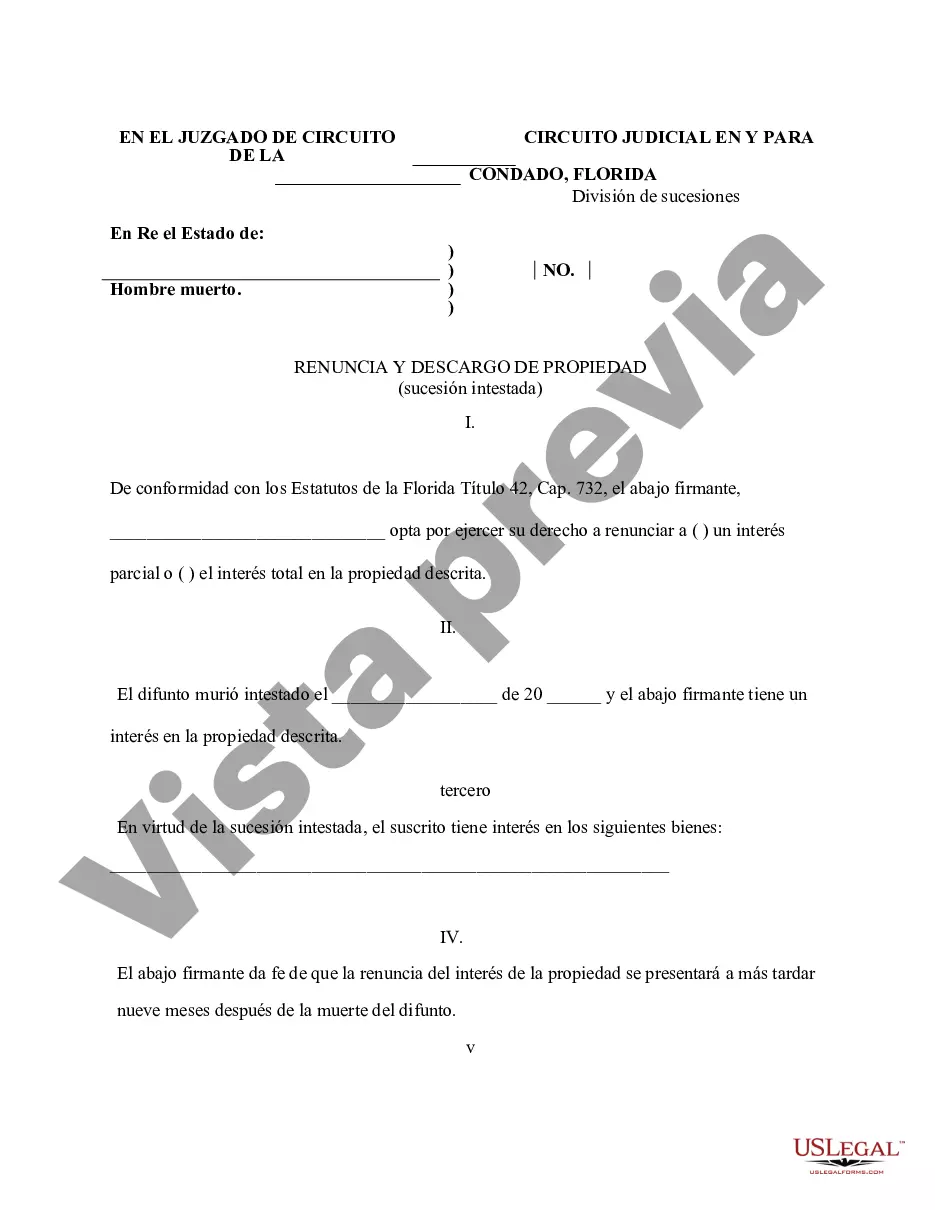

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the property of the decedent. However, the beneficiary has chosen to exercise his/her right to disclaim the property pursuant to the Florida Statutes Title 42, Chap. 732. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify the delivery.

