A junior or second deed of trust is a deed of trust which is subordinate to existing liens on the securing property, usually because the junior deed of trust was made, executed and recorded after one or more earlier deeds of trust or other encumbrances.

Junior deeds of trust can be created in several ways. For example, such deeds of trust often arise as the result of a sale of real property, either when a new loan in the full amount of the purchase price cannot be obtained or when an existing loan on the securing property is assumed. In this situation, a junior deed of trust is given to secure the portion of the purchase price which exceeds the balance of the new or existing loan.

Additionally, a junior deed of trust may be created where an existing lienholder, typically a seller, subordinates to another secured debt, usually a construction loan. Finally, junior deeds of trust may arise where the owner of real property obtains a loan secured by the property after its purchase.

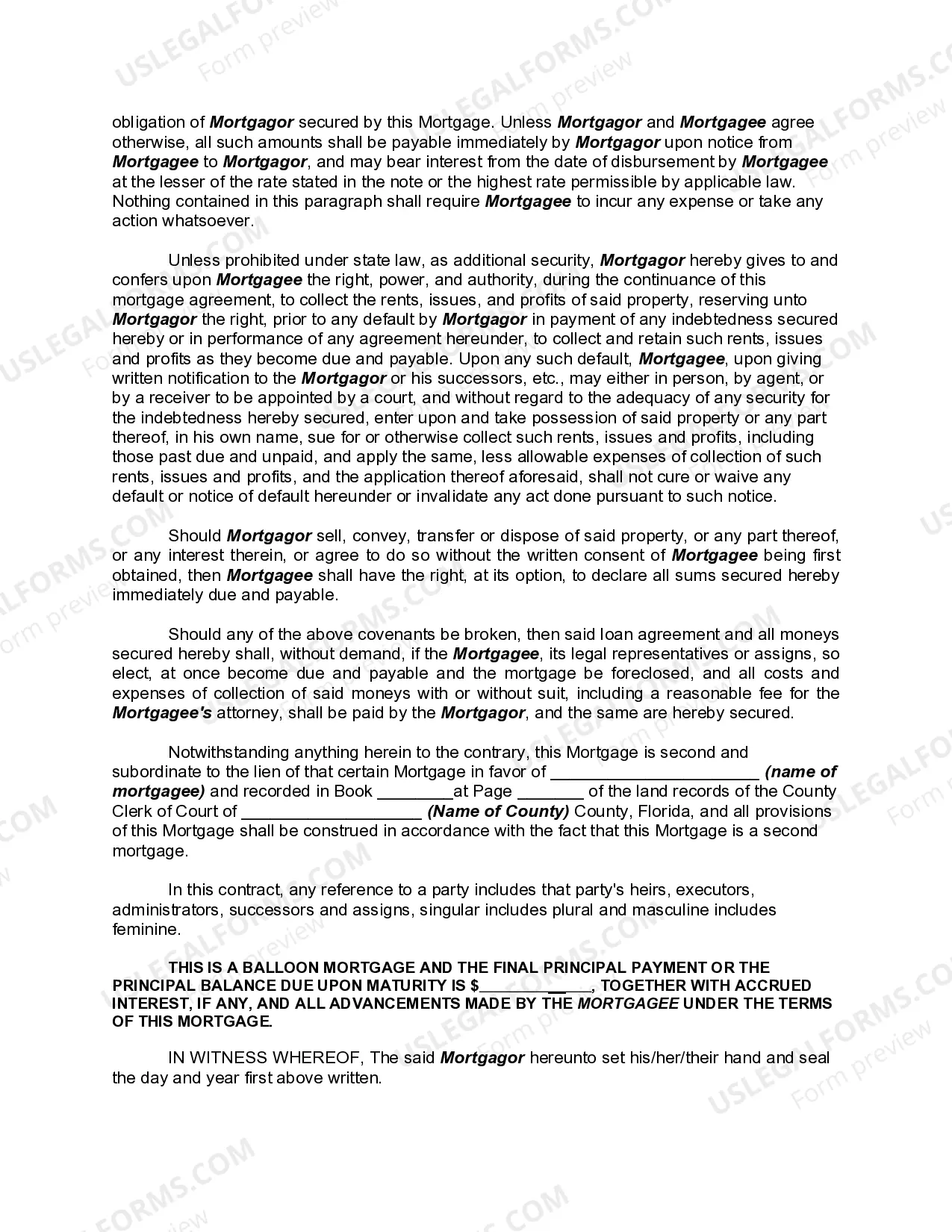

Miami Gardens Florida Junior or Second Mortgage Deed is a legal document that allows homeowners in Miami Gardens, Florida to secure an additional loan against their property, using the property as collateral. This type of mortgage deed is typically used when the homeowner already has an existing first mortgage, and wishes to borrow additional funds. A Junior or Second Mortgage Deed in Miami Gardens, Florida can provide homeowners with access to funds for various purposes, such as home renovations, debt consolidation, or paying for education expenses. This type of mortgage deed is particularly beneficial for individuals who may not qualify for traditional loans or those seeking to avoid high-interest unsecured loans. There are different types of Junior or Second Mortgage Deeds available to residents of Miami Gardens, Florida. Some of them include: 1. Fixed-Rate Second Mortgage: This type of mortgage deed offers borrowers a fixed interest rate throughout the loan term, providing stability and predictability in monthly payments. 2. Adjustable-Rate Second Mortgage: With this type of mortgage deed, the interest rate is typically fixed for an initial period, after which it can fluctuate based on market conditions. Borrowers should carefully consider their ability to handle potential interest rate adjustments. 3. Home Equity Line of Credit (HELOT): A HELOT allows homeowners to access a line of credit, similar to a credit card, that is secured by their property's equity. Borrowers can withdraw funds as needed within a specified period of time, known as the draw period. During this time, borrowers must make minimum payments, typically interest-only. Helots offer flexibility but require prudent financial management. Miami Gardens, Florida Junior or Second Mortgage Deeds require homeowners to go through a similar application process as with a first mortgage. Lenders will assess the applicant's creditworthiness, debt-to-income ratio, and the equity available in the property. The property will also undergo an appraisal to determine its current market value. Borrowers should carefully review the terms and conditions of the Junior or Second Mortgage Deed, including interest rates, repayment terms, and any associated fees or penalties. It is advisable to consult with a qualified