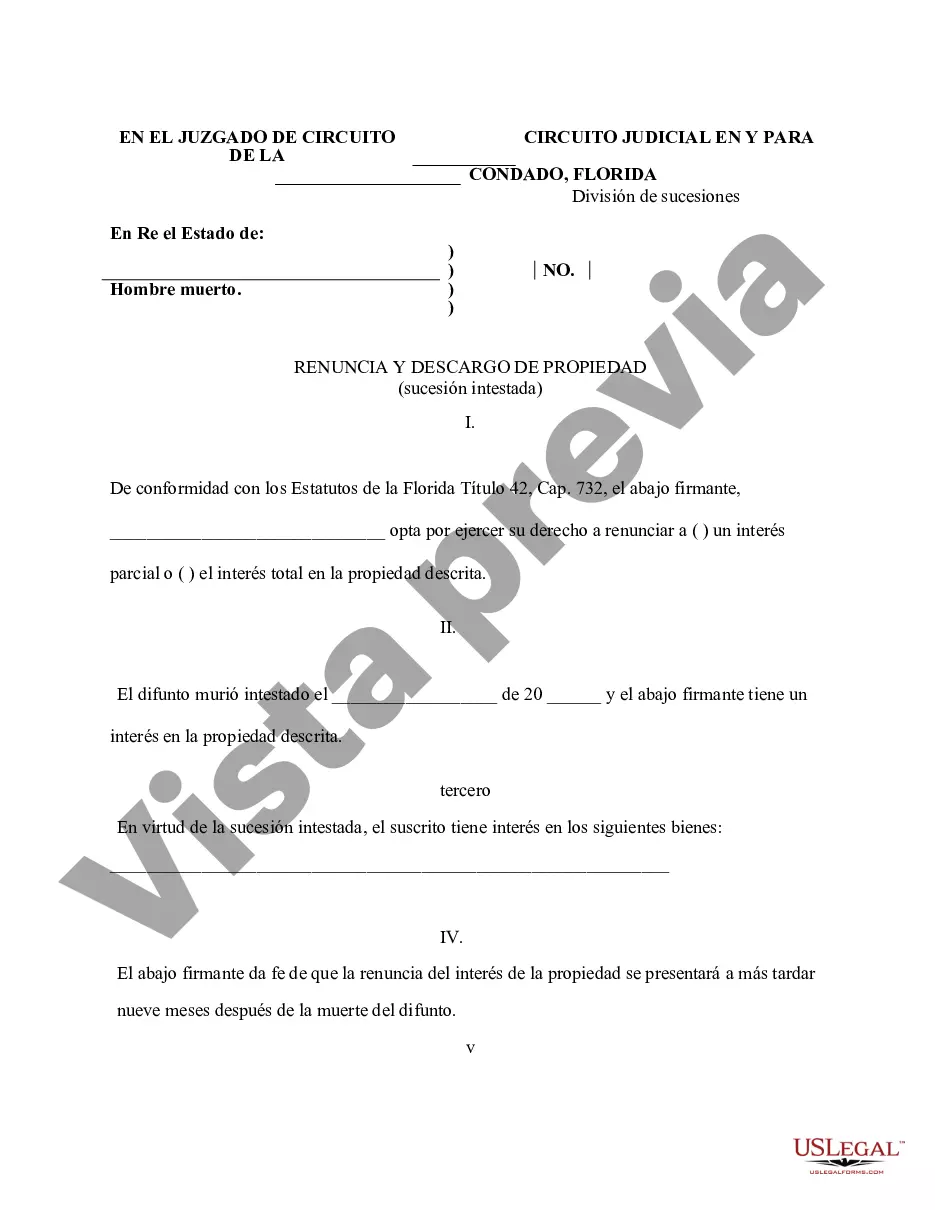

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Cape Coral, Florida Renunciation and Disclaimer of Property Received by Intestate Succession — A Comprehensive Guide If you are a resident of Cape Coral, Florida, and find yourself in a situation where you need to renounce or disclaim property received through intestate succession, it is essential to understand the process and its types. In this article, we will provide a detailed description of what a Cape Coral, Florida Renunciation and Disclaimer of Property received by Intestate Succession entails, along with the different types that exist. Intestate succession occurs when someone passes away without leaving behind a valid will or estate plan. In such cases, the state's laws define the distribution of the deceased person's assets among their legal heirs. However, circumstances may arise where an individual may wish to renounce or disclaim their share of the inherited property, for various reasons. The Renunciation of Property received by Intestate Succession refers to the act of formally refusing or relinquishing one's entitlement to an inheritance received through intestate succession. This renunciation must be done promptly following the individual becoming aware of their entitlement to the property. Renunciation can be advantageous in situations where the inheritor wishes to avoid the responsibilities or obligations associated with owning or managing the property. On the other hand, a Disclaimer of Property received by Intestate Succession entails an individual voluntarily giving up the property they inherited from an intestate estate. A disclaimer is typically made when the beneficiary does not wish to accept the property due to personal reasons, such as potential tax implications, financial constraints, or disinterest in maintaining the property. By disclaiming the property, the beneficiary essentially rejects their share of the inheritance, allowing it to pass on to the next eligible heir in line. It is important to note that there are specific legal requirements and processes to follow when renouncing or disclaiming property received through intestate succession in Cape Coral, Florida. The renunciation or disclaimer must be made in writing, stating the intention and reasons behind the decision. Furthermore, it is crucial to consult with a qualified attorney familiar with Florida probate laws to ensure compliance and proper execution of the renunciation or disclaimer. In conclusion, the Cape Coral, Florida Renunciation and Disclaimer of Property received by Intestate Succession are legal actions that allow individuals to refuse or give up their entitlement to inherited property when no valid will or estate plan exists. Renunciation involves formally rejecting the inheritance, while a disclaimer involves voluntarily relinquishing the property. If you find yourself in a situation where renunciation or disclaimer is necessary, it is advisable to seek legal guidance to ensure the process is executed correctly and in accordance with