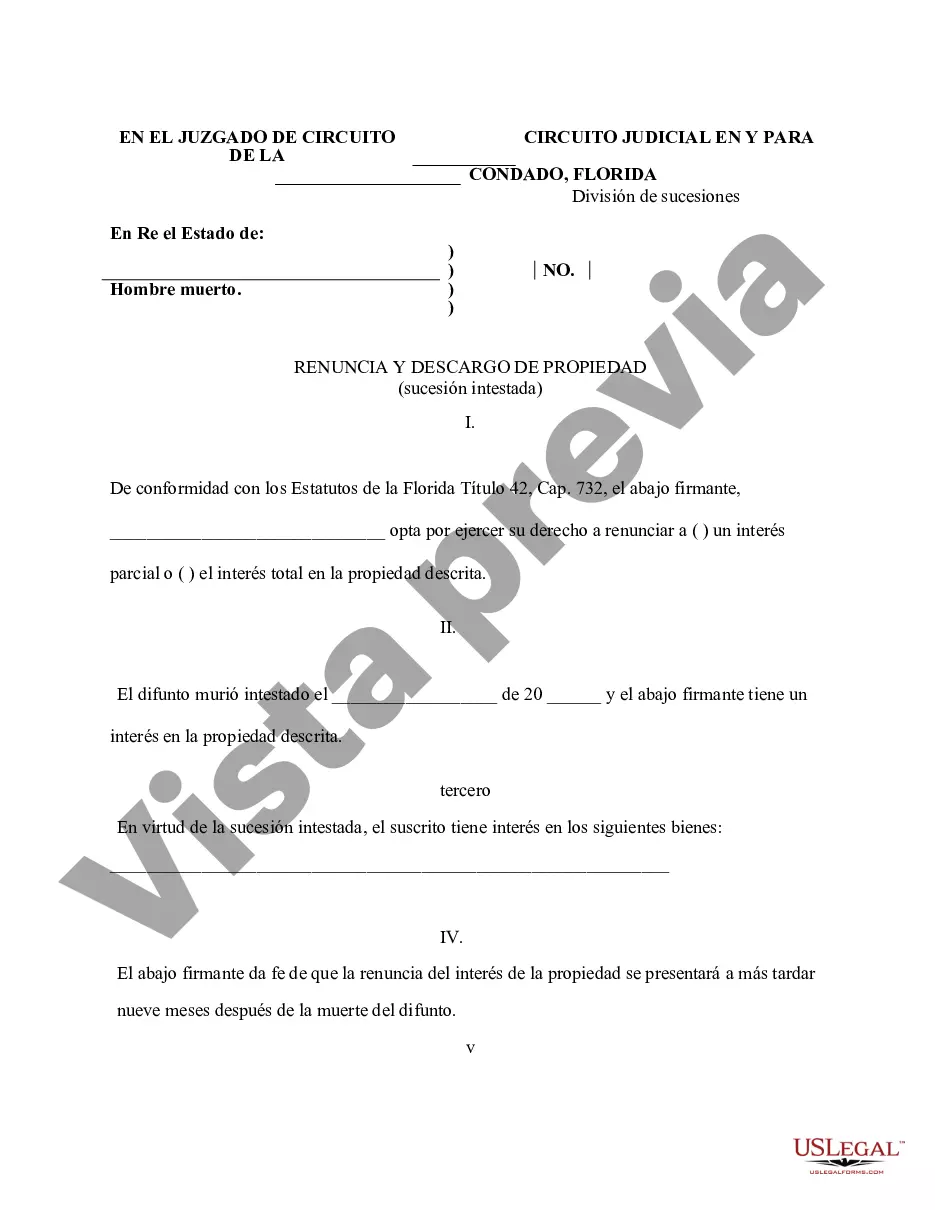

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession allows individuals to formally relinquish their rights or interest in property inherited through intestate succession. Intestate succession refers to the distribution of an individual's assets when they pass away without leaving behind a valid will. By renouncing or disclaiming their share of the intestate inheritance, individuals can legally refuse to accept the property. This process ensures that the assets are distributed to the next rightful heir in line, according to Florida's laws of intestate succession. There are different types of Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession, including partial renunciation and full renunciation. 1. Partial Renunciation: In this type, an individual renounces only a portion of the property received through intestate succession. They may choose to forfeit their interest in certain assets while keeping others. It allows for a more selective renunciation based on personal preferences or circumstances. 2. Full Renunciation: Full renunciation involves giving up one's entire share of the property received via intestate succession. By doing so, the individual declines any claim or ownership rights over the assets. This type of renunciation might be preferred when the individual does not wish to be involved in the management, taxes, or responsibilities associated with the inherited property. The procedure for executing a renunciation or disclaimer of property in Tallahassee, Florida, involves several steps. First, it is crucial to understand the specific laws and regulations pertaining to intestate succession and renunciation in Florida. Seeking legal advice or consulting with an attorney experienced in probate matters can provide individuals with the necessary guidance throughout the process. Once an individual decides to renounce or disclaim their share of the property, they must prepare a written renunciation document. This document should include a detailed description of the property being renounced and must be signed and notarized. It is vital to ensure that the renunciation adheres to the legal requirements set forth in Tallahassee, Florida. The renunciation document should also clearly mention the renouncing individual's relationship to the deceased and their intention to waive their inheritance rights. It is crucial to file this document with the appropriate probate court in Tallahassee, Florida, within the specified timeframe, typically within nine months from the date of death. By executing a Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession, individuals can choose to release their interest in inherited assets, providing a means to avoid responsibilities or complications associated with managing the property. This legal process ensures a smooth and lawful distribution of assets through intestate succession in Tallahassee, Florida.Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession allows individuals to formally relinquish their rights or interest in property inherited through intestate succession. Intestate succession refers to the distribution of an individual's assets when they pass away without leaving behind a valid will. By renouncing or disclaiming their share of the intestate inheritance, individuals can legally refuse to accept the property. This process ensures that the assets are distributed to the next rightful heir in line, according to Florida's laws of intestate succession. There are different types of Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession, including partial renunciation and full renunciation. 1. Partial Renunciation: In this type, an individual renounces only a portion of the property received through intestate succession. They may choose to forfeit their interest in certain assets while keeping others. It allows for a more selective renunciation based on personal preferences or circumstances. 2. Full Renunciation: Full renunciation involves giving up one's entire share of the property received via intestate succession. By doing so, the individual declines any claim or ownership rights over the assets. This type of renunciation might be preferred when the individual does not wish to be involved in the management, taxes, or responsibilities associated with the inherited property. The procedure for executing a renunciation or disclaimer of property in Tallahassee, Florida, involves several steps. First, it is crucial to understand the specific laws and regulations pertaining to intestate succession and renunciation in Florida. Seeking legal advice or consulting with an attorney experienced in probate matters can provide individuals with the necessary guidance throughout the process. Once an individual decides to renounce or disclaim their share of the property, they must prepare a written renunciation document. This document should include a detailed description of the property being renounced and must be signed and notarized. It is vital to ensure that the renunciation adheres to the legal requirements set forth in Tallahassee, Florida. The renunciation document should also clearly mention the renouncing individual's relationship to the deceased and their intention to waive their inheritance rights. It is crucial to file this document with the appropriate probate court in Tallahassee, Florida, within the specified timeframe, typically within nine months from the date of death. By executing a Tallahassee Florida Renunciation And Disclaimer of Property received by Intestate Succession, individuals can choose to release their interest in inherited assets, providing a means to avoid responsibilities or complications associated with managing the property. This legal process ensures a smooth and lawful distribution of assets through intestate succession in Tallahassee, Florida.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.