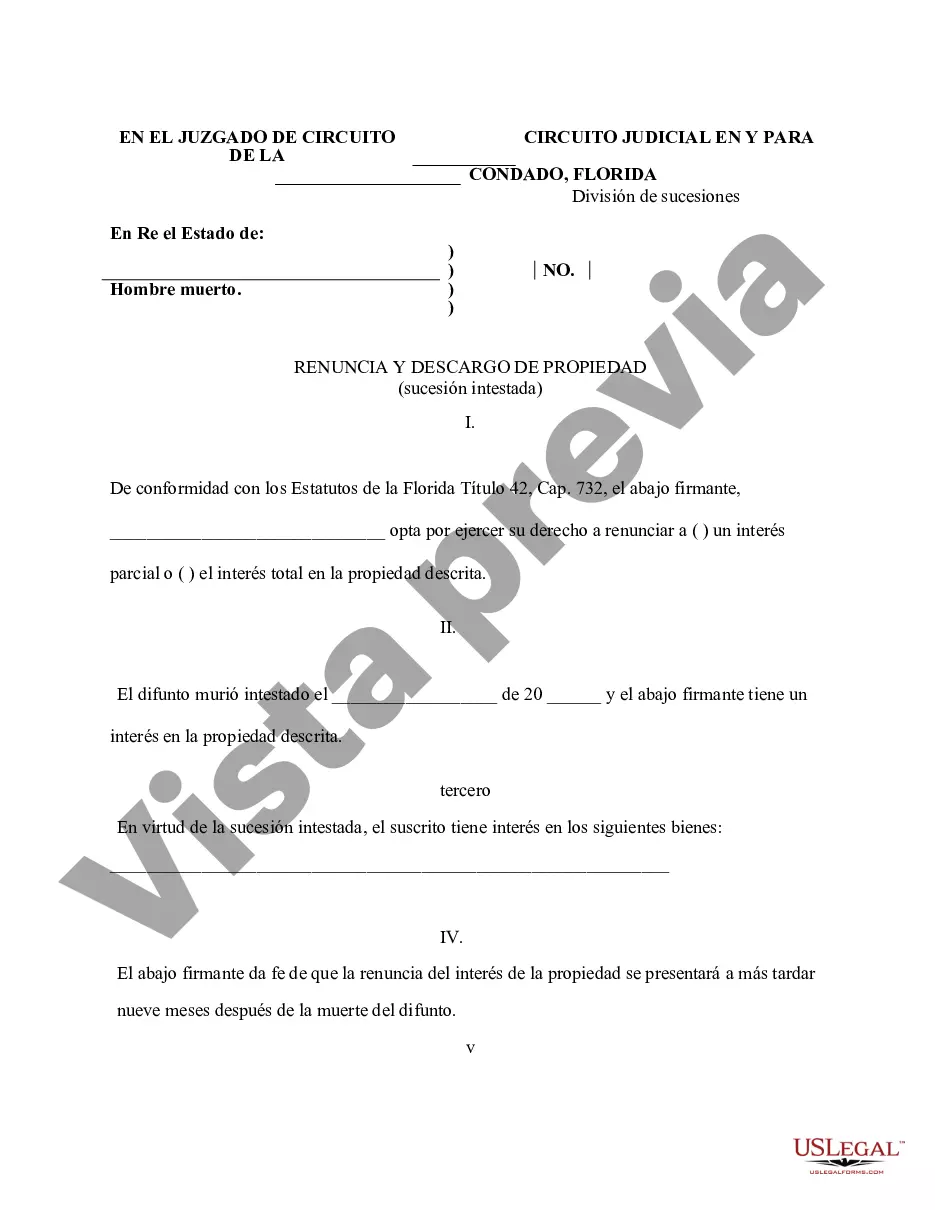

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Pembroke Pines, Florida Renunciation and Disclaimer of Property received by Intestate Succession In the state of Florida, when someone passes away without leaving a valid will, their property and assets are distributed according to the laws of intestate succession. However, there may be instances where an individual who is entitled to inherit property chooses to renounce or disclaim their right to it. This legal process is known as the Renunciation and Disclaimer of Property received by Intestate Succession. Renunciation and disclaimer allow beneficiaries to decline the inheritance they would normally receive through intestate succession. This decision could be based on various factors such as personal circumstances, financial considerations, or the desire to avoid potential complications associated with the property. In Pembroke Pines, Florida, there are two primary types of renunciation and disclaimer of property received by intestate succession: 1. Renunciation: Renouncing the right to inherit property means that the individual willingly declines their entitlement. By doing so, the renouncing party relinquishes their claim and any associated rights, effectively passing those assets to the next eligible heir in line. 2. Disclaimer: Similar to renunciation, a disclaimer is a legal document where a beneficiary denies or disclaims their right to inherit the property. This declaration must be made in writing and is typically filed with the appropriate court within a specific timeframe after the individual becomes aware of their entitlement to the assets. It's important to note that both renunciation and disclaimer must meet specific requirements and comply with Florida state laws. The renouncement or disclaimer document should include pertinent information such as the deceased person's name, the specific property being disclaimed, the beneficiary's name, and their intent to renounce or disclaim the inheritance. By renouncing or disclaiming their share of the property received through intestate succession, individuals in Pembroke Pines, Florida can ensure a smooth and efficient transfer of assets to the next eligible heirs and minimize potential disputes or complications associated with the inheritance process. If you find yourself in a situation where you need to consider renunciation or disclaimer of property received by intestate succession in Pembroke Pines, Florida, it is highly recommended consulting with an experienced estate planning attorney. They can guide you through the legal requirements, explain the potential consequences, and help ensure compliance with all necessary procedures.Pembroke Pines, Florida Renunciation and Disclaimer of Property received by Intestate Succession In the state of Florida, when someone passes away without leaving a valid will, their property and assets are distributed according to the laws of intestate succession. However, there may be instances where an individual who is entitled to inherit property chooses to renounce or disclaim their right to it. This legal process is known as the Renunciation and Disclaimer of Property received by Intestate Succession. Renunciation and disclaimer allow beneficiaries to decline the inheritance they would normally receive through intestate succession. This decision could be based on various factors such as personal circumstances, financial considerations, or the desire to avoid potential complications associated with the property. In Pembroke Pines, Florida, there are two primary types of renunciation and disclaimer of property received by intestate succession: 1. Renunciation: Renouncing the right to inherit property means that the individual willingly declines their entitlement. By doing so, the renouncing party relinquishes their claim and any associated rights, effectively passing those assets to the next eligible heir in line. 2. Disclaimer: Similar to renunciation, a disclaimer is a legal document where a beneficiary denies or disclaims their right to inherit the property. This declaration must be made in writing and is typically filed with the appropriate court within a specific timeframe after the individual becomes aware of their entitlement to the assets. It's important to note that both renunciation and disclaimer must meet specific requirements and comply with Florida state laws. The renouncement or disclaimer document should include pertinent information such as the deceased person's name, the specific property being disclaimed, the beneficiary's name, and their intent to renounce or disclaim the inheritance. By renouncing or disclaiming their share of the property received through intestate succession, individuals in Pembroke Pines, Florida can ensure a smooth and efficient transfer of assets to the next eligible heirs and minimize potential disputes or complications associated with the inheritance process. If you find yourself in a situation where you need to consider renunciation or disclaimer of property received by intestate succession in Pembroke Pines, Florida, it is highly recommended consulting with an experienced estate planning attorney. They can guide you through the legal requirements, explain the potential consequences, and help ensure compliance with all necessary procedures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.