Tampa Florida Renunciation and Disclaimer of Property received by Intestate Succession is a legal document that allows an individual to voluntarily relinquish their rights and interests in an inheritance received through intestate succession, which occurs when someone passes away without a valid will. This detailed description will highlight the purpose and process of renunciation and disclaimer and provide relevant keywords to further enhance the content. Renunciation and disclaimer of property received by intestate succession in Tampa, Florida is a crucial legal action taken by individuals who wish to refuse their entitlement to an inheritance from a deceased relative when no will exists. This action is particularly significant when the inheritor does not wish to accept the property or feels that accepting it may lead to potential issues, such as tax liabilities or creditor claims. By renouncing and disclaiming the inherited property, the individual ensures that they will not be legally bound to assume ownership or responsibility for the property. The process of renunciation and disclaimer in Tampa, Florida requires careful consideration and adherence to legal requirements. The individual who wishes to renounce their share of the inheritance must file a formal renunciation document with the appropriate court within a specified timeframe. It is essential to consult with a qualified attorney who specializes in estate planning and probate law to ensure compliance with the legal procedures and deadlines. Keywords: 1. Tampa, Florida: Highlighting the geographical location where the renunciation and disclaimer takes place. 2. Renunciation: The voluntary act of relinquishing one's rights to inheritance. 3. Disclaimer: A clear statement of refusal to accept property received through intestate succession. 4. Property: Refers to any assets, real estate, personal belongings, or financial holdings included in the inheritance. 5. Intestate Succession: The legal process that determines how property is distributed when no valid will exists. 6. Inheritance: Assets or property received after the death of a relative. 7. Legal Document: The formal paperwork required to execute the renunciation and disclaimer. 8. Tax Liabilities: Refers to potential taxes owed on the inherited property. 9. Creditor Claims: Claims made by creditors against the deceased individual's assets. 10. Estate Planning: The process of organizing one's assets to ensure their proper distribution after death. Types of Tampa Florida Renunciation and Disclaimer of Property received by Intestate Succession: 1. Full Renunciation: In this type, the individual renounces their entire share of the inheritance, disclaiming any legal rights and responsibilities associated with the property. 2. Partial Renunciation: With a partial renunciation, the individual renounces only a portion of their share, allowing them to retain some interests or benefits while relinquishing the rest. 3. Conditional Renunciation: This type involves renouncing the inheritance under specific conditions or circumstances agreed upon by the individual and the beneficiaries. 4. Contingent Renunciation: In a contingent renunciation, the individual agrees to renounce their share of the inheritance only if certain conditions are met, such as the resolution of ongoing legal disputes or liabilities. Note: It's important to consult with a legal professional to understand the specific types of renunciation and disclaimer available in Tampa, Florida, as they may vary based on individual circumstances and applicable laws.Tampa Florida Renunciation and Disclaimer of Property received by Intestate Succession is a legal document that allows an individual to voluntarily relinquish their rights and interests in an inheritance received through intestate succession, which occurs when someone passes away without a valid will. This detailed description will highlight the purpose and process of renunciation and disclaimer and provide relevant keywords to further enhance the content. Renunciation and disclaimer of property received by intestate succession in Tampa, Florida is a crucial legal action taken by individuals who wish to refuse their entitlement to an inheritance from a deceased relative when no will exists. This action is particularly significant when the inheritor does not wish to accept the property or feels that accepting it may lead to potential issues, such as tax liabilities or creditor claims. By renouncing and disclaiming the inherited property, the individual ensures that they will not be legally bound to assume ownership or responsibility for the property. The process of renunciation and disclaimer in Tampa, Florida requires careful consideration and adherence to legal requirements. The individual who wishes to renounce their share of the inheritance must file a formal renunciation document with the appropriate court within a specified timeframe. It is essential to consult with a qualified attorney who specializes in estate planning and probate law to ensure compliance with the legal procedures and deadlines. Keywords: 1. Tampa, Florida: Highlighting the geographical location where the renunciation and disclaimer takes place. 2. Renunciation: The voluntary act of relinquishing one's rights to inheritance. 3. Disclaimer: A clear statement of refusal to accept property received through intestate succession. 4. Property: Refers to any assets, real estate, personal belongings, or financial holdings included in the inheritance. 5. Intestate Succession: The legal process that determines how property is distributed when no valid will exists. 6. Inheritance: Assets or property received after the death of a relative. 7. Legal Document: The formal paperwork required to execute the renunciation and disclaimer. 8. Tax Liabilities: Refers to potential taxes owed on the inherited property. 9. Creditor Claims: Claims made by creditors against the deceased individual's assets. 10. Estate Planning: The process of organizing one's assets to ensure their proper distribution after death. Types of Tampa Florida Renunciation and Disclaimer of Property received by Intestate Succession: 1. Full Renunciation: In this type, the individual renounces their entire share of the inheritance, disclaiming any legal rights and responsibilities associated with the property. 2. Partial Renunciation: With a partial renunciation, the individual renounces only a portion of their share, allowing them to retain some interests or benefits while relinquishing the rest. 3. Conditional Renunciation: This type involves renouncing the inheritance under specific conditions or circumstances agreed upon by the individual and the beneficiaries. 4. Contingent Renunciation: In a contingent renunciation, the individual agrees to renounce their share of the inheritance only if certain conditions are met, such as the resolution of ongoing legal disputes or liabilities. Note: It's important to consult with a legal professional to understand the specific types of renunciation and disclaimer available in Tampa, Florida, as they may vary based on individual circumstances and applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.