Florida probate laws.Cape Coral, Florida Renunciation and Disclaimer of Property Received by Intestate Succession — A Comprehensive Guide If you are a resident of Cape Coral, Florida, and find yourself in a situation where you need to renounce or disclaim property received through intestate succession, it is essential to understand the process and its types. In this article, we will provide a detailed description of what a Cape Coral, Florida Renunciation and Disclaimer of Property received by Intestate Succession entails, along with the different types that exist. Intestate succession occurs when someone passes away without leaving behind a valid will or estate plan. In such cases, the state's laws define the distribution of the deceased person's assets among their legal heirs. However, circumstances may arise where an individual may wish to renounce or disclaim their share of the inherited property, for various reasons. The Renunciation of Property received by Intestate Succession refers to the act of formally refusing or relinquishing one's entitlement to an inheritance received through intestate succession. This renunciation must be done promptly following the individual becoming aware of their entitlement to the property. Renunciation can be advantageous in situations where the inheritor wishes to avoid the responsibilities or obligations associated with owning or managing the property. On the other hand, a Disclaimer of Property received by Intestate Succession entails an individual voluntarily giving up the property they inherited from an intestate estate. A disclaimer is typically made when the beneficiary does not wish to accept the property due to personal reasons, such as potential tax implications, financial constraints, or disinterest in maintaining the property. By disclaiming the property, the beneficiary essentially rejects their share of the inheritance, allowing it to pass on to the next eligible heir in line. It is important to note that there are specific legal requirements and processes to follow when renouncing or disclaiming property received through intestate succession in Cape Coral, Florida. The renunciation or disclaimer must be made in writing, stating the intention and reasons behind the decision. Furthermore, it is crucial to consult with a qualified attorney familiar with Florida probate laws to ensure compliance and proper execution of the renunciation or disclaimer. In conclusion, the Cape Coral, Florida Renunciation and Disclaimer of Property received by Intestate Succession are legal actions that allow individuals to refuse or give up their entitlement to inherited property when no valid will or estate plan exists. Renunciation involves formally rejecting the inheritance, while a disclaimer involves voluntarily relinquishing the property. If you find yourself in a situation where renunciation or disclaimer is necessary, it is advisable to seek legal guidance to ensure the process is executed correctly and in accordance with Florida probate laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.