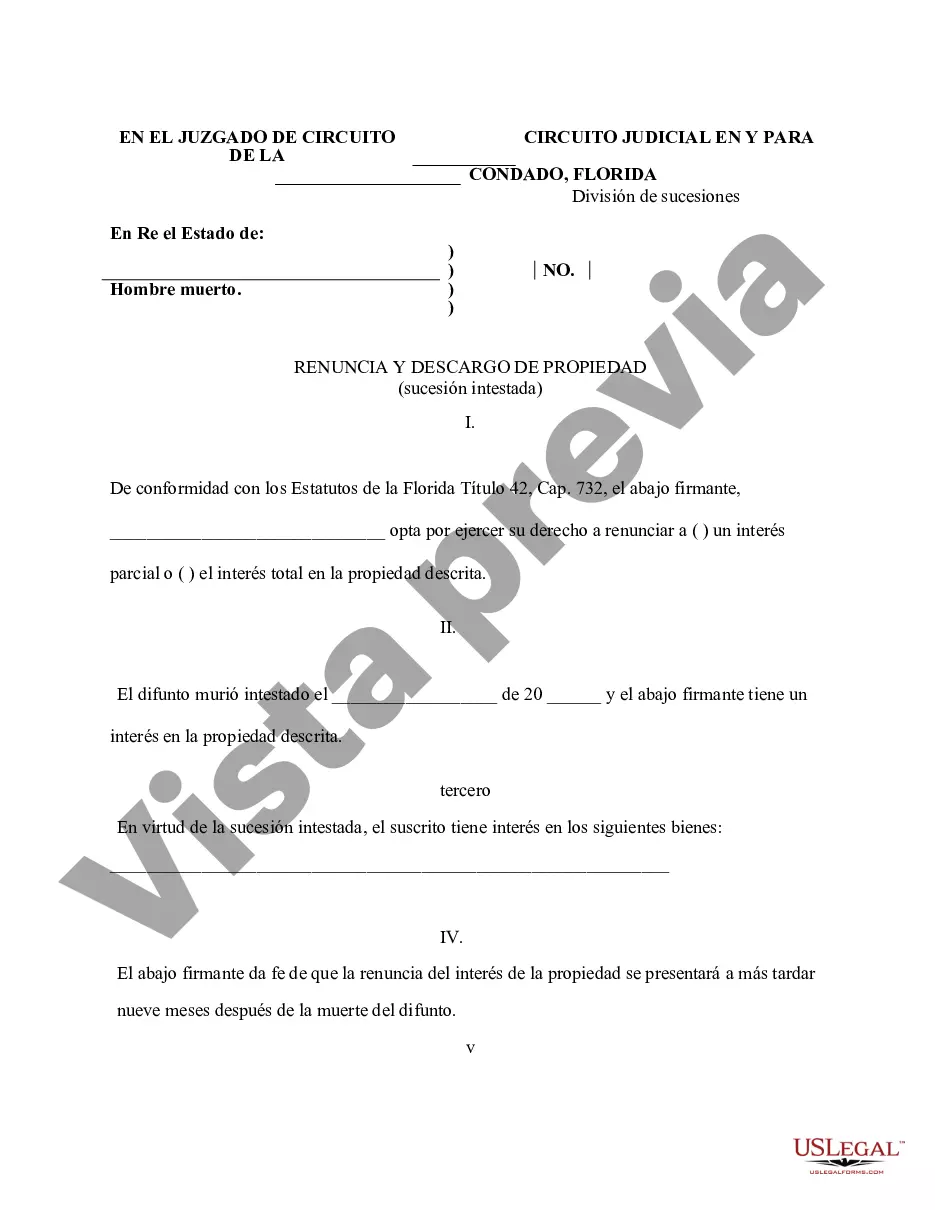

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession refers to the legal process of renouncing or disclaiming property inherited through intestate succession in Fort Lauderdale, Florida. Intestate succession occurs when a person passes away without leaving behind a valid will or trust, leading to the distribution of their assets based on state laws. When individuals receive property through intestate succession in Fort Lauderdale, they may choose to renounce or disclaim their rights to that property for various reasons. These reasons may include the desire to avoid associated taxes, debts, or any legal liabilities connected to the property. By renouncing or disclaiming the property, the individual essentially refuses their inheritance, and it will then pass on to the next eligible heir in line. There are a few different types of Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession that individuals may consider: 1. Partial Renunciation and Disclaimer: In this case, an individual renounces or disclaims only a portion of the property received through intestate succession. This option allows them to retain a specific portion while relinquishing the rest. It can often be employed when the individual wants to avoid the associated tax burdens or liabilities linked to the disclaimed portion. 2. Full Renunciation and Disclaimer: This form of renunciation and disclaimer involves completely refusing the entire property received through intestate succession. By doing so, the individual removes themselves entirely from any obligations, benefits, or responsibilities tied to the inherited assets. 3. Conditional Renunciation and Disclaimer: This type of renunciation and disclaimer is executed with certain conditions or requirements. It allows individuals to renounce or disclaim property received through intestate succession based on specific circumstances or events. For example, conditions may include the property being subject to substantial debts or encumbrances that exceed its value. It is important to note that the process of renunciation and disclaimer of property received by intestate succession in Fort Lauderdale, Florida, is subject to specific state laws and regulations. Seeking guidance from a qualified legal professional is advised to ensure compliance with all legal requirements and proper execution of the renunciation or disclaimer.Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession refers to the legal process of renouncing or disclaiming property inherited through intestate succession in Fort Lauderdale, Florida. Intestate succession occurs when a person passes away without leaving behind a valid will or trust, leading to the distribution of their assets based on state laws. When individuals receive property through intestate succession in Fort Lauderdale, they may choose to renounce or disclaim their rights to that property for various reasons. These reasons may include the desire to avoid associated taxes, debts, or any legal liabilities connected to the property. By renouncing or disclaiming the property, the individual essentially refuses their inheritance, and it will then pass on to the next eligible heir in line. There are a few different types of Fort Lauderdale Florida Renunciation And Disclaimer of Property received by Intestate Succession that individuals may consider: 1. Partial Renunciation and Disclaimer: In this case, an individual renounces or disclaims only a portion of the property received through intestate succession. This option allows them to retain a specific portion while relinquishing the rest. It can often be employed when the individual wants to avoid the associated tax burdens or liabilities linked to the disclaimed portion. 2. Full Renunciation and Disclaimer: This form of renunciation and disclaimer involves completely refusing the entire property received through intestate succession. By doing so, the individual removes themselves entirely from any obligations, benefits, or responsibilities tied to the inherited assets. 3. Conditional Renunciation and Disclaimer: This type of renunciation and disclaimer is executed with certain conditions or requirements. It allows individuals to renounce or disclaim property received through intestate succession based on specific circumstances or events. For example, conditions may include the property being subject to substantial debts or encumbrances that exceed its value. It is important to note that the process of renunciation and disclaimer of property received by intestate succession in Fort Lauderdale, Florida, is subject to specific state laws and regulations. Seeking guidance from a qualified legal professional is advised to ensure compliance with all legal requirements and proper execution of the renunciation or disclaimer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.