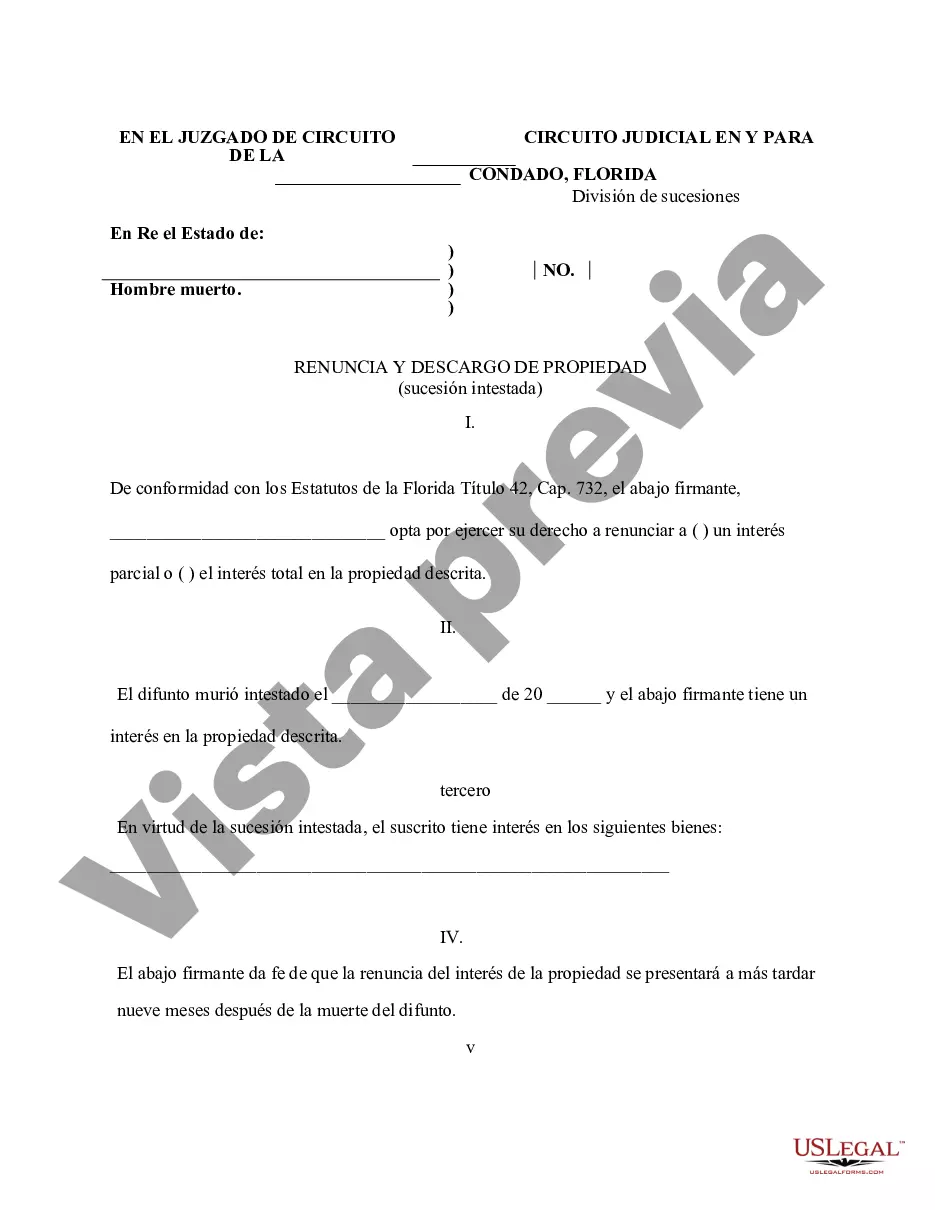

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Lakeland Florida Renunciation and Disclaimer of Property Received by Intestate Succession is a legal process through which an individual voluntarily gives up or disclaims their rights to inherit property from a deceased person who passed away without leaving a valid will or trust. This renunciation is done in accordance with the Florida Intestate Succession laws. The renunciation and disclaimer process allows individuals who do not wish to inherit property, either because they have no use for it or they want to avoid potential liabilities associated with it, to refuse their share of the estate. By renouncing their rights, these individuals effectively transfer their share of the property to the other heirs or beneficiaries, as if they had predeceased the deceased person. There are different types of renunciation and disclaimer options available in the context of Lakeland Florida Intestate Succession. Some common types include: 1. Full Renunciation: In this type, the individual renounces their entire share of the property received through intestate succession. They give up all rights, benefits, and obligations associated with the inherited property. 2. Partial Renunciation: With this option, individuals renounce only a portion of their share of the property. They may choose to retain some specific assets while disclaiming the rest. 3. Conditional Renunciation: Some individuals may renounce their inheritance on the condition that certain assets or liabilities associated with the property will be transferred or resolved prior to the renunciation taking effect. 4. Renunciation with Replacement: This type allows the renouncing individual to designate an alternate beneficiary who will receive their share of the property instead. The alternate beneficiary must be eligible under the Florida Intestate Succession laws. Renouncing and disclaiming property received by intestate succession can be a complex legal process, and it is advisable to consult with an experienced estate planning attorney to ensure compliance with all relevant laws and regulations. This will help to protect one's rights and interests while navigating the renunciation and disclaimer process smoothly. In conclusion, Lakeland Florida Renunciation and Disclaimer of Property received by Intestate Succession offers individuals the opportunity to voluntarily release their inheritance rights and obligations. Whether opting for a full or partial renunciation, or utilizing conditional renunciations or replacements, individuals have various options available to ensure their desires are met regarding inherited property. Consulting with a knowledgeable attorney is crucial to ensure compliance and a