mortgage professional or attorney who can guide them through the process and ensure they understand their rights and obligations. In summary, a Miami Gardens, Florida Junior or Second Mortgage Deed provides homeowners with the opportunity to access additional funds while leveraging the equity in their property. Different types of Junior or Second Mortgage Deeds, such as fixed-rate, adjustable-rate, and Helots, offer varying benefits and considerations that borrowers should evaluate before committing to a loan.Miami Gardens Florida Junior or Second Mortgage Deed is a legal document that allows homeowners in Miami Gardens, Florida to secure an additional loan against their property, using the property as collateral. This type of mortgage deed is typically used when the homeowner already has an existing first mortgage, and wishes to borrow additional funds. A Junior or Second Mortgage Deed in Miami Gardens, Florida can provide homeowners with access to funds for various purposes, such as home renovations, debt consolidation, or paying for education expenses. This type of mortgage deed is particularly beneficial for individuals who may not qualify for traditional loans or those seeking to avoid high-interest unsecured loans. There are different types of Junior or Second Mortgage Deeds available to residents of Miami Gardens, Florida. Some of them include: 1. Fixed-Rate Second Mortgage: This type of mortgage deed offers borrowers a fixed interest rate throughout the loan term, providing stability and predictability in monthly payments. 2. Adjustable-Rate Second Mortgage: With this type of mortgage deed, the interest rate is typically fixed for an initial period, after which it can fluctuate based on market conditions. Borrowers should carefully consider their ability to handle potential interest rate adjustments. 3. Home Equity Line of Credit (HELOT): A HELOT allows homeowners to access a line of credit, similar to a credit card, that is secured by their property's equity. Borrowers can withdraw funds as needed within a specified period of time, known as the draw period. During this time, borrowers must make minimum payments, typically interest-only. Helots offer flexibility but require prudent financial management. Miami Gardens, Florida Junior or Second Mortgage Deeds require homeowners to go through a similar application process as with a first mortgage. Lenders will assess the applicant's creditworthiness, debt-to-income ratio, and the equity available in the property. The property will also undergo an appraisal to determine its current market value. Borrowers should carefully review the terms and conditions of the Junior or Second Mortgage Deed, including interest rates, repayment terms, and any associated fees or penalties. It is advisable to consult with a qualified mortgage professional or attorney who can guide them through the process and ensure they understand their rights and obligations. In summary, a Miami Gardens, Florida Junior or Second Mortgage Deed provides homeowners with the opportunity to access additional funds while leveraging the equity in their property. Different types of Junior or Second Mortgage Deeds, such as fixed-rate, adjustable-rate, and Helots, offer varying benefits and considerations that borrowers should evaluate before committing to a loan.