualified attorney or real estate professional to ensure the accurate drafting and execution of such deeds in compliance with Florida law.

A Broward Florida quitclaim deed from corporation to individual is a legal document that facilitates the transfer of property ownership from a corporation to an individual in Broward County, Florida. The purpose of this deed is to legally release any interest or claim that the corporation may have on the property to the individual. Such a deed is commonly used in various situations, such as when a corporation wishes to transfer property to one of its shareholders, an executive, or a third party. The Broward Florida quitclaim deed serves as proof of the transfer of ownership and outlines the specifics of the property being conveyed. It includes details like the legal description of the property, identification of the corporation, identification of the individual receiving the property, and any considerations exchanged as part of the transfer. Additionally, this deed ensures that the corporation makes no warranties regarding the property's title, and any potential liens, claims, or encumbrances are not guaranteed. There are several types of Broward Florida Quitclaim Deeds from Corporation to Individual, each catering to specific scenarios: 1. Broward Florida Corporation to Shareholder Quitclaim Deed: This type of quitclaim deed is used when a corporation transfers property to one of its shareholders, either as part of share distribution, compensation, or any other purpose agreed upon by the corporation. 2. Broward Florida Corporation to Executive Quitclaim Deed: This type of quitclaim deed is utilized when a corporation wishes to transfer property ownership to an executive within the organization. This could include scenarios such as granting a property as part of a compensation package or other business-related reasons. 3. Broward Florida Corporation to Third Party Quitclaim Deed: This quitclaim deed is employed when a corporation transfers property ownership to an individual who is not a shareholder or executive. It could involve situations like selling surplus corporate assets or transferring property to a contractor, business partner, or any other third party. In conclusion, a Broward Florida quitclaim deed from corporation to individual is a crucial legal document facilitating the transfer of property ownership and releasing the corporation's interest in the property. The different types of quitclaim deeds cater to various scenarios involving shareholders, executives, or third parties. It is always advisable to consult with a qualified attorney or real estate professional to ensure the accurate drafting and execution of such deeds in compliance with Florida law.