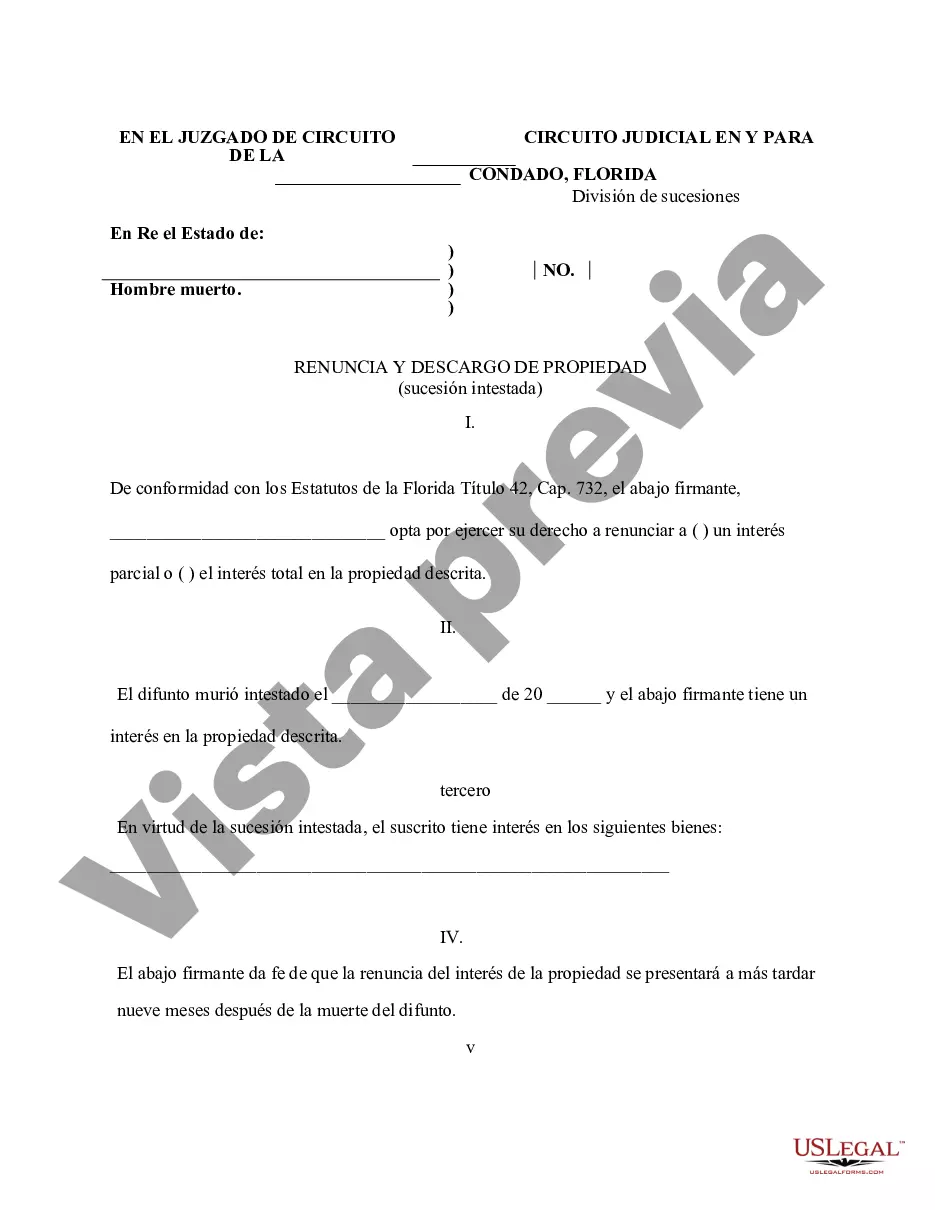

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Hillsborough Florida Renunciation And Disclaimer of Property received by Intestate Succession is a legal process by which a person voluntarily gives up their right to inherit certain property from a deceased person's estate when they die without a valid will. This renunciation and disclaimer act enables the property to pass to the next eligible heir in accordance with the laws of intestate succession. In Hillsborough County, Florida, there are two main types of renunciation and disclaimer of property that can occur in the context of intestate succession: 1. Renunciation of Property: This type of renunciation occurs when a potential heir decides to formally waive their right to inherit property from the deceased's estate. By renouncing their claim, the heir disclaims any interest or entitlement to the property, allowing it to pass to the next beneficiary as determined by state law. 2. Disclaimer of Property: Similar to renunciation, a disclaimer of property is a voluntary act in which an heir rejects their right to receive property from the intestate estate. By disclaiming the property, the heir acknowledges that they do not wish to accept the inheritance and transfers their share to the next eligible recipient, as determined by state laws of intestacy. It is important to note that both processes of renunciation and disclaimer of property must be executed in adherence to the specific legal requirements stipulated by the state of Florida. It is recommended to consult with a knowledgeable attorney who specializes in estate law and probate matters to navigate the complexities of renouncing or disclaiming property received through intestate succession. In summary, the Hillsborough Florida Renunciation And Disclaimer of Property received by Intestate Succession refers to the legal acts undertaken by potential heirs to abandon their rights to inherit assets from a deceased person's estate who died without a will. Renunciation and disclaimer play a crucial role in ensuring the smooth transition of property ownership to the appropriate beneficiaries according to the laws of intestate succession.Hillsborough Florida Renunciation And Disclaimer of Property received by Intestate Succession is a legal process by which a person voluntarily gives up their right to inherit certain property from a deceased person's estate when they die without a valid will. This renunciation and disclaimer act enables the property to pass to the next eligible heir in accordance with the laws of intestate succession. In Hillsborough County, Florida, there are two main types of renunciation and disclaimer of property that can occur in the context of intestate succession: 1. Renunciation of Property: This type of renunciation occurs when a potential heir decides to formally waive their right to inherit property from the deceased's estate. By renouncing their claim, the heir disclaims any interest or entitlement to the property, allowing it to pass to the next beneficiary as determined by state law. 2. Disclaimer of Property: Similar to renunciation, a disclaimer of property is a voluntary act in which an heir rejects their right to receive property from the intestate estate. By disclaiming the property, the heir acknowledges that they do not wish to accept the inheritance and transfers their share to the next eligible recipient, as determined by state laws of intestacy. It is important to note that both processes of renunciation and disclaimer of property must be executed in adherence to the specific legal requirements stipulated by the state of Florida. It is recommended to consult with a knowledgeable attorney who specializes in estate law and probate matters to navigate the complexities of renouncing or disclaiming property received through intestate succession. In summary, the Hillsborough Florida Renunciation And Disclaimer of Property received by Intestate Succession refers to the legal acts undertaken by potential heirs to abandon their rights to inherit assets from a deceased person's estate who died without a will. Renunciation and disclaimer play a crucial role in ensuring the smooth transition of property ownership to the appropriate beneficiaries according to the laws of intestate succession.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.