smooth renunciation process.Lakeland Florida Renunciation and Disclaimer of Property Received by Intestate Succession is a legal process through which an individual voluntarily gives up or disclaims their rights to inherit property from a deceased person who passed away without leaving a valid will or trust. This renunciation is done in accordance with the Florida Intestate Succession laws. The renunciation and disclaimer process allows individuals who do not wish to inherit property, either because they have no use for it or they want to avoid potential liabilities associated with it, to refuse their share of the estate. By renouncing their rights, these individuals effectively transfer their share of the property to the other heirs or beneficiaries, as if they had predeceased the deceased person. There are different types of renunciation and disclaimer options available in the context of Lakeland Florida Intestate Succession. Some common types include: 1. Full Renunciation: In this type, the individual renounces their entire share of the property received through intestate succession. They give up all rights, benefits, and obligations associated with the inherited property. 2. Partial Renunciation: With this option, individuals renounce only a portion of their share of the property. They may choose to retain some specific assets while disclaiming the rest. 3. Conditional Renunciation: Some individuals may renounce their inheritance on the condition that certain assets or liabilities associated with the property will be transferred or resolved prior to the renunciation taking effect. 4. Renunciation with Replacement: This type allows the renouncing individual to designate an alternate beneficiary who will receive their share of the property instead. The alternate beneficiary must be eligible under the Florida Intestate Succession laws. Renouncing and disclaiming property received by intestate succession can be a complex legal process, and it is advisable to consult with an experienced estate planning attorney to ensure compliance with all relevant laws and regulations. This will help to protect one's rights and interests while navigating the renunciation and disclaimer process smoothly. In conclusion, Lakeland Florida Renunciation and Disclaimer of Property received by Intestate Succession offers individuals the opportunity to voluntarily release their inheritance rights and obligations. Whether opting for a full or partial renunciation, or utilizing conditional renunciations or replacements, individuals have various options available to ensure their desires are met regarding inherited property. Consulting with a knowledgeable attorney is crucial to ensure compliance and a smooth renunciation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.